CONTENTS

- The RBI rate hike and its impact

- Environmental Performance Index (EPI) 2022

- The science behind the cancer cure

- The RBI plan to link credit cards with UPI

- Next-generation Corvettes

The RBI Rate Hike and Its Impact

Context:

In its bi-monthly review, the Reserve Bank of India hiked the repo rate by another 50 basis points. This move, and the RBI’s focus on the withdrawal of its accommodative policy, both in response to rising inflation, are expected to lead to a further rise in interest rates in the banking system.

Relevance:

GS III- Indian Economy

Dimensions of the Article:

- Why has RBI hiked the repo rate?

- How will it impact borrowers and depositors?

- What will be the impact of withdrawing the accommodative policy?

- Will consumer spending be impacted?

- Instruments of Monetary Policy

- About Monetary Policy Committee (MPC)

Why has RBI hiked the repo rate?

- The 50-basis-point hike, which follows a 40-basis-point hike in May, has been done with a view to taming inflation.

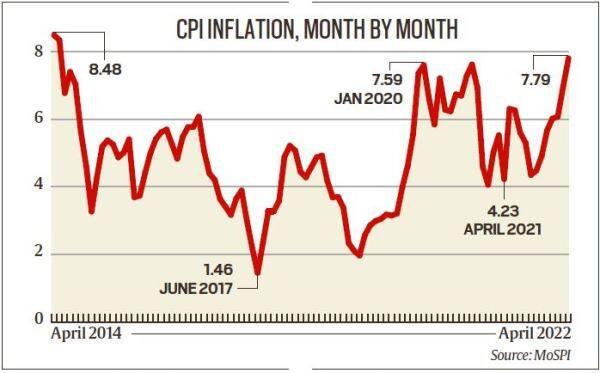

- Noting that headline inflation has risen by 170 bps between February and April 2022, the RBI has projected it at 7.5% in Q1 Of FY 22, 7.4% in Q2, 6.2% in Q3, and 5.8% in Q4, with a baseline inflation of 6.7% for 2022-23.

- The RBI aims to bring inflation down to its targeted 4% (±2%).

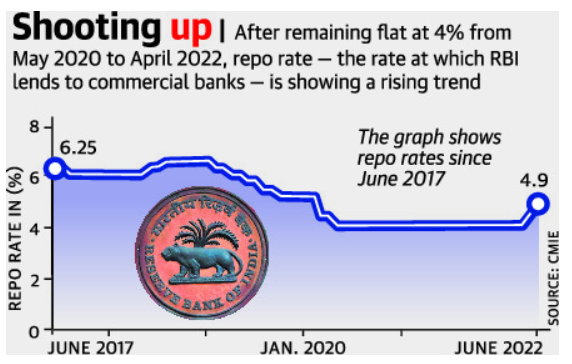

- The two hikes in repo rates over the last five weeks, totalling 90 bps, takes the rate to 4.9%.

- Repo rate refers to the rate at which the RBI lends to commercial banks. When interest rates are raised, it makes money more expensive, thereby resulting in reduction of demand in the economy and bringing down inflation.

- Even as it looks to support the economic recovery from the impact of the pandemic, RBI’s concerns around inflation has been the primary factor in raising the rates.

How will it impact borrowers and depositors?

- While both borrowers and depositors are expected to see a hike in lending rates and offering on deposit rates, respectively, over the coming days and weeks, borrowers are likely to be impacted earlier.

- Banks and housing finance companies, which have already raised their lending rates between 40 bps and 50 bps points following the 40 bps hike in repo rate in May, are now expected to raise the rates again.

- If the 90-bps hike in repo rate raises the lending rate by 100 bps, it will have a significant impact on EMIs.

- For example, if the rate on your home loan goes up by 100 basis points from 7% in April to 8% in the next couple of weeks, the EMI on principal outstanding of Rs 50 lakh for 15 years will go up from Rs 44,941 to Rs 47,782 — a jump of Rs 2,841 monthly if you keep the tenure unchanged.

- Should the rates rise by 150 bps by the end of the year (which is expected given RBI’s enhanced concerns around inflation), the loan rate would go up to 9.5%, and the EMI for the the same loan to Rs 49,236 — an increase of Rs 4,295 per month.

So, more rate hikes are expected?

- Given the RBI’s projected inflation of 6.7% for 2022-23 and enhanced concerns around it, market participants feel it may go for an additional hike of 50-100 bps over the remaining part of the year.

- Indeed, RBI Governor has said future decision on rate hikes would be in line with developments around inflation.

What will be the impact of withdrawing the accommodative policy?

- Interestingly, the RBI removed the word “accommodative” from the policy stance.

- The RBI’s policy panel, chaired by the RBI Governor, has decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target.

- The RBI had pumped huge liquidity into the system in 2020 to counter the impact of the pandemic.

- While this did support econonic recovery, it has also been the main reason for the rise in inflation.

- The RBI’s market operations had led to a decline in liquidity in May.

- Still, overall system liquidity remains in large surplus, with the average daily absorption under the liquidity adjustment facility (LAF) moderating to Rs 5.5 lakh crore during May 4-31, from Rs 7.4 lakh crore during April 8-May 3, in consonance with the policy of gradual withdrawal of accommodation.

- The withdrawal will also put upward pressure on interest rates.

Will consumer spending be impacted?

- The policy withdrawal and the rate hike are expected to impact consumption and demand in the economy.

- The impact is likely to be more pronounced in non-discretionary spending by consumers.

- According to the RBI policy panel, the forecast of a normal monsoon should boost kharif sowing and agricultural output. This will support rural consumption.

- The rebound in contact-intensive services is expected to sustain urban consumption.

- RBI’s surveys suggest further improvement in consumer confidence and households’ optimism for the outlook a year ahead.

Instruments of Monetary Policy

There are several direct and indirect instruments that are used for implementing monetary policy.

- Repo Rate: The (fixed) interest rate at which the Reserve Bank provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

- Reverse Repo Rate: The (fixed) interest rate at which the Reserve Bank absorbs liquidity, on an overnight basis, from banks against the collateral of eligible government securities under the LAF.

- Liquidity Adjustment Facility (LAF): The LAF consists of overnight as well as term repo auctions. Progressively, the Reserve Bank has increased the proportion of liquidity injected under fine-tuning variable rate repo auctions of range of tenors. The aim of term repo is to help develop the inter-bank term money market, which in turn can set market based benchmarks for pricing of loans and deposits, and hence improve transmission of monetary policy. The Reserve Bank also conducts variable interest rate reverse repo auctions, as necessitated under the market conditions.

- Marginal Standing Facility (MSF): A facility under which scheduled commercial banks can borrow additional amount of overnight money from the Reserve Bank by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit at a penal rate of interest. This provides a safety valve against unanticipated liquidity shocks to the banking system.

- Corridor: The MSF rate and reverse repo rate determine the corridor for the daily movement in the weighted average call money rate.

- Bank Rate: It is the rate at which the Reserve Bank is ready to buy or rediscount bills of exchange or other commercial papers. The Bank Rate is published under Section 49 of the Reserve Bank of India Act, 1934. This rate has been aligned to the MSF rate and, therefore, changes automatically as and when the MSF rate changes alongside policy repo rate changes.

- Cash Reserve Ratio (CRR): The average daily balance that a bank is required to maintain with the Reserve Bank as a share of such per cent of its Net demand and time liabilities (NDTL) that the Reserve Bank may notify from time to time in the Gazette of India.

- Statutory Liquidity Ratio (SLR): The share of NDTL that a bank is required to maintain in safe and liquid assets, such as, unencumbered government securities, cash and gold. Changes in SLR often influence the availability of resources in the banking system for lending to the private sector.

- Open Market Operations (OMOs): These include both, outright purchase and sale of government securities, for injection and absorption of durable liquidity, respectively.

- Market Stabilisation Scheme (MSS): This instrument for monetary management was introduced in 2004. Surplus liquidity of a more enduring nature arising from large capital inflows is absorbed through sale of short-dated government securities and treasury bills. The cash so mobilised is held in a separate government account with the Reserve Bank.

About Monetary Policy Committee (MPC)

- The Monetary Policy Committee (MPC) is the body of the RBI, headed by the Governor, responsible for taking the important monetary policy decisions about setting the repo rate.

- Repo rate is ‘the policy instrument’ in monetary policy that helps to realize the set inflation target by the RBI (at present 4%).

Membership of the MPC

- The Monetary Policy Committee (MPC) is formed under the RBI with six members.

- Three of the members are from the RBI while the other three members are appointed by the government.

- Members from the RBI are the Governor who is the chairman of the MPC, a Deputy Governor and one officer of the RBI.

- The government members are appointed by the Centre on the recommendations of a search-cum-selection committee which is to be headed by the Cabinet Secretary.

Objectives of the MPC

Monetary Policy was implemented with an initiative to provide reasonable price stability, high employment, and a faster economic growth rate.

The major four objectives of the Monetary Policy are mentioned below:

- To stabilize the business cycle.

- To provide reasonable price stability.

- To provide faster economic growth.

- Exchange Rate Stability.

-Source: The Hindu, Indian Express

Environmental Performance Index (EPI) 2022

Context:

India has reacted to the EPI, 2022, a report that ranks India last (along with Nigeria) among 180 countries in terms of managing climate change, environmental health, and ecosystem vitality.

- The Environment Ministry of India has claimed that some of the indicators that were used for the index are ‘extrapolated and based on the surmises and unscientific methods’.

Relevance:

GS III- Environment and Ecology

Dimensions of the Article:

- About Environmental Performance Index 2022

- Environmental Performance Index 2022: India’s score

About Environmental Performance Index 2022

- It is recently published by the Yale Center for Environment Law and Policy and the Center for International Earth science Information Network, Columbia University.

- The report has ranked the 180 countries in Environmental Performance Index 2022 on 40 performance indicators across the 11 issue categories on environmental health, climate change performance, and ecosystem vitality.

- The analysis of the environmental performance by the 180 countries for the Environmental Performance Index 2022 is being done by the researchers at the Earth Institute of Yale and Columbia University.

- As per the report, the countries are scored and ranked in the Environmental performance Index 2022 on the basis of the environmental performance with the use of the most recent year’s data available.

- The scores are calculated to observe how they have changed over the previous years.

Top 5 Countries:

- Denmark

- United Kingdom

- Finland

- Malta

- Sweden

Environmental Performance Index 2022: India’s score

- In Environmental Performance Index 2022 India is ranked at 180 with a total score of 18.9 and in the last decade, the performance has gone down by 0.6 scores.

- The country has scored the lowest among 180 countries in the index that evaluated the environmental performance of these countries.

- India’s neighboring nations have done better including Pakistan which is ranked at 176 and Bangladesh at 177

- The three primary categories under which the scores have been given are

- Ecosystem vitality

- Climate change performance

- Environmental health

- India has score 19.3 on the ecosystem vitality on the index and the change in the area in the last decade in -2.

- The country has score 12.5 on health, meaning poor air quality, drinking water and sanitation.

- India’s waste management in terms of ocean plastics, solid wastes and recycling is also poor.

-Source: The Hindu

The Science Behind The Cancer Cure

Context:

In a medical trial, 12 patients in the United States were completely cured of rectal cancer without requiring any surgery or chemotherapy.

- The study was done by doctors from the Memorial Sloan Kettering Cancer Centre in New York.

Relevance:

GS III- Science and Technology

Dimensions of the Article:

- What are the findings?

- What is this deficiency, and how was it cured?

- When can such a treatment be accessible in India?

What are the findings?

- The trial used a monoclonal antibody called dostarlimab every three weeks for six months for the treatment of a particular kind of stage two or three rectal cancer.

- The trial showed that immunotherapy alone – without any chemotherapy, radiotherapy, or surgery that have been staples of cancer treatment – could completely cure the patients with a particular kind of rectal cancer called ‘mismatch repair deficient’ cancer”.

- All 12 patients had completed the treatment and were followed for six to 25 months after.

- No cases of progression or recurrence had been reported during the follow-up.

- The response too was rapid, with symptoms resolving in 81% of the patients within nine weeks of starting the therapy.

What is this deficiency, and how was it cured?

- ‘Mismatch repair deficient’ cancer is most common among colorectal, gastrointestinal, and endometrial cancers.

- Patients suffering from this condition lack the genes to correct typos in the DNA that occur naturally while cells make copies.

- The immunotherapy belongs to a category called PD1 blockades that are now recommended for the treatment of such cancers rather than chemotherapy or radiotherapy.

- PD1 is a type of protein that regulates certain functions of the immune system, including by suppressing T cell activity, and PD1 blockade therapy looks to release the T cells from this suppression.

When can such a treatment be accessible in India?

- The problem with immunotherapies is that they are expensive and unaffordable for most people in India

- An immunotherapy treatment can cost around Rs 4 lakh per month, with patients needing the treatment for six months to a year.

- Precision medicine, such as using particular immunotherapy drugs for particular types of cancers, is still at a nascent stage in India.

- It would take at least ten years for it to become commonplace.

-Source: Indian Express

The RBI Plan to Link Credit Cards With UPI

Context:

The Reserve Bank of India has proposed to allow the linking of credit cards with the Unified Payments Interface (UPI).

Relevance:

GS III- Indian Economy

Dimensions of the Article:

- Details

- What is Unified Payments Interface (UPI)?

- What is the significance of the move?

- What could be the hurdles?

Details:

- The integration will first begin with the indigenous RuPay credit cards.

- Both the RuPay network and UPI are managed by the same organisation – the National Payments Corporation of India (NPCI).

What is Unified Payments Interface (UPI)?

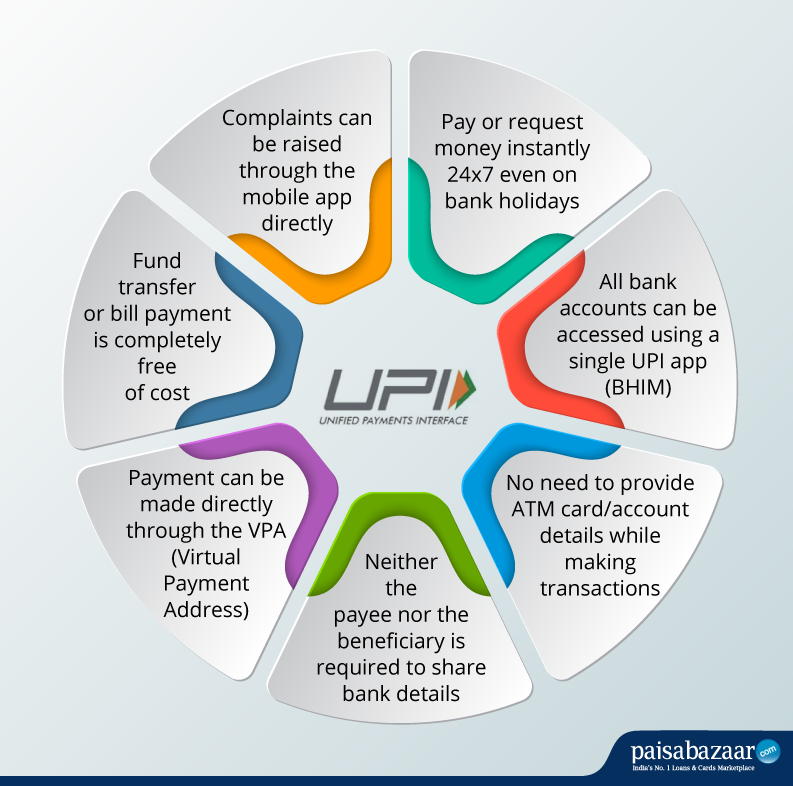

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- UPI, which was introduced in 2016, has become one of the most used digital payments platforms in the country.

- The volume of UPI transactions has already reached ₹76 lakh crore in the current year, compared to ₹41 lakh crore in FY21 ,

- Advantages of UPI Includes – Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- UPI Enables Single mobile application for accessing different bank accounts with Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines yet provides for a very strong feature of seamless single click payment.

- It also features Virtual address of the customer for Pull & Push providing for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

What is the significance of the move?

- The linkage of UPI and credit cards could possibly result in credit card usage zooming up in India given UPI’s widespread adoption.

- The integration also opens up avenues to build credit on UPI through credit cards in India, where in the last few years, a number of startups like Slice, Uni, One etc. have emerged.

- The move could also be a push to increase adoption by banking on UPI’s large user base.

- So far, UPI could only be linked to debit cards and bank accounts.

- This will provide additional convenience to the users and enhance the scope of digital payments.

What could be the hurdles?

- There are some regulatory areas that would have to be addressed before the linkage happens.

- For instance, it is not clear how the Merchant Discount Rate (MDR) will be applied to UPI transactions done through credit cards.

- The MDR is a fee that a merchant is charged by their issuing bank for accepting payments from their customers via credit and debit cards.

- According to a norm that has been in effect since January 2020, UPI and RuPay attract zero-MDR, meaning that no charges are applied to these transactions, which is a key reason behind the prolific adoption of UPI both by users and merchants.

- However, the norm has faced pushback from the payments industry, which has argued that it limits the aggregators’ ability to “invest in and maintain the financial infrastructure” of the payment ecosystem that they have built.

- Applicability of zero-MDR on UPI could also be a reason why other card networks such as Visa and Mastercard may not have been onboarded to UPI for credit cards yet.

-Source: Indian Express

Next-Generation Corvettes

Context:

The Defence Acquisition Council (DAC) has given the Acceptance of Necessity (AoN) for several capital acquisition projects of the Indian defence forces. This includes the procurement of next-generation Corvettes for the Indian Navy at an approximate cost of Rs 36,000 crore.

Relevance:

GS III- Defence

Dimensions of the Article:

- What is a Corvette?

- What kind of Corvettes does the Indian Navy possess?

- What new capabilities will the new generation Corvettes have?

What is a Corvette?

- A Corvette is the smallest class of naval ships and it falls below the warship class of a frigate.

- These are highly agile ships and are categorised as missile boats, anti-submarine ships, coastal patrol crafts and fast attack naval vessels.

- The word corvette itself is derived from French and Dutch origin.

- Corvettes date back to the 18th and the 19th century when they were extensively used in the naval warfare duels that were fought at high seas.

- However, these were powered by sails and masts, and disappeared for a while when steam powered naval ships made their appearance.

- During World War II, the term Corvette was used to describe vessels which had anti-submarine roles assigned to them.

- Modern Corvettes can go up to 2,000 tons in displacement which helps in keeping them agile.

What kind of Corvettes does the Indian Navy possess?

- The Indian Navy at present has the Kamorta Class Corvettes, which are also known as Project 28.

- These ships have an anti-submarine role and are manufactured at Garden Reach Shipbuilders and Engineers in Kolkata.

- The four Kamorta Class Corvettes that the Indian Navy possesses are named INS Kamorta, INS Kadmatt, INS Kiltan and INS Kavaratti.

- The first of these was commissioned in 2014 and the last one in 2020.

What new capabilities will the new generation Corvettes have?

- The next-generation Corvettes will be manufactured for various roles like surveillance missions, escort operations, deterrence, surface action group operations, search and attack and coastal defence.

- It is worth noting that these roles will be in addition to the anti-submarine roles being already performed by the existing Corvettes in the Navy.

- Corvettes will be constructed based on new in-house design of the Indian Navy using latest technology of ship buildings.

- They would contribute to further the government’s initiative of Security and Growth for all in the region (SAGAR).