Contents

- IISS report on India as a cyber power

- Chief Economic Adviser on Govt’s divestment targets

- Impact of extreme sea-level rise: Greenpeace

- Micro, Small and Medium-sized Enterprises Day

- China turns on second-biggest dam in world

IISS report on India as a cyber power

Context:

According to a new report by the International Institute for Strategic Studies (IISS) India has made only modest progress in developing its policy and doctrine for cyberspace security despite the geostrategic instability of its region and a keen awareness of the cyber threat it faces.

Relevance:

GS-III: Internal Security Challenges (Cyber Security, Internal security challenges through communication networks, Role of media and social-networking sites in internal security challenges)

Dimensions of the Article:

- About the report by IISS

- Highlights of the IISS Study

Click Here to read more about Cyber Attack and Cyber Security, Challenges of Cyber Security in India and Measures taken

About the report by IISS

- The report has done a qualitative assessment of cyber power in 15 countries. The 15 countries considered are:

- Four members of the Five Eyes intelligence alliance – the United States, the United Kingdom, Canada and Australia and three cyber-capable allies of the Five Eyes states – France, Israel and Japan.

- Four states at earlier stages in their cyber power development – India, Indonesia, Malaysia and Vietnam.

- Four countries viewed by the Five Eyes and their allies as cyber threats – China, Russia, Iran and North Korea.

- The methodology analyses the cyber ecosystem of each state and how it intersects with international security, economic competition and military affairs. The countries are assessed in seven categories:

- Strategy and doctrine

- Governance, command and control

- Core cyber-intelligence capability

- Cyber empowerment and dependence

- Cyber security and resilience

- Global leadership in cyberspace affairs

- Offensive cyber capability

- The report has divided the 15 states into three tiers of cyber power:

- First Tier: States with world-leading strengths across all the categories in the methodology. The United States of America is the only country in this tier.

- Second Tier: States that have world-leading strengths in some of the categories. Australia, Canada, China, France, Israel, Russia and the United Kingdom are in this tier.

- Third Tier: States that have strengths or potential strengths in some of the categories but significant weaknesses in others. India, Indonesia, Iran, Japan, Malaysia, North Korea and Vietnam are in this tier.

Highlights of the IISS Study

On U.S. vs China

- In advanced cyber technologies and their exploitation for economic and military power, the US is still ahead of China.

- Since 2018, the US and several of its leading allies have agreed to restrict China’s access to some Western technologies – By doing so, these countries have endorsed a partial decoupling of the West and China that could potentially impede the latter’s ability to develop its own advanced technology.

- Thus, US digital-industrial superiority is likely to last for at least the next ten years.

On India

- India has made only “modest progress” in developing its policy and doctrine for cyberspace security despite the geo-strategic instability of its region and a keen awareness of the cyber threat it faces.

- The military confrontation with China in the disputed Ladakh border area in June 2020, followed by a sharp increase in Chinese activity against Indian networks, has heightened Indian concerns about cyber security, not least in systems supplied by China.

- India has some cyber-intelligence and offensive cyber capabilities but they are regionally focused, principally on Pakistan.

- India’s approach towards institutional reform of cyber governance has been “slow and incremental”, with key coordinating authorities for cyber security in the civil and military domains established only as late as 2018 and 2019 respectively.

- The strengths of the Indian digital economy include a vibrant start-up culture and a very large talent pool. The private sector has moved more quickly than the government in promoting national cyber security.

- The country is active and visible in cyber diplomacy but has not been among the leaders on global norms, preferring instead to make productive practical arrangements with key states. India is currently aiming to compensate for its weaknesses by building new capability with the help of key international partners – including the US, the UK and France – and by looking to concerted international action to develop norms of restraint.

-Source: The Hindu

Chief Economic Adviser on Govt’s divestment targets

Context:

India’s Chief Economic Adviser has expressed confidence that the ₹1.75-lakh crore disinvestment target of this fiscal will be achieved, with a good part coming from the proposed IPO of insurance behemoth LIC and privatisation of Bharat Petroleum Corporation (BPCL).

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Inclusive growth and issues therein, Budgeting)

Dimensions of the Article:

- What is Disinvestment?

- Evolution of Disinvestment Policy in India

- Privatization in 2019 and onwards

- Policy of Strategic Disinvestment announced in the Union Budget FY 2021-22

- What goes outside government control?

- Issues related to Disinvestment

- Significance of the disinvestment

What is Disinvestment?

- Disinvestment or divestiture refers to the government selling or liquidating its assets or stakes in PSE (public sector enterprise).

- The Department for investment and public asset management (DIPAM) under Ministry of finance is the nodal agency for disinvestment

- It is done when a PSU start incurring the loss of exchequer.

- Disinvestment proceeds can help the government fund its fiscal deficit.

Evolution of Disinvestment Policy in India

- The liberalization reforms undertaken in 1991 ushered in an increased demand for privatization/ disinvestment of PSUs.

- The new economic policy 1991 indicated that PSUs had shown a very negative rate of return on capital employed due to:

- Subsidized price policy of public sector undertakings.

- Under–utilization of capacity

- Problems related to planning and construction of projects.

- Problems of labour, personnel and management and lack of autonomy

- In the initial phase, this was done through the sale of a minority stake in bundles through auction. This was followed by a separate sale for each company in the following years, a method popularly adopted till 1999-2000.

- India adopted strategic sale as a policy measure in 1999-2000 with the sale of a substantial portion of government shareholding in identified Central PSEs (CPSEs) up to 50% or more, along with transfer of management control. This was started with the sale of 74 % of the Government’s equity in Modern Food Industries Limited (MFIL).

- Thereafter, 12 PSUs (including four subsidiaries of PSUs), and 17 hotels of Indian Tourism Development Corporation (ITDC) were sold to private investors along with transfer of management control by the Government.

- Another major shift in disinvestment policy was made in 2004-05 when it was decided that the government may “dilute its equity and raise resources to meet the social needs of the people”, a distinct departure from strategic sales.

- Department of Investment and Public Asset Management (DIPAM) has laid down comprehensive guidelines on “Capital Restructuring of CPSEs” in May 2016 by addressing various aspects, such as payment of dividends, buyback of shares, issues of bonus shares and splitting of shares.

Privatization in 2019 and onwards

- In November 2019, India launched its biggest privatization drive in more than a decade. An “in-principle” approval was accorded to reduce the government of India’s paid-up share capital below 51% in select Central Public Sector Enterprises (CPSEs).

- Among the selected CPSEs, strategic disinvestment of the Government’s shareholding of 53.29% in Bharat Petroleum Corporation Ltd (BPCL) was approved which led to an increase in value of shareholders’ equity of BPCL by INR 33,000 crore when compared to its peer Hindustan Petroleum Corporation Limited (HPCL) and this reflects an increase in the overall value from anticipated gains from consequent improvements in the efficiency of BPCL when compared to HPCL which will continue to be under Government control.

The Economic Survey 2020 on Govt. Divestment in PSUs

- The Economic Survey 2020 has aggressively pitched for divestment in PSUs by proposing a separate corporate entity wherein the government’s stake can be transferred and divested over a period of time.

- The performance of privatized firms, after controlling for other confounding factors using the difference in the performance of peer firms over the same period, improves significantly the following privatization.

- Further, the survey has said privatized entities have performed better than their peers in terms of net worth, profit, return on equity and sales, among others.

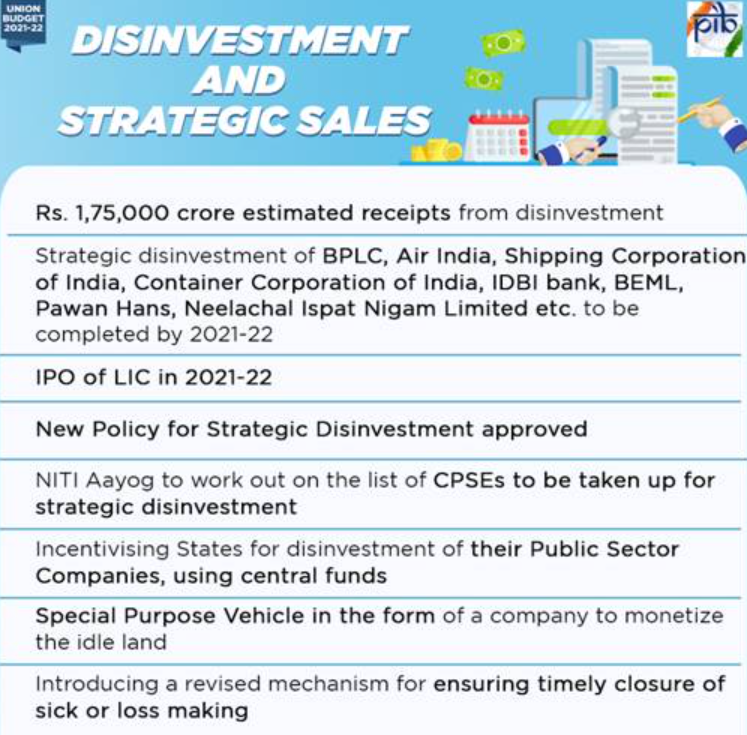

Policy of Strategic Disinvestment announced in the Union Budget FY 2021-22

- The government aims at making use of disinvestment proceeds to finance various social sector and developmental programmes and also to infuse private capital, technology and best management practices in Central Government Public Sector Enterprises.

- Union Minister for Finance and Corporate Affairs, while presenting the Union Budget FY 2021-22 in Parliament announced that government has approved a policy of strategic disinvestment of public sector enterprises that will provide a clear roadmap for disinvestment in all non-strategic and strategic sectors.

- Fulfilling the governments’ commitment under the AtmaNirbhar Package of coming up with a policy of strategic disinvestment of public sector enterprises, the Minister highlighted the following as its main features:

- Existing CPSEs, Public Sector Banks and Public Sector Insurance Companies to be covered under it.

- Most significant, however, is the new strategic disinvestment policy for public sector enterprises and the promise to privatise two public sector banks and a general insurance company in the year.

- The policy, promised as part of the AtmaNirbhar Bharat package, states the government will exit all businesses in non-strategic sectors, with only a ‘bare minimum’ presence in four broad sectors.

What goes outside government control?

- Strategic Sectors identified: The strategic sectors identified at the time for retaining certain public sector entities within the government’s control remain the same in the final policy approved by the Cabinet. These are atomic energy, space and defence, transport and telecommunications, power, petroleum, coal and other minerals, and lastly, banking, insurance and financial services. While the initial plan was to retain one to four public sector firms in these sectors, this has now been replaced by the phrase “bare minimum presence”.

- Bare Minimum Presence: Once the government decides what is the bare minimum number of firms it wants to retain, the rest of the firms will be privatised, merged or subsidiarized with other CPSEs, or closed.

- Non-Strategic Firms: For all firms in sectors considered non-strategic, privatisation or closure are the only two options being considered. The policy’s objective is to minimise the public sector’s role and create new investment space for the private sector, in the hope that the infusion of private capital, technology and management practices will contribute to growth and new jobs. The proceeds from the sale of these firms would finance various government-run social sector and developmental programmes.

Issues related to Disinvestment

- It is against the socialist ideology of equal distribution of resources amongst the population.

- It will lead to monopoly and oligopolistic practices by corporates.

- Proceedings of disinvestment had been used to cater the fiscal deficit of the state which would lead unhealthy fiscal consolidation.

- Private ownership does not guarantee the efficiency (Rangarajan Committee 1993).

- Disinvestment exercise had been done by undervaluation of public assets and favoritism bidding, thereby, leading to loss of public exchequers.

- Private ownership might overlook developmental region disparity in order to cut the cost of operation

Significance of the disinvestment

- Trade unionism and political interference often lead to halting of PSUs projects thereby hampering the efficiency in long run.

- Problem of disguised unemployment and outdated skill in PSUs employee are the major cause of inefficiency.

- Private prayers works out of Red Tapism bureaucratic mentality and focus on performance-driven culture and effectiveness (Disinvestment Commission 1996).

- More robust competitive bidding leads to competition in private sectors to participate in PSUs.

- Moreover, it ensuring that product service portfolio remains contemporary by developing/ acquiring technology.

-Source: The Hindu

Impact of extreme sea-level rise: Greenpeace

Context:

A recent report by Greenpeace East Asia flagged that as many as 15 million people in seven Asian cities could be affected by extreme sea-level rise and coastal flooding by 2030.

Relevance:

GS-III: Environment and Ecology (Climate Change and its issues, Environmental Pollution and Degradation)

Dimensions of the Article:

- Trends in rising Sea Levels

- Impact of Rising Sea Levels

- Highlights of the Greenpeace report on Rising Sea Levels

Click Here to read about a study on rising sea level’s impact on Lakshadweep

Trends in rising Sea Levels

- Global sea level has been rising over the past century, and the rate has accelerated in recent decades. The average global sea level has risen 8.9 inches between 1880 and 2015. That’s much faster than in the previous 2,700 years.

- SLR is not uniform across the world. Regional SLR may be higher or lower than Global SLR due to subsidence, upstream flood control, erosion, regional ocean currents, variations in land height, and compressive weight of Ice Age glaciers.

- Earlier, IPCC released ‘The Special Report on the Ocean and Cryosphere in a Changing Climate’ which underlined the dire changes taking place in oceans, glaciers, and ice-deposits on land and sea. The report expects oceans to rise between 10 and 30 inches by 2100 with temperatures warming 1.5 °C.

Impact of Rising Sea Levels

- Coastal Flooding: Globally, eight of the world’s 10 largest cities are near a coast, which is threatened by coastal flooding. Jakarta (Indonesia) is being known as the world’s fastest-sinking city, by about 25 cm into the ground every year. Other cities that regularly feature in the lists endangered by climate change include Guangzhou, Jakarta, Miami, Mumbai and Manila.

- Destruction of Coastal Biodiversity: SLR can cause destructive erosion, wetland flooding, aquifer and agricultural soil contamination with salt, and lost habitat for biodiversity.

- Dangerous Storm Surges: Higher sea levels are coinciding with more dangerous hurricanes and typhoons leading to loss of life and property.

- Lateral and Inland Migration: Flooding in low-lying coastal areas is forcing people to migrate to the higher ground causing displacement and dispossession and in turn a refugee crisis worldwide.

- Effect on Communications Infrastructure: The prospect of higher coastal water levels threatens basic services such as internet access.

- Threat to Inland Life: Rising seas can contaminate soil and groundwater with salt threatening life farther away from coasts.

- Tourism and Military Preparedness: Tourism to coastal areas and military preparedness will also be negatively affected by an increase in SLR.

Highlights of the Greenpeace report on Rising Sea Levels

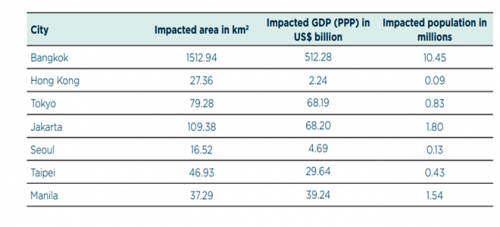

- The report analysed 7 cities that are economic centres and are located on or close to the coast, which are: Bangkok, Hong Kong, Tokyo, Jakarta, Seoul, Taipei and Manila.

- In Asia, coastal cities are at high risk from rising sea levels and intensifying storms. Approximate 600 million people, mostly live in low-lyingcoastal regions in Asia, are at risk of flooding due to sea level rise.

- An estimated $724 billion in gross domestic product (GDP) could be impacted due to extreme sea-level rise and coastal flooding by 2030, according to the report.

- The estimated GDP impact accounted ranged from 0.4 per cent to 96 per cent of each city’s entire GDP.

- The report did not take into account the effect of levees or seawalls some cities have built or could be building until 2030, which could minimise the flood risk.

- The report urged for faster and more ambitious climate action. It urged the governments to commit to achieving ‘net zero’ by 2050.

Major findings of seven Asian cities

- More than 96 per cent of Bangkok’s land area could be flooded in 2030 and could put $512.28 billion of GDP at purchasing power parity and 10.45 million people at risk.

- The analysis projected that in Hong Kong, extreme sea-level rise and any subsequent flooding in 2030 could put $2.24 billion of GDP at purchasing power parity and 90,000 people at risk.

- Extreme sea-level rise and any subsequent flooding in 2030 in Tokyo could put $68.19 billion of GDP at purchasing power parity 0.83 million people at risk.

- Almost 17 per cent of Jakarta’s total land area is below the level to which sea water could rise, leading to GDP risk of $68.20 billion and 1.80 million people at risk.

- Approximately 3 per cent of Seoul’s land area is below the level to which sea water could rise by 2030. The report suggested the affected areas would mainly be residential and agricultural, leading to $4.69 billion of GDP at purchasing power parity risk and put 0.13 million people at risk.

- In Taipei, extreme sea-level rise and any subsequent flooding in 2030 could put $29.64 billion of GDP at purchasing power parity and 0.43 million people at risk.

- Almost 87 per cent of Manila’s land area is below the level to which sea water could rise in 2030. Up to 1.54 million people and a total of $39.24 billion of GDP at purchasing power parity could be affected.

-Source: Down to Earth Magazine

Micro, Small and Medium-sized Enterprises Day

Context:

Micro, Small and Medium-sized Enterprises (MSMEs) Day is celebrated every year on June 27 to recognise the contribution of these industries in the implementation of the Sustainable Development Goals (SDGs).

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Mobilization of Resources)

Dimensions of the Article:

- Understanding MSMEs in India

- About International MSMEs Day

- Measures that can give some hope to the MSME sector

Understanding MSMEs in India

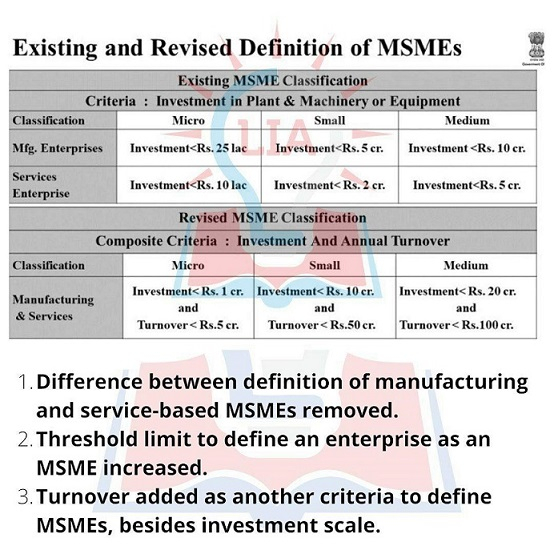

- MSME stands for Micro, Small, and Medium Enterprises which are small sized entities, defined in terms of their size of investment in plant and machinery/equipment along with THE NEW CRITERION OF ANNUAL TURNOVER.

- As per the revised definition, any firm with investment up to Rs 1 crore and turnover under Rs 5 crore will be classified as “micro”.

- A company with investment up to Rs 10 crore and turnover up to Rs 50 crore will be classified as “small”.

- A firm with investment up to Rs 50 crore and turnover under Rs 250 crore will be classified as “medium”.

Pointers about MSMEs in India

- According to the Annual Report of the Department of MSMEs (2018-19), there are more than 6 crore MSMEs in the country.

- MSMEs are the growth accelerators of the Indian economy, contributing about 30% of the country’s gross domestic product (GDP).

- 99.5% of all MSMEs fall in the micro category. Small and medium MSMEs are predominantly present in urban India whereas, micro enterprises are equally distributed over rural and urban India.

- Around 51% of MSMEs are situated in rural India and 49% of them are situated in urban India.

- Both rural and urban MSMEs together employ over 11 crore people but 55% of the employment happens in the urban MSMEs.

- The gender ratio among employees is largely consistent across the board at roughly 80% male and 20% female.

- In terms of exports, MSMEs are an integral part of the supply chain and contribute about 48% of the overall exports.

- MSMEs also play an important role in employment generation, as they employ about 110 million people across the country.

About International MSMEs Day

- The United Nations (UN) designated 27th June as Micro, Small and Medium-sized Enterprises Day through a resolution passed in the UN General Assembly in 2017.

- The theme for the 2021 International MSMEs day is “MSME 2021: Key to an inclusive and sustainable recovery.”

- It has been funded by the 2030 Agenda for Sustainable Development Sub-Fund of the United Nations Peace and Development Fund.

- The UN wants countries to recognise sustainable development goals and create awareness about them.

Measures that can give some hope to the MSME sector

- Why assemble in India, when we can Make-in-India?: Now could be the right time for the Government to roll out sops to MSMEs that manufacture locally. The Government eMarketplace (GeM) could be of great use to suppliers looking for purchasers and vice versa. Investing in online infrastructure while also encouraging small businesses to source locally could help improve manufacturing while also cutting on our import costs.

- Delay MSME loan repayments or extend tenures: As the RBI pumps in more cash into the banking sector, deferring or relieving the MSMEs of loan repayments could come as a welcome move. Most businesses are looking for financial support from the government and doing this can help them cope with cash flow problems. Relaxing bad loan norms could also be a saving move for this sector.

- Inventory management for exporters: Businesses that are into exports could use some help with inventory management. In the Union Budget 2020, Sitharaman proposed building warehouses at block/taluk level. If the government could allot subsidised warehousing to exporters while figuring out the supply chain side of things, it could potentially help support the economy.

-Source: Hindustan Times

China turns on second-biggest dam in world

Context:

The first two generating units of the world’s second-biggest hydroelectric dam were officially turned on in southwestern China.

Relevance:

Prelims, GS-I: Geography, GS-II: International Relations

Dimensions of the Article:

- About China and its large hydropower dams

- Important Rivers of China

About China and its large hydropower dams

- China is the world’s leader in hydropower capacity, with a total of 1.302 terawatt-hours as of 2019. Canada is a distant second with 398 TWh.

- As befits the global leader, China is home to four of the world’s largest hydropower plants, including the massive Three Gorges dam and Xiluodu, with a capacity of 13.86 GW.

Chinese Dams in news recently

- Despite environmentalists criticizing China for putting up massive dams on the Yangtze River and its tributaries, Chinese authorities proceed with hydropower construction as they seek to reduce the carbon footprint of electricity generation in the country.

- The Baihetan Dam, built by the Chinese Three Gorges Corporation, will be the second-largest hydropower generating facility in the world – it comes second after the largest hydropower project in the world (also in China) the Three Gorges which has a capacity of 22.5 GW.

- Recently, another massive hydropower project became fully operational in China, the Wudongde hydropower plant on the Yangtze River – the Wudongde hydropower plant would have the capacity to produce 38.91 billion kWh annually at full capacity. This will be the equivalent of saving some 12.2 million tons of standard coal and eliminating 30.5 million tons of carbon dioxide annually.

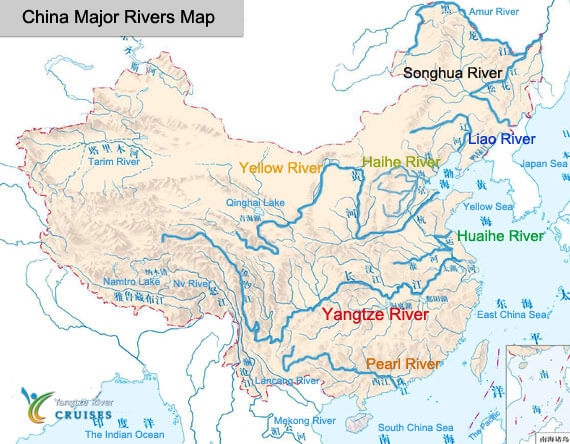

Important Rivers of China

Yangtze River

- Yangtze River is the largest and longest river in China, even in Asia (surpassed only by the Nile of Africa and the Amazon of South America).

- It originates from the Tuotuo River on the southwestern side of the snow-draped Geladandong, flowing from west to east through 9 provinces and city of Shanghai before running into the East China Sea.

- Yangtze river is responsible for half of China’s agricultural produce and 35% population of China lives along it.

- Hydroelectricity is generated by the massive dams on the river including the Three Gorges Dam.

Yellow River

- Huang He (yellow river) is a perennial river cutting across the loess plateau and it is the second longest river of China. It is the highest sediment carrying river in the world that shifts constantly.

- It originates from Kariqu Stream on the northern side of Bayan Har Mountans in Qinghai-Tibet Plateau, flowing from west to east and finally pouring into Bohai Sea.

- It is “the cradle of Chinese civilization” as its basin, specifically, the Wei valley that cuts across the long Ordos loop, was the birthplace of ancient Chinese civilizations and the most prosperous region in early Chinese history.

Heilongjiang River / Amur River

- Heilongjiang River (black water) forms the border between the Russian Far East and Northeastern China. It is also known as the Amur River.

- It rises in the hills of western Manchuria and as it flows through China, Mongolia and Russia, it can be called an “international river”.

- Within the river basin, there are abundant mineral resources and fish stocks, especially Salmon and Huang Fish.

- The Amur is an important symbol of, and geopolitical factor in, Chinese–Russian relations. The Amur became especially prominent in the period of the Sino–Soviet political split of 1956–1966.

-Source: The Hindu