Context: Inflation, as measured by the consumer price index (CPI), was 6.7% in the January-March quarter, 6.6% in the April-June quarter (based on imputed data) and 6.9% in the July-September quarter.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Mains questions:

- In many ways, the inception of the MPC itself was to make the decision making of the RBI more broad-based. Discuss. 15 marks

Dimensions of the editorial

- What is the Monetary Policy Committee?

- What are the objectives of MPC?

- Challenges related to MPC

- Way forward

What is MPC?

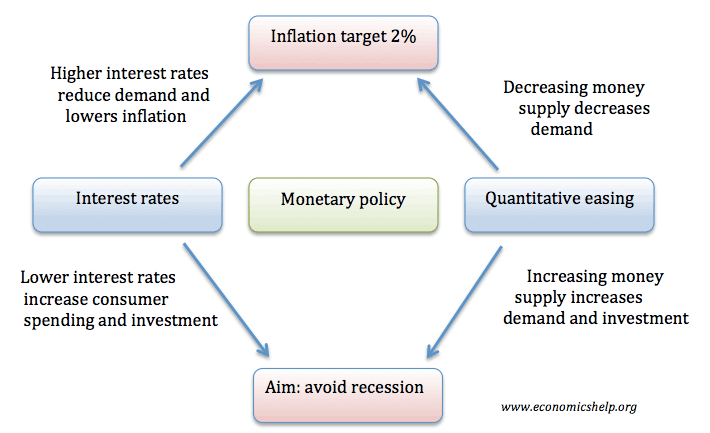

The Monetary Policy Committee (MPC) is the body of the RBI, headed by the Governor, responsible for taking the important monetary policy decisions about setting the repo rate. Repo rate is ‘the policy instrument’ in monetary policy that helps to realize the set inflation target by the RBI (at present 4%).

The Monetary Policy Committee (MPC) is formed under the RBI with six members. Three of the members are from the RBI while the other three members are appointed by the government. Members from the RBI are the Governor who is the chairman of the MPC, a Deputy Governor and one officer of the RBI. The government members are appointed by the Centre on the recommendations of a search-cum-selection committee which is to be headed by the Cabinet Secretary.

Objectives of the MPC

Monetary Policy was implemented with an initiative to provide reasonable price stability, high employment, and a faster economic growth rate. The major four objectives of the Monetary Policy are mentioned below:

- To stabilize the business cycle.

- To provide reasonable price stability.

- To provide faster economic growth.

- Exchange Rate Stability.

The inflation target, notified in August 2016, is 4%. The upper tolerance level was set at 6% and the lower tolerance level at 2%. Average inflation overshooting the upper tolerance level or remaining below the lower tolerance level for any three consecutive quarters constitutes a failure to achieve the inflation target. In such an event, the Reserve Bank of India (RBI) is required to send a report to the Centre, stating the reasons for the failure to achieve the inflation target, the remedial actions it proposes to initiate, and an estimate of the time-period within which it expects to achieve the inflation target through the corrective steps proposed.

Challenges related to MPC:

Ineffective monetary policy transmission: Monetary transmission refers to the process by which a central bank’s monetary policy signals (like repo rate) are passed on, through financial system to influence the businesses and households. The ineffective monetary policy transmission has following consequences.

- RBI is unable to achieve its mandate effectively– towards regulating various parameters like inflation, growth.

- Economic situation remains out of control– whereby country faces job losses, growth in unemployment rates due to stagnating growth.

- Inflation hurts the marginalized– as price rise hits at the pocket of poor sections the most. It becomes a failure on the part of a welfare state.

- Negative signals to the investors– which are otherwise tempted to invest in India due to its favorable interest eco-system.

- Uncertainties in business cycle– where major companies are not able to take decisions with predictable policy cycle.

- Ineffectiveness of Fiscal Policy– whereby government incentives like subsidies, interest subventions do not remain attractive as banks do not respond to policy signals.

Reasons for a lag in monetary transmission in India: Followings are the reasons related to poor monetary transmission in India.

- Overdependence on banks– The Indian financial system remains bank-dominated, and the share of nonbank finance companies (NBFCs) and markets (corporate bonds, commercial paper, equity, etc.) is less. Hence, most public savings are in Bank deposits, reducing the banks’ dependency on repo rate.

- Double Financial Repression– Pressure on banks due to locking of funds in government securities (SLR) and cash reserves (CRR).

- Priority Sector Lending- creates additional burden on banks to lend on a priority basis

- Increasing Non Performing Assets- in bank balance sheets, which impedes the bank’s ability to offer lower interest rates.

Data limitations:

The MPC uses the inflation data from Consumer Price Index. However, sometime it faces challenges related to accuracy of this data e.g. The normal data collection exercise of the National Statistics Office was disrupted during the lockdown imposed due to the COVID-19 pandemic. The publication of the CPI had to be suspended for the months of April and May.

Way forward

The central bank should be allowed to state expressly what support by way of government policy it needs to meet the inflation target. This can only strengthen the RBI’s hand; it should not let go of the opportunity to reinforce the MPC framework. Transparency can enable more informed decision-making within the government, greater public scrutiny of the RBI’s performance, and an improved inflation-targeting regime. To slack off on it would be to compromise with the credibility, transparency and predictability of monetary policy.

Background:

RBI and its Functions: It was established in 1935 under the provisions of RBI Act, 1934. RBI has seven major functions:

- Print Notes: RBI has the sole autonomy to print notes. The government has the sole authority to mint coins and one rupee notes.

- Banker to the Government: It manages government’s deposit accounts. It also represents govt. as a member of the IMF and World Bank.

- Custodian of Commercial Bank Deposits

- Custodian to Country’s Foreign Currency Reserves

- Lender of Last Resort: Commercial banks come to RBI for their monetary needs in case of emergency.

- Central Clearance and Accounts Settlement: As RBI keeps cash reserves from commercial banks therefore it rediscounts their bills of exchange easily.

- Credit Control: It controls supply of money in the economy through its monetary policy.

- The power to appoint RBI Governor solely rest with the Central Govt. and he holds office at the pleasure of Central Government (tenure not exceeding 5 years).