Focus: GS-II Polity and Governance

Why in news?

An application has been filed in the Supreme Court for an urgent hearing of a pending petition against the electoral bonds scheme, especially on account of the opening of the sale window for electoral bonds right before the Bihar Assembly elections.

Electoral Bonds Explained

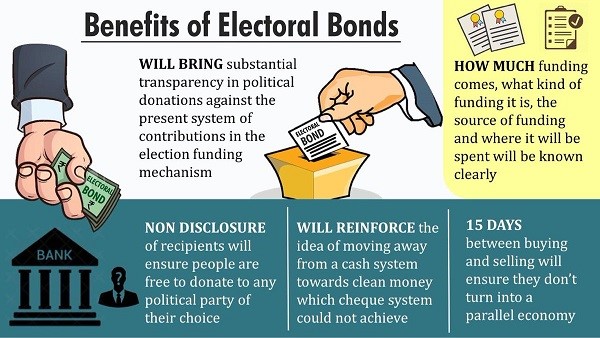

- On January 2, 2018, the government had notified the Electoral Bond Scheme 2018. It was touted as an alternative to cash donations and to ensure transparency in political funding.

- As per the provisions of the scheme, electoral bonds may be purchased by an Indian citizen or a company incorporated or established in India.

- Only political parties registered under Section 29A of the Representation of the Peoples Act, 1951 and has secured no less than one per cent votes in the last Lok Sabha elections are eligible to receive electoral bonds.

- The electoral accounts are issued by the State Bank of India (SBI). The electoral bonds can be purchased in the months of January, April, July and October.

- Political parties are allotted a verified account by the Election Commission and all the electoral bond transactions are done through this account only.

- The donors can buy these electoral bonds and transfer them into the accounts of the political parties as a donation. The electoral bonds are available in denominations from Rs 1,000 to Rs 1 crore.

- The bonds remain valid for 15 days and can be encashed by an eligible political party only through a bank account with the authorised bank within that period only.

- Every donor has to provide his/her KYC detail to the banks to purchase the electoral bonds. The names of the donors are kept confidential.

- Before 2017, the electoral bonds scheme was for donation of over Rs 20,000. In 2017, the government capped the donation limit at Rs 2,000.

What is Political Funding?

- Political Funding implies the methods that political parties use to raise funds to finance their campaign and routine activities.

- A political party needs money to pitch itself, its objectives, its intended actions to get votes for itself.

Statutory Provisions

- Section 29B of the Representation of the People Act (RPA) entitles parties to accept voluntary contributions by any person or company, except a Government Company.

- Section 29C of the RPA mandates political parties to declare donations that exceed 20,000 rupees. Such a declaration is made by making a report and submitting the same to the EC. Failure to do so on time disentitles a party from tax relief under the Income Tax Act, 1961.

-Source: The Hindu