Context: Over the last couple of months, the Centre and States have not been on the same page over issues connected with the Goods and Services Tax (GST).

Relevance:

GS Paper 2: issues and challenges of federal structure

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein

Mains Questions:

- Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. 15 marks

- Discussion the rationale for introducing Good and services tax in India. Bring out critically the reasons for delay in roll out for its regime. 15 marks

- Economic and fiscal federalism scholarship offers us reasonably sound economic and normative reasons, which include efficiency, equity, stabilisation, economic growth, and balanced development. Examine this statement in context of implementation of GST in India. 15 marks

Dimensions of the editorial:

- What is GST?

- Significance of GST.

- Advantages of GST.

- Challenges regarding GST.

- Steps to address these challenges.

- Way forward

What is GST?

GST is a destination-based indirect tax and is levied at the final consumption point. Under it, the final consumer of the goods and services bear the tax charged in the supply chain. GST is a transparent and fair system that prevents black money and corruption and promotes new governance culture.

Significance of GST:

- GST merged the indirect central government levies like sales tax, service tax, excise duty, surcharges and cesses and indirect state government levies like VAT, Entry tax etc. Earlier, India’s indirect tax regime was fragmented with many taxes at both Centre & State level with varying rates of each in different jurisdictions. This created tariff & nontariff barriers to trade.

- Encouragement to co-operative federalism: GST Council has proved to be an extremely effective and powerful decision making federal institution.

- Reduced Human Interface: GST is largely technology driven leading to speedy decisions.

- Improving revenue buoyancy: GST revenue growth is 11 per cent, would translate into a revenue buoyancy of 1.14 against the historical buoyancy of indirect taxes of about 0.9.

- GST Network: data generated by the GSTN can provide deep insights about the economy. It would also provide data quickly to the policy-makers on various emerging trends in the economy.

- Better Compliance: Total registrations post GST increased from around 65 lakh to a110 lakh (without double counting), representing a net gain of around 70 percent.

- More efficient neutralization of taxes especially for exports thereby making our products more competitive in the international market.

Advantages of GST:

- Unified National Market: It is a step towards “One Country, One Tax, One Market” providing a relatively stable tax regime which will give boost to foreign investment and Make in India.

- Impact on economy – It is estimated to increase the GDP growth by 1.5 to 2%. Inflation in general for goods is going to be reduced due to removal of cascading effect as well as lower rates than present regime for most of them.

- No Cascading effect: GST prevents cascading of taxes as it is a destination based consumption tax & Input Tax Credit is available across goods and services at every stage of supply.

- Ease of doing business: Harmonization of laws, procedures and rates of tax, will improve environment of compliance as all returns to be filed online, input credits to be verified online reducing need to deal with different tax authorities. It would also discourage mere ‘invoice shopping’.

- Reduce Tax Evasion: Uniform SGST and IGST rates will reduce incentive for evasion because of

- Elimination of rate arbitrage between neighbouring States and that between intra and inter-state sales as integrated GST rate would be applicable.

- ‘Self-policing feature’ of tax being levied on the value added to a good or service.

- Reduction in compliance costs due to simplification as no multiple record keeping for a variety of taxes because 17 taxes and cesses is merged into one.

- Impact on consumer – Half the consumer price index basket, including food grains, will be attract zero tax rate, thus enabling them to be part of GST chain but without burdening consumers.

Challenges regarding GST:

- Digital infrastructure – Availability of bandwidth for digital connectivity all-over India to conduct electronic transfers and payments properly.

- Issue of Parliamentary and Legislative autonomy : GST Council (an executive body) will finalize a vote by a majority of not less than three-fourths of weighted votes of members present and voting (Centre to have 33% and states to have 66% weight of the total votes cast).

- Federalism: The states are giving up much of their most important power – ‘to impose taxes’ autonomously. States will no longer be able to change their tax rates individually. As both Centre and State is vested with power to make law on GST under Art. 246(A) unlike existing regime, both centre and state will have to work together which may create workspace challenge.

- Urban local bodies will have to deal with a huge fiscal gap once local body tax, octroi and other entry taxes are scrapped for GST system.

- List of Exclusions & different rates – Many exclusions like petroleum products, diesel, petrol, aviation turbine fuel, alcohol etc. & 4 different rates are undermining the principle of One Country, One Tax.

- Pressure due to increased taxes – Small companies with a turnover of Rs 10 lakh will have to pay GST as opposed to currently Rs 1.5 crore. Even unorganized sector, biggest job creator, may loose its competitive edge. They may have to raise prices to stay profitable.

- For consumers – Benefits from reduced cost due to lower taxes may not be passed on to them. Also, some are seeing GST as a regressive system of taxation as it more or less equalizes taxation across products which mean that rich will pay less tax on luxury goods and services and poor will pay more for basic goods and services.

Steps taken by Government to address these challenges:

- Exemptions to small business – Businesses in the North-eastern and hill states with annual turnover below Rs.10 lakh would be out of the GST net, while the threshold for the exemption in the rest of India would be an annual turnover of Rs 20 lakh.

- Anti – profiteering law: The GST council has approved the creation of National Anti-Profiteering Authority (NAA) to ensure that benefits of input tax credit and tax reductions are passed on to the end consumer.

- Mandatory registration: Tax can’t be evaded now– as every person should be in the GST system if he wants to trade. E-way bill also has been passed where movement of good costing more than 50,000 beyond 10 Km is required to be registered online.

- Change in ownership pattern of Goods and Services Tax Network: Earlier 51% of GSTN was privately held. This gave the control of tax and trade data to a private company and without adequate data protection measures. GSTN council has approved change in the ownership structure and eventually the central government should hold 50 percent and the state governments will hold 50 percent collectively.

- Communication and awareness programs: For this, Suvidha Kendra’s in government offices and various handholding programmes are started.

- GST suvidha providers (GSP): GSTN has selected 34 GSPs to provide innovative and convenient methods to taxpayers and to smoothen the process of tax administration under GST.

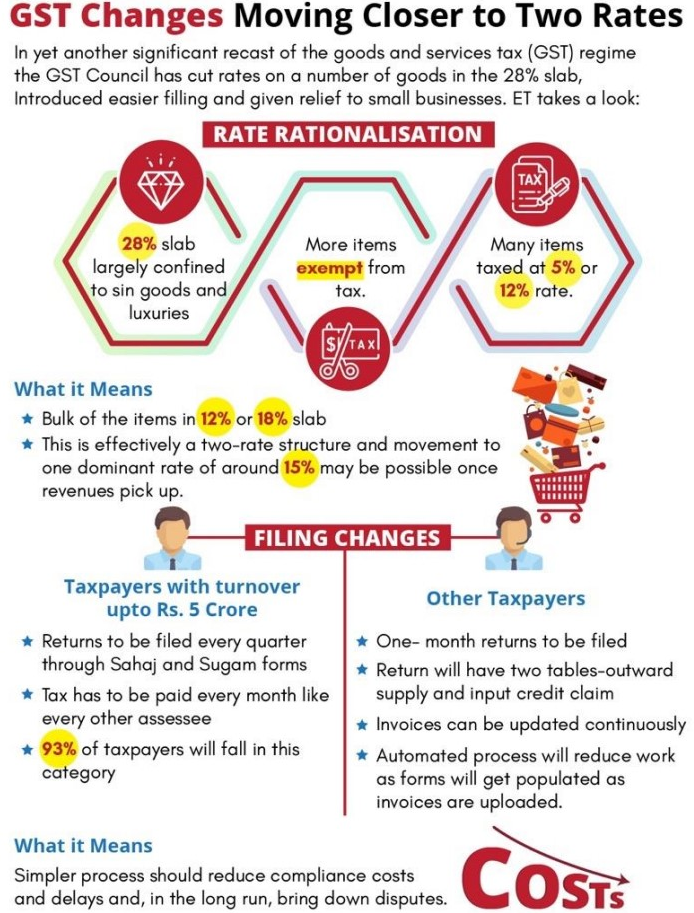

- Rate Rationalization: GST rates has been rationalized to make system more effective which would lead to lower tax burden and better tax compliance.

- Mandatory e-way Application:

Way forward:

The GST has helped us transition from “one nation, many taxes” to “one nation, one tax”. It has been a wonderful lesson in co-operative federalism, one which is in the process of transforming India into a common market by bringing about economic integration in an already integrated polity. GST is still a work in progress and the next important step would be to bring the excluded items, especially electricity, real estate and petroleum products, within its ambit.