Context: While the waiver of the interest on interest is welcome, MSMEs need more help

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Sub topics: Sector of economy (Small Scale Industries)

Mains questions:

- For India, just achieving economic growth is not sufficient. We require job-led growth to provide employment to 400 million plus workforce. Discuss this statement in context of MSMEs sector in India. 15 marks

- India needs a roadmap to make MSMEs resilient, sustainable and a part of the nation’s green development plan. In this context examine the U.K. Sinha committee recommendations. 15 marks

Dimensions of topic:

- What is MSMEs?

- What is new classification of MSMEs?

- Significance of MSMEs.

- Challenges being faced by MSMEs.

- Recent measures by the government to help MSMEs.

- Recommendations of expert committee on MSMEs (U.K. Sinha)

- Way forward

What is MSMEs?

The Government of India has introduced MSME or Micro, Small, and Medium Enterprises in agreement with Micro, Small and Medium Enterprises Development (MSMED) Act of 2006. These enterprises primarily engaged in the production, manufacturing, processing, or preservation of goods and commodities.

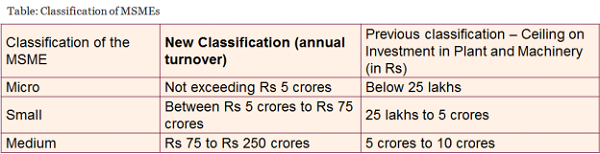

Classification of MSMEs: The government proposed new classification:

Significance of MSMEs: Across the globe, MSMEs are accepted as a means of economic growth and for promoting equitable development. They are known to generate the highest rate of growth in the economy. MSMEs have driven India to new heights through requirements of low investment, flexible operations, and the capacity to develop appropriate native technology.

- MSMEs employ around 120 million persons, becoming the second-largest employment generating sector after agriculture.

- With approximately 45 lac units throughout the country, it contributes about 6.11% of GDP from manufacturing and 24.63% of the GDP from service activities.

- MSME ministry targets to increase its contribution towards GDP by up to 50% by 2025 as India moves ahead to become a $5 trillion economy.

- Contributing around 45% of overall Indian exports.

- MSMEs promote all-inclusive growth by providing employment opportunities, especially to people belonging to weaker sections of the society in rural areas.

- MSMEs in tier-2 and tier-3 cities help in creating opportunities for people to use banking services and products, which can amount to the final inclusion of the contribution of MSMEs for the economy.

Challenges being faced by MSMEs:

- Limited capital: Absence of adequate and timely banking finance, as per Economic Survey 2017-18, the MSME received only 17.4 per cent of the total credit outstanding as of November 2017.

- Problem of delayed payments is faced by MSMEs due to various reasons, which increase the financial crunch for their businesses.

- Due to their lack of scale and in-house capabilities, MSEs find it difficult to access proper market for selling their products.

- Large-scale presence of MSMEs in informal sector, which doesn’t allow them to use different assistance available to MSMEs.

- Non-availability of suitable technology, creating public perception of products with low quality standards.

- Low production due to reasons such as Ineffective marketing strategy, constraints on modernisation & expansions etc.

- Deficiencies in basic infrastructural facilities like water, power supply, road/rail and telephone connectivity, etc.

- There are large numbers of clusters but the resource availability for undertaking cluster development activities is limited.

- A huge divergence persists between research institutions (suppliers of technology) and the business requirements of MSMEs (consumers of technology)

- Presently, MSMEs must do multiple registrations with various entities such as Udyog Aadhaar portal, GSTN, NSIC, etc. This leads to cumbersome registration process and duplication of efforts.

Recent measures by the government to help MSMEs:

1: Credit and Financial Assistances to MSMEs:

- 59-minute loan portal to enable easy access to credit for MSMEs: A link to this portal will be made available through the GST portal.

- Interest Subvention: A 2 percent interest subvention will be provided for all GST registered MSMEs, on fresh or incremental loans. For exporters who receive loans in the pre-shipment and post-shipment period, there will be an increase in interest rebate from 3 percent to 5 percent.

- Cash flow certainty: All companies with a turnover more than Rs. 500 crore, must now compulsorily be brought on the Trade Receivables e-Discounting System (TReDS). Joining this portal will enable entrepreneurs to access credit from banks, based on their upcoming receivables. This will resolve their problems of cash cycle.

- Prime Minister’s Employment Generation Programme (PMEGP) is aimed at generating self-employment opportunities through establishment of micro-enterprises in the non-farm sector by helping traditional artisans and unemployed youth.

- Credit Guarantee Scheme for Micro and Small Enterprises covers collateral free credit facility (term loan and/or working capital) extended by eligible lending institutions including Non-Banking Financial Company (NBFC) to new and existing micro and small enterprises up to 2 crore per borrowing unit.

- Credit Linked Capital Subsidy Scheme (CLCSS) aims at facilitating technology upgradation of the MSME sector.

- The Government has also initiated the Pradhan Mantri Mudra Yojana for development and refinancing activities relating to micro industrial units.

2: Skill Development and Training :

- A Scheme for Promotion of Innovation, Rural Industry & Entrepreneurship (ASPIRE) to create a framework for start-up promotion through Network of Technology Centres and Incubation and commercialisation of Business Idea Programme.

3: Infrastructure:

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI)

- Scheme for Micro & Small Enterprises Cluster Development Programme (MSE-CDP)

4: Marketing Assistance:

- Scheme for providing financial assistance to Khadi institutions under MPDA (Market Promotion Development Assistance).

- MSME Delayed Payment Portal – MSME Samadhaan

- Public Procurement Portal for MSEs – MSME Sambandh

- Mandatory public procurement: Public sector companies have been mandated to compulsorily procure 25 percent, instead of 20 percent of their total purchases, from MSMEs.

- Women entrepreneurs: Out of the 25 percent procurement mandated from MSMEs, 3 percent now be reserved for women entrepreneurs.

- GeM Portal: All public sector undertakings of the Union Government must now compulsorily be a part of GeM. They should also get all their vendors registered on GeM.

5: Technology Upgradation and Competiveness:

- Financial Support to MSMEs in ZED (Zero Defect and Zero Effect) certification to encourage MSMEs to upgrade their quality standards in products and processes with adoption of Zero Defect production processes and without impacting the environment, etc

6: Ease of Doing Business

- Support to pharma companies: Clusters will be formed of pharma MSMEs and 70 percent cost of establishing these clusters will be borne by the Union Government.

- One annual return: The return under 8 labour laws & 10 Union regulations now to be filed only once a year.

- No more inspector raj: Now the establishments to be visited by an Inspector will be decided through a computerised random allotment and inspectors must upload reports on portal within 48 hours.

- Relaxation in environmental clearances: As part of establishing a unit, an entrepreneur needs two clearances namely, environmental clearance and consent to establish. Under air pollution and water pollution laws, now both these have been merged as a single consent. Moreover, the return will be accepted through self-certification.

- Reserve Bank of India (RBI) has asked the banks to link the floating interest rate on retail loans and loans extended to micro and small businesses to external benchmarks like Repo Rate or Treasury Bills.

Committee recommendations: the report of the ‘Expert Committee on Micro, Small and Medium Enterprises’ under the chairmanship of U.K. Sinha was released by the Reserve Bank of India.

- Review of the legislative framework- The Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 may be reimagined as a comprehensive and holistic MSME Code having a provision for sunset on plethora of complex laws scattered all over the legislative framework.

- Change in the definition of MSMEs– from current investment based to turnover-based definition, as it would be more transparent, progressive, easier to implement. It will also remove the bias towards manufacturing enterprises in the existing definition.

- Strengthening the procurement mechanism– by promotion of the Government e-Market (GEM) Portal and improving its payment system.

- Exit Policy for MSMEs- Due to the lack of sophistication on the part of MSMEs, Insolvency code/ delegated legislation should provide for out-of-court assistance to MSMEs such as mediation, financial education, or the appointment of a trustee.

- Market Support for MSMEs- can be enhanced by developing networks of development service providers that can provide customized solutions to MSMEs that are struggling with capability and resources constraints.

- Setup a National Council for MSMEs- under the Chairmanship of the Prime Minister, in order to facilitate coherent policy outlook and unity of monitoring.

Way forward:

The development of MSMEs is crucial on many counts for Indian economy and society. Apart from proper implementation of U.K. Sinha Committee recommendations, a cue could be taken from the global best practices such as the Competition by cooperation concept in Italy, Contract Financing in Mexico and success stories of Shenzhen as a technology hub in China.