Focus: GS-III Indian Economy

Why in news?

The Government of India, the Government of Maharashtra, Mumbai Railway Vikas Corporation and the Asian Infrastructure Investment Bank (AIIB) signed a loan agreement for a $500 million Mumbai Urban Transport Project-III.

Details

- The Project aims to improve the network capacity, service quality and safety of the suburban railway system in Mumbai.

- The Project is expected to increase network capacity in the region with the reduction in journey time and fatal accidents of commuters.

- There will be direct safety benefits to passengers and the public through introduction of trespass control measures.

- With a population of less than 25 million (2011), Mumbai Metropolitan Region (MMR) is the most populous metropolitan region in India and is expected to reach almost 30 million by 2031. Around 86 per cent of Mumbai commuters rely on public transport.

- This population growth represents the core driver behind Mumbai’s urban expansion, compelling the state of Maharashtra to prioritize sound urban and infrastructure planning which balances economic activities, mobility as well as the optimization of environmental and social outcomes.

Recently in news:

- The latest loan for India was for $750 million, to support vulnerable households impacted by COVID-19 – which came two days after the clash in Galwan Valley in Ladakh along the India-China border.

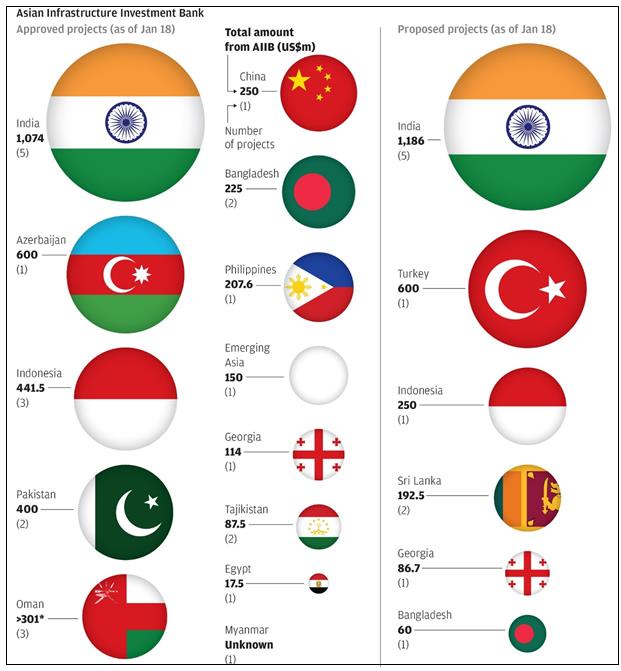

- India has received the most funding of any country from the bank.

- India was among the AIIB’s 57 founding members in 2016 and is also its second-largest shareholder with around 8% of voting shares (China is the largest with more than 25%).

- AIIB president assured that the management will look at the proposed projects from the economic and financial point of view and not with a political view.

- The bank has supported several projects under the BRI framework, but is not formally linked to the plan.

About Asian Infrastructure Investment Bank (AIIB)

- The Asian Infrastructure Investment Bank (AIIB) is an international financial institution proposed by China. The purpose of the multilateral development bank is to provide finance to infrastructure projects in the Asia-Pacific region.

- It is headquartered in Beijing and commenced operations in 2016.

- By investing in sustainable infrastructure and other productive sectors today, it aims to connect people, services and markets that over time will impact the lives of billions and build a better future.

Membership:

- Membership in the AIIB is open to all members of the World Bank or the Asian Development Bank and is divided into regional and non-regional members.

- Regional members are those located within areas classified as Asia and Oceania by the United Nations.

- The China-led Asian Infrastructure Investment Bank (AIIB) has officially approved 57 nations as prospective founding members, with Sweden, Israel, South Africa, Azerbaijan, Iceland, Portugal and Poland the latest to be included.

- Countries accepted as AIIB founding members include China, India, Malaysia, Indonesia, Singapore, Saudi Arabia, Brunei, Myanmar, the Philippines, Pakistan, Britain, Australia, Brazil, France, Germany and Spain.

- Founding members have priority over nations that sign up later because they will have the right to set the rules for the bank.

- As of May, 2020, the bank currently has 78 members as well as 24 prospective members from around the world.

Financial Capital of AIIB:

- The AIIB’s initial total capital is USD 100 billion divided into 1 million shares of 100 000 dollars each, with 20% paid-in and 80% callable.

- Paid-Up Share Capital: It is the amount of money that has already been paid by investors in exchange for shares of stock.

- Called-Up Share Capital: Some companies may issue shares to investors with the understanding they will be paid at a later date.

- This allows for more flexible investment terms and may entice investors to contribute more share capital than if they had to provide funds up front.

- China is the largest contributor to the Bank, contributing USD 50 billion, half of the initial subscribed capital.

- India is the second-largest shareholder, contributing USD 8.4 billion.

- Voting Rights:

- China is the largest shareholder with 26.61 % voting shares in the bank followed by India (7.6%), Russia (6.01%) and Germany (4.2 %).

- The regional members hold 75% of the total voting power in the Bank.