Contents

- India rejects market economy tag for China

- India’s trade balance with China not suitable for boycott

- SEBI eases fund-raising norms for firms

- PM CARES Fund: SC seeks government reply

- Giant manta ray caught off Masula coast

INDIA REJECTS MARKET ECONOMY TAG FOR CHINA

Focus: GS-III Indian Economy, GS-II International Relations

Why in news?

India rejected China’s demand to grant it market economy status.

Background

- World Trade Organization (WTO) members are allowed to apply anti-dumping measures on any company if it exports a product at a lower price than its home market, and if the product threatens to impact the local industry.

- China joined the WTO after years of negotiations on the condition that it will be treated as a non-market economy by other member countries for anti-dumping proceedings.

- While the 15-year period ended the European Union and the US have held back from granting market economy status to China, citing wide-ranging price control on export commodities by China.

- India initiated 18 anti-dumping proceedings in 2019, most of them against China, however, China remains one of India’s largest trading partners and a major source for intermediate products for its industry.

What is a non-market economy?

A non-market economy refers to a country which has a complete or substantially complete monopoly of its trade and where all domestic prices are fixed by the state.

Details

- Chinese companies are demanding to Directorate General Of Anti-Dumping And Allied Duties (DGTR), that India must recognize China PR as a market economy status, and after the expiry of China’s accession to WTO, it must be treated in same way as any other WTO member and, regardless of the domestic law of a particular member, imports from China PR must be demonstrated on the basis of Chinese prices and costs

- China’s demands come in response to anti-dumping investigations involving imports of organic chemical compound Aniline and anti-biotic Ciprofloxacin Hydrochloride.

- India said that since Chinese producers failed to file relevant information to prove the market economy status, India will continue to treat China as a non-market economy, which allows it to impose steep anti-dumping duties on imports from China.

Way forward for China

- China has to take positive actions, remove distortions from its market and provide evidence for other countries to take an informed decision about its market economy status.

- As 80% of Chinese companies are directly or indirectly controlled by the state and the banks are controlled by the Chinese Communist Party, then China’s claim that its trade partners should give it market economy status is not correct.

Click Here to read more about DGTR and China’s dumping of medicine (5th Article)

-Source: Livemint

INDIA’S TRADE BALANCE WITH CHINA NOT SUITABLE FOR BOYCOTT

Focus: GS-III Indian Economy, GS-II International Relations

Introduction

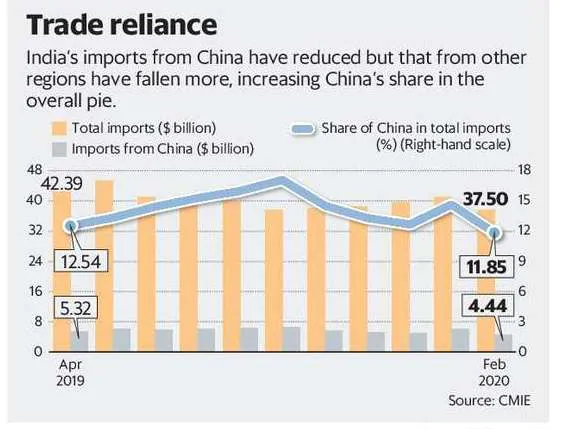

- The border tensions with China have given rise to calls for an economic boycott of the neighbour.

- A look at India’s trade balance with China shows that the trade interdependence between the two countries is quite deep.

- Unless Indian companies begin to make the products currently imported from China in a cost-effective way, we would only be hurting ourselves by putting restrictions on these.

Current Situation and Dependence on China

- China accounted for almost 12% of India’s total imports, and only 3% of India’s total exports. Clearly, we buy more from China than we sell.

- India’s trade deficit with China is a large portion of India’s overall trade deficit.

- Chinese exports into India are entrenched in the supply chain of several sectors.

- There is actually an increase in China’s share in India’s overall imports, because, Chinese businesses were slowly opening up even as India and other countries were under lockdown, hence, the neighbouring country could cater to a lot of cross-border trade.

- While imports are crucial, the latest improvement in India’s exports can also be partly attributed to the increased demand from China.

What did we import from China?

Engineering goods dominate the import basket from China to India, followed by electronics.

Another major segment is key raw materials for sectors such as pharmaceuticals and automobiles.

-Source: Livemint

SEBI EASES FUND-RAISING NORMS FOR FIRMS

Focus: GS-III Indian Economy

Why in news?

As part of its attempts to make it easier for listed companies to raise funds in the current volatile scenario, the Securities and Exchange Board of India (SEBI) has taken 2 important steps with respect to intervals and stakes.

Details

- SEBI has allowed listed companies to raise funds at shorter intervals while also giving promoters the go-ahead to increase their stakes by a higher quantum without triggering an open offer.

- This is a significant move as the earlier regulations mandated a minimum gap of six months between two such issuances.

- In another important amendment, the regulator has said that promoters can increase their stakes in their companies through preferential allotments by up to 10% without triggering an open offer.

Benefits

- These measures along with the relaxation on rights issues, permitted earlier, are aimed at increasing liquidity for Indian companies.

- Relaxation from the takeover code could be a good opportunity for promoters who are looking to increase their stakes at attractive valuations, given the current market sentiments.

SEBI

The Securities and Exchange Board of India (SEBI) is the regulator of the securities and commodity market in India owned by the Government of India.

SEBI was established in 1988 and given Statutory Powers on 30 January 1992 through the SEBI Act, 1992.

The SEBI is managed by its members, which consists of the following:

- The chairman is nominated by the Union Government of India.

- Two members, i.e., Officers from the Union Finance Ministry.

- One member from the Reserve Bank of India.

- The remaining five members are nominated by the Union Government of India, out of them at least three shall be whole-time members.

SEBI has to be responsive to the needs of three groups, which constitute the market:

- issuers of securities

- investors

- market intermediaries

SEBI has three functions rolled into one body: quasi-legislative, quasi-judicial and quasi-executive.

- It drafts regulations in its legislative capacity.

- It conducts investigation and enforcement action in its executive function.

- It passes rulings and orders in its judicial capacity.

Though this makes it very powerful, there is an appeal process to create accountability.

- There is a Securities Appellate Tribunal which is a three-member tribunal.

- A second appeal lies directly to the Supreme Court.

Powers of SEBI

For the discharge of its functions efficiently, SEBI has been vested with the following powers:

- to approve by−laws of Securities exchanges.

- to require the Securities exchange to amend their by−laws.

- inspect the books of accounts and call for periodical returns from recognised Securities exchanges.

- inspect the books of accounts of financial intermediaries.

- compel certain companies to list their shares in one or more Securities exchanges.

- registration of Brokers and sub-brokers

-Source: The Hindu

PM CARES FUND: SC SEEKS GOVERNMENT REPLY

Focus: GS-II Governance

Why in news?

The Supreme Court sought a response from the government to a plea that contributions made to the PM CARES Fund to fight COVID-19 should be transferred entirely to the National Disaster Response Fund (NDRF).

Details

Petition called for future contributions and grants by individuals and institutions for the COVID-19 battle should be credited to the NDRF and not the PM CARES Fund.

The Petition also asked the court to direct the government to frame a National Plan to deal with pandemic.

Recently in News

The Prime Minister’s Office (PMO) had refused to disclose details on the creation and operation of the PM CARES Fund, telling a Right to Information applicant that the fund is “not a public authority” under the ambit of the RTI Act, 2005.

Click Here to read more about the Petition of PM CARES (1st Article)

Click Here to read more about the PM CARES fund and PMNRF

-Source: The Hindu

GIANT MANTA RAY CAUGHT OFF MASULA COAST

Focus: GS-III Environment and Ecology, Prelims

Why in news?

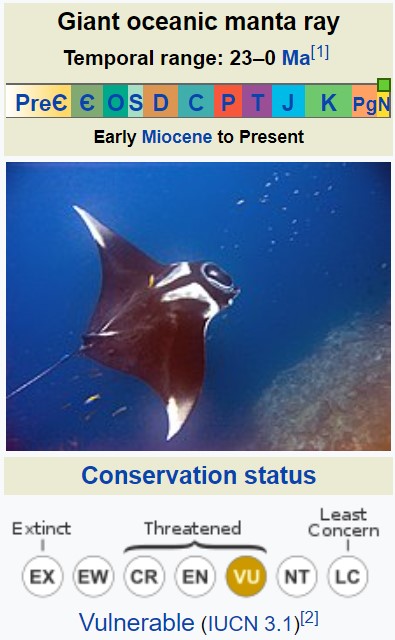

A giant manta ray (Mobula birostris) weighing about 1,150 kg was caught by fishermen off Machilipatnam coast.

Giant Oceanic Manta Ray

- The giant oceanic manta ray (Mobula birostris) is a species of ray in the family Mobulidae, and the largest type of ray in the world.

- The oceanic manta ray is considered to be vulnerable by the IUCN’s Red List of Endangered Species because its population has decreased drastically over the last twenty years due to overfishing.

- They are circumglobal and are typically found in tropical and subtropical waters, but can also be found in temperate waters.

-Source: The Hindu