Why in news?

The Centre’s steep tax hike on petrol and diesel may net it a huge Rs 1.7 lakh crore in additional tax revenue this fiscal year.

Since March, tax-starved states such as Delhi, Tamil Nadu, Maharashtra, Goa, Karnataka, West Bengal, Assam, Punjab and Haryana have sharply hiked Value Added Taxes (VAT) on fuel in an effort to plug massive holes in revenue collections.

How and How much the Government Cashes in?

- Taxes on oil and related sectors have been a major source of revenue for the Central and state governments since crude oil prices began falling in 2015.

- Over the past six years, both the Centre and states have sharply hiked fuel taxes even as crude oil plunged from over $100 per barrel levels in late 2014 to below $20 this summer.

- Since 2014, the Centre has raised levies over a dozen times, sending fuel tax revenues soaring from just Rs 1.15 lakh crore in 2014-15 to Rs 2.32 lakh crore in 2018-19.

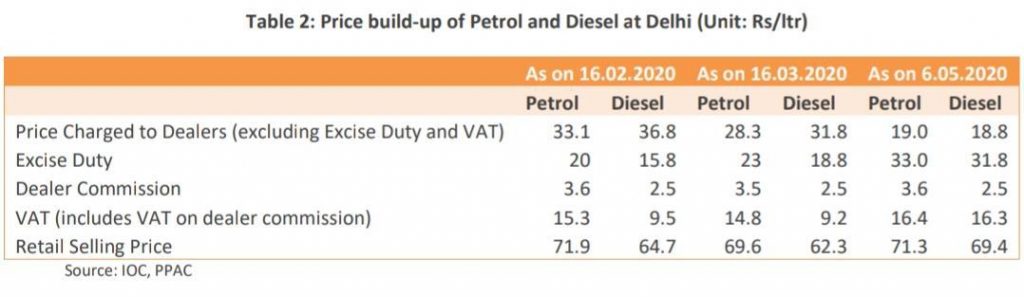

- Central and state taxes accounted for over 69% of retail fuel prices in the national capital on May 6.

Impact on Oil Marketing Companies (OMCs)

- While marketing margins for oil firms remain higher than normal due to the decision to freeze prices, OMCs will lose out from the Centre’s move. Especially if crude oil prices recover and the government does not cut taxes in the future.

- If OMCs protect their margins and pass on the price rise to consumers, it could lead to a sharp rise in fuel prices and inflation.

-Source: Indian Express