Introduction to rising Gold Prices

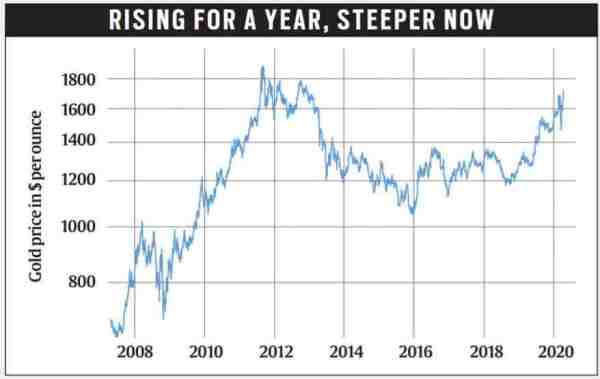

- Much before Covid-19’s impact reverberated across economies and led to a crash in global stock markets, gold prices had started their upward glide since May 2019 to culminate into a nearly 40 per cent jump in less than a year.

- The present gold prices in India are even higher, as they jumped from around Rs 32,000 per 10 grams to nearly Rs 46,800 per 10 gram during the same period, a nearly 45 per cent return.

- Since gold is mostly imported commodity into India, the depreciation of the rupee vis-a-vis the US dollar of around 7 per cent since last September pushed the gold prices in India even higher.

Why are gold prices rising?

- The expectation of recession sowed the seeds of the gold rally, and shutdown of major economies across the world, added momentum to the rising gold prices as a major global recession now looks certain.

- Any expansion in the paper currency tends to push up gold prices.

- Apart from this, major gold buying leading central banks of China and Russia over the last two years supported higher gold prices.

Trend in rising gold prices

- While gold by itself does not produce any economic value, it is an efficient tool to hedge against inflation and economic uncertainties.

- It is also more liquid when compared with real estate and many debt instruments which come with a lock-in period.

- After any major economic crash and recession, gold prices continue their upward run.

- The empirical findings suggest that gold prices fall with a rise in equity prices.

- Gold prices also move in tandem with heightened economic policy uncertainty, thereby indicating the safe haven feature of the asset, the RBI said in its latest Monetary Policy Report.

Can gold prices crash?

- Given the economic uncertainty, gold is expected to touch a new all time high, which will be over $1900 an ounce. In India, the prices will also be supported by any further weakness in the Indian rupee. Any sudden sale of gold holdings by central banks to tide over the economic crisis, and crisis in other risk assets prompting investors compensate their losses through sale of gold ETFs (exchange traded funds), are the key events could stall the gold rise.

- As an when economic recovery picks up pace investors will start allocating more funds to risk assets like stocks, real estate and bonds and pull out money from safe havens such as gold, US dollar, government debt and Japanese yen.

- As per historical trends, when equity and risk assets start an upward trend, gold typically falls significantly as was the case from 2011 till 2015.