CONTENTS

- Surge in Tax Concessions for Political Donations

- Dark Oxygen

- Report on Currency and Finance

- Landslide

- Nano-MIND Technology

- Integrated Disease Surveillance Programme

- Mettur Dam

Surge in Tax Concessions for Political Donations

Context:

Recent financial data shows a notable increase in tax concessions for donations to political parties, with nearly Rs 4,000 crore granted in the fiscal year 2022-23. This rise underscores the growing trend of using tax deductions to support electoral funding and highlights broader shifts in political finance and its impact on fiscal policy.

Relevance:

GS II: Indian Economy

Dimensions of the Article:

- Tax Concessions on Political Donations

- Implications of Increasing Tax Concessions

- Regulations on Political Donations in India

- Way Forward

Tax Concessions on Political Donations

- Definition of Tax Concession

- A tax concession refers to a reduction in tax liabilities or a favorable change in tax regulations that benefits specific groups or organizations.

- Indian Tax Provisions

- In India, tax concessions for political donations are governed by the Income Tax Act, 1961.

- Section 80GGB: Allows Indian companies to receive tax deductions for donations to political parties or electoral trusts, excluding cash donations.

- Section 80GGC: Applies to individuals, firms, and non-corporate entities, enabling tax deductions for similar contributions, also excluding cash donations.

- Deductions are available for donations made through cheques, account transfers, or electoral bonds.

- Definition of Political Party

- A political party is defined as one that is registered under Section 29A of the Representation of the People Act, 1951.

- Recent Statistics

- For FY 2022-23, tax concessions for political donations totaled approximately Rs 3,967.54 crore.

- In FY 2021-22, the tax concessions were Rs 3,516.47 crore, reflecting a 13% increase from the previous year.

- Since FY 2014-15, the cumulative impact of tax concessions on political donations has reached around Rs 12,270.19 crore.

- In FY 2022-23, Rs 2,003.43 crore of these concessions were attributed to corporate donations under Section 80GGB.

- Individuals claimed Rs 1,862.38 crore in deductions under Section 80GGC.

Implications of Increasing Tax Concessions

- Trends in Electoral Financing

- The rise in tax concessions points to a growing dependence on donations from corporations and individuals for political financing.

- This trend may influence the balance of power and decision-making within politics.

- Need for Transparency

- The increase in political donations underscores the need for enhanced transparency in political financing to ensure accountability and mitigate undue influence.

- Impact on Public Finances

- Rising tax concessions could affect government revenue, potentially impacting funding for public services and infrastructure.

- Excessive tax concessions might lead to market distortions, benefiting specific sectors or companies disproportionately.

- Long-Term Fiscal Concerns

- While tax concessions may promote short-term growth, they need to be managed carefully to avoid compromising long-term fiscal health and sustainability.

Regulations on Political Donations in India

- Acceptance of Donations

- Section 29B of the Representation of the People Act, 1951: Permits political parties to accept voluntary contributions from individuals or companies, excluding government entities and foreign sources.

- Corporate Contributions

- Section 182 of the Companies Act, 2013: Authorizes Indian companies to donate to political parties under specific conditions, including:

- Board approval

- Payments made through non-cash methods

- Disclosure in the company’s profit and loss account

- Section 182 of the Companies Act, 2013: Authorizes Indian companies to donate to political parties under specific conditions, including:

- Tax Deductions

- Income Tax Act, 1961: Provides tax deductions for donations to political parties or electoral trusts:

- Section 80GGB: For Indian companies

- Section 80GGC: For individuals and non-corporate entities

- Income Tax Act, 1961: Provides tax deductions for donations to political parties or electoral trusts:

- Foreign Contributions

- Foreign Contributions (Regulations) Act, 2010 (FCRA): Prohibits political parties from accepting donations from foreign sources. However, Indian companies with permissible foreign investment are not classified as foreign sources and can contribute under the Companies Act, 2013.

- Electoral Bonds Scheme

- Introduced in 2018, this scheme allows anonymous donations to political parties. Bonds can be purchased from authorized banks and are valid for 15 days.

- In February 2024, the Supreme Court of India declared the Electoral Bond Scheme and related amendments unconstitutional, citing violations of the right to information.

Way Forward

- Revising Tax Concessions

- Reevaluating the framework for tax concessions to ensure they align with fiscal policies and minimize negative impacts on government revenues.

- Alternative Funding Mechanisms

- Setting reasonable limits on tax deductions and exploring other political funding methods to ensure system sustainability.

- Public Funding for Political Parties

- Considering government financial support to reduce reliance on private donations and minimize the influence of vested interests. Public funding models vary, with some countries offering funds based on election performance, membership fees, or donations. Examples include “democracy vouchers” in Seattle.

- Enhanced Transparency

- Mandating full disclosure of all political donations, including those through electoral bonds. Establishing an independent commission to oversee political finance with robust oversight mechanisms.

-Source: The Hindu

Dark Oxygen

Context:

Scientists have recently reported an unknown process generating oxygen in the world’s oceans’ deep regions, where photosynthesis is not possible due to the absence of sunlight. This discovery is significant as it indicates the presence of previously unknown ecosystems and highlights the importance of oxygen in supporting marine life.

Relevance:

GS I: Geography

Dimensions of the Article:

- What is Dark Oxygen?

- About Deep Sea Mining

- About Deep Ocean Mission

What is Dark Oxygen?

- Observation

- Scientists have detected an unexpected increase in oxygen levels in certain regions of the abyssal zone, where sunlight is too dim for photosynthesis to occur.

- Definition

- This phenomenon, identified as ‘dark oxygen,’ represents a new source of oxygen independent of photosynthesis.

- Potential Causes

- Great Conveyor Belt: Normally, oxygen in deep ocean areas is supplied by this global circulation system, which should diminish without local production due to oxygen consumption by small marine organisms.

- Polymetallic Nodules: One hypothesis suggests that polymetallic nodules on the ocean floor might be generating oxygen. These nodules are made of iron, manganese hydroxides, and rock and could potentially produce oxygen by splitting water molecules through transported electric charges.

- Unclear Energy Source: The exact mechanism or energy source for how these nodules produce oxygen is still unknown.

- Study Location

- The research was carried out in the Clarion-Clipperton Zone, located off the west coast of Mexico. This region is renowned for its high concentration of polymetallic nodules.

About Deep Sea Mining

- The deep sea is the region of the ocean below a depth of 200 metres, and the practise of mining for minerals there is referred to as deep-sea mining.

- The international seabed is defined as the area that lies outside of national jurisdiction and accounts for about 50% of the total area of the world’s oceans, according to the International Seabed Authority, a body established under the United Nations Convention on the Law of the Sea (UNCLOS) for monitoring all activities related to mineral resources in the deep sea.

Issues:

- It may significantly affect marine ecosystems and biodiversity.

- Deep-sea habitats may change or be destroyed by machine-aided excavation and gauging of the ocean floor.

- As a result, there will be a loss of species—many of which are unique to the area—as well as a fragmentation or loss of the structure and functionality of the ecosystem.

- It will agitate the seafloor’s fine sediments and release suspended particle plumes.

- Mining ships’ surface wastewater discharges make this situation worse.

- Noise, vibration, and light pollution brought on by mining machinery and surface vessels, as well as potential fuel leaks and spills, could have an impact on species like whales, tuna, and sharks.

About Deep Ocean Mission:

Nodal: Ministry of Earth Sciences

- Deep Ocean Mission is a mission mode project to support the Blue Economy Initiatives of the Government of India.

- Government of India has also launched a ‘Deep Ocean Mission’ for exploration of polymetallic nodules in Central Indian Ocean Basin.

- Polymetallic nodules contain multiple metals like copper, nickel, cobalt, manganese, iron, lead, zinc, aluminium, silver, gold, and platinum etc. in variable constitutions and are precipitate of hot fluids from upwelling hot magma from the deep interior of the oceanic crust.

- It is a Central Sector Scheme and no separate allocation for States is envisaged.

- It is proposed to collaborate with non-governmental organizations for research collaboration for various components of Deep Ocean Mission.

The major objectives proposed under Deep Ocean Mission are as follows:

- Development of technologies for deep sea mining, underwater vehicles and underwater robotics;

- Development of ocean climate change advisory services;

- Technological innovations for exploration and conservation of deep sea biodiversity;

- Deep ocean survey and exploration;

- Proof of concept studies on energy and freshwater from the ocean; and

- Establishing advanced marine station for ocean biology.

-Source: The Hindu

Report on Currency and Finance

Context:

The Reserve Bank of India (RBI) released the Report on Currency and Finance (RCF) for the year 2023-24 with the theme – India’s Digital Revolution.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- India’s Digital Revolution – Key Highlights

- Significance of Digitalisation in India’s Financial Sector

- Challenges Posed by Digitalisation in Finance

- Remittances in India – Key Insights

- Way Forward for India’s Digital Finance Ecosystem

India’s Digital Revolution – Key Highlights

- Leadership in Digital Public Infrastructure: India is at the forefront of the global digital revolution, bolstered by its robust digital public infrastructure (DPI), evolving institutional frameworks, and a tech-savvy population.

- Global Rankings: India ranks first globally in biometric-based identification (Aadhaar) and real-time payments volume, second in telecom subscribers, and third in the startup ecosystem.

- Unified Payments Interface (UPI): UPI has transformed the retail payment landscape in India, providing a faster and more convenient transaction experience for users.

- Central Bank Digital Currency (CBDC): The Reserve Bank of India (RBI) is leading the charge with pilot runs of the e-rupee, India’s version of a central bank digital currency.

- Digital Lending Ecosystem: This sector is gaining momentum with initiatives like the Open Credit Enablement Network and the Open Network for Digital Commerce. FinTechs are partnering with banks and non-banking financial companies (NBFCs) to offer digital credit services.

Significance of Digitalisation in India’s Financial Sector

- Next-Generation Banking: Innovations in digital payments and credit assessment models are streamlining loan disbursements in the retail sector.

- Efficient Financial Markets: Digitalisation is enhancing access to affordable financial services, improving the efficiency of direct benefit transfers (DBTs), and boosting e-commerce through embedded finance.

- Global Impact: India’s digitalisation is fueling growth in service exports and reducing remittance costs. The RBI’s participation in Project Nexus aims to interlink India’s UPI with fast payment systems in Malaysia, the Philippines, Singapore, and Thailand for instant cross-border retail payments.

Challenges Posed by Digitalisation in Finance

- Cybersecurity and Data Privacy: The increasing digital footprint raises concerns about cybersecurity, data privacy, and data bias, along with risks associated with vendors and third parties.

- Complexity and Risks: Emerging technologies bring new financial models that users may not fully understand, increasing the risk of exposure to fraudulent apps and manipulative practices.

- Human Resource Challenges: The financial sector may face a skills gap, necessitating significant investments in upskilling and reskilling workers.

Remittances in India – Key Insights

- Global Context: According to the World Bank, global remittances reached an estimated US$ 857.3 billion in 2023, with India contributing US$ 115.3 billion, the highest share globally.

- Regional Sources: In 2021, more than half of India’s inward remittances came from Gulf countries, with North America contributing 22%.

- Economic Impact: The remittance-to-GDP ratio in India has increased from 2.8% in 2000 to 3.2% in 2023, surpassing the ratio of gross FDI inflows to GDP (1.9% in 2023), strengthening India’s external sector.

- Future Outlook: India’s working-age population is expected to continue growing until 2048, positioning the country as a leading labor supplier globally. This demographic trend could drive remittances to around $160 billion by 2029.

Way Forward for India’s Digital Finance Ecosystem

- Enhanced Regulatory Frameworks: To ensure financial stability, customer protection, and competition, India’s regulatory and supervisory frameworks must evolve. The Digital Personal Data Protection (DPDP) Act 2023 is an example of efforts to safeguard personal data in a digitalized environment.

- Balancing Regulation and Innovation: The goal is to maintain a balance between effective regulation and the promotion of financial innovations within a safe and trustworthy ecosystem.

-Source: Indian Express

Wayanad Landslide

Context:

At least 144 persons were killed and 197 injured after multiple landslides flattened some three villages in Vythiri taluk of the hilly Wayanad district of Kerala early on July 30.

Relevance:

GS III- Disaster Management

Dimensions of the Article:

- Landslide in Wayanad: Key Details and Causes

- What are Landslides?

- Two Primary varieties of Landslides in India

- Why are Landslides more frequent in the Himalayas than in the Western Ghats?

Landslide in Wayanad: Key Details and Causes

Incident Overview

- Event: A severe landslide occurred in the hilly region of Meppadi in Kerala’s Wayanad district.

- Casualties: The disaster claimed the lives of at least 144 people.

- Timing: The first landslide struck around 1 AM, followed by a second at 4:30 AM.

Causes of the Wayanad Landslide

- Heavy Rainfall: The region experienced extremely heavy rainfall, with over 140 mm recorded in just 24 hours, about five times the normal amount for this period.

- Fragile Ecology: The area’s fragile ecological balance, coupled with increased population pressures, contributed to the landslides.

- Geographical Vulnerability: The western part of Kerala, characterized by hilly terrain with steep slopes, is inherently susceptible to landslides.

- Terrain Composition: Wayanad’s landscape has a distinctive structure with a layer of soil over hard rocks. Intense rainfall saturates the soil, allowing water to penetrate and flow between the soil and rock layers, destabilizing the soil and triggering landslides.

- Deforestation: Loss of forest cover, particularly in plantation areas, increases the land’s vulnerability to landslides. According to a 2021 study, 59% of landslides in Kerala occur in plantation regions.

Environmental and Climatic Factors

- Arabian Sea Warming: Climate scientists have highlighted the warming of the Arabian Sea as a factor behind unpredictable and heavy rain patterns. This warming causes atmospheric instability, leading to the formation of deep cloud systems that result in heavy rainfall over short periods, thereby increasing landslide risks.

- Ecological Sensitivity: The “Western Ghats Ecology Expert Panel,” led by ecologist Madhav Gadgil, recommended in 2011 that the Wayanad hill ranges and 75% of the Western Ghats’ 129,037 sq km area be declared ecologically sensitive due to dense forests, endemic species, and unique geology.

- Panel Recommendations: The panel advised creating zones based on ecological sensitivity, with strict monitoring and protection measures, including bans on mining, quarrying, new thermal power plants, hydropower projects, and large-scale wind energy projects in the most sensitive areas.

- Implementation: Despite these recommendations, implementation has been delayed for over 14 years due to opposition from state governments, industries, and local communities.

What are Landslides?

Landslides are physical mass movement of soil, rocks and debris down the mountain slope because of heavy rainfall, earthquake, gravity and other factors.

Why do Landslides Occur?

- Base of the huge mountains eroded by rivers or due to mining activities or erosion agents resulting in steep slopes.

- Increased industrialisation leading to climate change and weather disturbances.

- Change in river flow due to construction of dams, barriers, etc.

- Loose soil cover and sloping terrain.

Two Primary varieties of Landslides in India

I- Himalayas

- India has the highest mountain chain on earth, the Himalayas, which are formed due to collision of Indian and Eurasian plate, the northward movement of the Indian plate towards China causes continuous stress on the rocks rendering them friable, weak and prone to landslides and earthquakes.

- The Northeastern region is badly affected by landslide problems causing recurring economic losses worth billions of rupees.

II- Western Ghats

- A different variety of landslides, characterized by a lateritic cap (Laterite is a soil and rock type rich in iron and aluminium , and is commonly considered to have formed in hot and wet tropical areas), pose constant threat to the Western Ghats in the South, along the steep slopes overlooking the Konkan coast besides Nilgiris, which is highly landslide prone.

- The problem needs to be tackled for mitigation and management for which hazard zones have to be identified and specific slides to be stabilized and managed in addition to monitoring and early warning systems to be placed at selected sites.

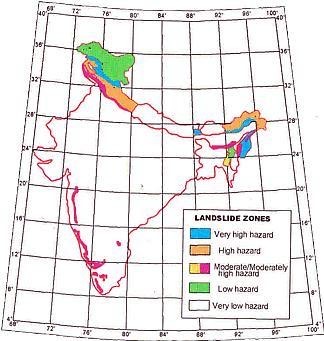

Zone Map

Himalayas of Northwest and Northeast India and the Western Ghats are two regions of high vulnerability and are landslide prone.

Why are Landslides more frequent in the Himalayas than in the Western Ghats?

In the Himalayas, Landslides are very frequent because:

- Heavy snowfall in winter and melting in summer induces debris flow, which is carried in large quantity by numerous streams and rivers – which results in increases chances of Landslides.

- Himalayas are made of sedimentary rocks which can easily be eroded – hence, erosions contribute to more landslides.

- Drifting of Indian plate causes frequent earthquakes and resultant instability in the region.

- Man-made activities like grazing, construction and cultivation abet soil erosion and risks of landslides.

- Himalayas not yet reached its isostatic equilibrium which destabilizes the slopes causing landslides.

- Diurnal changes of temperature are much more in northern India than in southern slopes – weakening the rocks and increasing mass wasting and erosion.

In the Wester Ghats, Landslides are comparatively less frequent because:

- Western Ghats are eroded, denuded, aged, mature, worn out by exogenic forces and have a much lower height – hence, occurrence of Landslides is lesser.

- The Western Ghats are on more stable part of Indian plate, hence, there is a lesser occurrence of earthquakes and landslides.

- While steep slope on western side with high rainfall creates idea condition for landslide but gentle eastern slope with low rainfall and rivers in senile stage, counters the condition.

- Moving of Indian plates doesn’t affect the Western Ghats much (as they are old block mountains), hence the reduced number of landslides.

- Small & swift flowing streams of western side and big matured rivers on eastern side (like Krishna, Godavari, etc) cannot carry large amount of debris.

-Source: The Hindu

Nano-MIND Technology

Context:

Researchers from the Korean Institute of Basic Science have developed a magnetogenetics technology dubbed Nano Magnetogenetic Interface for NeuroDynamics (Nano-MIND) which has been demonstrated on mice.

Relevance:

GS III: Science and Technology

Nano-MIND Technology: Overview and Highlights

Overview

- Nano-MIND (Magnetogenetic Interface for NeuroDynamics): This cutting-edge technology offers new avenues for exploring and influencing complex brain functions, including cognition, emotion, and motivation.

- Functionality: It enables wireless, remote, and precise modulation of specific deep brain neural circuits using magnetic fields and magnetized nanoparticles. This method represents a significant improvement over traditional brain manipulation techniques.

Research Highlights

- Demonstration on Mice: The research team showcased Nano-MIND’s capabilities by activating particular neurons in various brain regions of mice.

- Maternal Behavior Induction: One key achievement was the activation of inhibitory GABA receptors in the medial preoptic area (MPOA), known for governing maternal behaviors. When these neurons were stimulated in non-maternal female mice, the animals displayed markedly increased nurturing behaviors similar to those of maternal mice.

- Regulation of Feeding Behaviors: The researchers also targeted motivation circuits in the lateral hypothalamus to regulate feeding behaviors. Activating inhibitory neurons in this region led to a significant 100% increase in appetite and feeding behaviors in mice. In contrast, activating excitatory neurons resulted in more than a 50% reduction in these behaviors.

Significance

- Advancement in Neuroscience: Nano-MIND technology marks a major advancement in neuroscience, potentially revolutionizing our understanding of brain functions and disorders.

- Applications: The technology holds promise for developing advanced brain-computer interfaces (BCIs) and could play a critical role in treating neurological disorders, offering new avenues for therapeutic interventions.

-Source: India Today

Integrated Disease Surveillance Programme

Context:

A total of 1,862 disease outbreaks were reported to the Integrated Disease Surveillance Programme last year, with the highest number being reported from Kerala, the Lok Sabha was informed recently.

Relevance:

GS II: Health

Integrated Disease Surveillance Programme (IDSP)

Overview

- Nature: The Integrated Disease Surveillance Programme (IDSP) is a decentralized, state-based initiative designed to strengthen disease surveillance across India.

- Launch: It was initiated in November 2004 with assistance from the World Bank, under the Ministry of Health and Family Welfare, Government of India.

Objectives

- Primary Goal: The program aims to establish and maintain a decentralized, laboratory-based, IT-enabled surveillance system for monitoring epidemic-prone diseases.

- Specific Goals:

- To track disease trends.

- To detect and respond to outbreaks during their early stages using trained Rapid Response Teams (RRTs).

Programme Components

- Surveillance Units: Establishment of surveillance units at the national, state, and district levels to integrate and decentralize surveillance activities.

- Human Resource Development: Training of personnel, including State Surveillance Officers, District Surveillance Officers, RRTs, and other medical and paramedical staff, on the principles of disease surveillance.

- Information Technology: Utilization of ICT for data collection, collation, analysis, and dissemination.

- Laboratory Strengthening: Enhancing the capabilities of public health laboratories.

- Inter-Sectoral Coordination: Collaboration with other sectors for managing zoonotic diseases.

Data Management

- Data Collection: Data on epidemic-prone diseases are gathered weekly, categorized into “S” (suspected cases), “P” (presumptive cases), and “L” (laboratory-confirmed cases). This data is reported by health workers, clinicians, and laboratory staff.

- Reporting: Weekly disease outbreak reports are collected from States/UTs, including NIL reports if no cases are observed. These reports are compiled to provide insights into disease trends and seasonality.

- Outbreak Response: If a rising trend in illness is detected, RRTs investigate to identify and control potential outbreaks.

- Data Analysis: The collected data is analyzed at the state and district levels, with appropriate actions taken based on the findings.

-Source: Indian Express

Mettur Dam

Context:

A warning has been issued to people residing in low-lying areas of the Mettur Dam, following increased inflow into the dam.

Relevance:

GS II: Geography

Dimensions of the Article:

- Overview of Mettur Dam

- Key Facts about the Kaveri River

Overview of Mettur Dam

- Introduction:

- Established in 1934, the Mettur Dam stands as one of India’s largest dams.

- Location:

- Positioned in Mettur, Salem District, Tamil Nadu.

- Built across a gorge where the Kaveri River enters the plains.

- Specifications:

- Type: Masonry gravity dam.

- Dimensions: Extends 1,700 meters in length, reaches a maximum height of 120 feet, and holds a capacity of 93.4 tmc ft.

- Reservoir: Creates the Stanley Reservoir.

- Additional Features:

- In 1937, the Mettur hydroelectric and thermal power plant was established at the base of the dam, generating 32 MW of hydropower.

- Nearby park on the opposite side features lawns, fountains, and a statue of Muniappan/Aiyanar.

- Irrigation Benefits:

- Supports irrigation across several districts including Salem, Erode, Namakkal, Karur, Tiruchirappali, and Thanjavur, covering 271,000 acres (110,000 hectares) of farmland.

Key Facts about the Kaveri River

- Overview:

- The Kaveri River, also known as the Cauvery River, is a major river in southern India and holds sacred significance in Hinduism.

- Course:

- Originates from Brahmagiri Hill in the Western Ghats of southwestern Karnataka, at an elevation of 1,341 meters (4,400 feet) above sea level.

- Flows southeast through Karnataka and Tamil Nadu, eventually emptying into the Bay of Bengal through two main mouths.

- Total length: 800 kilometers from source to mouth.

- Geographical Boundaries:

- Flanked by the Western Ghats to the west, the Eastern Ghats to the east and south, and ridges separating it from the Krishna and Pennar basins to the north.

- Basin Area:

- The Kaveri Basin spans Tamil Nadu, Karnataka, Kerala, and the Union Territory of Puducherry, covering 81,155 square kilometers.

- Tributaries:

- Left-bank tributaries: Harangi, Hemavati, Shimsha, and Arkavati.

- Right-bank tributaries: Lakshmantirtha, Kabbani, Suvarnavati, Bhavani, Noyil, and Amaravati.

- Dams:

- Notable dams include Krishna Raja Sagara Dam, Mettur Dam, and Banasura Sagar Dam on the Kabini River, a Kaveri tributary.

-Source: The Hindu