Contents

- The social contract needs to be rewritten

- Bad Bank: Explained

- Student Visa Ban: Hurdle, Opportunity

THE SOCIAL CONTRACT NEEDS TO BE REWRITTEN

Focus: GS-II Governance

Introduction

Professor H.L.A. Hart once said, “freedom (the absence of coercion) can be valueless to those victims of unrestricted competition too poor to make use of it; so, it will be pedantic to point out to them that even though they are starving they are free”.

Social Contract Theory and Democracy

- There is a view that mankind’s ancestors, in the course of evolution, formed the concept of social groups and resultant rules they would abide by. This is the most rudimentary form of what is known as the ‘social contract theory’.

- When monarchies and empires prevailed, it was easy to understand a social contract — to obey an identifiable sovereign, who in turn was deemed to be god’s representative on Earth.

- But democratically elected governments have found it more difficult to derive the same legitimacy.

The social contract comprises two distinct agreements:

- People agreed to establish society by collectively and reciprocally renouncing the rights they had against one another in unbridled nature.

- The people agreed to confer upon one (or more) among them, the authority and power to enforce the initial contract.

In Modern day governments the idea is that society is best-served if a government or other type of institution takes on executive or sovereign power, with the consent of the people.

The case of two Indias

- During the Pandemic, the access to resources to avoid the disease has not been equal.

- The first is an India that observes social distancing, buys its groceries and provisions by observing all precautions and largely obeys governmental directives about COVID-19 prevention.

- The second is an India that crowds railway terminals to travel long distances, sometimes for days, to get back to native towns, and when that fails, decides to resort to the drastic step of even walking those hundreds of kilometres, defying all governmental directives.

- There are still lakhs of Indians less privileged and living cheek by jowl in hovels and slums, for whom the mandated distance of separation of “6 feet” was and still is an impossibility; an abstract concept.

Inequality and dealing with the Pandemic

- However, in deeply unequal societies (where the Gini Coefficient exceeds 0.4, for instance) different strata of society will have very different needs to deal with a crisis of this nature.

- We have seen societies with lower Gini Coefficients deal with the crisis far better, because a uniform approach works perfectly when society is perfectly equal.

Conclusion

- In moments of crisis, people look to the state for guidance and taking them to safety.

- The social contract which imbues a centralised sovereign with overreaching powers has clearly failed on this occasion, and will continue to fail every time a similar challenge is posed.

- What is required is not just a decentralised approach but also a state which is sensitive and responds not only to the needs of those who cry out for help but also meets the requirements of those who are voiceless.

-Source: The Hindu

BAD BANK: EXPLAINED

Focus: GS-III Indian Economy

Why in news?

The Indian Banks Association (IBA) submitted a proposal for setting up a bad bank to the finance ministry and the RBI, proposing equity contribution from the government and the banks.

Introduction

- The idea of setting up a bad bank often comes up for debate, especially when stress in the banking sector is projected to rise in the near term.

- A slump in earnings of companies and individuals could lead to a jump in non-performing assets, reversing the early trends of NPA reduction post enactment of the Insolvency and Bankruptcy Code (IBC) and write-off of bad loans by banks.

- To tackle this upcoming challenge, the banking industry has proposed the setting up of a government-backed bad bank.

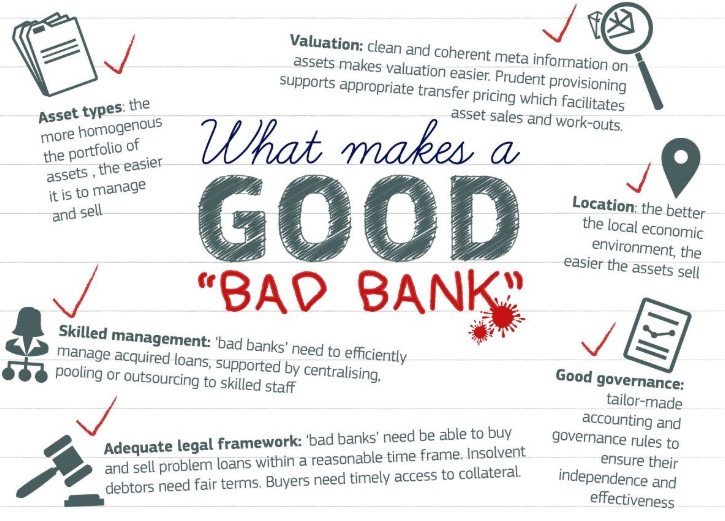

Understanding Bad Banks

- A bad bank buys the bad loans and other illiquid holdings of other banks and financial institutions, which clears their balance sheet.

- A bad bank structure may also assume the risky assets of a group of financial institutions, instead of a single bank.

- Bad banks are typically set up in times of crisis when long-standing financial institutions are trying to recuperate their reputations and wallets.

- Banks that become insolvent as a result of the process can be recapitalized, nationalized, or liquidated.

- If they do not become insolvent, it is possible for a bad bank’s managers to focus exclusively on maximizing the value of its newly acquired high-risk assets.

- Critics of bad banks say that the option encourages banks to take undue risks, leading to moral hazard, knowing that poor decisions could lead to a bad bank bailout.

What kind of NPA spike is expected down the line?

- The impact of Covid-19 and the associated policy response is likely to result in an additional debt of more than Rs. 1.5 Lakh Crores from the top 500 debt-heavy private sector borrowers turning delinquent between FY21 and FY22.

- Given that more than 10% per cent of the outstanding debt is already stressed, the proportion of stressed debt is likely to increase to almost 20% per cent of the outstanding quantum.

What is the government’s view?

- While the finance ministry has not formally submitted its view on the proposal, senior officials have indicated that it is not keen to infuse equity capital into a bad bank.

- The government’s view is that bad loan resolution should happen in a market-led way, as there are many asset reconstruction companies already operating in the private space.

- The government has significantly capitalised state-owned banks in recent years and pursued consolidation in the PSU banking space.

- These steps, along with insolvency resolution under the IBC, are seen as adequate to the tackle the challenge of bad loans.

What is the RBI view?

The central bank has so far never come out favourably about the creation of a bad bank with other commercial banks as main promoters.

Indeed, if the bad bank were in the public sector, the reluctance to act would merely be shifted to the bad bank.

Way Forward: Alternative Options

- Instead of creating a Bad Bank, infusing the capital that would be given to the bad bank directly into the public sector banks is an option.

- The enactment of (Insolvency and Bankruptcy Code) IBC has reduced the need for having a bad bank, as a transparent and open process is available for all lenders to attempt insolvency resolution.

- According to RBI, banks recovered on average more than 40% of the amount filed through the IBC in 2018-19, against just over 20% in total through the SARFAESI, Lok Adalats and Debt Recovery Tribunals.

- A model of Private Asset Management Company (PAMC) which would be suitable for sectors where the stress is such that assets are likely to have economic value in the short run, with moderate levels of debt forgiveness, can be set up.

- National Asset Management Company (NAMC) for sectors where the problem is not just of excess capacity, but possibly also of economically unviable assets in the short- to medium-term, such as in the power sector can also be set up.

What is a Non-Performing Asset (NPA)?

- A nonperforming asset (NPA) refers to a classification for loans or advances that are in default or in arrears.

- A loan is in arrears when principal or interest payments are late or missed.

- A loan is in default when the lender considers the loan agreement to be broken and the debtor is unable to meet his obligations.

How do Non-Performing Assets (NPA) Work?

- Nonperforming assets are listed on the balance sheet of a bank or other financial institution.

- After a prolonged period of non-payment, the lender will force the borrower to liquidate any assets that were pledged as part of the debt agreement.

- If no assets were pledged, the lender might write-off the asset as a bad debt and then sell it at a discount to a collection agency.

SARFAESI Act

- The Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (also known as the SARFAESI Act) is an Indian law that allows banks and other financial institution to auction residential or commercial properties (of Defaulter) to recover loans.

- Under this act secured creditors (banks or financial institutions) have many rights for enforcement of security interest under section 13 of SARFAESI Act, 2002.

- If borrower of financial assistance makes any default in repayment of loan or any instalment and his account is classified as Non performing Asset by secured creditor, then secured creditor may require before expiry of period of limitation by written notice.

- The law does not apply to unsecured loans, loans below ₹100,000 or where remaining debt is below 20% of the original principal.

Click Here to read more about the Insolvency and Bankruptcy Code

-Source: Indian Express

STUDENT VISA BAN: HURDLE, OPPORTUNITY

Focus: GS-II International Relations

Why in news?

- The US Immigration and Customs Enforcement has decided that international students whose courses have gone completely online will have to return to their home countries.

- At the same time, the directive reiterates that international students cannot take more than one class or three credits online.

Significance and what is being done

- After China, India is the second largest country of origin for students in the US.

- While universities are working to find a way out, putting in place hybrid options for international students, national governments are taking up the matter with the US government.

- The current move to use international students to pressure universities to open up has risks, and Universities and even the states stand to lose sizeable revenue.

- The other factor behind this decision is an outreach to a key pro-Trump lobby that wants to reduce immigration, including that of students, who, it argues, would stay on and ‘compete for American jobs.

Opportunity

- This move could momentarily dim the attractiveness of the US as an education destination.

- And it provides an opportunity for alternative destinations to emerge.

- India should treat this as an opportunity and put in place a superior higher education system.

- While it could attract foreign students — and that would be a plus — it would grant Indian students who aspire for world-class higher education their wish right at home, and raise standards across the board.

Click Here to read more about the U.S. Move on Student Visas

-Source: Economic Times