Contents

- Alert amid uncertainty: RBI

- Why are forex reserves shooting up now?

- RBI’s new loan recast scheme

ALERT AMID UNCERTAINTY: RBI

Focus: GS-III Indian Economy

Introduction

- The RBI has prudently decided to keep the key interest rates unchanged citing the “extreme uncertainty” that characterises the current outlook for inflation and economic activity.

- Observing that the “unprecedented shock” from the pandemic has left the economy stressed, the RBI said that while the monetary policy committee recognised the primacy of supporting a recovery, it was necessarily mindful of its inflation targeting mandate.

Uncertainties, and being aware of them

- The provisional June CPI inflation reading of 6.1% had edged over the upper limit of the mandated medium-term goal of 4% plus/minus 2%.

- This excess CPI inflation reading and a spike in food prices as well as cost push pressures from higher transport fuel and raw material prices were combining to obscure the inflation outlook.

- So, RBI’s current stance is that it will take swift action by changing rates, rules, schemes etc., once the picture is clear and the need arises (i.e., when a durable reduction in inflation is sighted).

- The latest round of households’ expectations of price gains in an RBI survey shows that consumers expect inflation to remain elevated in the near term — a finding that the RBI’s assessment broadly backs.

Prognosis

- While the RBI expects the rural economy to turn in a robust recovery on the back of a strong showing by agriculture, a deterioration in consumer sentiment in the central bank’s July survey undermines the prospects for a more broadbased revival in domestic demand.

- Additionally, external demand faces headwinds from a world economy in recession and as global trade shrinks.

- Forecasting a contraction in real GDP in the current fiscal year, the RBI rather optimistically posits that an early containment of the pandemic may impart an upside surprise to its outlook.

- Potential challenges that heightened tensions with China could bring consider China is one of India’s largest trading partners (and in recent years China has become a source of foreign capital), could bring does not seem to figure in RBI’s current analysis given.

- The restructuring, resolution and enhanced gold loan proposals mooted by the RBI acknowledge the sheer scale of the pandemic’s devastation on the finances of firms and households.

-Source: The Hindu

WHY ARE FOREX RESERVES SHOOTING UP NOW?

Focus: GS-III Indian Economy

Introduction

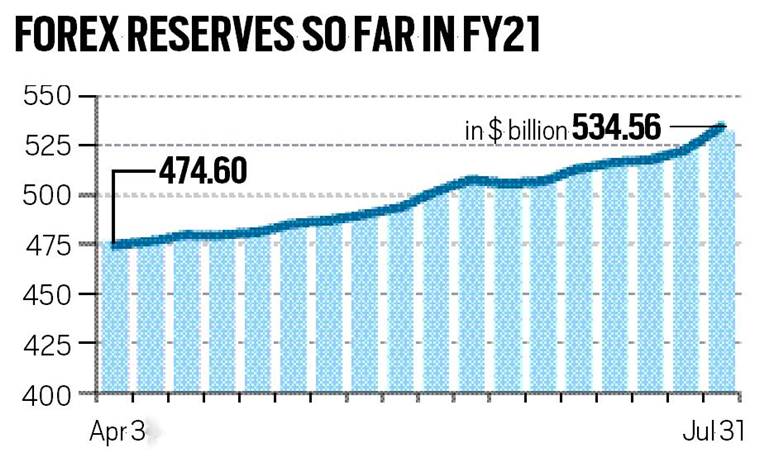

- Covid-hit India’s foreign exchange reserves jumped by a record approx. $12 Billion in the last week of July 2020.

- India’s Forex reserves have hit a new high of almost $ 535 billion, making it the fifth largest holder of reserves in the world.

- At a time when the economy is under stress and the growth is expected to contract in 2020-21, the rising forex reserves have come as a breather as it can cover India’s import bill of more than one year.

What has led to this rise in forex reserves?

I. FPI inflows

While it started with a sharp rise in FPI inflows following the government’s decision in September to cut corporate tax rate.

Between April and December 2019, FPIs pumped in a more than net $ 15 billion, according to the RBI.

II. Dip in crude oil prices

India’s oil import bill declined as the global spread of coronavirus not only roiled the stock markets but also led to a crash in the Brent crude oil prices.

Crude accounts for almost 20 per cent of India’s total import bill, hence the drop-in prices greatly reduced the bills.

III. Import savings

Lockdown across countries in response to Covid-19 pandemic impacted global trade and has resulted in a sharp dip in import expenditure — electronics, gold and also crude oil prices among others.

IV. FDI inflows

FDI inflow has been a significant contributor to the rise in foreign exchange reserves- especially the recent Rs 1 lakh crore plus investment by global tech giants in Jio Platforms.

V. Dip in gold imports

Gold which was a big import component for India witnessed a sharp decline in the quarter ended June 2020 following the high prices and the lockdown induced by the Covid-19 pandemic.

-Source: Indian Exrpress

RBI’S NEW LOAN RECAST SCHEME

Focus: GS-III Indian Economy

Introduction

Reserve Bank of India gave the green signal to a loan restructuring scheme for stressed borrowers – a special window providing one-time loan restructuring to companies and individuals, it will provide relief specifically to those impacted by the Covid-19 pandemic.

Who will benefit from the scheme?

- It is expected to provide relief to companies that were servicing loan obligations on time but could have found it difficult after March, as the pandemic affected their revenues.

- Companies that were already in default for more than 30 days as on March 1, however, cannot avail this facility.

- Industry sources said this could affect revival plans of companies that were about to regain profitability but got hit when the lockdown was imposed.

How will it be implemented?

- The RBI has set up a five-member expert committee which will make recommendations on the financial parameters required.

- While the RBI has given the broad contours, the panel will recommend the sector-specific benchmark ranges for such parameters to be factored into each resolution plan for borrowers with an aggregate exposure of Rs 1,500 crore or above at the time of invocation.

- The committee will also undertake a process validation of resolution plans for accounts above a specified threshold.

- RBI will have the last word on who will be eligible and the parameters.

- According to the RBI’s systemic risk survey, the three sectors most adversely affected by the pandemic are tourism and hospitality, construction and real estate, and aviation.

How will the scheme impact banks?

- The biggest impact will be that banks will be able to check the rise in non-performing assets (NPAs) to a great extent.

- However, it will not bring down the NPAs from the present levels.

- Banks will have to maintain additional 10% provisions against post-resolution debt which will be a burden for banks.

Were earlier such schemes not misused by banks and corporates?

CDR

The RBI discontinued the corporate debt restructuring (CDR) scheme in 2015 because – for several years, corporates were misusing the debt recast plans with the regulator turning a blind eye to manipulations by shady promoters in connivance with some banks.

These promoters managed to get fresh loans and they used liberal loan recasts to evergreen their accounts and keep out of the NPA books.

SDR

Under the Strategic Debt Restructuring (SDR) scheme, banks were given an opportunity to convert the loan amount into 51% of equity which was to be sold to the highest bidder, once the firm became viable.

This was unable to help banks resolve their bad loan problem as only two sales have taken place through this measure due to viability issues.

S4A

In the Sustainable Structuring of Stressed Assets (S4A) scheme, banks were unwilling to grant write-downs as there were no incentives to do so, and write-downs of large debtors could exhaust banks’ capital cushions.

-Source: Indian Express