Contents

- Poor find access to accounts hard

- Govt fast-tracks new definition of MSMEs

- Centre and States absorb Crude Oil Price Drop benefits

- EU forecasts recession of historic proportions

- No proof from U.S. on Wuhan lab claims

POOR FIND ACCESS TO ACCOUNTS HARD

Focus: GS-III Disaster Management

Why in news?

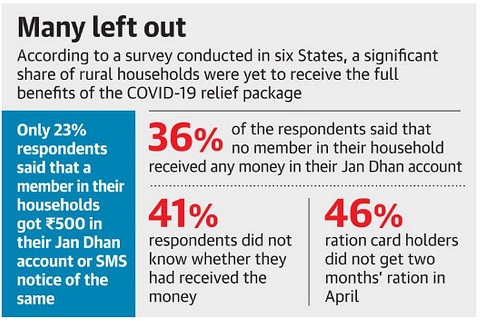

A survey of rural households in Six States cautioned that difficulty in accessing bank accounts meant that the impact of the benefits extended by the Central Government is more limited for the rural poor.

The Benefits that Arrived

- Finance Ministry data showed that ₹34,800 crore has been transferred so far, from the COVID-19 relief package, including extra grain allocations and cash transfers for the poor.

- Beneficiaries include 20 crore poor women who received the first instalment of ₹500 in their Jan Dhan bank accounts, indicating more than 98% coverage of the target group.

- Almost 3 crore pensioners, 8.2 crore farmers, 2.2 crore construction workers and 45 lakh salaried workers also received benefits.

Benefits that could NOT Arrive

- A survey of 130 rural families in Uttar Pradesh, Chhattisgarh, Gujarat, Odisha, Jharkhand and Madhya Pradesh showed that only a third of the households had been able to go to the bank last month, although bank branches were supposed to remain open during the lockdown.

- They also mentioned repeated visits, long queues and Aadhaar-related problems.

- One in five returned without any money; reasons included that the bank was shut or they were put off by the large crowds, or that their passbooks were blocked or their accounts showed zero balance.

- The survey showed that the foodgrain portion of the relief scheme may have had better reach among intended beneficiaries, with 96% of surveyed households having received their ration for April.

- Only 23% of surveyed households said they had received ₹500 in their Jan Dhan bank accounts or received an SMS notification about it.

- About a third of households did not get any money, but more than 40% said they simply did not know if the money had been received.

What does this mean?

- In practice, this means that many of the intended beneficiaries of the Centre’s cash transfers in these areas have not been able to access the relief at a time when it was desperately needed.

- The problem with the government’s decision to give female Jan Dhan account holders ₹500 is that many poor women have non-JDY accounts.

- Further, those who have JDY accounts are also not able to access the cash, because they can’t go to a bank.

-Source: The Hindu

GOVT FAST-TRACKS NEW DEFINITION OF MSMES

Focus: GS-III Indian Economy

Why in news?

The government is fast-tracking the move to amend the definition of micro, small and medium enterprises (MSMEs) to allow these entities to grow in size.

This plan to redefine MSMEs has been on the works for months and is likely a part of the stimulus package that will be announced in the near future.

Background on the proposal to change the definition of MSMEs

- There are around 6.3 crore MSME units in the country, with over 99% categorised as small units.

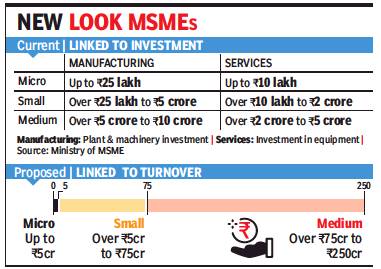

- The current definition is linked to investment in plant and machinery.

- The government has been pushing for turnover-based classification.

- The Citicisms against the move to define MSMEs based on Turnover is that, it will not be in the interest of manufacturers but will benefit assemblers.

- This move was announced as part of a series of stimulus packages announced by her in the wake of slowdown.

- The Government wants to make this move because MSMEs may get hobbled by the definition that was put in place in 2006, when they try to scale up to take on competition from larger and foreign players.

New Definition of MSMEs

- Any unit with a turnover of up to Rs 5 crore was to be classified as a micro enterprise.

- Those with up to Rs 75 crore annual revenue will be in the small unit category.

- Entities with turnover of up to Rs 250 crore will be classified as medium-sized enterprises.

- Until the 2006 law was enacted, there was only one category of manufacturing that was classified as small scale enterprise, eligible for several benefits, including on payment of excise.

Current Definition of Micro, Small and Medium Enterprises:

Enterprises engaged in the manufacture or production, processing or preservation of goods as specified below:

- A micro enterprise is an enterprise where investment in plant and machinery does not exceed Rs. 25 lakh;

- A small enterprise is an enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crore;

- A medium enterprise is an enterprise where the investment in plant and machinery is more than Rs. 5 crore but does not exceed Rs.10 crore.

What are MSMEs?

- MSME stands for Micro, Small, and Medium Enterprises.

- The Micro- Small and Medium Enterprises (MSMEs) are small sized entities, defined in terms of their size of investment.

In accordance with the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006, the enterprises are classified into two divisions.

1. Manufacturing Enterprises

The enterprises engaged in the manufacture or production of goods pertaining to any industry specified in the first schedule to the industries (Development and regulation) Act, 1951) or employing plant and machinery in the process of value addition to the final product having a distinct name or character or use. The Manufacturing Enterprise are defined in terms of investment in Plant & Machinery.

2. Service Enterprises

The enterprises engaged in providing or rendering of services and are defined in terms of investment in equipment.

-Source: Times of India

CENTRE AND STATES ABSORB CRUDE OIL PRICE DROP BENEFITS

Focus: GS-III Indian Economy

Why in news?

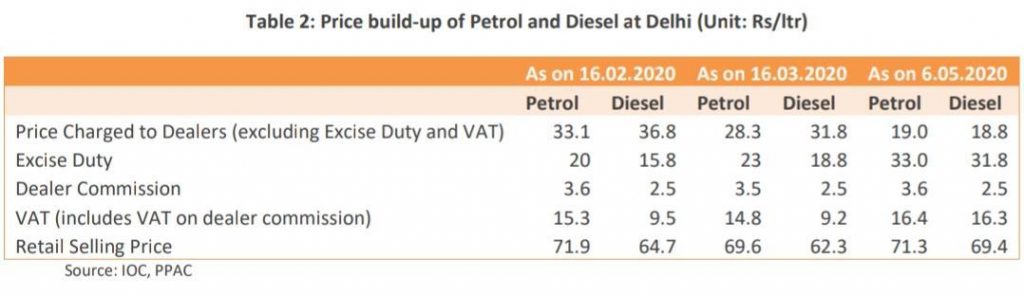

The Centre’s steep tax hike on petrol and diesel may net it a huge Rs 1.7 lakh crore in additional tax revenue this fiscal year.

Since March, tax-starved states such as Delhi, Tamil Nadu, Maharashtra, Goa, Karnataka, West Bengal, Assam, Punjab and Haryana have sharply hiked Value Added Taxes (VAT) on fuel in an effort to plug massive holes in revenue collections.

How and How much the Government Cashes in?

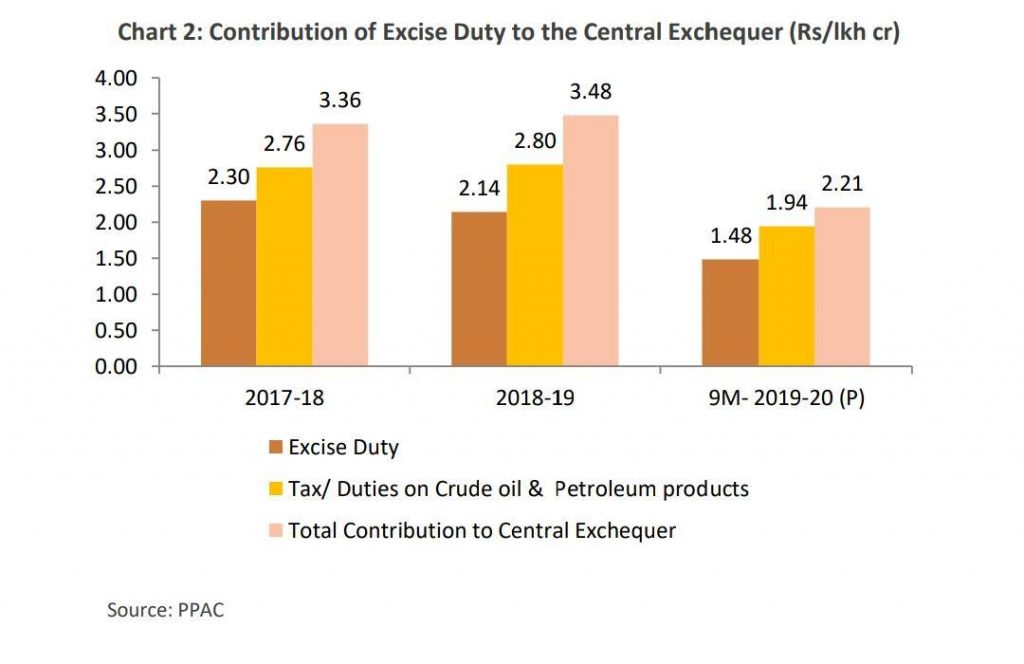

- Taxes on oil and related sectors have been a major source of revenue for the Central and state governments since crude oil prices began falling in 2015.

- Over the past six years, both the Centre and states have sharply hiked fuel taxes even as crude oil plunged from over $100 per barrel levels in late 2014 to below $20 this summer.

- Since 2014, the Centre has raised levies over a dozen times, sending fuel tax revenues soaring from just Rs 1.15 lakh crore in 2014-15 to Rs 2.32 lakh crore in 2018-19.

- Central and state taxes accounted for over 69% of retail fuel prices in the national capital on May 6.

Impact on Oil Marketing Companies (OMCs)

- While marketing margins for oil firms remain higher than normal due to the decision to freeze prices, OMCs will lose out from the Centre’s move. Especially if crude oil prices recover and the government does not cut taxes in the future.

- If OMCs protect their margins and pass on the price rise to consumers, it could lead to a sharp rise in fuel prices and inflation.

-Source: Indian Express

EU FORECASTS RECESSION OF HISTORIC PROPORTIONS

Focus: GS-III Disaster Management

Why in news?

The European Union predicted 6th May “a recession of historic proportions this year” due to the impact of the coronavirus.

Details

- The 27-nation EU economy is predicted to contract by 7.5 per cent this year, before growing by about 6 per cent in 2021.

- With the spread slowing in most European countries, people are cautiously venturing out from confinement and gradually returning to work.

- However, strict health measures remain in place amid concern of a second wave of outbreaks and any return to something like normal life is at least months away.

- Much will depend, he said, on the speed at which lockdowns can be lifted, the importance of services like tourism in each economy and by each country’s financial resources.

European Union

Note: United Kingdom is not a part of the EU now.

- The European Union (EU) is a political and economic union of 27 member states that are located primarily in Europe.

- The EU has developed an internal single market through a standardised system of laws that apply in all member states in those (Only those) matters where members have agreed to act as one.

- A monetary union was established in 1999, coming into full force in 2002, and is composed of 19 EU member states which use the euro currency.

- In January 2020, the United Kingdom became the first member state ever to leave the EU.

-Source: The Hindu

NO PROOF FROM U.S. ON WUHAN LAB CLAIMS

Focus: GS-III Science and Technology

Why in news?

The World Health Organization said on 4th May that Washington had provided no evidence to support “speculative” claims by the U.S. president that COVID-19 originated in a Chinese lab.

Existing Zoonotic theory, and other ideas

- Scientists believe the killer virus jumped from animals to humans, emerging in China late 2019, possibly from a market in Wuhan selling exotic animals for meat.

- But U.S. President Donald Trump, increasingly critical of China’s management of the first outbreak, claims to have proof it started in a Wuhan laboratory.

What are zoonoses?

- A zoonosis is any disease or infection that is naturally transmissible from vertebrate animals to humans.

- The issue of pathogens crossing species to cause diseases is not a new concept. According to the United Nations Environment Programme (UNEP), 60% of all infectious diseases in humans are zoonotic, and about 75% of all emerging infectious diseases are zoonotic in nature.

- Emerging pathogens are more likely to be viruses, than any other kind — bacteria, parasites, fungi — and are more likely to have a broad host range.

- All SARS-CoV-2 genomes sequenced so far have the genomic features described, and are thus derived from a common ancestor that had them too.

- As well as being a public health problem, many of the major zoonotic diseases prevent the efficient production of food of animal origin and create obstacles to international trade in animal products.

-Source: The Hindu