Contents:

- Supreme Court Upholds 2018 order on Land Acquisition

- India Joins Indian Ocean Commission as Observer

- Jagannath temple in trouble with Yes Bank Desposits

- DICGC: Relevance in the wake of Yes Bank issue

- Enforcement Directorate (ED) Questions Kapoor

- Containment is Highest Priority: WHO

- Sensex plunges 2.3% on COVID-19, Yes Bank

- NCLT Approves Cochin Shipyard’s Tebma Plan

SUPREME COURT UPHOLDS 2018 ORDER ON LAND ACQUISITION

Focus: GS-II Governance

Why in news?

The Supreme Court on 6th March 2020, reaffirmed its February 2018 ruling on Section 24 on land acquisition compensation awards, given by a three-judge bench

What is Land Acquisition Act, 2013?

- Land Acquisition Act, 2013 is an Act of Indian Parliament that regulates land acquisition and lays down the procedure and rules for granting compensation, rehabilitation and resettlement to the affected persons in India.

- The Act has provisions to provide fair compensation to those whose land is taken away, brings transparency to the process of acquisition of land to set up factories or buildings, infrastructural projects and assures rehabilitation of those affected.

- The Act establishes regulations for land acquisition as a part of India’s massive industrialisation drive driven by public-private partnership.

- The Act replaced the Land Acquisition Act, 1894, a nearly 120-year-old law enacted during British rule.

What was Section 24 previously?

- Section 24 (2) which concerns land acquisition compensation awards made five years “prior or more” to the coming of existence of the 2013 Act, which replaced the 1894 law.

- The provision said that in such cases, if the physical possession has not been taken “or” the compensation is not paid, the acquisition proceeding is “deemed to have lapsed”.

- The government, if it so wishes, would have to initiate “fresh acquisition proceedings” under the new Act of 2013, which provides for “fair compensation”.

What were the changes in Section 24?

- The Court currently said compensation would be considered paid if the amount is put in the Treasury. There was no obligation that the amount should be deposited in the court in order to sustain the land acquisition proceedings under the 2013 Act.

- Further, the court held that a land acquisition proceeding under Section 24(2) would only lapse if the authorities have neither taken physical possession nor paid the compensation due to the landowner for five or more years prior to January 1, 2014. For this, an “or” in the Section was “interpreted” as an “and”.

- Thus, there is no lapse if possession has been taken and compensation has not been paid. Similarly, there is no lapse if compensation has been paid and possession not taken of the land.

- Further, the Bench held that Section 24(2) of the Act of 2013 does not give rise to a new cause of action to question the legality of concluded proceedings of land acquisition.

INDIA JOINS INDIAN OCEAN COMMISSION AS OBSERVER

Focus: GS-II International Relations, Prelims

Why in news?

India has joined as an observer of the Indian Ocean Commission — the inter-governmental organisation that coordinates maritime governance in the south-western Indian Ocean — a move that will bolster Delhi’s Indo-Pacific vision.

What are the benefits?

- This move has strategic importance as the Commission is an important regional institution in the Western Indian Ocean (WIO).

- It facilitates collective engagement with the islands in Western Indian Ocean that are becoming strategically significant.

- It boosts cooperation with France that has strong presence in the Western Indian Ocean and lends depth to India’s SAGAR policy of PM Narendra Modi 2015.

- The move also strengthens western flank of the Indo-Pacific and is a stepping stone to security cooperation with East Africa.

Indian Ocean Commission

- The Indian Ocean Commission (French: Commission de l’Océan Indien, COI) is an intergovernmental organization that was created in 1982 at Port Louis, Mauritius and institutionalized in 1984 by the Victoria Agreement in Seychelles.

- The COI is composed of five African Indian Ocean nations: Comoros, Madagascar, Mauritius, Réunion (an overseas region of France), and Seychelles.

Missions of COI

- COI’s principal mission is to strengthen the ties of friendship between the countries and to be a platform of solidarity for the entire population of the African Indian Ocean region.

- COI’s mission also includes development, through projects related to sustainability for the region, aimed at protecting the region, improving the living conditions of the populations and preserving the various natural resources that the countries depend on.

- Being an organisation regrouping only island states, the COI has usually championed the cause of small island states in regional and international fora.

Western Indian Ocean (WIO)

- The Western Indian Ocean spans the offshore waters from Somalia to South Africa, and extends beyond Madagascar to include many Small Island Developing States (SIDS).

- This expanse of water encompasses a diverse range of ecologically and nutritionally rich ecosystems such as hydrothermal vents and seamounts, with depths of up to 7,000 metres.

SAGAR Programme (Security and Growth for All in the Region)

- SAGAR is a term coined by PM Modi in 2015 during his Mauritius visit with a focus on blue economy.

- It is a maritime initiative which gives priority to Indian Ocean region for ensuring peace, stability and prosperity of India in Indian Ocean region.

- The goal is to seek a climate of trust and transparency; respect for international maritime rules and norms by all countries; sensitivity to each other`s interests; peaceful resolution of maritime issues; and increase in maritime cooperation.

- It is in line with the principles of Indian Ocean Rim Association.

Significance of Western Indian Ocean (WIO) for India

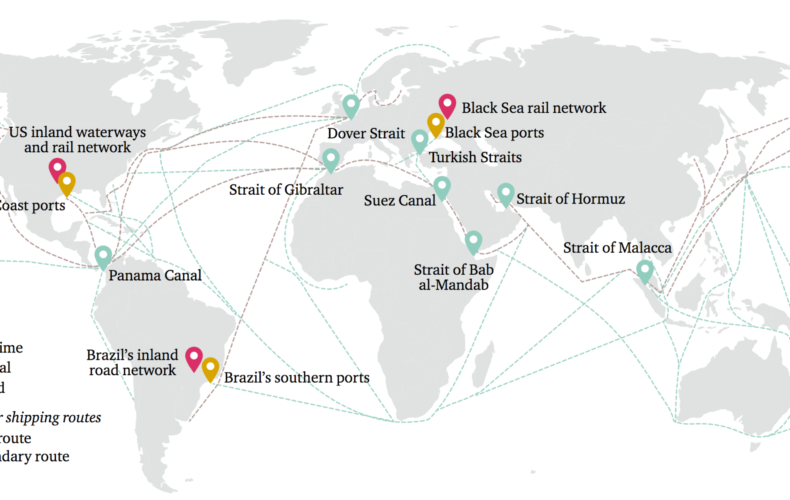

- The Western Indian Ocean (WIO) is a strategic sub-theatre of the Indian Ocean linking the Southeastern coast of Africa to the wider Indian Ocean and beyond.

- It is home to one of the key chokepoints in the Indian Ocean- the Mozambique Channel.

- While Comoros sits at the northern mouth of the Mozambique Channel, Madagascar borders the channel to its west.

- While the channel lost its significance post the opening of the Suez Canal, the recent hostilities near the Strait of Hormuz brought the channel back into focus as the original route for bigger commercial vessels (especially for oil tankers).

- While Comoros sits at the northern mouth of the Mozambique Channel, Madagascar borders the channel to its west.

- While the channel lost its significance post the opening of the Suez Canal, the recent hostilities near the Strait of Hormuz brought the channel back into focus as the original route for bigger commercial vessels (especially for oil tankers).

- For India, engagements with this region will become critical as the Navy begins to strengthen its presence under its mission based deployments. Engagements with the region, especially with the islands- given their geo-strategic location- could become key in supporting Indian naval presence as well as furthering Delhi’s Indian Ocean engagement.

JAGANNATH TEMPLE IN TROUBLE WITH YES BANK DESPOSITS

Focus: GS-I Art and Culture

Why in news?

Imposition of restriction on withdrawal of money from Yes Bank imposed by RBI on 5th March 2020, spells trouble as ₹545 crore belonging to Shree Jagannath Temple is deposited in the bank.

Shree Jagannath temple

- The Shree Jagannath Temple of Puri is an important Hindu temple dedicated to Lord Jagannath, a form of Vishnu, in Puri in the state of Odisha on the eastern coast of India.

- The present temple was rebuilt from the 10th century onwards, on the site of an earlier temple, and begun by King Anantavarman Chodaganga Deva, first of the Eastern Ganga dynasty.

- The Puri temple is famous for its Annual Ratha yatra, or chariot festival, in which the three principal deities are pulled on huge and elaborately decorated temple cars. These gave their name to the English term Juggernaut.

- Unlike the stone and metal icons found in most Hindu temples, the image of Jagannath is made of wood and is ceremoniously replaced every twelve or nineteen years by an exact replica.

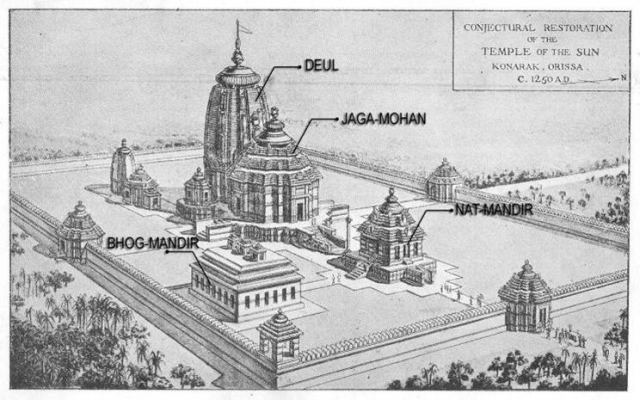

Architecture of Jagannath temple

- The Temple of Jagannath at Puri is one of the major Hindu temples in India.

- The temple is built in the Kalinga style of architecture, with the Pancharatha (Five chariots) type consisting of two anurathas, two konakas and one ratha. Jagannath temple is a pancharatha with well-developed pagas. ‘Gajasimhas’ (elephant lions) carved in recesses of the pagas, the ‘Jhampasimhas’ (Jumping lions) are also placed properly.

- The perfect pancharatha temple developed into a Nagara-rekha temple.

- The temple is built on an elevated platform, as compared to Lingaraja temple and other temples belonging to this type.

- This is the first temple in the history of Kalingaan temple architecture where all the chambers like Jagamohana, Bhogamandapa and Natyamandapa were built along with the main temple.

- There are miniature shrines on the three outer sides of the main temple.

DICGC: RELEVANCE IN THE WAKE OF YES BANK ISSUE

Focus: GS-III Indian Economy, Economic Development

Deposit Insurance and Credit Guarantee Corporation (DICGC)

- Deposit Insurance and Credit Guarantee Corporation (DICGC) is a wholly owned subsidiary of Reserve Bank of India.

- It was established on 15 July 1978 under the Deposit Insurance and Credit Guarantee Corporation Act, 1961.

- Hence, it is a Statutory body.

- It was established for the purpose of providing insurance of deposits and guaranteeing of credit facilities.

- DICGC insures all bank deposits, such as saving, fixed, current, recurring deposit for up to the limit of Rs. 500,000 of each deposits in a bank.

How does DICGC manage deposit insurance?

- DICGC charges 10 paise per ₹ 100 of deposits held by a bank. The premium paid by the insured banks to the Corporation is paid by the banks and is not to be passed on to depositors.

- DICGC last revised the deposit insurance cover to ₹ 1 lakh on May 1, 1993, raising it from ₹ 30,000 since 1980. The protection cover of deposits in Indian banks through insurance is among the lowest in the world.

- The Damodaran Committee on ‘Customer Services in Banks’ (2011) had recommended a five-time increase in the cap to ₹5 lakh due to rising income levels and increasing size of individual bank deposits.

- Banks, including regional rural banks, local area banks, foreign banks with branches in India, and cooperative banks, are mandated to take deposit insurance cover with the DICGC.

- The DICGC does not deal directly with depositors.

- The RBI (or the Registrar), on directing that a bank be liquidated, appoints an official liquidator to oversee the winding up process.

- Under the DICGC Act, the liquidator is supposed to hand over a list of all the insured depositors (with their dues) to the DICGC within three months of taking charge.

- The DICGC is supposed to pay these dues within two months of receiving this list.

- In FY19, it took an average 1,425 days for the DICGC to receive and settle the first claims on a de-registered bank.

ENFORCEMENT DIRECTORATE (ED) QUESTIONS KAPOOR

Focus: GS-II Governance

Why in news?

Yes Bank’s founder Rana Kapoor was brought to the Enforcement Directorate’s (ED) office in Mumbai for questioning in connection with a money-laundering case against him.

Note: No need to go through the Details of the case for this news article

Enforcement Directorate

- The Directorate of Enforcement (ED) is a law enforcement agency and economic intelligence agency responsible for enforcing economic laws and fighting economic crime in India.

- It is part of the Department of Revenue, Ministry of Finance, Government Of India.

- It is composed of officers from the Indian Revenue Service, Indian Corporate Law Service, Indian Police Service and the Indian Administrative Service.

- The origin of this Directorate goes back to 1 May 1956, when an ‘Enforcement Unit’ was formed, in Department of Economic Affairs, for handling Exchange Control Laws violations under Foreign Exchange Regulation Act, 1947.

- In the year 1957, this Unit was renamed as ‘Enforcement Directorate’.

Functions of Enforcement Directorate

- The prime objective of the Enforcement Directorate is the enforcement of two key Acts of the Government of India namely, the Foreign Exchange Management Act 1999 (FEMA) and the Prevention of Money Laundering Act 2002 (PMLA).

- The ED’s (Enforcement Directorate) official website enlists its other objectives which are primarily linked to checking money laundering in India.

- In fact this is an investigation agency so providing the complete details on public domain is against the rules of GOI.

- ED; investigates suspected violations of the provisions of the FEMA. Suspected violations includes; non-realization of export proceeds, “hawala transactions”, purchase of assets abroad, possession of foreign currency in huge amount, non-repatriation of foreign exchange, foreign exchange violations and other forms of violations under FEMA.

- ED collects, develops and disseminates intelligence information related to violations of FEMA, 1999. The ED receives the intelligence inputs from Central and State Intelligence agencies, complaints etc.

- ED has the power to attach the asset of the culprits found guilty of violation of FEMA. “Attachment of the assets” means prohibition of transfer, conversion, disposition or movement of property by an order issued under Chapter III of the Money Laundering Act [Section 2(1) (d)].

- To undertake, search, seizure, arrest, prosecution action and survey etc. against offender of PMLA offence.

- To provide and seek mutual legal assistance to/from respective states in respect of attachment/confiscation of proceeds of crime and handed over the transfer of accused persons under Money Laundering Act.

- To settle cases of violations of the erstwhile FERA, 1973 and FEMA, 1999 and to decide penalties imposed on conclusion of settlement proceedings.

CONTAINMENT IS HIGHEST PRIORITY: WHO

Focus: Prelims, GS-II International Institutions

Why in news?

All countries should make containing the outbreak of COVID-19 their top priority,

The World Health Organisation (WHO) said on 6th May.

WHO

- The World Health Organization (WHO) is a specialised agency of the United Nations that is concerned with world public health. It was established on 7 April 1948, and is headquartered in Geneva, Switzerland. The WHO is a member of the United Nations Development Group.

- It is an inter-governmental organization and works in collaboration with its member states usually through the Ministries of Health.

- As of 2016, the WHO has 194 member states, WHO Member States appoint delegations to the World Health Assembly.

- The World Health Assembly (WHA) is the legislative and supreme body of WHO, based in Geneva.

Publications of the WHO

- World Health Report

- Bulletin of the World Health Organization

- The worldwide World Health Survey

- Pan American Journal of Public Health

- Eastern Mediterranean Health Journal

- Human Resources for Health (journal published in collaboration with BioMed Central)

Aims of WHO

- To act as the directing and coordinating authority on international health work.

- To establish and maintain effective collaboration with the United Nations, specialized agencies, governmental health administrations, professional groups and such other organizations as may be deemed appropriate.

- To provide assistance to the Governments, upon request, in strengthening health services.

- To promote cooperation among scientific and professional groups which contribute to the advancement of health.

Functions of WHO

The World Health Assembly (WHA) determines the policies of the Organization.

- It supervises the financial policies of the Organization and reviews and approves the budget.

- It reports to the Economic and Social Council in accordance with any agreement between the Organization and the United Nations.

- WHO coordinates international efforts to control outbreaks & sponsors programs to prevent and treatment of infectious diseases such as SARS, malaria, tuberculosis, influenza, and HIV/AIDS, the WHO also such diseases.

- The WHO supports the development and distribution of safe and effective vaccines, pharmaceutical diagnostics, and drugs, such as through the Expanded Program on Immunization.

After over two decades of fighting smallpox, the WHO declared in 1980 that the disease had been eradicated – the first disease in history to be eliminated by human effort.

India and WHO

- India became a party to the WHO on 12 January 1948.

- Regional office for South East Asia is located in New Delhi.

- In 1967 the total number of smallpox cases recorded in India accounted for nearly 65% of all cases in the world.

- In 1967, the WHO launched the Intensified Smallpox Eradication Programme.

- With a coordinated effort by Indian government with the World Health Organization (WHO), smallpox was eradicated in 1977.

- India began the battle against Polio in response to the WHO’s 1988 Global Polio Eradication Initiative with financial and technical help from World Bank.

- The WHO Country Cooperation Strategy – India (2012-2017) has been jointly developed by the Ministry of Health and Family Welfare (MoH&FW) and the WHO Country Office for India (WCO).

Polio Campaign-2012

- The Indian Government, in partnership with UNICEF, the World Health Organization (WHO), the Bill & Melinda Gates Foundation, Rotary International and the Centers for Disease Control and Prevention contributed to almost universal awareness of the need to vaccinate all children under five against polio.

- As a result of these efforts, India was removed from the list of endemic countries in 2014.

SENSEX PLUNGES 2.3% ON COVID-19, YES BANK

Focus: GS-III Indian Economy

Why in news?

- A mix of domestic and global negative factors drove Indian equity benchmarks down more than 2% on 6th March 2020.

- On the global front, almost all leading equity markets across the world lost ground on 6th March as the number of people infected by COVID-19 crossed the 10,000-mark even as close to 3,400 people have died since the outbreak.

- Moratorium impact On the domestic front, investor sentiment was hit after the country’s fourth largest private sector lender Yes Bank was placed under moratorium.

What are Equity Benchmarks?

- A benchmark is an unmanaged group of securities which are considered as a ‘benchmark’ to measure a fund’s/stock’s performance.

- Benchmarks are generally broad market indices (indicators) like BSE Sensex, CNX Nifty of the Indian stock market with which mutual fund returns are compared.

What is an Index?

- The stock exchanges comprise of several thousand companies.

- It is not possible to evaluate each and every stock to understand the market’s performance and so a certain set of companies representing various sectors are chosen and a group is made. This group is called as index.

- The companies are picked on the basis of free-float market cap.

What is Sensex and NIFTY?

- The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply the SENSEX) is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on Bombay Stock Exchange.

- The NIFTY 50 index (National Index Fifty) National Stock Exchange of India’s benchmark broad based stock market index for the Indian equity market, representing the weighted average of 50 Indian company stocks in 13 sectors.

- It is one of the two main stock indices used in India, the other being the BSE Sensex.

What are the factors that affect the Stock Market?

1. Economic growth:

Higher economic growth or better prospects for growth will help firms be more profitable because there will be more demand for goods and services. This will help boost company dividends and therefore share prices.

2. Interest rates:

Lower interest rates can make shares more attractive for two reasons. Lower interest rates help boost economic growth making firms more profitable. Also, lower interest rates make shares relatively more attractive than saving money in a bank or holding bonds. If bond yields fall, it may encourage investors to switch into shares which give a relatively better dividend.

3. Inflation:

An unanticipated rapid rise in inflation would probably cause a fall in stock markets. A rise in inflation would probably lead to a greater chance of interest rises. This will reduce growth and profitability. Also, higher inflation may encourage investors to move into more inflation proof investments like gold.

4. Stability:

Stock markets dislike shocks that could threaten economic stability and future growth. Therefore, they will tend to fall on news of terrorist attacks or spikes in the price of oil. They will also dislike political instability which may make it difficult to pursue strong economic policies.

5. Confidence and expectations:

A key factor is the mood of investors. If they receive economic news that gives optimism then they are more likely to buy shares. If they receive bad news they will sell. This is why in the depth of a recession, stock markets can start to rise. Investors are always trying to predict the future. Therefore if they feel the worst is over – the stock market can rally – even when economic fundamentals remain poor.

6. Bandwagon effect:

At times the stock market seems to over-react to certain events. For example, in 1987, relatively little bad news caused the stock market to fall 25%. Even today it remains a little mystery why the stock market fell so much – there was no economic problem. In fact, the stock market soon recovered it’s lost ground. Part of the issue is that people follow the mood. When prices fall, people may feel the need to follow suit and get out of the market.

7. Related markets:

Often investors have choices. For example, rather than investing in stock market, they could buy government bonds or commodities. If investors feel government bonds are overpriced and likely to fall, then the stock market can benefit as people move into shares.

8. Price to earnings ratios:

If share prices rise significantly above historical averages, then this is a sign that shares are becoming overvalued and are due a correction at some point in the future.

NCLT APPROVES COCHIN SHIPYARD’S TEBMA PLAN

Focus: GS-III Industry and Infrastructure, Indian Economy

Why in news?

- The Chennai bench of the National Company Law Tribunal (NCLT) has approved the ₹65-crore resolution plan submitted by Cochin Shipyard Limited for Tebma Shipyards Limited.

- NCLT noted that the resolution plan value was lower than the liquidation value of about ₹89.09 crore.

- However, it said as held by the Supreme Court, there was NO provision in the insolvency and bankruptcy code that stipulated that the resolution plan should match the liquidation value. (Can be applied to Yes Bank case if Liquidation happens in the future)

NCLT

- The National Company Law Tribunal is a quasi-judicial body in India that adjudicates issues relating to Indian companies.

- The tribunal was established under the Companies Act 2013 and was constituted on 1 June 2016 by the government of India.

- Hence, NCLT is a Statutory Body.

- All proceedings under the Companies Act, including proceedings relating to arbitration, compromise, arrangements and reconstruction and winding up of companies shall be disposed of by the National Company Law Tribunal.

- The National Company Law Tribunal is the adjudicating authority for insolvency resolution process of companies and limited liability partnerships under the Insolvency and Bankruptcy Code, 2016.

- No criminal court shall have jurisdiction to entertain any suit or proceeding in respect of any matter which the Tribunal or the Appellate Tribunal is empowered to determine by or under this Act or any other law for the time being in force and no injunction shall be granted by any court or other authority in respect of any action taken or to be taken in pursuance of any power conferred by or under this Act or any other law for the time being in force, by the Tribunal or the Appellate Tribunal.

NCLAT

- The National Company Law Appellate Tribunal (NCLAT) is a tribunal which was formed by the Central Government of India under Section 410 of the Companies Act, 2013.

- Hence, NCLAT is also a Statutory Body.

- The tribunal is responsible for hearing appeals from the orders of National Company Law Tribunal(s) (NCLT), starting on 1 June, 2016.

- The tribunal also hears appeals from orders issued by the Insolvency and Bankruptcy Board of India under Section 202 and Section 211 of IBC.

- It also hears appeals from any direction issued, decision made, or order passed by the Competition Commission of India

Differences between NCLT and NCLAT

- NCLT makes the judgement on the insolvency resolution proceedings. NCLAT makes judgement on the decisions made by the NCLT.

- NCLT is the primary Tribunal and NCLAT is the appellate tribunal.

- NCLT analyzes the evidences that are presented by the insolvent debtor or their creditors. NCLAT analyzes the decisions that are made by the NCLT.