Contents

- True fiscal responsibility

- A new map for the end of Oil Age

- In farm debate, a green reality check

TRUE FISCAL RESPONSIBILITY

Context:

The National Statistical Office (NSO) recently announced estimates of economic activity in the second quarter of the current financial year. The GDP contracted by 23.9% in that quarter (compared to the same quarter of the previous year).

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein

Mains Questions:

- What is Fiscal Policy? Assess the role of fiscal policy to revive the economic growth during the recession period. 15 Marks

- Slashing public expenditure amid a recession is a recipe for serious economic disaster. Critically comment. 15 Marks

Dimensions of the Article:

- What is Fiscal Management?

- Main objectives of Fiscal Policy in India

- Issues related to fiscal management in India

- Importance of Fiscal Discipline in India

- Way Forward

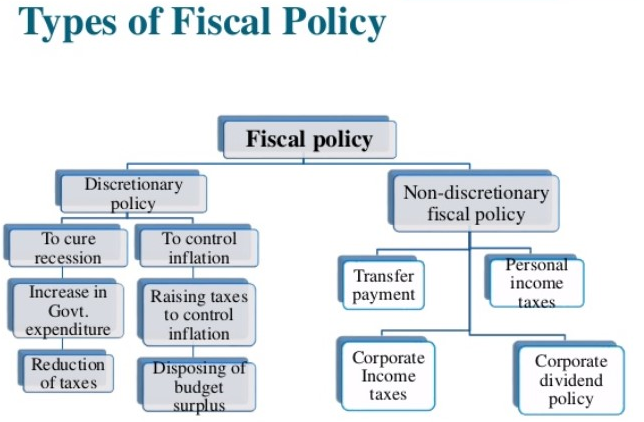

What is Fiscal Management?

Through the fiscal policy, the government of a country controls the flow of tax revenues and public expenditure to navigate the economy. If the government receives more revenue than it spends, it runs a surplus, while if it spends more than the tax and non-tax receipts, it runs a deficit. To meet additional expenditures, the government needs to borrow domestically or from overseas. Alternatively, the government may also choose to draw upon its foreign exchange reserves or print additional money.

Main objectives of Fiscal Policy in India:

- Economic growth: Fiscal policy helps maintain the economy’s growth rate so that certain economic goals can be achieved.

- Price stability: It controls the price level of the country so that when the inflation is too high, prices can be regulated.

- Full employment: It aims to achieve full employment, or near full employment, as a tool to recover from low economic activity.

Issues related to fiscal management in India

- Poor Budgetary Forecasting: Budgets often overstate revenue projections (15 out of 20 years since fiscal 1998) and understate expenditures (12 out of 20 years since fiscal 1998). According to CAG Report in 2017, the over-ambitious revenue targets combined with the lack of transparency in tax administration lead overzealous taxmen resorting to ‘irregular’ and ‘unwarranted’ methods to meet targets.

- Limited Tax Buoyancy: Faster growth in nominal gross domestic product (GDP) usually leads to faster growth in tax collections. However, in India, tax buoyancy shows no stable pattern and hence, forecasting tax revenues is difficult.

- Creative Accounting: Moreover, fiscal deficits are also understated by the use of ‘creative accounting’ such as ‘rolling over’ a part of the overall subsidy bill & dues to the states to the next financial year; using PSEs like LIC to purchase divested stakes in the disinvestment process.

- Such “creative” accounting has led to a decline in the headline fiscal deficit number but failed to reduce India’s public debt to GDP ratio, adversely impacting India’s macroeconomic stability.

- Use of Extra Budgetary Resources (EBR): Over the years, the Govt’s reliance on EBRs- such as funds of state-owned enterprises like LIC, SBI etc – to fund Govt. programmes has increased, but it doesn’t appear in real time fiscal deficit numbers. E.g. 61.4% of all capital expenditure outlined in the 2018-19 Budget is to be financed through EBR, up from 54% in 2016-17.

- Absence of uniform fiscal consolidation rules for centre & states:

- Various cesses and surcharges, in which States’ have no share, are becoming a disproportionate portion of overall divisible revenue. This is against the spirit of fiscal federalism and financial devolution process.

- For State Govt., Art 293(3) provides a constitutional check over market borrowings while no such restriction is there for the centre.

- States have constraints in managing their finances as the RBI controls their deficit and cannot float a bond on a state’s behalf without the Centre’s approval.

- Non-adherence to Fiscal Responsibility and Budget Management (FRBM) Act targets: Since 2003 FRBM law came into effect, there have been four pauses in the deficit targets enshrined in it and many occasions where the targets have been flouted.

- Fiscal Populism: Political class has the tendency to make fiscal policy over-expansive, which increases burden on future government and thus, has detrimental long-run impacts e.g. loan waivers to farmers, tax waiver to MSMEs etc.

- Poor institutional infrastructure for monitoring: CAG has presented its audit report on Compliance of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 but the assessment is only post-facto.

- Fiscal Populism: Political class has the tendency to make fiscal policy over-expansive, which increases burden on future government and thus, has detrimental long-run impacts e.g. loan waivers to farmers, tax waiver to MSMEs etc.

- Poor institutional infrastructure for monitoring: CAG has presented its audit report on Compliance of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 but the assessment is only post-facto.

Importance of Fiscal Discipline in India

- To improve investment: Pile-up of past domestic debt severely restricts the ability to finance new investment. If debt becomes unsustainable, there is an increased risk of default & hence, downgrading of sovereign credit ratings.

- Increasing credit availability to private sector: As more money is lent to government rather than invested in the market, corporate sector is crowded out leading to slower industrial and capital asset growth and potential loss of employment.

- Control inflation: Too much of government debt can lead to inflation and reduction in real interest rates. It might prompt people to invest more in gold and real estate, thereby accentuating the problem of poor economic liquidity and black money.

- Intergenerational parity will be hurt as future generations will have to pay increased taxes to settle the government debt.

- Constitutional Requirement: Article 292 of the Constitution envisages fiscal responsibility in the form of legislation that obliges the government to have a ceiling on debt.

Conclusion

According to International Monetary Fund (IMF), Independent Fiscal Council are now an indispensable part in the design of fiscal frameworks aimed at guiding fiscal policymakers’ discretion. An independent fiscal council can bring about much needed transparency and accountability in fiscal processes across the federal polity.

A NEW MAP FOR THE END OF OIL AGE

Context:

How should a large, import-dependent, fossil-fuel-based developing economy with a rising demand for energy and an unhealthily strong linkage between this demand and environmental pollution navigate the reordered cartography of geopolitics and energy?

Relevance:

GS Paper 3: Infrastructure (energy, ports, roads, airports, railways);

Mains Questions:

- Access to affordable, reliable, sustainable and modern energy is the sine qua non to achieve Sustainable Development Goals (SDGs). Comment on the progress made in India in this regard. 15 Marks

- How should India, an economy dependent on fossil fuels, navigate future energy transitions? 15 marks

Dimensions of the Article:

- Status of energy sector in India

- Priority of India’s Energy Sector

- Challenges related to power sector in India

- A new map for the end of Oil Age

- Way Forward

Status of Energy Sector in India?

- India is the third largest energy consumer in the world after USA and China. (With a share of 5.8 per cent of the world’s primary energy consumption.)

- India has improved its ranking to 76th position in the Energy Transition Index published by the World Economic Forum (WEF) suggesting paradigm shift in the sector. This can be attributed to Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya) as 18 States have reported supply of more than 20 hours of electricity supply while remaining states have reported about 15 or more hours.

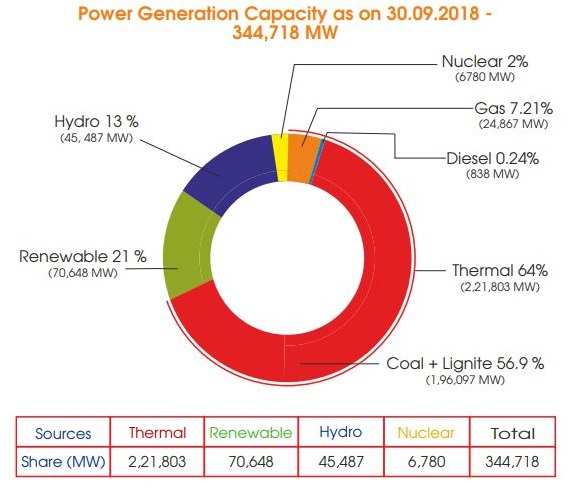

- Capacity and its distribution: Thermal power accounts for about 63 percent (with renewable energy- 23 percent and Hydro- 12.4 percent) of total installed capacity and roughly half of the generation capacity is in the private sector.

- India’s energy mix is dominated by coal with a 49.6 per cent share, followed by oil (28 per

cent), biomass (11.6 per cent), gas (7.3 per cent), renewable and clean energy (2.2 per cent) and nuclear energy (1.2 per cent). India is the world’s

third largest energy consumer.

- However, in 2017, its per capita energy consumption was about 625.6 kilogram of oil equivalent (kgoe) against the world average of 1860 kgoe. The US and China’s per

capita energy consumption in 2015 was 6800 kgoe and 2170 kgoe, respectively.

Priority of India’s Energy Sector

- To chart way to meet government recent announcements:

- Achieving universal electrification with 24×7 electricity by 2022. As of now, 304 million Indians live without access to electricity

- Increasing share of manufacturing in our GDP from 16% currently to 25%

- Target of Ministry of Petroleum to reduce oil imports by 10% from (2014-15 levels) by 2022.

- To meet energy needs of vast population predicted to go up to 1.6 billion by 2040.

- 500 million people, still dependent on solid bio-mass for cooking

- According to NITI AYOG exercise, the energy demand in India is likely to go up by 2.7-3.2 times between 2012 and 2040 and thus import demand could increase from 31% in 2012 to 36-55% in 2040.

- To increase coordination to achieve the goal of energy security as energy is handled by different Ministries with their own sectoral agenda

- To reduce cost due to air pollution – It is estimated to be 3% of its GDP and causes 1.2 million deaths every year.

Challenges related to power sector in India:

- Fuel Security Concerns: Thermal capacity addition is plagued by the growing fuel availability concerns faced by the Industry. While a significant gas based capacity of more than 20,000 MW is idle due to nonavailability of gas. Coal supplies by CIL is restricted to around 65% of actual coal requirement by coal based thermal plants, leading to increased dependence on imported coal with the cascading result of high power generation costs.

- Under-procurement of Power by States: Increasing power generation costs due to limited fuel availability, poor financial health of State Discoms, high AT&C losses have contributed in suppressed demand projections by State Discoms.

- Inimical Financing Environment: Over the last 4-5 years, the leading rates have increased significantly from the time of project appraisal resulting in project cost overrun and hence higher end tariffs.

- Policy Paralysis: The micro level policies governing the fuel cost pass-through, mega power policy, competitive bidding guidelines are not in consonance with the macro framework like The Electricity Act 2003 and the National Electricity Policy.

A new map for the end of Oil Age

Daniel Yergin, in his latest book The New Map: Energy, Climate and the Clash of Nations gave six themes which will decide the New Energy Map:

- The first is the US shale revolution, which transformed the US from a major importer of oil and gas to a significant exporter;

- The second is the leveraging by Russia of its gas exports to compel former members of the Soviet Union to stay within its sphere of influence and to embrace China into an energy partnership (“Russia needs markets; China needs energy”);

- The third is China’s assertion of its rights over the South China Seas — a critical maritime route for its energy imports and the Belt and Road initiative;

- The fourth is sectarian strife (Sunni/Shia) in the Middle East which, compounded by volatile and falling oil prices, has brought the region to the edge;

- The fifth is the Paris climate summit and its impact on public sentiment, investment decisions, corporate governance and regulatory norms.

- And the last is the consequential impact of the manifold and impressive advancement of clean energy technologies.

Way Forward:

According to The New Map: Energy, Climate and the Clash of Nations of Daniel Yergin, The government should focus on two dimensions:

- India must develop its own world-scale, competitive, manufacturing systems for photovoltaics (PVs) and battery storage. If not, it will find itself on the horns of a dilemma. It will not be able to provide affordable solar units unless it accepts the further deepening of dependence on Chinese imports. Currently, China manufactures 75 per cent of the world’s lithium batteries; 70 per cent of solar cells; 95 per cent of solar wafers and it controls 60 per cent of the production of poly silica. It is also looking to secure a chokehold over several strategic minerals (cobalt, nickel).

- India must prepare a clean energy technology strategy. Technology is the answer to the energy transition. That is what will bring the system to the tipping point of radical change. China recognises this fact. It has placed clean energy R&D at the forefront of its “Plan 2025”. The India strategy should identify relevant “breakthrough technologies”, establish the funding mechanisms and create the ecosystem for partnerships (domestic and international).

IN FARM DEBATE, A GREEN REALITY CHECK

Context:

The current debate on agriculture miss the fundamental reality of today’s times — that the current agrarian impasse reflects the fatigue of dominant approaches to agriculture, which assumes growth is limitless and resources are inexhaustible.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Agriculture policies

Mains Questions:

- If we truly want to ensure the livelihoods of our farmers and provide safe, healthy, nutritious food for our consumers, it is imperative to make policies that go beyond the productivity trope and populist posturing. Explain. 15 Marks

- India’s agrarian structure, closely aligned with the caste structure, thereby marking the whole system with tremendous inequality in access to natural resources, capital and markets. Discuss. 15 Marks

Dimensions of the Article:

- Status of Agriculture in India?

- Issues related to Agriculture in India.

- Different approach to deal with these issues.

- Way Forward

Status of Agriculture in India

Agriculture (inclusive of animal husbandry, forestry and fishing) is central to the nutrition needs of India and remains the largest sector of India’s economy as a source of employment and accounts for 18% of India’s GDP.

- According to the Fifth Annual Employment-Unemployment Survey of the Ministry Labour and Employment, 45.7% of India’s workforce in 2014-15 was employed in agriculture.

- India’s agriculture production has been increasing at about 3.6% annually since 2011, sustained by improved access to inputs such as fertilisers and seeds, as well as better irrigation and credit coverage.

- The sector has also been diversifying from grains towards pulses, fruit, vegetables and livestock products, largely driven by evolving demographics, urbanisation and changing demand patterns.

- Total agricultural exports from India grew at a CAGR of 16.45 % over FY10-18 to reach US$ 38.21 billion in FY18. India is among the 15 leading exporters of agricultural products in the world.

- It is the world’s largest producer of milk, pulses, and spices, and has the world’s largest cattle herd (buffaloes), as well as the largest area under wheat, rice and cotton.

- It is the second largest producer of rice, wheat, cotton, sugarcane, farmed fish, sheep & goat meat, fruit, vegetables and tea.

Issues related to Agriculture in India:

- Low Agricultural Productivity: According to Agriculture Ministry, India’s crop yields are lower than those in the US, Europe and China, due to (see infographic 2).

- Policy Issues: There has been a total absence of the kind of syncretic policy between the Centre and states on the interlinked issues of agriculture, water, commerce and finance.

- Agricultural Marketing: In the absence of sound marketing facilities, the farmers have to depend upon local traders and middlemen for the disposal of their farm produce which is sold at throw-away price. Agricultural Produce Market Committee (APMC) Act has also allowed the cartelization of traders that keeps farm-gate prices low.

- Input Challenges: According Ashok Dalwai committee report, rise in input cost has led to decline in crop income over the years, which has resulted in the low productivity and purchasing power of farmers.

- Inefficient MSP structure: According to the Shanta Kumar Committee, only 6% farmers get the benefit of MSP and remaining 94% are dependent on the markets.

- Lack of Alternative Employment Opportunity leading to Overcrowding: The Situation Assessment of India reported that more than 40 % of farmers would like to quit agriculture if alternative opportunities were available.

- Climate Change: Higher frequency of droughts, floods, temperature fluctuations, and unseasonal rains and hailstorms are adversely affecting agricultural production through soil erosion, pest attack, crop failure etc.

- Poor state of Agriculture Education: State Agricultural Universities (SAUs) are facing non-replacement of retired faculty and high inbreeding of faculty (nearly 51% of faculty members have their degrees from the same university in which they are teaching), which hampers the quality of academic and research programmes.

Different approach to deal with these issues:

Agriculture Ministry has recently released a blueprint having strategy to achieve the vision of doubling farmer’s income by 2022.

- Increase in production by improving irrigation efficiency through

- increased irrigation budget (Madhya Pradesh, which achieved an agricultural growth rate of 9.7% from 2004-2015 against national average of 3.6%, did so on the back of substantial irrigation investment)

- implementing Pradhan Mantri Krishi Sinchai Yojana

- expediting pending medium and large irrigation projects

- fast-tracking watershed development and water harvesting & management projects.

- Effective use of input cost – Government has taken up different steps for different inputs

- Soil – introduced Soil Health Card Scheme to inform farmers about nutrients status of the soils

- Fertilisers – rationalising the use of fertilisers by giving information about nutrient status of soil, curbing illegal use of urea as well as ensuring adequate supply through Neem Coated Urea scheme

- Seeds – Providing with better quality seeds at affordable prices

- Awareness – giving timely information and advisory services to farmers through online and telecom mediums such as Kisan Call Centre and Kisan Suvidha App

- Better Planning – through adoption of new technologies such as space technology which helping in better planning through forecasting of crop production, agricultural land-use mapping, drought prediction, and utilisation of fallow paddy fields for Rabi crops .

- Reduction of post-harvest losses

- Storage facilities – government is encouraging farmers to use warehouses and avoid distressed sales at lower cost. Also, loans are being provided against negotiable warehouse receipts are being provided with interest subvention benefits.

- Integrated cold chains in rural areas.

- Value Addition

- Promoting quality through food processing – Under Pradhan Mantri Kisan Sampada Yojana, food processing capabilities will be developed by working on forward and backward linkage of agro processing cluster, benefitting 20 lakh farmers and creating employment opportunities for about 5 lakh.

- Reforms in Agriculture Marketing

- Integrating markets through e-NAM where 455 mandis have been linked to this platform. o Model Agricultural Produce Market Committee (APMC) Act is being worked upon which also includes private market yards and direct marketing.

- Contract farming – the Government has released Model Act to promote contract farming.

Way forward:

If we truly want to ensure the livelihoods of our farmers and provide safe, healthy, nutritious food for our consumers, it is imperative to make policies that go beyond the productivity trope and populist posturing. This can begin with the salient recognition that any sound economic and techno-scientific model must have agroecology and equity at the core and, must indeed, be guided by them.