Contents:

- What next for virtual currency?

- Caught in a bureaucratic web

- The current state of cooperative federalism in India

WHAT IS NEXT FOR VIRTUAL CURRENCY?

Focus: GS-III Science and Technology, Prelims

Why in news?

The Supreme Court set aside a ban by the Reserve Bank of India (RBI) on banks and financial institutions from dealing with virtual currency holders and exchanges.

Why did SC put aside ban?

- The court held that the ban did not pass the “proportionality” test.

- The test of proportionality of any action by the government, the court held, must pass the test of Article 19(1)(g), which states that all citizens of the country will have the right to practise any profession, or carry on any occupation or trade and business.

|

What is proportionality test? In the test of Proportionality the courts will quash exercise of discretionary powers in which there is no reasonable relation between the objective which is sought to be achieved and the means used to that end, or where punishments imposed by administrative bodies or inferior courts are wholly out of proportion to the relevant misconduct. So the administrative action which arbitrarily discriminates will be quashed by the court. The implication of the principle of proportionality is that the court will weigh for itself the advantages and disadvantages of an administrative action and such an action will be upheld as valid if and only if the balance is advantages |

What are virtual currencies? Are they different from cryptocurrencies?

- There is no globally accepted definition of what exactly is virtual currency.

- Some agencies have called it a method of exchange of value; others have labelled it a goods item, product or commodity.

- In its judgment, the Supreme Court observed, “Every court which attempted to fix the identity of virtual currencies, merely acted as the 4 blind men in the Anekantavada philosophy of Jainism, who attempt to describe an elephant, but end up describing only one physical feature of the elephant.”

| Cryptocurrency Cryptocurrency is a virtual or digital currency for which encryption techniques (the process of encoding a message or information in such a way that only authorized parties can access it) are used to control its creation as a monetary unit and to verify the transfer of funds involved. Decentralized: unlike, fiat currencies (like INR, USD, EUR, etc) cryptocurrencies are not regulated or controlled by any bank, government or centralized financial authorities instead they are created and stored electronically through blockchain technology. Cryptocurrencies are transferred from “peer to peer” without the intervention of financial institutions, with transactions moderated by miners who record them in a blockchain. It has no physical existence and cannot be redeemed in another commodity like gold. Bitcoin, Litecoin, Ripple, Ethereum, PPcoin, Dogecoin, Coinye, Namecoin, etc. are some of the examples of cryptocurrencies. Note: Facebook has announced the launch of a cryptocurrency called Libra by 2020. |

| Blockchain Technology The National Payments Corporation of India (NPCI) is considering using highly scalable blockchain solution to further strengthen digital payments, which have seen an exponential growth in recent times. A blockchain is a list of records, linked using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. At the basic level, a blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable manner. Data security is there as data stored in a block cannot be changed without altering subsequent blocks. As per a recent report of global consultancy firm PwC, India would be one of the world’s blockchain leaders by 2023. |

Why did the RBI ban virtual currencies?

- Owing to the lack of any underlying fiat, episodes of excessive volatility in their value

- Their anonymous nature which goes against global money-laundering rules

- Risks and concerns about data security and consumer protection

- potential impact on the effectiveness of monetary policy

Extra coverage:

What is Fiat Money?

- Fiat money gets its value from a government order (i.e., fiat). That means, the government declares fiat money to be legal tender, which requires all people and firms within the country to accept it as a means of payment.

- By definition, its intrinsic value is significantly lower than its face value. Hence, the value of fiat money is derived from the relationship between supply and demand. Most modern economies are based on a fiat money system.

- When fiat money is backed by gold or silver standard, it’s called “representative money”, and when central bank promises “to pay bearer the sum of this many rupees”, currency becomes an “anonymous bearer bond with zero interest”.

What is Fiduciary Money?

- Fiduciary money depends for its value on the confidence that it will be generally accepted as a medium of exchange. Unlike fiat money, it is not declared legal tender by the government, which means people are not required by law to accept it as a means of payment.

- Examples of fiduciary money include cheques or drafts.

| Q. Currency notes and coins are called Fiat money because (a) they do not have intrinsic value like gold or silver (b) made on special imported paper (c) they are printed by government (d) exchanged for goods and services Answer a. |

CAUGHT IN A BUREAUCRATIC WEB

Focus: GS-III Science and Technology, Prelims

Why in news?

The Gauhati High Court declared Sahijuddin a foreigner on November 13, 2015. He had appealed to the High Court against an ex-parte order of the Foreigners Tribunal in Kokrajhar declaring him a foreigner. Mr. Sahijuddin was too poor to afford the services of a lawyer and was not represented before the Tribunal. The High Court found this reason unconvincing and stripped him of his citizenship without even examining the documents he possessed.

What is discussed in this article?

The authors discuss the problems with how appeals from Foreigners Tribunals cases are decided by the Gauhati High Court, based on an analysis of 787 such orders and judgments between 2010 and 2019.

Facts:

Of the cases analysed, 41% of the appeals were from Morigaon, Barpeta, and Goalpara, none of which share a border with Bangladesh. Around 35% of these appeals were from ex-parte orders of Foreigners Tribunals i.e., without hearing the person accused of being a foreigner.

| Ex parte is a legal term defined as one of the involved parties are not present or not represented. An example of an ex parte hearing is one where the victim is not there. |

Details:

- The burden of proof under the Foreigners Act, 1946 is on the person accused of being a foreigner.

- If the person accused does not appear before the Tribunal, they will be declared a foreigner without the state having to prove their case.

- In 99% of the appeals from ex-parte orders of the Foreigners Tribunals, the High Court agreed with the findings of the Tribunals.

- All the persons who appealed to the High Court had some form of documentation.

- Around 61% of them produced electoral rolls and 39% of them produced permanent residence certificates/certificates from the panchayat.

- In 66% of the cases, the Foreigners Tribunals found the documentation unsatisfactory.

- In 38% of the cases, documentation was rejected because spellings did not match and in 71% of them, the secondary evidence was deemed inadmissible.

- This means that where people had produced copies of documents, these were not certified copies or the person who had created the document could not certify its contents.

Note: These numbers are just for reference purpose. Don’t try to memorise them.

Problem in case of Women:

- Women who do not have birth certificates and get married before registering as voters do not have any document linking them to their parents.

- The Supreme Court in Rupajan Begum vs. Union of India allowed a certificate from the gram panchayat secretary to be submitted as a link document to prove descent from a person who entered India before March 24, 1971.

- However, wherever this certificate is produced as evidence, the gram panchayat secretary needs to testify in person. This standard of proof is quite difficult to meet, given that gram panchayat secretaries change over time.

- In 99% of the cases where such a document was produced, the person was declared a foreigner.

Note: These numbers are just for reference purpose. Don’t try to memorise them.

Detention and deportation

- Overall, in 97% of the appeals before the High Court, the person was declared a foreigner.

- In 15% of these cases, the High Court ordered deportation.

- Amongst the remaining cases, in 1%, the Court ordered that the person be sent to a detention centre, and in 80% of the cases, the Court did not specify what steps were to be taken.

- In a majority of cases, the High Court instructed the Border Police or the Foreigners Tribunal to “do the needful.”

Note: These numbers are just for reference purpose. Don’t try to memorise them.

The question of citizenship is nestled in a confusing tangle of documents, bureaucracy, and legal procedures which Foreigners Tribunals and the Gauhati High Court are tasked with resolving.

Background:

The Foreigners’ Tribunals are quasi-judicial bodies meant to “furnish opinion on the question as to whether a person is or is not a foreigner within the meaning of Foreigners Act, 1946”.

In 1964, the Centre passed the Foreigners’ (Tribunals) Order under provisions of Section 3 of the Act.

The Foreigners’ Tribunals get two kinds of cases:

- those against whom a “reference” has been made by border police, and

- those whose names in the electoral rolls have a D (Doubtful) against them.

Under what provision do Foreigners’ Tribunals pass ex parte orders?

Section 9 of the Foreigners Act says that “the onus of proving that such person is not a foreigner or is not a foreigner of such particular class or description, as the case may be, shall, not withstanding anything contained in the Indian Evidence Act, 1872, lie upon such person”.

Thus, the accused has to prove he or she is an Indian. Since the onus is on the person, if he or she is absconding and doesn’t appear before the tribunal, the member can pass an ex parte order.

Can an accused contest an ex parte order?

The said order may be reviewed by the Foreigners’ Tribunal if sufficient reasons are shown by the proceedee for his absence or for having no knowledge about the cases, within the absence or for having no knowledge about such order.

What happens if an exparte order does not come up for review, or a review fails?

If police can track the person after the order, he or she will be arrested and put into a detention camp. If not, the person will be an ‘untraced foreigner’. Many ‘declared foreigners’ appeal in the High Court and then the Supreme Court against an order by the Foreigners’ Tribunals.

| Q. What is/are following statements true regarding Foreigners’ Tribunals? 1) The Foreigners’ Tribunals are constitutional bodies 2) Onus of proving that accused person is not a foreigner is on accused only 3) Foreigners’ Tribunals can hear those case where names in the electoral rolls have a D (Doubtful) against them A) Only 2 B) 2 and 3 C) 1 and 2 D) All of the above Ans. B |

THE CURRENT STATE OF COOPERATIVE FEDERALISM IN INDIA

Focus: GS-II Governance

Why in news?

Amid the growing rhetoric of strengthening cooperative federalism in India, it is useful to pause from time to time and review the actual progress. The ongoing budget season is the right time to carry out a realistic assessment.

Details about budget picture:

In her budget speech, Union finance minister highlighted the need for greater Centre-state cooperation to implement agricultural reforms, strengthen medical education, promote tourism, and attract investments.

- Almost all state budgets cover these issues.

- In fact, the Odisha government follows a practice of presenting its budget in two parts, with the first part dedicated to agriculture and allied activities.

- To promote tourism, the Rajasthan government has proposed implementing a policy on the Ease of Travelling.

- The Uttar Pradesh government is in the process of establishing 21 new medical colleges and a medical university.

- The Tamil Nadu government is likely to launch a new industrial policy shortly that will provide incentives compatible with the goods and services tax regime to attract investors.

Transfer from centre to states?

- Under the Union budget, the total estimated transfers to states from the Centre for the ongoing fiscal year have been reduced by around ₹1.41 trillion.

- This is because of a decrease in the estimated transfers to states on account of their share in central taxes and centrally-sponsored schemes.

- Rajasthan government argues that while the Centre has several options of raising funds, such as disinvestment and approaching the Reserve Bank of India, no such option is available to the state.

- The Tamil Nadu budget also points out that the Centre has reduced the state’s share in central taxes for the current fiscal year by around ₹8,000 crore.

- The government of Odisha, in its budget, has also noted that its share in central taxes for the current fiscal year has been reduced by ₹9,000 crore.

- The most interesting story emerges from Uttar Pradesh. The state has been forced to revise its estimated receipts on account of its share in central taxes downwards by a massive ₹17,000 crore. Unlike other states, this substantial reduction did not find mention in its budget speech, and was quietly slipped into one of the budget documents.

Way forward:

- Politics has trumped economics and the greater good thus far in India’s story of cooperative federalism. This needs to be fixed before it is too late.

- Greater transparency and stakeholder participation in the budget-making process of the Centre as well as states could go a long way in this regard, as also institutionalized mechanisms for better Centre-state coordination.

- Above all, political parties need to rise above their electoral mindsets and act in favour of the country’s greater good for India to realize the true potential of cooperative federalism.

Background:

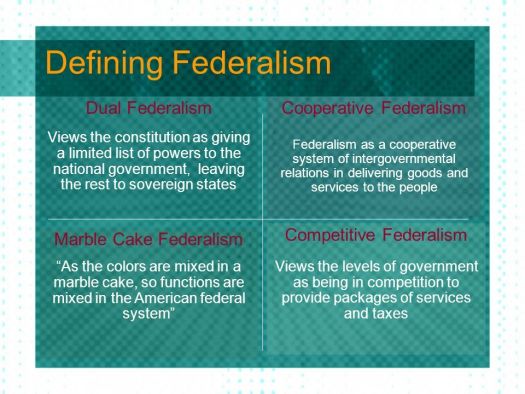

What is cooperative federalism?

- In Cooperative federalism the Centre and states share a horizontal relationship, where they “cooperate” in the larger public interest.

- It is an important tool to enable states’ participation in the formulation and implementation of national policies.

- Union and the states are constitutionally obliged to cooperate with each other on the matters specified in Schedule VII of the constitution.

What is competitive federalism?

- In Competitive federalism the relationship between the Central and state governments is vertical and between state governments is horizontal.

- This idea of Competitive federalism gained significance in India post 1990s economic reforms.

- In a free-market economy, the endowments of states, available resource base and their comparative advantages all foster a spirit of competition. Increasing globalisation, however, increased the existing inequalities and imbalances between states.

- In Competitive federalism States need to compete among themselves and also with the Centre for benefits.

- States compete with each other to attract funds and investment, which facilitates efficiency in administration and enhances developmental activities.

- The investors prefer more developed states for investing their money. Union government devolves funds to the states on the basis of usage of previously allocated funds.

- Healthy competition strives to improve physical and social infrastructure within the state.

- Competitive federalism is not part of the basic structure of Indian constitution. It is the decision of executives.

In 1974, when the Supreme Court commented on the Constitution envisaging a cooperative federal structure, federalism has come a long way in India.

In relation to the imposition of President’s rule under Article 356 of the Constitution, federalism is far more mature.

Between 1947 and 1977, there were 44 instances when the power to impose President’s rule was exercised.

Between 1977 and 1996, the power was exercised almost 59 times. Prime Minister Indira Gandhi’s cabinet resorted to the power an estimated 50 times in her 14 years.

From 1991 till 2016, there have been 32 instances of the exercise of this power compared to 92 instances in the preceding period.

In S.R. Bommai v. Union of India (1994), the limitation laid down by the Supreme Court might have placed gentle breaks on exercise of this power (President’s Rule), but the Centre continues to wield superior legislative powers, including residuary powers and legislative precedence.

Although Cooperative Federalism has been Improved, Instances of Contentious terrain:

Taxation powers are contentious issue and the Central government has won most of the disputes purely due to express provisions in the Constitution.

In the Goods and Services Tax (GST) scenario, States have foregone some taxation powers (octroi, entry tax, luxury and entertainment taxes, etc.) but have powers to levy taxes through panchayats and municipalities.

The spirit of co-operative federalism in India is observed by following

1. Distribution of Powers,

2. Supremacy of the Constitution,

3. A Written Constitution,

4. Rigidity and

5. Authority of Courts.

Under this arrangement in the Constitution, Center has got dominant power as evident from following:

- States must exercise their executive power in compliance with the laws made by the Central government and must not impede on the executive power of the Union within the States.

- Centre can even usurp the legislative discretion of state with the permission of Rajyasabha (Article 249)

- Governors are appointed by the Central government to oversee the States.

- The Centre can even take over the executive of the States on the issues of national security or breakdown of constitutional machinery of the State. (Article 356)

Cooperative federalism in India is practiced under following norms:

- Article 263 of the Constitution has provided for the setting up of an Inter-State Council for investigation, discussion and recommendation for better coordination of relation between the Centre and the States.

- The Zonal Councils set up under the State Reorganization Act 1956 provide another institutional mechanism for centre- state and inter-state cooperation to resolve the differences and strengthen the framework of cooperation.

- The National Development Council and the National Integration Council are the two other important forums that provide opportunities for discussion to resolve differences of opinion. Central councils have been set up by various ministries to strengthen cooperation.

- NITI Ayog and its governing councils

- Conference of state Governors

- Conference of State Chief Ministers