Contents

- Patent (Amendment) Rules, 2020

- Success of Faceless Tax Assessment scheme

- Vietnam buys Indian rice for first time in decades

PATENT (AMENDMENT) RULES, 2020

Context:

The central government recently published the Patent (Amendment) Rules, 2020, amending the format of a statement that patentees and licensees are required to annually submit to the Patent Office disclosing the extent to which they have commercially worked or made the patented inventions available to the public in the country.

Relevance:

GS-II: Polity and Governance (Government policies and interventions), GS-III: Intellectual Property Rights

Dimensions of the Article:

- What is a Patent?

- What is an Intellectual Property?

- History of Indian Patent System

- Office of the Controller General of Patents, Designs and Trade Marks (CGPDTM)

- Changes through the Patent (Amendment) Rules, 2020

What is a Patent?

- A patent is an exclusive right granted for an invention, which is a product or a process that provides, in general, a new way of doing something, or offers a new technical solution to a problem.

- To get a patent, technical information about the invention must be disclosed to the public in a patent application.

What is an Intellectual Property?

- Intellectual property (IP) is a category of property that includes intangible creations of the human intellect.

- There are many types of intellectual property – most well-known of which are copyrights, patents, trademarks, and trade secrets.

- The intangible nature of intellectual property presents difficulties when compared with traditional property like land or goods.

Laws regarding Intellectual Property

- The main purpose of intellectual property laws is to encourage the creation of a wide variety of intellectual goods.

- It was only in the late 20th century that intellectual property became commonplace in the majority of the world’s legal systems.

- Indian government approved its first Intellectual Property Rights Policy in 2016.

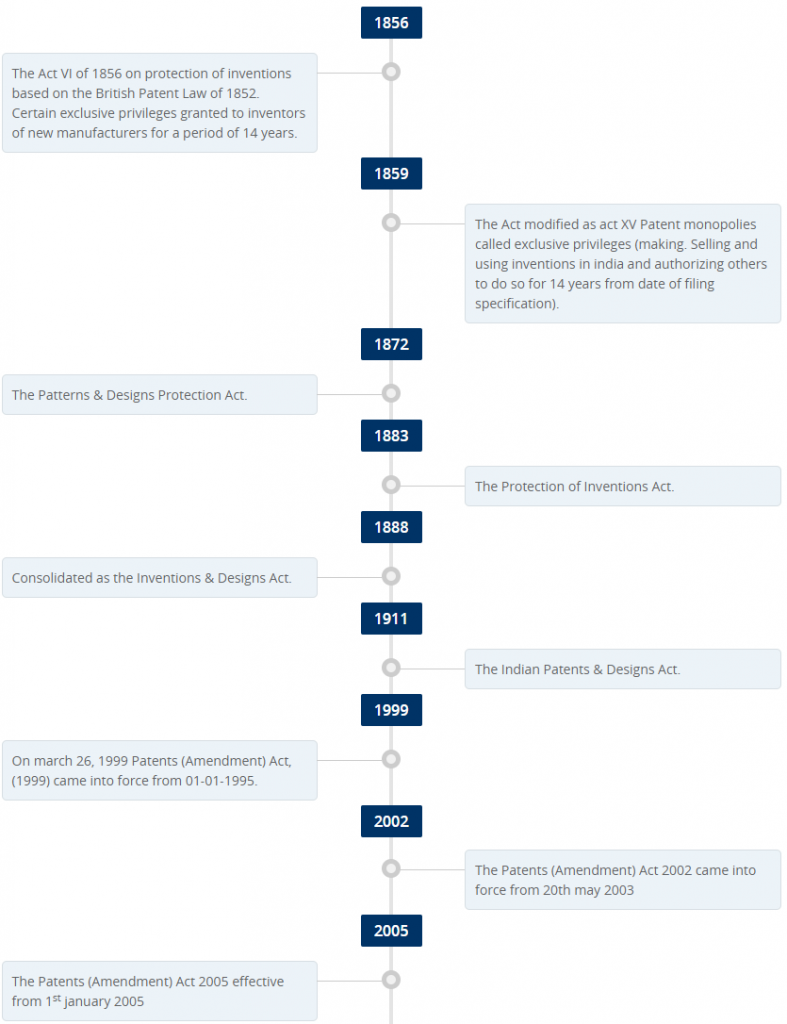

History of Indian Patent System

- The first legislation in India relating to patents was the Act VI of 1856 – But it was repealed by Act IX of 1857 because it had been enacted without the approval of the British Crown

- Fresh legislation for granting ‘exclusive privileges’ was introduced in 1 859 as Act XV of 1859.

- In 1872, the Act of 1859 was renamed as “The Patterns and Designs Protection Act” and it was consolidated to provide protection relating to designs.

- The Indian Patents and Designs Act, 1911, (Act II of 1911) replaced all the previous Acts.

- After Independence, it was felt that the Indian Patents & Designs Act, 1911 was not fulfilling its objective.

- Based on the recommendations of a Committee formed by the Indian Government after independence, the 1911 Act was amended in 1950.

- In 1952, an amendment was made to provide compulsory licence in relation to patents in respect of food and medicines, insecticide, germicide or fungicide and a process for producing substance or any invention relating to surgical or curative devices.

- In 1957, the Government of India appointed Justice N. Rajagopala Ayyangar Committee to examine the question of revision of the Patent Law and advise government accordingly and the committee recommended retention of the Patent System, despite its shortcomings.

- The Patents Act 1970 was passed which repealed and replaced the 1911 Act so far as the patents law was concerned.

- The Patents Act of 1970 has Amended a number of times. A new Patent Rules, 2003 was introduced (by replacing the earlier Patents Rules, 1972) since, under the Patents Act 1970 the Central Government is empowered to make rules for implementing the Act and regulating patent administration.

Office of the Controller General of Patents, Designs and Trade Marks (CGPDTM)

- The Office of the Controller General of Patents, Designs and Trade Marks (CGPDTM) generally known as the Indian Patent Office, is an agency under the Department for Promotion of Industry and Internal Trade which administers the Indian law of Patents, Designs and Trade Marks.

- The CGPDTM reports to the Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry.

- Since the rights granted by an Indian Patent Office extends only throughout the territory of the India and ceases to have effect in a foreign country. An inventor who wishes patent protection in another country must apply for a patent in a specific country (according to its law).

- The Indian Patent office had an unusually high grant rate for the year 2005–06 in respect of numbers of refused patent applications compared to other major patent offices.

- In exchange of a 20-year patent monopoly granted to an inventor, India’s patent law imposes a duty on the patentee to commercially work the invention in India to ensure that its benefits reach the public.

- In fact, the purpose of granting patents itself is to not only encourage innovation but also ensure that the inventions are worked in India and are made available to the public in sufficient quantity at reasonable prices.

Changes through the Patent (Amendment) Rules, 2020

- The Patent (Amendment) Rules, 2020 has significantly weakened the critical duty imposed by the law on patentees/licensees to disclose patent working information.

- This in turn could hinder access to vital inventions including life-saving medicines, thereby impacting public health.

- The lack of this information could prevent invocation of compulsory licensing and other public interest measures in cases of patent abuse and make certain inventions inaccessible to the public.

Why was this Amendment required?

- Indian Patent law has a special provision which requires every patentee and licensee to submit to the Patent Office an annual statement explaining the extent to which they have worked the invention in India.

- This is meant to help the Patent Office, potential competitors, etc. to determine whether the patentee has worked the invention in India and made it sufficiently available to the public at reasonable prices.

- Seeking local working information is part of India’s use of its sovereign rights. The state is obligated to protect the right to life of its citizens under Article 21, and this duty is heavier than any duty that the state may owe the patentees.

- The state should ensure that patentees perform their duties as monopoly holders. This means that the grant of patents must contribute to the promotion of technological innovation and to the transfer and dissemination of technology in a manner conducive to social and economic welfare and to a balance of rights and obligations.

- Unfortunately, patentees and licensees as well as the Patent Office have blatantly disregarded this statutory requirement.

- Also, there has been significant pressure from multinational corporations and the United States government to do away with this requirement.

-Source: The Hindu

SUCCESS OF FACELESS TAX ASSESSMENT SCHEME

Context:

- The government’s faceless tax assessment scheme has managed to deliver about 24,000 final orders since its introduction in August 2020.

- The Faceless Tax Assessment system is now stabilized and faceless appeals systems are now in place.

Relevance:

GS-III: Indian Economy (Economic Development)

Dimensions of the Article:

- Transparent Taxation – Honouring the Honest (T2-H2)

- Criticism of Faceless Tax Assessment and Appeal System

- E-Assessment v/s Faceless Assessment

Transparent Taxation – Honouring the Honest (T2-H2)

- The Transparent Taxation – Honouring the Honest [T2-H2] is an extension of E-assessment scheme 2019 launched by Government of India.

- The new platform will be having Faceless Assessments, Faceless Appeal and Taxpayer Charter.

- Government has acknowledged that the country can move forward and can develop when the life of honest taxpayer is made easy and the launch of Taxpayer’s Charter is to ensure fair, courteous, and rational behaviour to the honest taxpayers.

- The issue of tax harassment by officers has gained a lot of attention in India and the government introduced faceless income tax assessment to reduce the scope for corruption and overreach by officials.

- The CBDT has given a framework and put in place a system in the form of this platform using technology such as data analytics and AI, a transparent efficient and accountable tax system.

Faceless Tax Assessment

The Faceless Assessment aims to eliminate human interface between the taxpayer and the income tax department and the selection of a taxpayer is possible through systems using analytics and Artificial Intelligence.

Faceless Appeal System

Under the Faceless Appeal system, appeals will be randomly allotted to any officer in the country. The identity of the officer deciding the appeal will remain unknown.

Criticism of Faceless Tax Assessment and Appeal System

- In a joint letter sent to the Central Board of Direct Taxes (CBDT) this month, representatives of the Income Tax Employees Federation and the Income Tax Gazetted Officers’ Association voiced their displeasure.

- Concerns were raised but tax officials that faceless tax assessment may reduce tax collection and raise pressure on officers that are under stress to meet lofty tax targets for the current fiscal year.

E-Assessment v/s Faceless Assessment

- In E-assessment the assessee will be aware of the assessing officer who will be carrying out the assessment proceedings.

- In Faceless Assessment, the assessee will not be aware of assessing officer who will be doing his tax assessment.

- The e-assessment was more of one assessing officer carrying out the assessment whereas in faceless assessment there will be a team of assessing officers who will be carrying out the assessment.

-Source: The Hindu

VIETNAM BUYS INDIAN RICE FOR FIRST TIME IN DECADES

Context:

Vietnam, as the 3rd largest exporter of rice, has started buying the grain from rival India for the first time in decades.

Relevance:

GS-III: Agriculture (Major Crops, Marketing of agricultural produce)

Dimensions of the Article:

- Why did Vietnam have to import rice from India?

- Recently in News: China had to import Rice from India

- India’s rice trade

- Does this increasing Rice trade help our farmers?

Why did Vietnam have to import rice from India?

- Vietnam required rice from India because local prices jumped to their highest in nine years amid limited domestic supplies.

- The purchases underscore tightening supplies in Asia, which could lift rice prices in 2021 and even force traditional buyers of rice from Thailand and Vietnam to switch to India.

Recently in News: China had to import Rice from India

- China had begun importing Indian rice in 2020 for the first time in at least three decades due to tightening supplies from Thailand, Myanmar and Vietnam and an offer of sharply discounted prices.

- China is the largest importer of rice and had avoided purchases from India, citing quality issues.

- The rice imports come despite political tensions over a border dispute in the Himalayas which erupted into a clash in June in which 20 Indian soldiers were killed.

- China’s traditional suppliers, such as Thailand, Vietnam, Myanmar and Pakistan, have limited surplus supplies for export and were quoting at least $30 per tonne more compared with Indian prices.

- Thailand, the world’s second-largest rice exporter and key supplier to China, suffered a drought this year that has affected the rice crop.

India’s rice trade

- India emerged the world’s largest rice exporter in 2011-12, displacing Thailand from its leadership position.

- As opposed to exports of around 1 lakh tons of non-basmati rice in 2010-11, exports soared to 40 lakh tons in 2011-12.

- There was a continuous increase in exports of non-basmati varieties since then until 2015.

- After a fall in the subsequent year 2016, there a rise again to 86 lakh tons in 2017-18.

- The consequent increase in domestic prices obviously reduced the incentive to sell in export markets rather than to the government or in the local market.

- India was a major beneficiary, recording a sharp increase in exports of non-basmati varieties.

Does this increasing Rice trade help our farmers?

- Domestic demand for rice has remained below domestic availability, despite the rising share of exports to domestic production.

- This subdued demand hits farmers, who find cultivation increasingly unviable despite rising rice exports.

- Moreover, the benefit of a “disciplining” international price does not seem to have accrued to consumers.

- Retail prices in all metropolitan cities have remained well above the export price showing high and rising distribution margins.

- So, the liberalization of the rice trade seems to have benefited only one section, the merchant capitalists, and not the actual producers or consumers

-Source: The Hindu