Contents

- The many layers to agricultural discontent

- Growth Pangs

THE MANY LAYERS TO AGRICULTURAL DISCONTENT

Context:

COVID-19 triggered supply and demand challenges — and highlighted several problems of agricultural marketing for farmers. Topping the list is the reality that farmers need to be able to independently market their products directly to customers.

Relevance:

GS Paper 3: storage, transport & marketing of agro-produce and related issues & constraints;

Mains Questions:

- What are the impediments in marketing and supply chain management in industry in India? Can e-commerce help in overcoming these bottlenecks? 15 Marks

- Assess the role of agriculture marketing in India. Also give suggestions to address the issues in Agriculture marketing. 15 Marks.

Dimensions of the Article:

- What is Agriculture Marketing?

- Three different categories of Agriculture Marketing

- Importance of well functioned Agriculture Marketing

- Issues related to agriculture marketing

- Measures taken by the government

- Way Forward

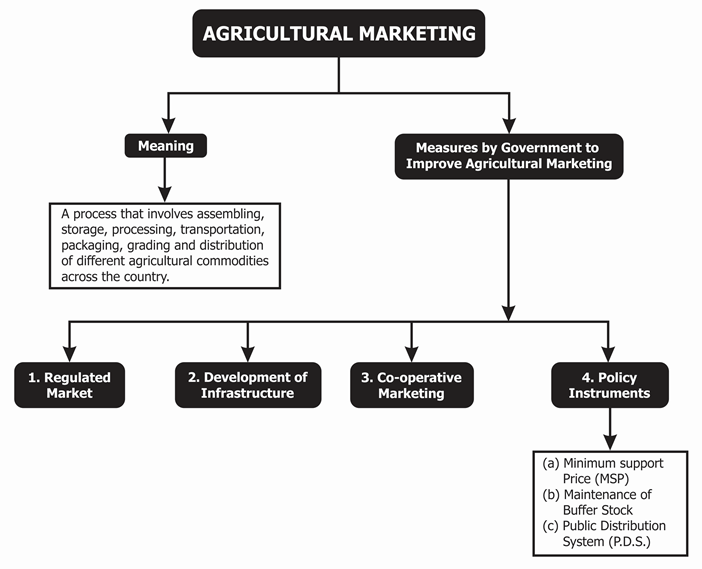

What is Agriculture Marketing?

The term agricultural marketing is composed of two words- agriculture and marketing. Agriculture, generally means growing and/or raising of crops and livestock while, marketing encompasses a series of activities involved in moving the goods from the point of production to point of consumption. Many scholars have defined agricultural marketing and incorporated essential elements of time, place, form and passion utility. Some of the definitions of agricultural marketing are given below;

- Human activity directed at satisfying the needs and wants through exchange process (Phillip Kotler).

- Performance of business activities that directs the flow of goods and services from producers to users (American Marketing Association).

- Agricultural marketing is a process which starts with a decision to produce a saleable farm commodity, involves all the aspects of market structure or system, both financial and institutional, based on technical and economic considerations, and includes pre- and post-harvest operations, assembling, grading, storage, transportation and distribution (National Commission on Agriculture, 1976).

Key aspects of agricultural marketing

- Agricultural marketing comprising of all activities involved in supply of farm inputs to the farmers and movement of agricultural products from the farms to the consumers.

- The agricultural marketing system includes two major sub-system viz. product marketing and input (factor) marketing. The product marketing sub-system includes farmers, village/primary traders, wholesalers, processors, importers, exporters, marketing cooperatives, regulated marketing committees and retailers. The input sub-system includes input manufacturers, distributors, related associations, importers, exporters and others who make available various farm production inputs to farmers.

- The marketing system should be such as may bring about the overall welfare to all the segments (producers, consumers, middlemen and traders) society. Government act as a watch-dog in ensuring the interest of all the groups associated in the marketing.

- The subject of agricultural marketing includes marketing functions, agencies, channels, efficiency and costs, price spread and market integration, producer’s surplus, government policy and research, training and statistics on agricultural marketing and imports/exports of agricultural commodities.

- The overall objective of agricultural marketing in a developing country like India is to help the primary producers viz. the farmers in getting the remunerative prices for their produce and to provide right type of goods at the right place, in the right quantity and quality at a right time and at right prices to the processors and/or ultimate consumers on the other.

Three different categories of Agriculture Marketing

- Traditional Marketing Methods: Traditional methods generally start with sale by farmer and involve a number of intermediaries at different levels from rural markets to terminal markets. (refer infographic). Close to 50% of the agricultural produce in India is sold via these channels.

- Cooperative based marketing: In this method, agri-products are directly purchased from farmers through marketing network of NAFED (National Agricultural Cooperative Marketing Federation of India Limited), thus eliminating middlemen.

- Over the course of time, there have been various successful cooperative marketing models like Anand Pattern Cooperatives (APC), Chicory contract farming coordination in Jamnagar Gujarat and Kerala Horticulture Development Program (KHDP).

- Emerging models of agricultural marketing: With the emergence of new inputs, business opportunities and technologies in the market, several innovative marketing methods have evolved over the time, like

- National Agriculture Market (eNAM): It is a pan-India electronic trading portal which networks the existing APMC mandis to create a unified national market for agricultural commodities. Till date, more than 1 lakh traders and over 66,000 commission agents have been registered on the portal. As of 2018, trade recorded on the e-NAM portal stood at a value of Rs 50,575 crore, and in terms of volume it was more than two crore tonnes.

- Commodity and Futures markets: There have been efforts to create exchanges and trading options for further facilitation and better price discovery for farmers. For example, creation of National Spot Exchange Limited (NSEL).

- Private sector initiatives: Several start-ups and businesses have created innovative pilot solutions for agricultural markets. For example, Indian Tobacco Company’s e-choupal.

- Apart from these, there are other methodologies like Farmer Producer Organizations (FPOs) and Contract Farming. (They will be discussed in detail in subsequent articles.)

Importance of well functioned Agriculture Marketing

- Monetizing the Produce: Marketing facilitates the sales of agricultural products.

- Acting as a source of market information and price signal.

- Reducing the role of intermediaries.

- Encouraging capital formation and investment in technology.

- Value addition in agriculture by increasing access of agricultural produce to downstream industries. For example, large scale ‘Makhana’ snack industry in Bihar.

Issues related to agriculture marketing

- Institutional Issues like licensing barriers for owning a shop or godown, very high incidence of market charges (as large as 15% in some cases) and absence of standardized grading mechanism of agricultural produce.

- Infrastructural Issues like limited access of Agricultural Produce Markets in some areas in the country, poor Infrastructure in Agricultural Markets (like Cold Storage facilities) and poor economic viability of agricultural infrastructure projects.

- Market information system issues like absence of real time informational channels creating lag in demand signals, information to farmers is limited to major commodities and poor awareness among farmers regarding new channels of information (like SMS based advisories).

- Absence of a National Integrated Market: Although, there exists a national level physical market in the form of APMCs, there is no national level regulation for the same.

- Limited public investment: Public expenditure on agricultural marketing sub-sector ranges 4-5 % of the total public expenses on agriculture, while expenditure on marketing infrastructure development has been less than 1 %.

Measures taken by the government

- Creating a Model APMC Act, 2003: It aimed to facilitate amendment of the existing Rules. So far, only sixteen States have amended their Act and only six states have notified the amended Rules. There are some States which do not have APMC Act and some have partially amended their Act.

- Consumer/Farmer Market (Direct Sale by the Producer): Direct marketing by farmers to the consumers has been experimented in the country at the State level. For example, Apni Mandi of Punjab, Rythu Bazaars in Andhra Pradesh, Shetkari Bazar in Maharashtra etc.

- AGMARKNET: It is a G2C e-governance portal that caters to the needs of various stakeholders such as farmers, industry, policy makers and academic institutions by providing agricultural marketing related information from a single window.

- Gramin Agricultural Markets (GrAMs): Efforts are being made to develop and upgrade existing 22,000 rural haats (Rural Primary Markets) into GrAMs.

- Initiatives like Kisan Rail for movement of vegetables, fruits and other perishables. It aims to ensure their safe, reliable and fast transportation which will aid in better price realisation for the farmers. India’s first Kisan Rail was recently flagged off in Maharashtra.

Way Forward

While market factors must be taken into consideration, any country’s agriculture sector must find an equilibrium of the interest of the producers and consumers, and account for uneven environmental factors across different regions. The apprehensions of the farmers are not unfounded. The onus is on the government to win their confidence. It must unconditionally reach out to the farmers and empathetically listen to them and not precipitate a crisis by high-handedness.

GROWTH PANGS

Context:

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI)voted unanimously to maintain the status quo on interest rates.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Mains Questions

- What is Monetary Policy? How is it different from fiscal policy? 10 marks

Dimensions of the Article:

- What is monetary policy?

- Difference between monetary policy and fiscal policy

- Types of Monetary Policy

- Objectives of Monetary Policy

- Tools of Monetary Policy

- Conclusion

What is Monetary policy?

Monetary policy is the macroeconomic policy laid down by the central bank. It involves management of money supply and interest rate and is the demand side economic policy used by the government of a country to achieve macroeconomic objectives like inflation, consumption, growth and liquidity.

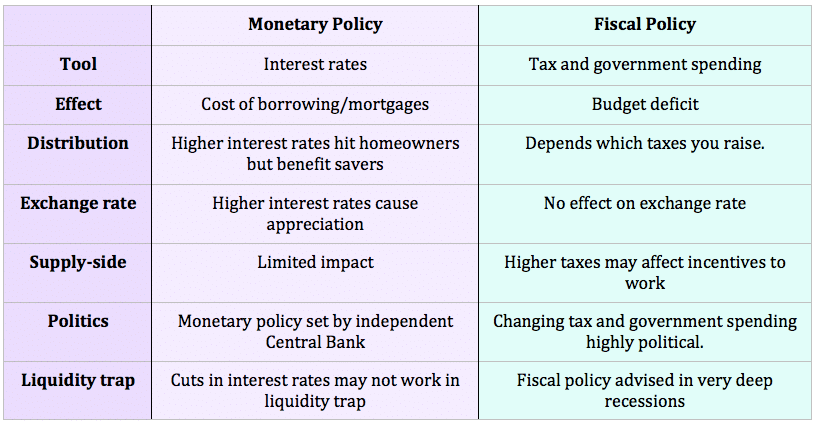

Difference between monetary policy and fiscal policy

Types of Monetary Policy

- Expansionary Monetary Policy: It increases the supply of money in an economy by making credit supply easily available. Money produced through such a policy is called as cheap money. An expansionary monetary policy is required when an economy goes through a phase of recession accompanied by lower levels of growth/high levels of unemployment. But risk associated with EMP is inflation.

- Contractionary Monetary Policy: It decreases the supply of money in the economy. Contractionary monetary is used to tackle the menace of inflation in the economy by raising the interest rates.

Objectives of Monetary Polity

In India, as defined by former RBI governor C. Rangarajan, broad objectives of monetary policy are:

- To regulate monetary expansion so as to maintain a reasonable degree of price stability; and

- To ensure adequate expansion in credit to assist economic growth

Further the objectives of Monetary Policy are:

- It leads to economic growth: The monetary policy can influence economic growth by controlling real interest rates and its resultant impact on the investment. If the RBI opts for a cheap credit policy by reducing interest rates, the investment level in the economy can be encouraged. This increased investment can speed up economic growth.

- Price Stability: Inflation and deflation both are not suitable for an economy. Price stability is defined as a low and stable order of inflation. Thus, the monetary policy having an objective of price stability tries to keep the value of money stable.

- Exchange Rate Stability: If exchange rate of an economy is stable it shows that economic condition of the country is stable. Monetary policy aims at maintaining the relative stability in the exchange rate. The RBI by altering the foreign exchange reserves tries to influence the demand for foreign exchange and tries to maintain the exchange rate stability.

- It generates employment: Monetary policy can be used for generating employment. If the monetary policy is expansionary then credit supply can be encouraged. It would thus help in creating more jobs in different sector of the economy.

- Equitable distribution of income: Earlier many economists used to justify the role of the fiscal policy in maintaining economic equality. However, in recent years economists have given the opinion that the monetary policy can play a supplementary role in attainting economic equality.

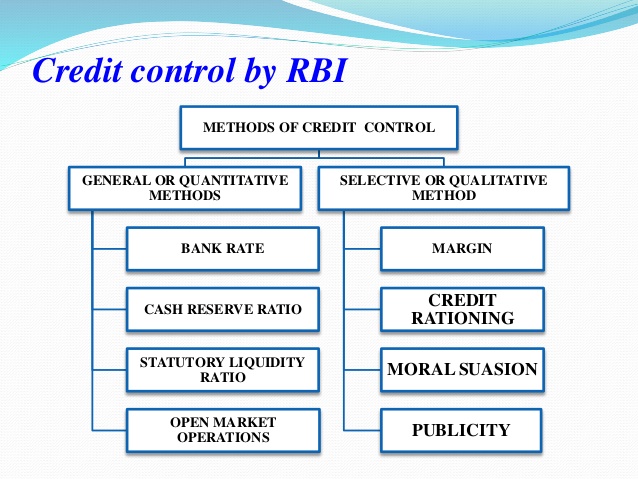

Tools of Monetary Policy:

Quantitative Credit Control Methods:

These are the instruments of monetary policy that affect over all supply of money/credit in the economy. Some are as follows:

- Statutory Liquidity Ratio: The Statutory Liquidity Ratio refers to that proportion of total deposits which the commercial banks are required to keep with themselves in a liquid form. The commercial banks generally make use of this money to purchase the government securities.

- Cash Reserve Ratio: The Cash Reserve Ratio (CRR) is the ratio fixed by the RBI of the total deposits of a bank in India, which is kept with the RBI in cash form. CRR deposits do not earn any interest for banks.

- Bank Rate: In basic terms, bank rate is the interest rate at which RBI provides long term credit facility to commercial banks. A change in bank rate affects the other market rates of interest. An increase in bank rate leads to an increase in other rates of interest, and conversely, a decrease in bank rate results in a fall in other rates of interest. Bank rate is also referred to as the discount rate.

- Repo Rate: If the RBI wants to make it more expensive for the banks to borrow money, it increases the repo rate.

- Reverse Repo Rate: Reverse Repo is the rate at which the Central Bank (RBI) borrows from the market. This is called as reverse repo as it the reverse of repo operation. Reverse repo rate at present is 50 basis points (or 0.5%) lower than the Repo Rate. Repo and Reverse.

- Open Market Operations (OMOs): It refers to buying and selling of government securities in open market in order to expand or contract the amount of money in the banking system. This technique is superior to bank rate policy. Purchases inject money into the banking system while sale of securities do the opposite.

- Marginal Standing Facility: Marginal Standing Facility is a liquidity support arrangement provided by RBI to commercial banks if the latter doesn’t have the required eligible securities above the SLR limit.

Qualitative Credit Control Methods

These are those tools through which the Central Bank not only controls the value of loans but also the purpose for which these loans are assigned by the commercial banks. Some of these are:

- Moral Suasion: Moral suasion means persuasion and request. To arrest inflationary situation Central Bank persuades and requests the commercial banks to refrain from giving loans for speculative and non-essential purposes. On the other hand, to counter deviation Central Bank persuades the commercial banks to extend credit for different purposes.

- Rationing of credit: Rationing of credit is a method by which the Reserve Bank seeks to limit the maximum amount of loans and advances, and also in certain cases fix ceiling for specific categories of loans and advances.

- Regulation of Consumer Credit: Now-a-days, most of the consumer durables like Cars, Televisions, and Laptops, etc. are available on installment basis financed through bank credit. Such credit made available by commercial banks for the purchase of consumer durables is known as consumer credit.

- Direct action: This method is adopted when a commercial bank does not co-operate with the central bank in achieving its desirable objectives.

- Margin Requirements: Generally, commercial banks give loan against ‘stocks or ‘securities’. While giving loans against stocks or securities they keep margin. Margin is the difference between the market value of a security and its maximum loan value.

Conclusion

Thus, Monetary Policy plays an important role in managing money supply, increasing investment, generating employment opportunities and bringing financial inclusion.