Contents

- Asian desert dust and Indian summer monsoon

- Delay in CBDT appointments raises concerns

- CM will represent Delhi at World Cities Cultural Forum

- First farm-based solar power plant under PM- KUSUM

- India asks state refiners to review oil import contracts

ASIAN DESERT DUST AND INDIAN SUMMER MONSOON

Context:

A new study has shown how dust coming from the deserts in the West, Central and East Asia plays an important role in the Indian Summer Monsoon.

The researchers also explain how the Indian Summer Monsoon has a reverse effect and can increase the winds in West Asia to produce yet more dust.

Relevance:

GS-I: Geography (Climatology, Important Geographical Phenomena, Indian Geography)

Dimensions of the Article:

- What is Monsoon?

- Causes of Monsoon

- What the recent research finds?

What is Monsoon?

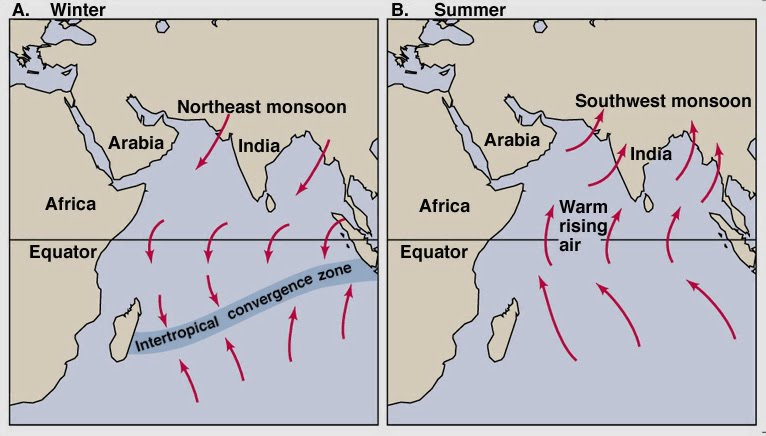

- Monsoon connotes the climate associated with seasonal reversal in the direction of winds. India has hot monsoonal climate which is the prevalent climate in south and southeast Asia.

- The Indian summer monsoon typically lasts from June-September with large areas of western and central India receiving more than 90% of their total annual precipitation during the period, and southern and northwestern India receiving 50%-75% of their total annual rainfall.

- Overall, monthly totals average 200-300 mm over the country as a whole, with the largest values observed during the heart of the monsoon season in July and August.

Causes of Monsoon

- During the summer months, sunlight heats the surfaces of both lands and oceans, but land temperatures rise more quickly due to a lower heat capacity.

- As the land’s surface becomes warmer, the air above it expands and an area of low pressure develops.

- Meanwhile, the ocean remains at a lower temperature than the land and so the air above it retains a higher pressure.

- Since winds flow from areas of high-pressure area to low, this deficit in pressure over the continent causes winds to blow in an ocean-to-land circulation (a sea breeze).

- As winds blow from the ocean to the land, moist air is brought inland. This is why summer monsoons cause so much rain.

What the recent research finds?

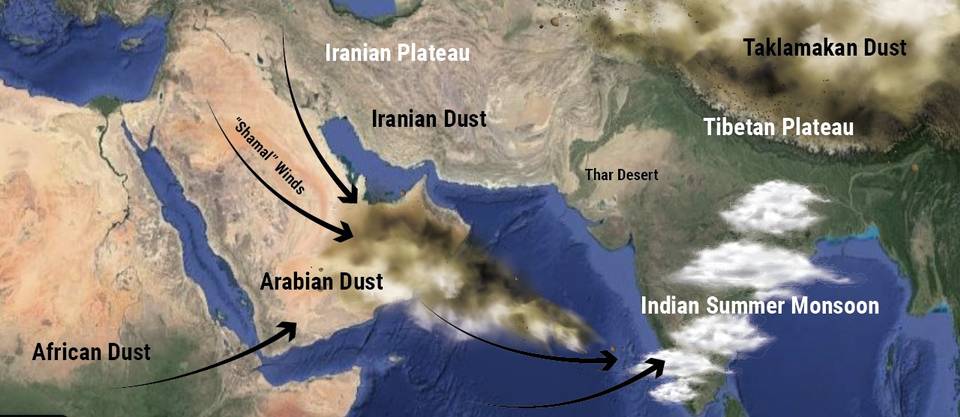

- Dust swarms from the desert when lifted by strong winds can absorb solar radiation and become hot.

- This can cause heating of the atmosphere, change the air pressure, wind circulation patterns, influence moisture transport and increase precipitation and rainfall.

- A strong monsoon can also transport air to West Asia and again pick up a lot of dust.

- Also, the hot air over the Iranian Plateau can heat the atmosphere over the plateau, strengthen the circulation over the deserts of the Arabian Peninsula and increase dust emission from the Middle East.

Aerosols transported

- The dust aerosols from deserts in West China such as the Taklamakan desert and the Gobi Desert can be transported eastward to eastern China and can influence the East Asia summer monsoon. And in the southwest United States, we have some small deserts that influence the North African monsoon.

- Some studies have found that the anthropogenic aerosols emitted from the Indian subcontinent can decrease summer monsoon precipitation, while others found that absorbing aerosols such as dust can strengthen the monsoon circulation.

- Many studies have shown that the dust emission scheme is extremely sensitive to climate change and the team writes that understanding these mechanisms and effects of dust will help understand our monsoon systems in the face of global climate change.

-Source: The Hindu

DELAY IN CBDT APPOINTMENTS RAISES CONCERNS

Context:

- A delay in appointing members of the Central Board of Direct Taxes (CBDT), the apex body of the Income Tax Department, is puzzling the entire revenue service and tax bureaucracy.

- The Committee of Secretaries (CoS) shortlisted names for CBDT members, however, there appears to be no progress in the appointment process, and the government appears to be in a wait-and-watch mode.

Relevance:

Prelims, GS-III: Indian Economy (Taxation, Organizations and Bodies set up for taxation)

Dimensions of the Article:

- About Central Board of Direct Taxes (CBDT)

- Composition of CBDT

- Functions of CBDT:

About Central Board of Direct Taxes (CBDT)

- The Central Board of Direct Taxes (CBDT) is a Statutory Body functioning under the Central Board of Revenue Act, 1963.

- It is official Financial action task force unit.

- CBDT is a part of the Department of Revenue in the Ministry of Finance, Government of India.

Composition of CBDT

The CBDT Chairman and Members of CBDT are selected from Indian Revenue Service (IRS), a premier civil service of India, whose members constitute the top management of Income Tax Department.

The Central Board of Direct Taxes consists of a Chairman, and six members that deal with the following:

- Income Tax & Revenue

- Administration

- Legislation & Computerization

- Audit and Judicial

- Investigation

- Transaction Processing System (TPS) & System

Functions of CBDT:

- CBDT is responsible for administration of the direct tax laws through Income Tax Department.

- The officials of the Board in their ex-officio capacity also function as a Division of the Ministry dealing with matters relating to levy and collection of direct taxes.

- CBDT provides essential inputs for policy and planning of direct taxes in India as well.

- It deals with matters related to levying and collecting Direct Taxes.

- Formulation of various policies.

- Supervision of the entire Income Tax Department

- Suggests legislative changes in Direct Tax Enactments

- Suggests changes in tax rates

- Proposes changes in the taxation structure in line with the Government policies.

-Source: The Hindu

CM WILL REPRESENT DELHI AT WORLD CITIES CULTURAL FORUM

Context:

The Chief Minister of Delhi will represent the Capital and India at the World Cities Cultural Forum.

Relevance:

Prelims, GS-II: International Relations (Groupings & Agreements Involving India and/or Affecting India’s Interests), GS-I: Art and Culture

Dimensions of the Article:

- About the World Cities Culture Forum (WCCF)

- World Cities Culture Summit

- The World Cities Culture Report

About the World Cities Culture Forum (WCCF)

- The World Cities Culture Forum is a network of local governments and cultural sector leaders from 43 world cities. (http://www.worldcitiescultureforum.com/ – 43 cities are listed).

- The World Cities Culture Forum was established in London in 2012 with eight cities (London, New York City, Tokyo, Shanghai, Paris, Istanbul, Sydney and Johannesburg) convened by the Mayor of London.

- Underpinning the World Cities Culture Forum’s work is an extensive programme of research and publications: The World Cities Culture Report is the network’s flagship publication.

- It also publishes the World Cities Culture Finance Report is the first comparative analysis of culture financing in world cities.

- The World Cities Culture Forum database is a comprehensive database on culture in world cities.

World Cities Culture Summit

- Each year, members of the World Cities Culture Forum meet at the three-day World Cities Culture Summit which is an opportunity for members to share best practice.

- Forum members collaborate via a programme of events including themed symposia, regional summits and workshops. These events feed into the annual World Cities Culture Summit.

- It enables the policy makers of member cities to share research and intelligence, and explores the vital role of culture in their future prosperity.

- The World Cities Culture Forum 2021 Theme is – “The Future of Culture”.

The World Cities Culture Report

- The World Cities Culture Report is a compendium of data and innovative policies in cities, providing an analysis of comparative data and identifying emerging issues.

- It is published on a triennial basis.

- The first version of this report was launched in London during the 2012 Summer Olympics.

-Source: The Hindu

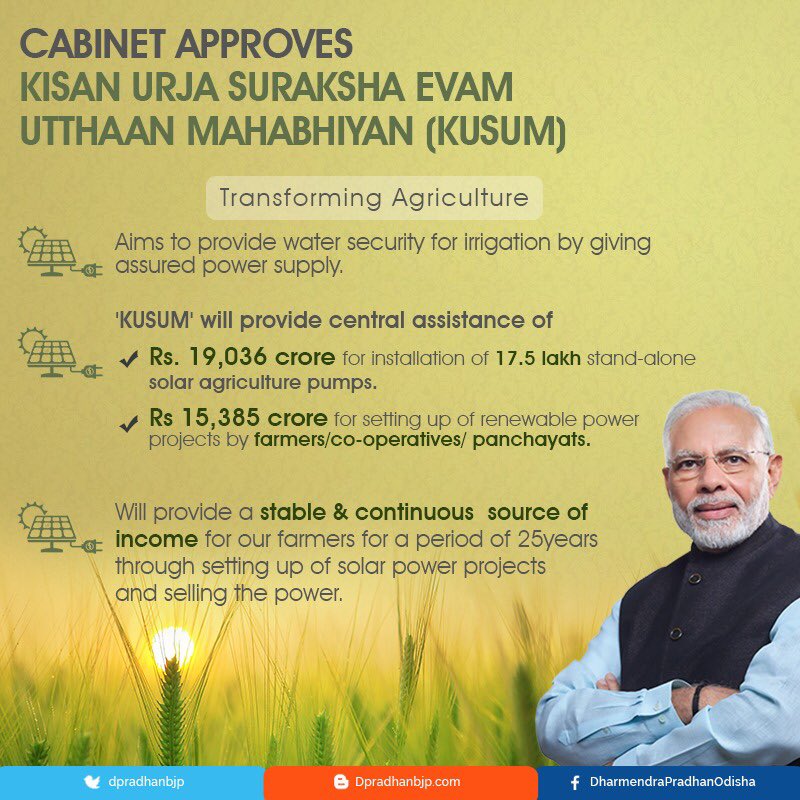

FIRST FARM-BASED SOLAR POWER PLANT UNDER PM- KUSUM

Context:

The first farm-based solar power plant under the Prime Minister’s Kisan Urja Suraksha Evam Utthan Mahabhiyan (PM-KUSUM) scheme has come up in Jaipur (Rajasthan) district’s Kotputli tehsil with a provision for production of 17 lakh units of electricity every year.

Relevance:

GS-III: Industry and Infrastructure (Energy related Infrastructure, Renewable energy sources, Government Policies and Interventions)

Dimensions of the Article:

- About Pradhan Mantri – Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM)

- Benefits of PM-KUSUM

- Challenges in implementation of PM-KUSUM

About Pradhan Mantri – Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM)

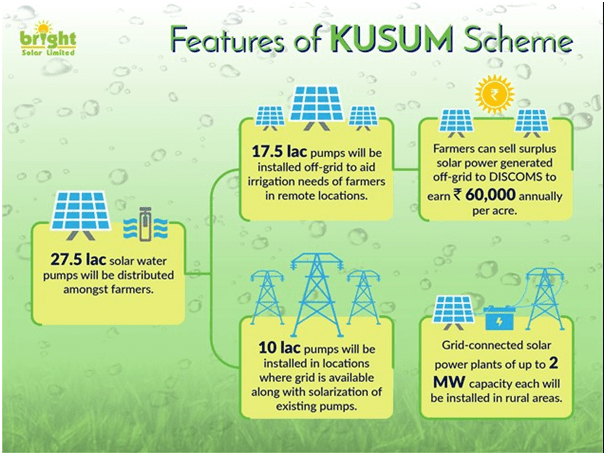

- The PM-KUSUM scheme was launched by the Ministry of New and Renewable Energy (MNRE) to support installation of off-grid solar pumps in rural areas and reduce dependence on grid, in grid-connected areas.

- The Cabinet Committee on Economic Affairs (CCEA) had in February 2019 approved the launch of the scheme with the objective of providing financial and water security.

- The government’s Budget for 2020-21 expanded the scope for the scheme with 20 lakh farmers to be provided assistance to install standalone solar pumps; another 15 lakh farmers to be given help to solarise their grid-connected pump sets.

- This will enable farmers to set up solar power generation capacity on their barren lands and to sell it to the grid.

PM-KUSUM consists of three components and aims to add a solar capacity of 30.8 GW by 2022:

- Component-A: 10,000 MW of decentralised ground-mounted grid-connected renewable power plants.

- Component-B: Installation of two million standalone solar-powered agriculture pumps.

- Component-C: Solarisation of 1.5 million grid-connected solar-powered agriculture pumps.

Benefits of PM-KUSUM

- PM-KUSUM, supports the financial health of electricity distribution companies (Discoms) by reducing the burden of subsidy to the agriculture sector and helps them meet the RPO (Renewable Purchase Obligation) targets.

- PM-KUSUM promotes decentralised solar power production, and reduces transmission losses and a potential way to reduce their subsidy outlay towards irrigation.

- If farmers are able to sell surplus powers, they will be incentivised to save power and, in turn, it will mean the reasonable and efficient use of groundwater, and it will also increase their income.

Challenges in implementation of PM-KUSUM

- Due to the strict DCR (Domestic Content Requirements), the suppliers of solar equipment have to raise the domestic cell sourcing. However, there isn’t enough domestic cell manufacturing capacity.

- There has been the relative omission of small and marginal farmers, as the scheme focuses on pumps of 3 HP and higher capacities. It is due to this, solar pumps are not reaching the majority of farmers, as nearly 85% of them are small & marginal.

- Due to power subsidies, the recurring cost of electricity is so low that farmers keep on pumping water and the water table is going down.

- In a solar installation, it becomes a more difficult job to upgrade to higher capacity pumps in case the water table falls because one will have to add new solar panels which are expensive.

-Source: The Hindu

INDIA ASKS STATE REFINERS TO REVIEW OIL IMPORT CONTRACTS

Context:

Amid tensions with Saudi Arabia over oil production cuts, India has asked its State refiners to review contracts they enter into for buying crude oil from the Middle East nation and negotiate more favourable terms.

Relevance:

GS-III: Indian Economy (International Trade, Mobilization of Resources, Growth and Development of Indian Economy)

Dimensions of the Article:

- Background to the Tensions with Saudi Arabia regarding oil imports

- Issues with OPEC Producers

- About Organization of the Petroleum Exporting Countries (OPEC)

- India and Oil Imports

- Diversifying India’s Oil Imports

Background to the Tensions with Saudi Arabia regarding oil imports

- When oil prices started to rise in February 2021, India wanted Saudi Arabia to relax output controls but the Kindgom ignored its calls.

- Saudi Arabia and other OPEC (Organization of the Petroleum Exporting Countries) producers have been the mainstay suppliers of crude oil for India. But their terms have often been loaded against the buyers.

- OPEC is a permanent intergovernmental organization of 13 oil-exporting developing nations that coordinates and unifies the petroleum policies of its Member countries.

- This has led to the Indian government now pressing for diversification of the supply base.

- Keen to break producers’ cartel dictating pricing and contractual terms, the government has told Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limted (HPCL) to look for oil supplies from outside the Middle East region and use collective bargaining power to get favourable terms.

Issues with OPEC Producers

- Indian firms buy two-third of their purchases on term or fixed annual contracts.

- These term contracts provide assured supplies of the contracted quantity but the pricing and other terms favour only the supplier.

- The buyer has to indicate at least six weeks in advance of their intention to lift quantity out of the annual term contract in any month and has to pay an average official price announced by the producer.

- While buyers have an obligation to lift all of the contracted quantity, Saudi Arabia and other producers have the option to reduce supplies in case OPEC decides to keep production artificially lower to boost prices.

About Organization of the Petroleum Exporting Countries (OPEC)

- The Organization of the Petroleum Exporting Countries is an intergovernmental organization of 14 nations, founded in 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), and headquartered since 1965 in Vienna, Austria.

- As of 2018, the 14 member countries accounted for an estimated 44 percent of global oil production and almost 82% of the world’s “proven” oil reserves, giving OPEC a major influence on global oil prices that were previously determined by the so-called “Seven Sisters” grouping of multinational oil companies.

- The stated mission of the organization is to “coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets, in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers, and a fair return on capital for those investing in the petroleum industry.”

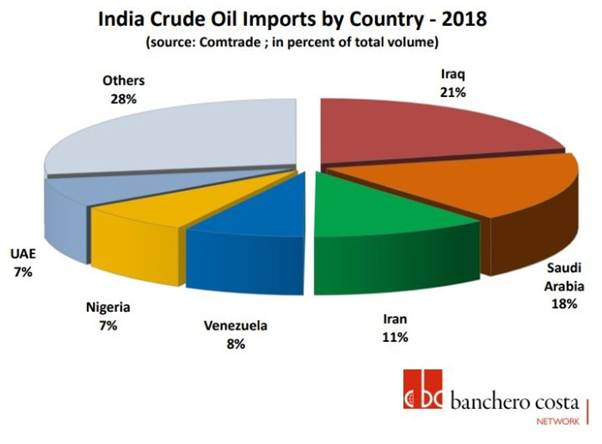

India and Oil Imports

- India is heavily dependent on crude oil and LNG imports with over 82% import dependence for crude oil and more than 45% for natural gas/LNG.

- India generated more than 35 million tons of petroleum products from indigenous crude oil production whereas the consumption of petroleum products is more than 200 million tons. Similarly, India generated 30 bcm natural gas locally against the consumption of almost 60 bcm (double).

- LNG price is linked to the prevailing crude oil price in global markets.

- India is the third biggest oil importer after US and China in 2018 and expected to occupy second place surpassing the US in 2019.

Diversifying India’s Oil Imports

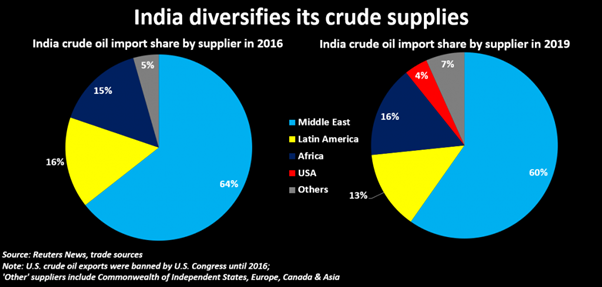

- India’s imports of Middle Eastern oil plunged to a four-year low in 2019.

- India imports about almost 85% of its oil needs and traditionally relies on the Middle East for the majority of its supplies, however, the region’s share of India’s crude shrank to 60% in 2019.

- The reason being: a record output from the United States and countries like Russia offered opportunities for importers to tap other sources.

Way Forward

- India needs pricing flexibility as well as the certainty of supply even during times when production falls due to any reason. Besides, choice of time of supply and flexibility on quantity (ability to reduce or increase) is what India should be looking at.

- Indian refiners can look to reduce the quantity they buy through term contracts and instead buy more from the spot or current market. Buying from the spot market would ensure that India can take advantage of any fall in prices on any day and book quantities.

- State-owned refineries have also been asked to coordinate buying and also explore joint strategy with private refiners such as Reliance Industries and Nayara Energy.

-Source: The Hindu