Contents

- Education, the nation and the States

- Reinforcing RBI’s accountability

Education, the nation and the States

Context: New Education Policy 2020: A look at the proposals on curriculum, courses and medium of instruction, and the takeaways for students, schools and universities.

Relevance:

GS Paper 2: Social Sector & Social Services (health, education, human resources – issues in development, management);

Mains questions:

- Education is fundamental for achieving full human potential, developing an equitable and just society, and promoting national development. Discuss the statement in context of New Education Policy 2020. 15 marks

- The National Education Policy 2020 underestimates the problem of reconciling the three systems of education in India. Comment 15 marks

- The National Education Policy is tailored to favour a neo-colonial economic order. It will favour those from affluent backgrounds, and discriminate against the poor and the oppressed. 15 marks

- Our aim should not be limited to imparting children with foundational skills of literacy, numeracy and competencies but removing structural disadvantages, thus enabling them to live a meaningful life, simultaneously strengthening our society as a secular, democratic space. Elaborate. 15 marks

Dimensions of the Article

- What purpose does an NEP serve?

- What are the key takeaways?

- How will these reforms be implemented?

- Significance of the NEP

- Challenges to the NEP

- Way forward

What purpose does an NEP serve?

An NEP is a comprehensive framework to guide the development of education in the country. A new NEP usually comes along every few decades. India has had three to date. The first came in 1968 and the second in 1986.

What are the key takeaways?

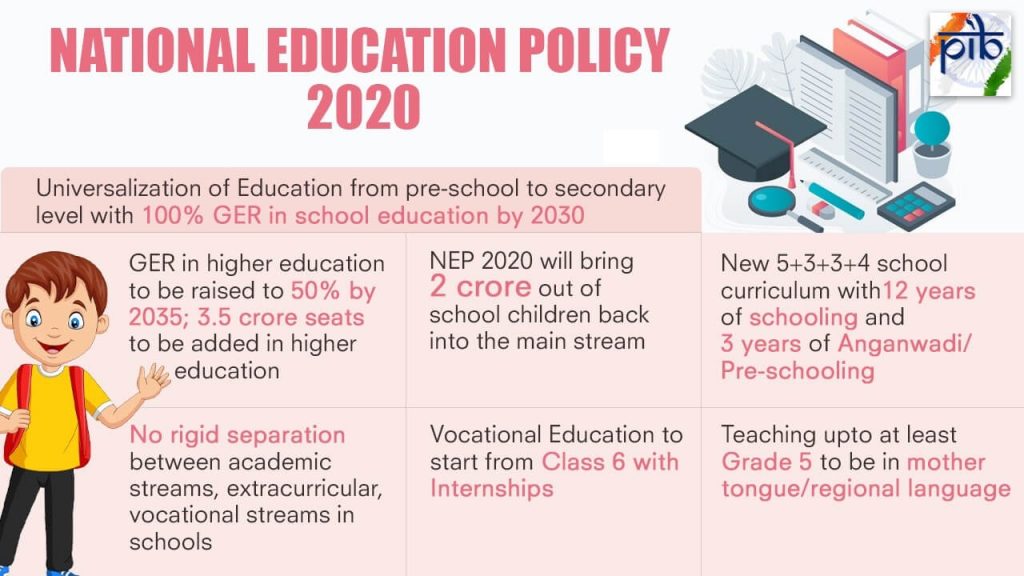

The National Education Policy (NEP) 2020 was released on July 30, 2020. It will replace the National Policy on Education, 1986. Key recommendations of the NEP include:

- Redesigning the structure of school curriculum to incorporate early childhood care and education.

- Curtailing dropouts for ensuring universal access to education.

- Increasing gross enrolment in higher education to 50 percent by 2035.

- Improving research in higher education institutes by setting up a Research Foundation.

Curtailing dropouts and universal access to education:

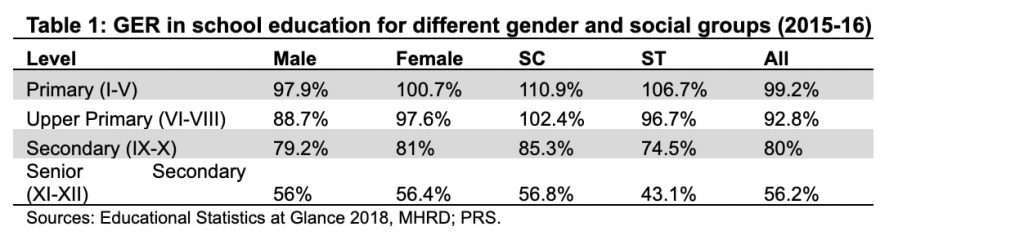

The NEP states that has been successful in achieving near-universal enrolment in elementary education, however retaining children remains a challenge for the schooling system. As of 2015-16, Gross Enrolment Ratio was 56.2 percent at the senior secondary level as compared to 99.2 percent at the primary level. GER denotes enrolment as a percent of the population of the corresponding age group. Further, it noted that the decline in GER is higher for certain socio-economically disadvantaged groups.

The NEP recommends strengthening existing schemes and policies which are targeted for such socio-economically disadvantaged groups (for instance, schemes for free bicycles for girls or scholarships) to tackle dropouts. Further, it recommends setting up special education zones in areas with a significant proportion of such disadvantaged groups. A gender inclusion fund should also be set up to assist female and transgender students in getting access to education.

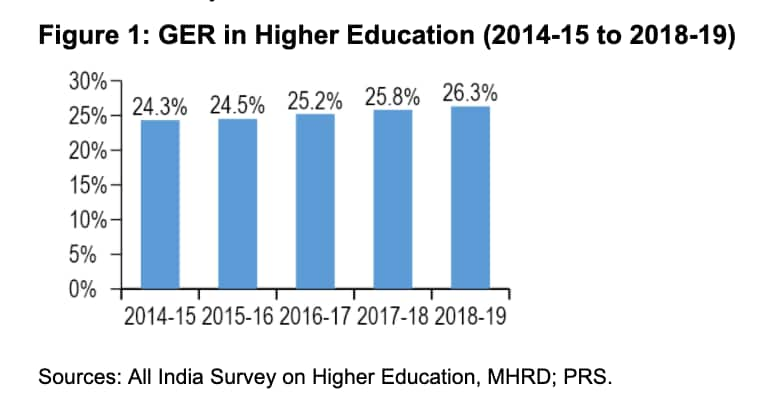

Increasing GER in higher education to 50 percent by 2035:

The NEP aims to increase the GER in higher education to 50 percent by 2035. As of 2018-19, the GER in higher education in the country stood at 26.3 percent.

The NEP recommends that all institutes should aim to be large multidisciplinary institutes (with enrolments in thousands), and there should be one such institution in or near every district by 2030. Further, institutions should have the option to run open distance learning and online programmes to improve access to higher education.

Foundational literacy and numeracy

The NEP states that a large proportion of the students currently enrolled in elementary school have not attained foundational literacy and numeracy (the ability to read and understand a basic text and carry out basic addition and subtraction). It recommends that every child should attain foundational literacy and numeracy by grade three.

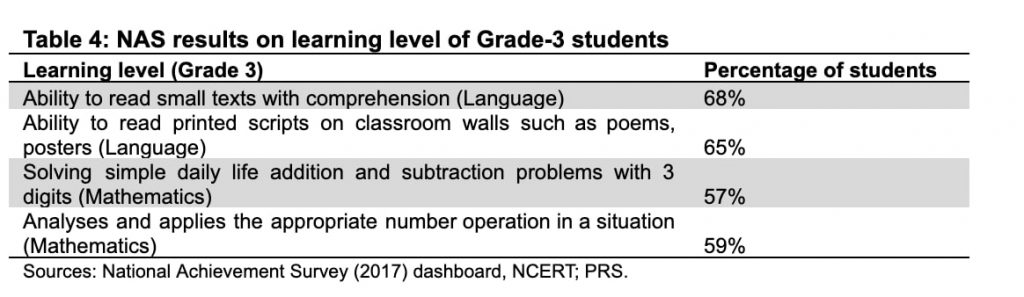

The National Achievement Survey 2017 to analyse the learning levels of students at Grade 3 in language and mathematics. The results of the survey suggest that only 57 percent students in Grade 3 are able to solve basic numeracy skills related to addition and subtraction.

To achieve universal foundational literacy and numeracy, the Policy recommends setting up a National Mission on Foundational Literacy and Numeracy under the MHRD. All state governments must prepare implementation plans to achieve these goals by 2025. A national repository of high-quality resources on foundational literacy and numeracy will be made available on the government’s e-learning platform (DIKSHA). Other measures to be taken in this regard include:

- Filling teacher vacancies at the earliest.

- Insuring a pupil to teacher ratio of 30:1 for effective teaching.

- Training teachers to impart foundational literacy and numeracy.

Effective governance of schools

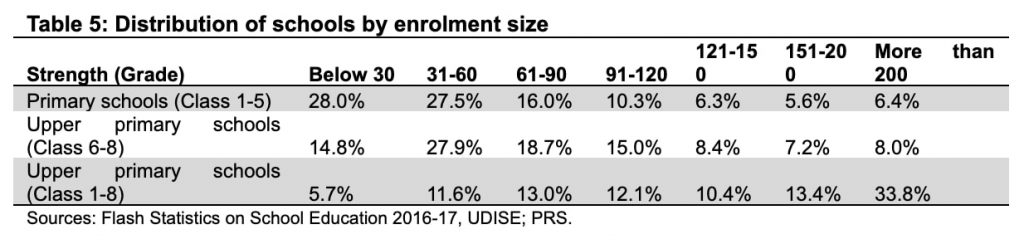

The Policy states that establishing primary schools in every habitation across the country has helped increase access to education. However, it has led to the development of schools with low numbers of students. The small size of schools makes it operationally and economically challenging to deploy teachers and critical physical resources (such as library books, sports equipment). Note that, as of September 2016, more than 55 percent of primary schools in the country had an enrolment below 60 students.

To overcome the challenges associated with the development of small schools, the NEP recommends grouping schools together to form a school complex. The school complex will consist of one secondary school and other schools, Anganwadi in a 5-10 km radius. This will ensure

- An adequate number of teachers for all subjects in a school complex.

- Adequate infrastructural resources.

- Effective governance of schools.

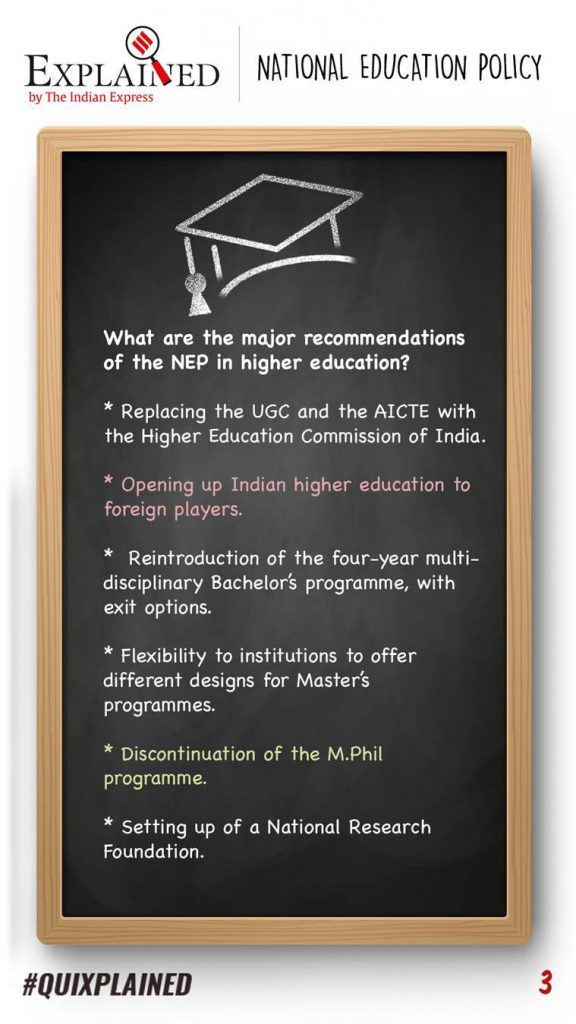

Restructuring of higher education institutes

The NEP notes that the higher education ecosystem in the country is severely fragmented. The present complex nomenclature of higher education institutes (HEIs) in the country such as ‘deemed to be university’, ‘affiliating university’, ‘affiliating technical university’, ‘unitary university’ shall be replaced simply by ‘university’.

The NEP recommends that all HEIs should be restructured into three categories:

- Research universities focusing equally on research and teaching.

- Teaching universities focusing primarily on teaching.

- Degree-granting colleges primarily focused on undergraduate teaching.

Setting up a National Research Foundation to boost research

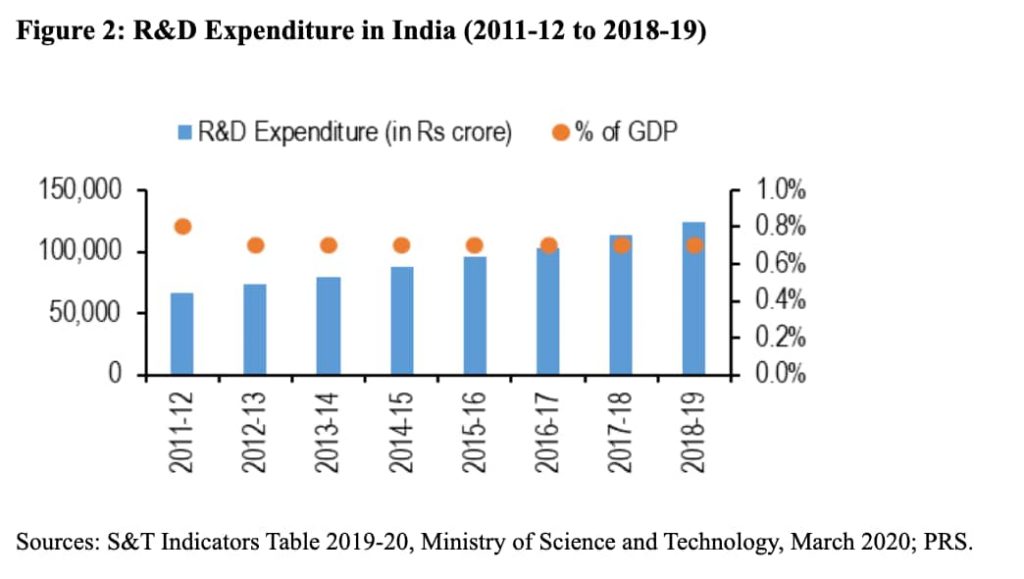

The NEP states that investment on research and innovation in India, at only 0.69 percent of GDP, lags behind several other countries.

To boost research, the NEP recommends setting up an independent National Research Foundation (NRF) for funding and facilitating quality research in India. The Foundation will act as a liaison between researchers and relevant branches of government as well as industry.

Digital education

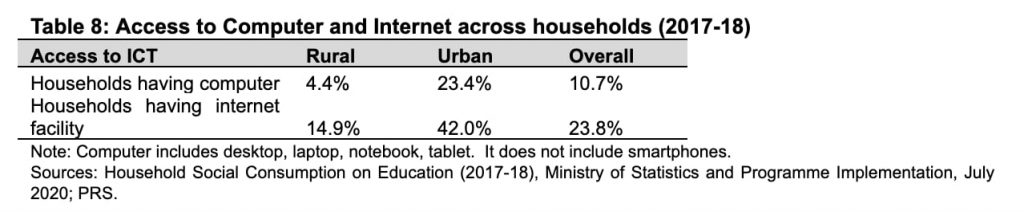

The NEP states that alternative modes of quality education should be developed when in-person education is not possible, as observed during the recent pandemic. However As of 2017-18, the access to internet and computer was relatively poor in rural areas. Only 4.4 percent of rural households have access to a computer (excludes smartphones), and nearly 15 percent have access to internet facilities. Amongst urban households, 42 percent have access to the internet.

6 percent of public investment on education

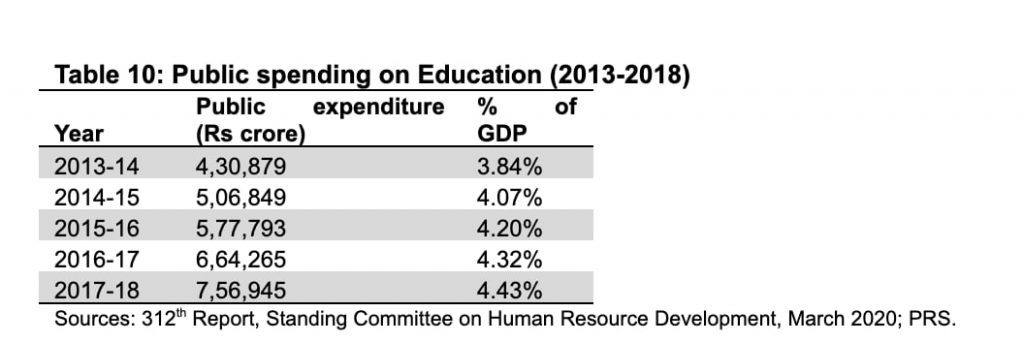

The recommendation of increasing public spending on education to 6 percent of GDP was first made by the National Policy on Education 1968 and reiterated by the 1986 Policy. NEP 2020 reaffirms the recommendation of increasing public investment on education to 6 percent of GDP. In 2017-18, the public spending on education (including spending by centre and states) was budgeted at 4.43 percent of GDP

How will these reforms be implemented?

The NEP only provides a broad direction and is not mandatory to follow. Since education is a concurrent subject (both the Centre and the state governments can make laws on it), the reforms proposed can only be implemented collaboratively by the Centre and the states. The government plans to set up subject-wise committees with members from relevant ministries at both the central and state levels to develop implementation plans for each aspect of the NEP.

Significance of NEP

- Developed after extensive consultations with more than 1 lakh villages, 6000 blocks with specific questions on 33 themes for all levels. Also, all other stakeholders including ministries, states have been deliberated for their views to develop a consensus over the provisions of the draft.

- Look at education as a continuous process and comprehensively addresses all stages of education including different verticals of professional education, vocational education, technical education etc.

- Focus on foundational stages of education– the actions suggested on ECCE can be the best investment that India could make in education since evidence indicates that over 85% of a child’s cumulative brain development occurs prior to the age of 6.

- Schools will be given autonomy is setting syllabus under the broad National Curriculum Framework. This will motivate principals and teachers to innovate. More importantly, it will create a set of best practices that work in Indian conditions.

- The NEP has laid out a framework for ensuring quality of teacher education, which is paramount in terms of ensuring quality education.

- Removes the burden and conflict of interests, by separating regulatory function from other functions of the state authorities.

- The idea of Special Education Zones (SEZ) to be set up in disadvantaged regions across the country can help government focusing more on such areas and experiment with different ideas to get the best results.

- Focus on research, as it talks about financing and involvement of private sector and intends to make all institutes comprehensive teaching-research institutions. A National Research Foundation on the lines of what exists in the US is a promising step to coordinate and give direction to research.

Challenges related to NEP

- The policy’s implementation is predicated on the assumption that the education budget would be almost doubled in the next 10 years. Also, the sheer scale of changes expected, the rapid timeline and the absence of a strong mechanism for handholding states on this journey raises questions on the full implementation of this policy.

- Does not address the lack of accountability of schools– as school management committees (SMCs) which are without significant powers, may not be able to hold schools and teachers accountable.

- Representatives of CBSE Schools Management Association expressed concern over expanding the ambit of the Right to Education Act to pre-kindergarten to Class 12 from the present Classes 1 to 8. Already, the schools were facing difficulties in determining the fee structure and getting reimbursement of the fee of the student.

- Does not consider Direct Benefit Transfer as a means to eliminate fake beneficiaries– such as the idea of school vouchers. It will also help parents uphold the accountability of schools.

- Misses to address the gap of access to quality education between India’s rich and poor children- by proposing to remove the expectations that all schools meet common minimum infrastructure and facility standards, and that primary schools be within a stipulated distance from children’s homes.

Way forward

The underlying focus of any educational policy should be on bringing every child, particularly the marginalised, to the forefront of our concern by ensuring an enabling and dignified environment, respectful of their worlds, knowledge and experiences. Our aim should not be limited to imparting children with foundational skills of literacy, numeracy and competencies but removing structural disadvantages, thus enabling them to live a meaningful life, simultaneously strengthening our society as a secular, democratic space.

Reinforcing RBI’s accountability

Context: Inflation, as measured by the consumer price index (CPI), was 6.7% in the January-March quarter, 6.6% in the April-June quarter (based on imputed data) and 6.9% in the July-September quarter.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Mains questions:

- In many ways, the inception of the MPC itself was to make the decision making of the RBI more broad-based. Discuss. 15 marks

Dimensions of the editorial

- What is the Monetary Policy Committee?

- What are the objectives of MPC?

- Challenges related to MPC

- Way forward

What is MPC?

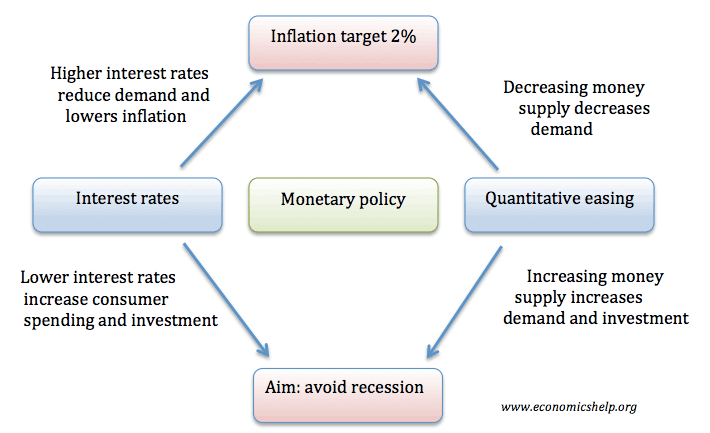

The Monetary Policy Committee (MPC) is the body of the RBI, headed by the Governor, responsible for taking the important monetary policy decisions about setting the repo rate. Repo rate is ‘the policy instrument’ in monetary policy that helps to realize the set inflation target by the RBI (at present 4%).

The Monetary Policy Committee (MPC) is formed under the RBI with six members. Three of the members are from the RBI while the other three members are appointed by the government. Members from the RBI are the Governor who is the chairman of the MPC, a Deputy Governor and one officer of the RBI. The government members are appointed by the Centre on the recommendations of a search-cum-selection committee which is to be headed by the Cabinet Secretary.

Objectives of the MPC

Monetary Policy was implemented with an initiative to provide reasonable price stability, high employment, and a faster economic growth rate. The major four objectives of the Monetary Policy are mentioned below:

- To stabilize the business cycle.

- To provide reasonable price stability.

- To provide faster economic growth.

- Exchange Rate Stability.

The inflation target, notified in August 2016, is 4%. The upper tolerance level was set at 6% and the lower tolerance level at 2%. Average inflation overshooting the upper tolerance level or remaining below the lower tolerance level for any three consecutive quarters constitutes a failure to achieve the inflation target. In such an event, the Reserve Bank of India (RBI) is required to send a report to the Centre, stating the reasons for the failure to achieve the inflation target, the remedial actions it proposes to initiate, and an estimate of the time-period within which it expects to achieve the inflation target through the corrective steps proposed.

Challenges related to MPC:

Ineffective monetary policy transmission: Monetary transmission refers to the process by which a central bank’s monetary policy signals (like repo rate) are passed on, through financial system to influence the businesses and households. The ineffective monetary policy transmission has following consequences.

- RBI is unable to achieve its mandate effectively– towards regulating various parameters like inflation, growth.

- Economic situation remains out of control– whereby country faces job losses, growth in unemployment rates due to stagnating growth.

- Inflation hurts the marginalized– as price rise hits at the pocket of poor sections the most. It becomes a failure on the part of a welfare state.

- Negative signals to the investors– which are otherwise tempted to invest in India due to its favorable interest eco-system.

- Uncertainties in business cycle– where major companies are not able to take decisions with predictable policy cycle.

- Ineffectiveness of Fiscal Policy– whereby government incentives like subsidies, interest subventions do not remain attractive as banks do not respond to policy signals.

Reasons for a lag in monetary transmission in India: Followings are the reasons related to poor monetary transmission in India.

- Overdependence on banks– The Indian financial system remains bank-dominated, and the share of nonbank finance companies (NBFCs) and markets (corporate bonds, commercial paper, equity, etc.) is less. Hence, most public savings are in Bank deposits, reducing the banks’ dependency on repo rate.

- Double Financial Repression– Pressure on banks due to locking of funds in government securities (SLR) and cash reserves (CRR).

- Priority Sector Lending- creates additional burden on banks to lend on a priority basis

- Increasing Non Performing Assets- in bank balance sheets, which impedes the bank’s ability to offer lower interest rates.

Data limitations:

The MPC uses the inflation data from Consumer Price Index. However, sometime it faces challenges related to accuracy of this data e.g. The normal data collection exercise of the National Statistics Office was disrupted during the lockdown imposed due to the COVID-19 pandemic. The publication of the CPI had to be suspended for the months of April and May.

Way forward

The central bank should be allowed to state expressly what support by way of government policy it needs to meet the inflation target. This can only strengthen the RBI’s hand; it should not let go of the opportunity to reinforce the MPC framework. Transparency can enable more informed decision-making within the government, greater public scrutiny of the RBI’s performance, and an improved inflation-targeting regime. To slack off on it would be to compromise with the credibility, transparency and predictability of monetary policy.

Background:

RBI and its Functions: It was established in 1935 under the provisions of RBI Act, 1934. RBI has seven major functions:

- Print Notes: RBI has the sole autonomy to print notes. The government has the sole authority to mint coins and one rupee notes.

- Banker to the Government: It manages government’s deposit accounts. It also represents govt. as a member of the IMF and World Bank.

- Custodian of Commercial Bank Deposits

- Custodian to Country’s Foreign Currency Reserves

- Lender of Last Resort: Commercial banks come to RBI for their monetary needs in case of emergency.

- Central Clearance and Accounts Settlement: As RBI keeps cash reserves from commercial banks therefore it rediscounts their bills of exchange easily.

- Credit Control: It controls supply of money in the economy through its monetary policy.

- The power to appoint RBI Governor solely rest with the Central Govt. and he holds office at the pleasure of Central Government (tenure not exceeding 5 years).