Contents

- Reaping the whirlwind

- Historic recession

- The Paris Agreement is no panacea

REAPING THE WHIRLWIND

Context:

The recently passed Agri.-reform Bills have created apprehensions among farmers that these legislations will ultimately lead to the dismantling of the MSP regime.

Relevance:

GS Paper 3: Farm subsidies and MSP and issues therein (direct and indirect); PDS (objectives, functioning, limitations, revamping, issues of buffer stocks & food security)

Mains Questions:

- What do you mean by Minimum Support Price (MSP)? How will MSP rescue the farmers from the low income trap? 15 marks

- The new legal architecture allows farmers more choices in selling their produce, in theory, and creates a national market for their produce. Comment 15 marks

Dimensions of the Article

- What is MSP?

- Why is there a need for MSP?

- What are the apprehensions of farmers related to New Laws?

- What are the issues related to MSP?

- NITI Aayog s recommendations related to MSP

- Way Forward

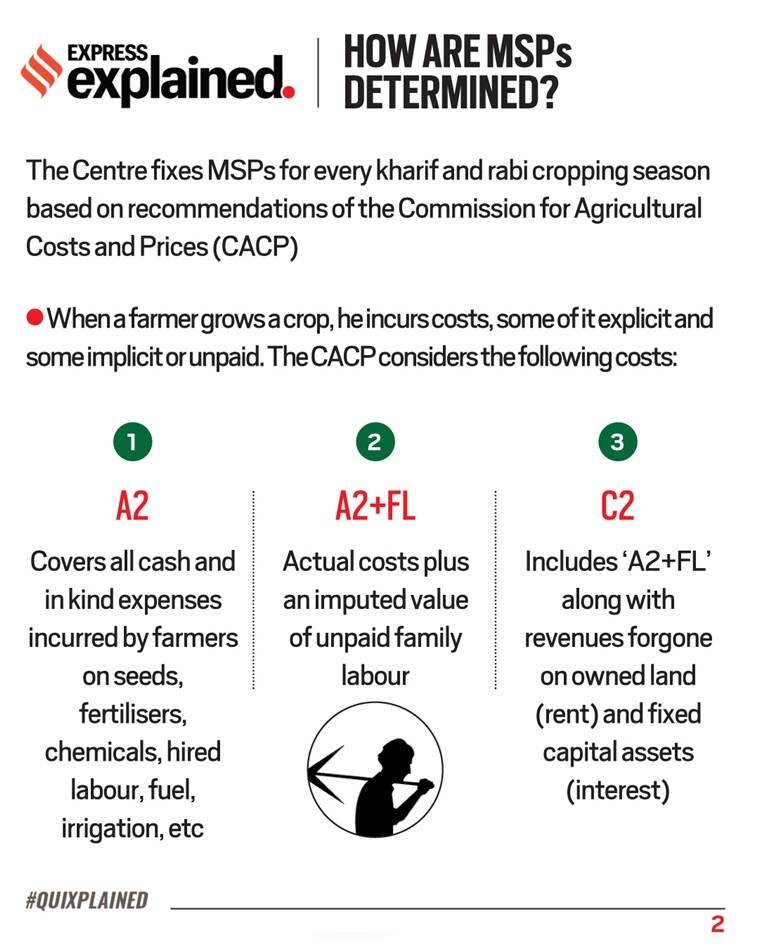

What is MSP?

- Minimum Support Price is the price at which government purchases crops from the farmers, whatever may be the price for the crops.

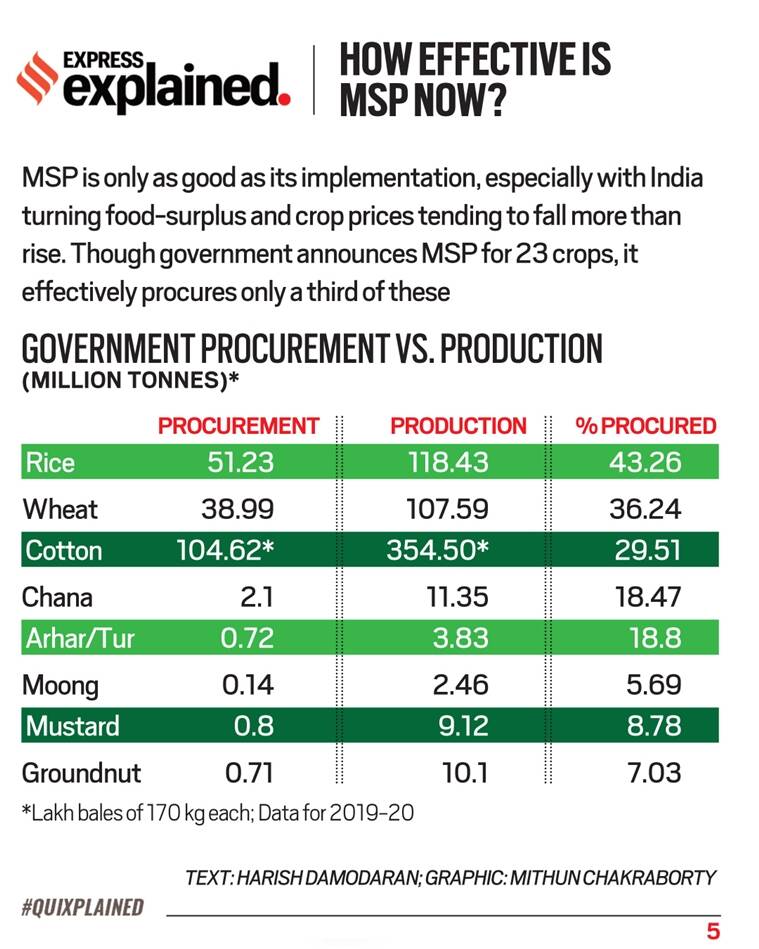

- Commission for Agricultural Costs & Prices (CACP) in the Ministry of Agriculture recommends MSPs for 23 crops. These include 14 grown during the kharif/post-monsoon season (see table) and six in rabi/winter (wheat, barley, chana, masur, mustard and safflower), apart from sugarcane, jute and copra

- CACP consider various factors while recommending the MSP for a commodity like cost of cultivation, supply and demand situation for the commodity; market price trends (domestic and global) and parity vis-à-vis other crops etc.

- MSP seeks to:

- Assured Value: To give guaranteed prices and assured market to the farmers and save them from the price fluctuations (National or International).

- Improving Productivity: By encouraging higher investment and adoption of modern technologies in agricultural activities.

- Consumer Interest: To safeguard the interests of consumers by making available supplies at reasonable prices.

Why is there a need for MSP?

- The MSP is a minimum price guarantee that acts as a safety net or insurance for farmers when they sell particular crops.

- The guaranteed price and assured market are expected to encourage higher investment and in adoption of modern technologies in agricultural activities.

- With globalization resulting in freer trade in agricultural commodities, it is very important to protect farmers from the unwarranted fluctuation in prices.

What are the apprehensions of farmers related to New Laws?

- The apprehension is based on The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, 2020. It is felt that the law will be manipulated by vested corporate interests and the farmers will be left to the vagaries of market forces and this will result in the denial of an optimum price for agriculture produce, fruits and vegetables to farmers.

- The primary reason for this distrust is the non-statutory nature of MSP. Although, MSP is an important aspect for boosting farmers’ income, it finds no mention in any law even if it has been around for decades. As a result, it technically means is that the government, though it buys at MSP from farmers, is not obliged by law to do so.

- The legislations are likely to impact influential commission agents in mandis, who do not want their grip over farmers to be weaken.

- The state governments of Punjab and Haryana will be affected most because of loss of mandi tax, a good source of revenue.

- The middle men will not only lose their commission but traditional business.

- It will make APMC (mandis) as irrelevant.

- The farmers may risk of loosing land rights under contract farming.

- Farmers, especially in Punjab and Haryana where MSPs are more prominently employed, are suspicious of what the markets will offer and how the “big companies” will treat them.

What are the issues related to MSP?

- Low accessibility and awareness of the MSP regime: A survey highlighted that, 81% of the cultivators were aware of MSP fixed by the Government for different crops and out of them only 10% knew about MSP before the sowing season.

- Arrears in payments: More than 50% of the farmers receive their payments of MSP after one week.

- Poor marketing arrangements: Almost 67% of the farmers sell their produce at MSP rate through their own arrangement and 21% through brokers.

According to NITI Aayog report on MSP, 21% of the farmers of the sample States expressed their satisfaction about MSP declared by the Government whereas 79% expressed their dissatisfaction due to various reasons. Although, majority of the farmers of the sample States were dissatisfied on MSP rates, still 94% of them desired that the MSP rates should be continued.

Recommendations suggested by NITI Aayog

- Information and Awareness: The awareness among the farmers needs to be increased and the information should be timely disseminated till the lowest level.

- MSP should be announced well in advance of the sowing season so as to enable the farmers to plan their cropping.

- Better marketing facilities: Improved facilities at procurement centres, such as drying yards, weighing bridges, toilets, etc. should be provided to the farmers.

- There should be meaningful consultations with the State Government, both on the methodology of computation of MSP as well as on the implementation mechanism.

- The small and marginal farmers can be provided with some exemption in Fair Average Quality (FAQ) norms to provide them with a source of income.

- The Procurement Centers should be in the village itself to avoid transportation costs.

Way Forward

While market factors must be taken into consideration, any country’s agriculture sector must find an equilibrium of the interest of the producers and consumers, and account for uneven environmental factors across different regions. The apprehensions of the farmers are not unfounded. The onus is on the government to win their confidence. It must unconditionally reach out to the farmers and empathetically listen to them and not precipitate a crisis by high-handedness.

HISTORIC RECESSION

Context:

According to the official data released last Friday, India’s gross domestic product (GDP) contracted by 7.5% during the July, August, and September quarter. This means in Q2 of 2020-21 India produced 7.5% fewer goods and services when compared to what India produced in Q2 of 2019-20.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein

Mains Questions:

- India’s economy needs a robust demand stimulus to avoid a protracted slump. Explain. 15 marks

Dimensions of the Article:

- What is GDP?

- Causes of falling of GDP

- Measures taken by the Government

- Way Forward

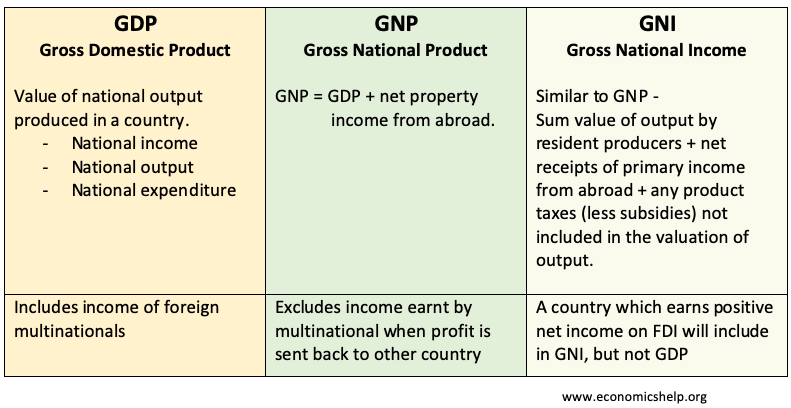

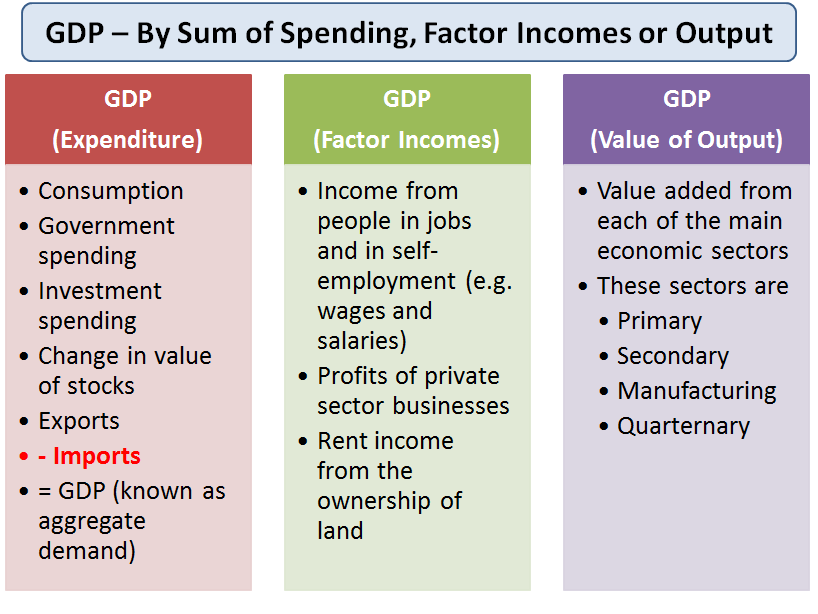

What is GDP?

Gross Domestic Product is the total value of goods and services produced in a country. GDP is measured over specific time frames, such as a quarter or a year.

- GDP as an economic indicator is used worldwide to show the economic health of a country.

- For low-income or middle-income countries, high year-on-year GDP growth is essential to meet the growing needs of the population. Hence, the GDP growth rate of India is an essential indicator of the country’s economic development and progress.

- Besides measuring the health of the economy and helping the government is framing policies, the GDP growth rate numbers are also useful for investors in better decision-making related to investments.

- Different countries have different methods to calculate GDP.

How is the GDP calculated?

The central statistical office, or CSO, is responsible for compiling data for calculating GDP. It aggregates the GDP data by coordinating with several federal and state-run agencies. Once the data collection process is completed, the task of calculating the GDP begins.

Causes of Falling of GDP in recent time

- Lingering weakness in some Non-Bank financial companies (NBFCs): Following ILFS crisis last year, abrupt reduction in NBFC’s credit expansion took place, leading to the associated broad-based tightening of credit conditions.

- Lesser consumption demand: Weak income growth, especially rural, has been affecting private consumption.

- Corporate and Environmental regulatory uncertainty: Private investment has been hindered by the financial sector difficulties (including in the public sector banks (PSBs)) and insufficient business confidence.

- Implementation issues with some structural reforms like goods and services tax (GST).

Measures taken by the Government

To combat slow economic growth and the impact of COVID-19, various measures have been announced by the government to revive the economy:

Monetary Policy Measures

- Repo rate cut: Repo rate has been brought down to 5.4% to spur credit growth.

- Monetary Policy Transmission: Linking floating rate loans extended to both retail consumers as well as MSMEs to external benchmarks to improve monetary policy transmission.

- Higher flow of funds to NBFC sector: RBI relaxed liquidity norms to allow more lending to non-banking finance companies (NBFCs) by banks.

Measures to boost exports

- Scheme for Remission of Duties & Taxes on Export Product to replace Merchandise Exports from India Scheme (MEIS) for all goods exported. It will provide more incentives to the exporters than existing schemes put together.

- Under the expanded Export Credit Insurance Scheme (ECIS), Export Credit Guarantee Corporation will offer higher insurance cover to banks, lending working capital for exports. Govt. will provide ₹1700 cr annually.

- Leverage technology to reduce Turn Around Time (TAT) at airports/ports/customs through process digitization and elimination of offline/manual services.

- Enable handicrafts industry to effectively harness e-commerce for exports through mass enrolment of handicraft artisans and cooperatives directly on e-commerce portals.

Measures to boost manufacturing sector

- Lower Corporate Tax: An amendment in Income Tax Act 1961 to give any domestic company an option to pay income tax at the rate of 22% subject to condition that they will not avail any exemption/incentive.

- Effective corporate tax rate for such companies shall be 25.17% and they will not be required to pay Minimum Alternate Tax (MAT).

- Boost Make in India: A new provision inserted in Income Tax Act’1961 allows any new domestic company, incorporated on or after 1st October 2019 & making fresh investment in manufacturing, an option to pay income-tax at the rate of 15%.

Impact of these measures

- Improve private investment: Tax cuts, by putting more money in the hands of the private sector, can offer people more incentive to produce and contribute to the economy, which, in turn, will create employment.

- Helps to attract investors: A cut in corporate taxation rate will India at parity with East Asian economies and will make India more competitive on the global stage

- Boost consumer demand: With lower tax rates in place, the firms may cut prices in order to attract consumers, which in turn will boost consumer demand

- Increase in fiscal capacity: The reforms have the potential to revive the economy, help boost tax collections and compensate for the loss of revenue.

Way forward

- Financial sector: these reforms are needed in the short term as per IMF, such as:

- Resolution of balance sheet issues including in the commercial banks, the corporate sector, and the NBFCs including housing finance companies.

- More information on smaller NBFCs is needed to better understand the impact of reduced credit on private demand, especially micro, small, and medium-sized enterprises and in rural areas.

- Fiscal policy suggestions:

- In the short term, focus on the composition of expenditures and rationalizing GST.

- Over the medium-term, focus on domestic revenue mobilization like increasing personal income tax collections by ending exemptions, reducing the minimum threshold for taxpayers and by raising contributions by top earners, decreasing expenditures on subsidies, and enhancing fiscal transparency and thus reducing uncertainty.

THE PARIS AGREEMENT IS NO PANACEA

Context:

Today, the Paris Agreement is deemed as the panacea for all environmental ills when the truth is that it is a repudiation of the principles of ‘common but differentiated responsibilities’ and ‘the polluter must pay’.

Relevance:

GS Paper 3: Environmental conservation; Environmental pollution and degradation; Environmental Impact Assessment.

Mains Questions:

- ‘Climate Change’ is a global problem. How India will be affected by climate change? How Himalayan and coastal states of India will be affected by climate change?

- The Paris Agreement is deemed as the panacea for all environmental ills when the truth is that it is a repudiation of the principles of ‘common but differentiated responsibilities’ and ‘the polluter must pay’. Explain. 15 marks

Dimensions of the Article

- What is Climate Change?

- Paris Agreement and Climate Change

- Focus of CoP25 in Madrid

- Way Forward

What is Climate Change?

Climate change refers to significant changes in global temperature, precipitation, wind patterns and other measures of climate that occur over several decades or longer. While “climate change” and “global warming” are often used interchangeably, global warming—the recent rise in the global average temperature near the earth’s surface—is just one aspect of climate change.

Various factors are responsible for it including:

- Natural Factors: such as continental drift, volcanoes, ocean currents, the earth’s tilt, and comets and meteorites. The natural factors affect the climate change in long term and persist for thousand to millions of years.

- Anthropogenic (Human Caused) Factors: includes greenhouse gases, aerosols and pattern of land use changes etc.

According to the IPCC, the extent of climate change effects on individual regions will vary over time and with the ability of different societal and environmental systems to mitigate or adapt to change. It predicts that increases in global mean temperature of less than 1.8 to 5.4 degrees above 1990 levels will produce beneficial impacts in some regions and harmful ones in others. Net annual costs will increase over time as global temperatures increase.

Paris agreement and Climate Change

The Paris Agreement was adopted under United Nations Framework Convention on Climate Change (UNFCCC) in 2015.

- The central aim of the agreement is to strengthen the global response to the threat of climate change by keeping the global temperature rise, in this century, well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius.

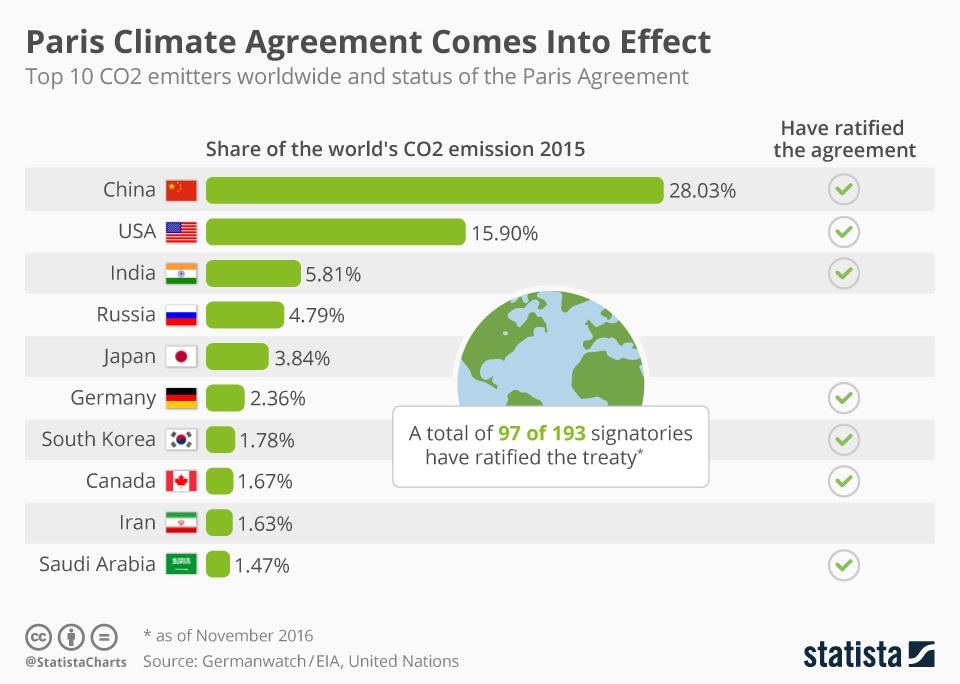

- China who is the largest emitter, has recently stated in UN that its CO2 emissions will peak before 2030 and will achieve carbon neutrality before 2060.

- The US has become the first nation in the world to formally withdraw from the Paris climate agreement. This weakens the global fight against climate change as US is the second largest emitter (~15%)

Focus of CoP25 in Madrid

Leaders dubbed the event as “blue COP”, laying out its intention to focus on oceans. It was conceded that it is no longer a climate crisis but a climate emergency. Delegates committed to limiting the global temperature rise to 1.5˚C, to achieve carbon neutrality by 2050, and to reduce greenhouse gas emissions by 45% of 2010 levels by 2030.

- On Emission Reductions: Rather than strong language setting out a clear timeline for nations to enhance their NDCs in 2020, it merely reiterated the invitation to parties to communicate.

- On Loss and Damage: The final decision that emerged was not as strong as developing nations had pushed for. Some stronger language was lost, such as a specific call for “developed countries” to increase their support.

- On Climate Finance: The Paris Agreement reaffirmed the obligations of developed countries, while for the first time also encouraging voluntary contributions by other Parties.

- Parties agreed that the GCF and GEF as well as the SCCF and the LDCF shall serve the Paris Agreement.

- Developed countries agreed to continue mobilizing $100 billion a year until 2025, and governments agreed to set a new collective mobilization goal beyond 2025, which would represent a progression beyond the existing goal

- On Carbon Market: The conference closed without resolving one of the most significant objectives it set out to achieve – setting rules for carbon markets under Article 6 of the Paris Agreement. The decision was deferred till COP26 next year.

- On Gender Action Plan: Decision was made on a new five-year gender action plan (GAP), intended to “support the implementation of gender-related decisions and mandates in the UNFCCC process”.

Way Forward

The IPCC report acknowledges that “the pathways to avoiding an even hotter world would require a swift and complete transformation not just of the global economy but of society too”. This will only be possible if the world rejects nationalism and parochialism and adopts collaborative responses to the crisis. The Paris Agreement falls short of that imperative.