Content

- Budget Analysis

- Pillars of Budget 2021-22

- State of Economy

- Taxes

- Economy

- Agriculture

- Healthcare

- Social Sector

Context:

- Finance Minister Nirmala Sitharaman made a brave effort to make good use of the lessons learnt from the unprecedented global health crisis and ensuing economic setback to put lives and livelihoods back on track.

Relevance:

- GS Paper 3: Government Budgeting, Indian Economy (issues re: planning, mobilization of resources, growth, development, employment); Inclusive growth and issues therein

Mains Questions:

- Budget puts welcome emphasis on health, infrastructure, privatization. But lack of income support continues. Discuss. 15 Marks

- The Finance Minister has presented a holistic, integrated and interconnected approach to health, livelihood and economic development without losing sight of making India a $5-trillion economy. Critically Discuss. 15 Marks

Pillars of the Budget 2021-22

The Union Budget proposals rest on six pillars viz:

- Health and well-being,

- Physical and financial capital and infrastructure,

- Inclusive development for an aspirational India,

- Reinvigorating human capital,

- Innovation and R&D,

- Minimum government and maximum governance.

STATE OF ECONOMY:

- Expenditure: The government proposes to spend Rs 34,83,236 crore in 2021-22. As per the revised estimates, the government spent Rs 34,50,305 crore in 2020-21, 13% higher than the budget estimate.

- Receipts: The receipts (other than borrowings) are expected to be Rs 19,76,424 crore in 2021-22, which is 23% higher than the revised estimates of 2020-21. In 2020-21, revised estimates for receipts were 29% lower than budget estimates. Given the impact due to COVID-19, it is useful to see the growth from 2019-20, an annual increase of 6%.

- GDP growth: Nominal GDP is expected to grow at of 14.4% (i.e., real growth plus inflation) in 2021-22.

- Deficits: Revenue deficit is targeted at 5.1% of GDP in 2021-22, which is lower than the revised estimate of 7.5% in 2020-21 (3.3% in 2019-20). Fiscal deficit is targeted at 6.8% of GDP in 2021-22, down from the revised estimate of 9.5% in 2020-21 (4.6% in 2019-20). The government aims to steadily reduce fiscal deficit to 4.5% of GDP by 2025-26.

- Ministry allocations: Among the top 13 ministries with the highest allocations, the highest annual increase over 2019-20 is observed in the Ministry of Jal Shakti (64%), followed by the Ministry of Consumer Affairs, Food and Public Distribution (48%) and the Ministry of Communications (31%).

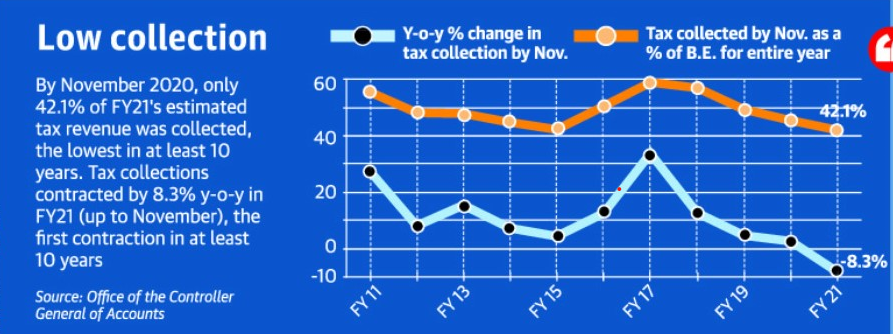

TAXATION SYSTEM:

Tax slabs remain unchanged:

- Without making any changes to the personal income tax slab, the Union Budget 2021-22 has provided relief to senior citizens in the filing of I-T returns; reduced the time limit for I-T proceedings; announced the setting-up of a Dispute Resolution Committee and faceless Income Tax Appellate Tribunal proceedings; provided relaxations for Non-Resident Indians (NRI); offered an increase in the exemption limit from audit; and accounted for relief for dividend income.

- To reduce the compliance burden on senior citizens aged 75 years or above, such taxpayers with only pension and interest income will be exempted from filing an I-T return — the paying bank will deduct the necessary tax on their income.

Easing complexity

- Reducing the complexity that NRIs face, on their return to India, on the issue of accrued incomes in their foreign retirement account. The Budget proposes to notify rules governing it.

- Attract foreign investment into infrastructure; relief for affordable housing and rental housing; tax incentives to the International Financial Services Centre (IFSC); relief to small charitable trusts; and steps for incentivising start-ups in the country.

- Tax Deduction at Source: The Budget has proposed to make dividend payments to REIT (Real Estate Investment Trusts) / InvIT (Infrastructure Investment Trusts) exempt from TDS (tax deducted at source).

- Attracting Foreign Direct Investment: For Foreign Portfolio Investors (FPI), the Budget has proposed the deduction of tax on dividend income at a lower treaty rate. As per the proposal, advanced tax liability on dividend income will arise only after the declaration or payment of dividend.

Affordable housing

- Housing for all: The FM has proposed to extend the eligibility period for claim of additional deduction for interest of ₹1.5 lakh on loan taken for the purchase of an affordable house to March 31, 2022.

- For increasing the supply of affordable houses, she also announced the extension of an eligibility period for claiming a tax holiday for affordable housing projects by one more year to March 31, 2022.

- To promote supply of affordable rental housing for the migrant workers, the FM announced a new tax exemption for notified affordable rental housing projects.

- Dispute Resolution Committee: Anyone with a taxable income up to ₹50 lakh and disputed income up to ₹10 lakh shall be eligible to approach the committee, which will be faceless to ensure efficiency, transparency and accountability.

Zero Coupon bond

- A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. The Budget has proposed to make notified infrastructure debt funds eligible to raise funds by issuing tax-efficient zero coupon bonds.

- To promote the IFSC in GIFT City (Gujarat International Finance Tec-City), the Budget has proposed more tax incentives, which include

- a tax holiday for capital gains from the incomes of aircraft leasing companies;

- tax exemption for aircraft lease rentals paid to foreign lessors;

- tax incentives for relocating foreign funds in the IFSC;

- allow tax exemption for the investment divisions of foreign banks located in IFSC.

States’ share in the divisible pool of taxes:

- The government has accepted the Fifteenth Finance Commission’s recommendation to maintain the States’ share in the divisible pool of taxes to 41% for the five-year period starting 2021-22, and given an ‘in-principle’ nod to the panel’s suggestion to set up a separate non-lapsable fund for defense and internal security modernization.

- The Fourteenth Finance Commission had raised States’ share to 42% of divisible revenues, but the Fifteenth Finance panel had reduced the share to 41% in its interim report for 2020-21, citing the conversion of Jammu, Kashmir and Ladakh into Union Territories.

- An additional borrowing ceiling of 0.5% of GSDP will also be provided based on meeting specified reforms in the power sector.

- Reducing Fiscal Deficit: States are expected to reach a fiscal deficit of 3% of GSDP by 2023-24, and maintain that level till 2025-26, as per the Commission’s report. The Centre has accepted ‘in-principle’ this quantum of net borrowing ceilings for the States, as per the action taken report.

- South vs North: The Commission has sought to assuage the fears of southern States about losing some share in tax transfers due to the reliance on the 2011 Census data instead of the 1971 census, which could penalise States that did better on managing demographics. It has done so by giving a 12.5% weightage for demographic performance in its tax-transfer calculations.

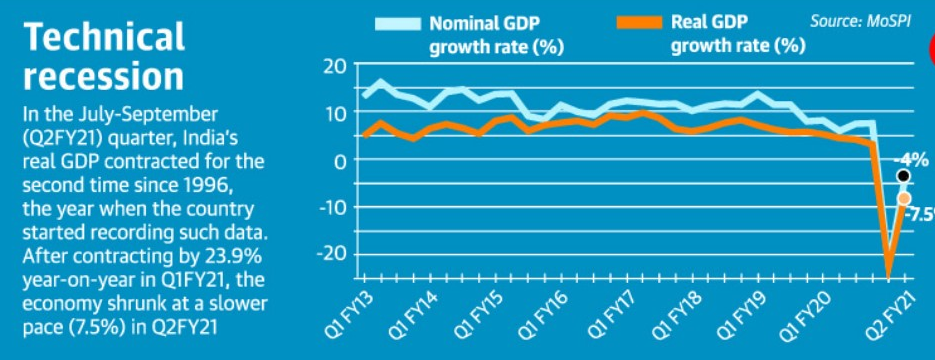

ECONOMY

Consumers will not be burdened by farm cess:

- A cess is a form of tax levied by the government on tax with specific purposes till the time the government gets enough money for that purpose.

- Improving Agriculture Investment: Agriculture Infrastructure and Development Cess (AIDC) on select items such as petrol, diesel, apples and alcohol. However, this will not lead to an additional burden on the consumers.

- Reducing Custom Duty: Basic Customs Duty rates have been reduced on most items where AIDC is being imposed, so as to not put a burden on the end consumer. This would ensure enhanced remuneration for the farmers.

- Imbalance Fiscal Federalism: The Customs Duty was shared with the States, while the cess would go entirely to the Centre. It would have an impact on sharing of resources between the Centre and the States, and more clarity would emerge once the fine print of the Budget documents was fully understood.

- Revival of the Infrastructure: The government will spend big on infrastructure, which spans roads, bridges, ports, power generation, and so on and, to also attend to the needs of the health sector.

- Ujjwal DISCOM Assurance Yojana: this scheme for the revival of the debt-laden discoms. Under the scheme, discoms were envisaged to turn around financially within three years from signing agreements.

Auto sector welcomes vehicle scrappage policy:

- The policy would help in encouraging fuel-efficient, environment-friendly vehicles, thereby reducing vehicular pollution and the oil import bill.

- Vehicles would undergo fitness tests after 20 years in automated fitness centres in the case of personal vehicles (PV), and after 15 years in the case of commercial vehicles (CV).

Government to privatise seven major ports:

- Seven major ports, worth ₹2,000 crore, will see their operations privatised in the year 2021-2022.

- Boosting Investment in ports: a subsidy scheme of ₹1,624 crore for a period of five years for Indian shipping companies to encourage more merchant ships with Indian flags. “This initiative will enable greater training and employment opportunities for Indian seafarers.

Govt. hopes to cut fiscal deficit to 4.5% by FY26:

- Fiscal Deficit is the difference between the total income of the government (total taxes and non-debt capital receipts) and its total expenditure.

- Finance Minister has pegged the fiscal deficit for 2021-22 at 6.8% of the GDP and aims to bring it back below the 4.5% mark by 2025-26.

- The original fiscal deficit target for 2020-21 was 3.5%. However, in reality, the deficit has shot up to a high of 9.5% of the GDP due to the impact of the COVID-19 pandemic — low revenue flows due to the lockdown and negative economic growth clubbed with high government spending to provide relief to vulnerable sections of society, as well as a stimulus package to revive demand.

- The government also took the opportunity to bring the food subsidy bill back on the budget books, which includes a one-time payment of more than ₹2 lakh crore to the Food Corporation of India (FCI) to deal with its accumulated loan from the National Small Savings Fund.

- The Centre proposes to make amendments to the Fiscal Responsibility and Budget Management (FRBM) Act, 2003, to reflect these changes to the fiscal consolidation road map. The Finance Ministry added that the Centre hopes to return to the path of fiscal consolidation by higher tax buoyancy through improved compliance on the one hand, and increased monetization of its assets, including public sector enterprises and land, on the other. She also proposed to augment the Contingency Fund of India from ₹500 crore to ₹30,000 crore.

- Market Borrowings: This year’s fiscal deficit has been funded through government borrowings, multilateral borrowings, small saving funds and short-term borrowings.

Jump in allocation for MSME sector:

- Increasing Allocations: The Union Budget has doubled the allocation to micro, small and medium enterprises (MSMEs) to ₹15,700 crore for the next financial year from ₹7,572 crore in 2020-2021.

- The Emergency Credit Line Guarantee Scheme: The Centre had announced the scheme to revive MSMEs when the lockdown restrictions were relaxed and several MSMEs benefited from it, say industry sources.

- According to the Federation of Indian Micro and Small & Medium Enterprises, a reduction in customs duties on steel and ferrous and non-ferrous scrap will help bring down the raw material prices.

- The Coimbatore District Small Industries Association said the plan to strengthen the NCLT framework, implement e-courts system and introduce alternate methods of debt resolution and special framework for MSMEs were significant.

LAC stand-off factored in for defence outlay:

- Military Modernization: Against the backdrop of the stand-off with China and an impetus for military modernisation, the allocation for capital expenditure in the defence budget saw an increase of ₹21,326 crore, or 18.75%, from the Budget estimates of 2020-21.

- Emergency Procurements: Budget data also show that the armed forces got an additional allocation of ₹20,776 crore under capital expenditure in 2020-21 for emergency procurements in the face of massive mobilisation along the Line of Actual Control (LAC).

- Defense Pensions: The defence pensions saw a significant dip from ₹1.34 lakh crore in the Budget estimate of 2020-21 to ₹1.25 lakh crore in the revised estimate and further to ₹1.15 lakh crore allocated for 2021-22. From 2020-21 to 2021-22, this represents a decrease of ₹17,775 crore or about 13.4%.

- 15th Finance Commission Report: The 15th Finance Commission observed it its report that the expenditure on defence services as a proportion of GDP declined from 2% in 2011-12 to 1.5% in 2018-19 and to 1.4% in 2020-21.

- Modernisation Fund for Defence and Internal Security (MFDIS): The 15th Finance Commission has recommended the constitution of a dedicated non-lapsable Modernisation Fund for Defence and Internal Security (MFDIS) to bridge the gap between projected budgetary requirements and the allocation for defence and internal security.

- The Commission said the fund will have four specific sources of incremental funding, which include transfers from the Consolidated Fund of India, disinvestment proceeds of defence public sector undertakings (DPSUs), proceeds from the monetisation of surplus defence land, including realisation of arrears of payment for defence land used by the State governments and for public projects and cost recovered from encroached land and proceeds of receipts from defence land.

- The proceeds will be utilised for capital investment for modernisation of the defence services, capital investment for the Central Armed Police Forces (CAPF) and modernisation of State police forces as projected by the Home Ministry and a small component as welfare fund for soldiers and paramilitary personnel.

- The Defence Ministry would have exclusive rights over the use of the amounts deposited in the fund from the specified sources of revenue. The Home Ministry will only be permitted to use what is earmarked for it from the source of revenue.

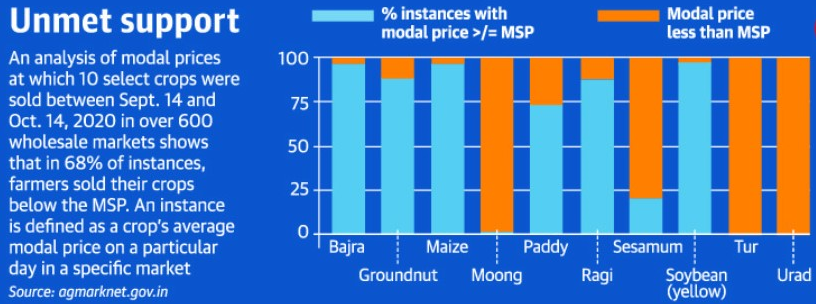

AGRICULTURE

Budget sends mixed signals on farm sector:

- Budget Allocation: On the one hand, the budget allocation for the Department of Agriculture, Cooperation and Farmers Welfare was slashed 8.5% in 2021-22. The flagship PM-KISAN scheme, meant to provide income support to farmers, saw a 13% drop in its budget, which is ₹10,000 crore lower than last year’s initial allocation.

- PM AASHA and the Price Support Scheme have seen budget cuts of 20-25%.

- PM KISAN, which gives each landowning farm family ₹6,000 of annual income support, has reduced its budget to match last year’s revised estimates which reached 9 crore households, rather than trying to reach out to its original target of 14.5 crore households.

- Agriculture Infrastructure Fund: Finance Minister Nirmala Sitharaman’s speech emphasised the government’s track record in paying minimum support prices (MSP) to farmers and the decision to allow State-run Agricultural Produce Marketing Committees (APMCs) to access the ₹1 lakh crore Agriculture Infrastructure Fund (AIF).

- The AIF was created last year, as part of a COVID-19 stimulus package to develop cold chain storage and other post-harvest management infrastructure.

- Agriculture Cess: An Agriculture Infrastructure Development Cess to be levied on petrol, diesel, gold and other imports, to improve facilities for production, conservation and processing of farm produce and thus “ensure enhanced remuneration for our farmers.

5 fishing harbours to be modernised:

- Fishing Harbours: Five major fishing harbours will see substantial investments for modernisation and development, according to Finance Minister.

- Promote seaweed cultivation: Seaweed farming is an emerging sector with potential to transform the lives of coastal communities. It will provide large scale employment and additional incomes. To promote seaweed cultivation, the finance minister propose a Multipurpose Seaweed Park to be established in Tamil Nadu.

Budget proposes 10% customs duty on import of cotton:

- Finance Minister announced in the Union Budget a levy of 10% customs duty on cotton and an increase in the customs duty on raw silk and silk yarn from 10% to 15% to benefit farmers.

- In a move to rationalize duties on raw material inputs for man-made textiles, the Budget proposed to bring nylon chain on a par with polyester and other man-made fibres by reducing the basic customs duty on caprolactam, nylon chips, nylon fibre and yarn to 5%.

- The Production Linked Incentive Scheme, Mega Investment Textile Parks would be set up with plug and play facilities. As many as seven parks would be established over three years.

- These would enable the industry to become globally competitive. Union Textiles Minister Smriti Irani tweeted that the textile park scheme would be a game changer for the Indian textile industry.

- The scheme would create a level-playing field for domestic manufacturers in the international market.

Food subsidy budget set at almost ₹2.43 lakh crore

- Food Subsidy: The food subsidy bill spiked sharply this year, from ₹1.15 lakh crore in the 2020-21 budget estimates to ₹4.22 lakh crore in the revised estimates, reflecting the additional cost of free foodgrain distribution in the wake of the COVID-19 pandemic, as well as the government’s decision to pay the Food Corporation of India’s burgeoning loans and return to budgetary transfers to fund the food subsidy bill.

- In 2021-22, the food subsidy budget has been set at almost ₹2.43 lakh crore. Economists welcomed the Centre’s move, saying it would help clean up the government’s accounts and improve the financial health of the FCI.

- National Small Savings Fund loan to FCI for food subsidy and accordingly Budget provisions have been made in RE 2020-21 and BE 2021-22.

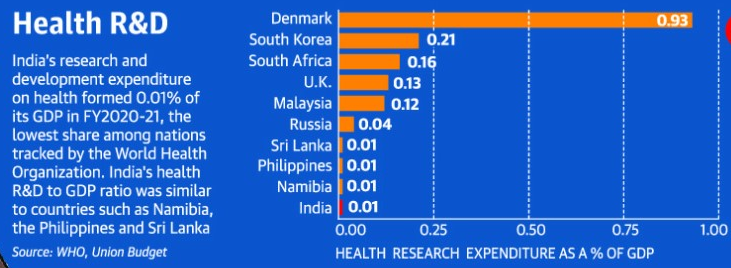

HEALTHCARE:

137% increase in health and well-being spend:

- Budgetary Allocation: Finance Minister said in her Budget speech that the government expected to spend ₹2,23,846 crore in the coming year on “health and wellbeing a 137% increase (from last year).

- Investment on health infrastructure in Budget 2021 has increased… the focus on strengthening three areas — preventive health, curative health and well-being… will be of immense help to the country at this critical juncture.

- PM Atmanirbhar Swasth Bharat Yojana, that would be launched on an outlay of about ₹64,180 crore over 6 years to improve primary, secondary, and tertiary care health systems, strengthen national institutions, create new institutions to cater to detection and cure of new and emerging diseases.

₹50,000 cr. for National Research Foundation:

- National Research Foundation: Finance Minister earmarked ₹50,000 crore over five years for the creation of a National Research Foundation (NRF) — an umbrella body that is expected to fund research across a range of disciplines, from science and technology to humanities.

- The NRF will also seed and build research capacity at universities and colleges through a formal mechanism of mentoring.

- It will also catalyse research at universities and colleges that have until now not been big players in research.

- The NRF will also help build the capacity to do research through an institutionalised mentoring mechanism, involving expert researchers from premier institutions of the country, the NEP document notes.

- This would be cross-disciplinary and also ensure that research — already being funded by Science Ministries, for instance — wouldn’t be duplicated.

Budget for Women and Child Development shrinks:

- Several schemes under the Ministry have been re-grouped and renamed, such as Saksham Anganwadi and POSHAN 2.0 for nutrition programmes, Mission SHAKTI for schemes on women empowerment and Mission Vatsalya for schemes on protection of children.

- Women’s safety and prevention of violence has not seen any major announcements though the pandemic resulted in a surge in cases of violence against women.

Water supply, Swachh Bharat 2.0 missions for urban areas:

- Water Supply: The government would launch a mission to provide universal water supply to areas under all the 4,378 urban local bodies and the next phase of the Swachh Bharat Mission focusing on management of sludge, waste water and construction and demolition waste in cities.

- The World Health Organization has repeatedly stressed the importance of clean water, sanitation, and clean environment as a prerequisite to achieving universal health.

- The Jal Jeevan Mission (Urban) will be launched. It aims at universal water supply in all 4,378 Urban Local Bodies with 2.86 crore household tap connections, as well as liquid waste management in 500 AMRUT cities.

- Second round, The Swachh Bharat Mission (Urban), which is being implemented by the Housing and Urban Affairs Ministry, would get a second round.

- For further swachhta [cleanliness] of urban India, we intend to focus on complete faecal sludge management and waste water treatment, source segregation of garbage, reduction in single-use plastic, reduction in air pollution by effectively managing waste from construction and demolition activities and bioremediation of all legacy dump sites,

SOCIAL SECTOR:

Rural India’s lifeline missing in Budget speech:

- The MGNERGA scheme that has been described as the lifeline of rural India during the COVID-19 pandemic and lockdown was completely missing from the Finance Minister’s Budget speech.

- The importance of MGNREGA this year can be seen from the fact that the revised expenditure estimates for the demand-driven scheme stand at ₹1.11 lakh crore in 2020-21, sharply higher than the budget estimates of just ₹61,500 crore.

- This undermines MGNREGA and shows utter disdain for one of the most important programmes that provided a modicum of protection to the rural poor.

Portal to collect data on gig workers: govt:

- Finance Minister announced the launch of a portal to collect information on gig, building and construction workers to formulate welfare schemes for migrant workers.

- One Nation One Ration Card scheme, through which beneficiaries can claim their rations anywhere in the country. Migrant workers, in particular, benefit from this scheme — those staying away from their families can partially claim their rations where they are stationed, while their families in their native places can claim the rest.

Conclusion:

Finance Minister Nirmala Sitharaman made a brave effort to make good use of the lessons learnt from the unprecedented global health crisis and ensuing economic setback to put lives and livelihoods back on track. There is greater spending on health care and some fiscal push to undergird the struggling demand in the pandemic-hit economy.