Contents

- Maintaining 4% inflation is appropriate: RBI paper

- China defends progress of CPEC amid debt concerns

- WB govt calls for EoI to set up Deep Sea Port in Tajpur

- ‘Main Bhi Digital’ drive for Street Vendors

- Ice calving and Iceberg A68a

MAINTAINING 4% INFLATION IS APPROPRIATE: RBI PAPER

Context:

A Reserve Bank of India paper said that maintaining a 4 per cent inflation is appropriate for India.

Relevance:

GS-III: Indian Economy (Macroeconomics – Inflation, Monetary Policy)

Dimensions of the Article:

- Highlights of the RBI paper on maintaining Inflation at 4%

- What is inflation?

- When is High Inflation a Problem for the Economy?

- When is Inflation Good for the Economy?

- What is Inflation targeting?

- How is Inflation Targeting done?

Highlights of the RBI paper on maintaining Inflation at 4%

- The RBI paper has found a steady decline in trend inflation to 4.1-4.3 per cent since 2014.

- Under the current dispensation, the RBI has been mandated by the government to maintain retail inflation at 4 per cent with a margin of 2 per cent on either side.

- The RBI paper said that this 4 percent target is optimal, as targeting a lower rate could impart deflationary bias to the monetary policy.

- Reason for a lower inflation target imparting a “Deflationary Bias” is: A target set below the trend – will go into overkill relative to what the economy can intrinsically bear in order to achieve the target.

- A target that is fixed above-trend renders monetary policy too expansionary and prone to inflationary shocks and unanchored expectations.

- The paper notes that estimating trend inflation with regular updates is important for the formulation of monetary policy, irrespective of the country setting.

- In India, this exercise acquires priority in the context of the flexible inflation targeting formally instituted in June 2016, which commits the central bank – the RBI – to a consumer price inflation target of 4 per cent with a symmetrical tolerance band of +/- 2 per cent around it.

What is inflation?

- Inflation is defined as an increase in general level of prices which is sustained over a period of time.

- It is inflation only if prices of most goods have gone up.

- Consequently, the purchasing power of the currency falls.

When is High Inflation a Problem for the Economy?

Income redistribution

- One risk of higher inflation is that it has a regressive effect on lower-income families and older vulnerable citizens who might be living on a fixed income.

- If prices are rising faster than wages, then there will be a steep decline in real incomes.

- Inflation tends to redistribute income and wealth towards groups who are better able to hedge against inflation by sheltering their assets in ways that earn a decent return.

Functions of money

- Hyperinflation destroys the internal purchasing power of money and undermines its value as a medium of exchange and as a unit of account.

- Alternative currencies that at least hold some of their value may take the place of the domestic unit of exchange and shadow markets with products traded at unofficial prices often become the norm.

Increased cost of borrowing

- High inflation may also lead to higher borrowing costs for businesses and people needing loans and mortgages as financial markets seek to protect themselves against rising prices and increase the cost of borrowing on short and longer-term debt.

Government spending

- High inflation puts pressure on a government to increase the value of the state pension and unemployment benefits and other welfare payments as the cost of living climbs higher.

Inflation expectations and wage demands

- High inflation can lead to an increase in pay claims as people look to protect their real incomes.

- This can lead to a rise in unit labour costs and lower profits for businesses. However, not all workers belong to strong trade unions who can use collective bargaining power to bid for higher pay.

- A rise in actual inflation can lead to an upward shift in inflation expectations (which can be modelled using Phillips Curve analysis) and once inflation is embedded into an economy, it can be difficult to eliminate.

Negative real interest rates

- If interest rates on savings accounts in banks are lower than the rate of inflation, then people who rely on interest from their savings will be poorer.

- Hyperinflation destroys the value of savings and means that many families are exposed to high interest-rate debt.

Business competitiveness in domestic and international markets

- If one country has a much higher rate of inflation than others for a considerable period of time, this will make exports of goods and services less price competitive in global markets.

- Eventually this may show through in reduced export orders, lower operating profits and fewer jobs, and also in a worsening of a country’s trade balance.

- A fall in exports can trigger negative multiplier and accelerator effects on real national income and employment.

When is Inflation Good for the Economy?

Boosting Consumer demand and Economic Growth

- Inflation is viewed in a positive manner when it helps boost consumer demand and consumption, driving economic growth.

- Example for inflation boosting demand and consumption: If the price of cars were to be dropping consistently (deflation) then instead of buying a new car in the present year, the consumers will prefer to buy it in the coming years when the car is cheaper. A little inflation would act as an encouragement to buy it in the present itself rather than wait and buy it at a higher price.

- This increased demand boosts economic growth.

Effect on wages

- Steadily Rising prices make it easier for companies to put up wages.

- They also give employers the flexibility not to increase wages by as much as inflation, but still offer their staff some sort of rise.

- In a world of zero inflation some companies might be forced to cut wages, and this would not be good for morale, recruitment or productivity.

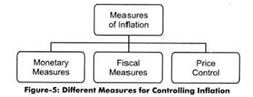

How is Inflation Controlled?

There are broadly two ways of controlling inflation in an economy:

- Monetary measures and

- Fiscal measures

Monetary Measures

- The most important and commonly used method to control inflation is monetary policy of the Central Bank (RBI in India).

- Most central banks use high interest rates as the traditional way to fight or prevent inflation.

Monetary measures used to control inflation include:

- Bank Rate Policy

- Cash Reserve Ratio and

- Open Market Operations.

Fiscal Measures

- Fiscal measures to control inflation include taxation, government expenditure and public borrowings.

- The government can also take some protectionist measures (such as banning the export of essential items such as pulses, cereals and oils to support the domestic consumption, encourage imports by lowering duties on import items etc.).

What is Inflation targeting?

Inflation targeting is basically a monetary policy system wherein the central bank of a country (RBI in India) has a specific target inflation rate for the medium-term and publicizes this rate.

How is Inflation Targeting done?

- Inflation targeting is done by raising or lowering interest rates based on above-target or below-target inflation, respectively.

- The conventional wisdom is that raising interest rates usually cools the economy to rein in inflation; lowering interest rates usually accelerates the economy, thereby boosting inflation.

Advantages of Inflation Targeting

- Inflation targeting allows monetary policy to “focus on domestic considerations and to respond to shocks to the domestic economy”, which is not possible under a fixed-exchange-rate system.

- Transparency is another key benefit of inflation targeting. Central banks in developed countries that have successfully implemented inflation targeting tend to “maintain regular channels of communication with the public”.

- An explicit numerical inflation target increases a central bank’s accountability, and thus it is less likely that the central bank falls prey to the time-inconsistency trap. This accountability is especially significant because even countries with weak institutions can build public support for an independent central bank.

Disadvantages of Inflation Targeting

- There is a propensity of inflation targeting to neglect output shocks by focusing solely on the price level.

- Leading economists argue that inflation targeting would maintain or enhance the transparency associated with a system based on stated targets, while restoring the balance missing from a monetary policy based solely on the goal of price stability, thus neglecting other factors of an economy as well.

-Source: Live Mint

CHINA DEFENDS PROGRESS OF CPEC AMID DEBT CONCERNS

Context:

China denied allegations that it was seeking additional guarantees from Pakistan before sanctioning a loan for a key project under the China Pakistan Economic Corridor (CPEC) – a flagship plan under President Xi Jinping’s Belt and Road Initiative (BRI).

Relevance:

GS-II: International Relations (India and neighborhood-relations, agreements involving India and/or affecting India’s interests)

Dimensions of the Article:

- What is the China–Pakistan Economic Corridor (CPEC)?

- What is Belt and Road Initiative (BRI) One Belt One Road (OBOR)?

- India’s perspective of the CPEC

- India’s Perspective of the BRI/OBOR

- Steps taken by India to Counter the BRI/OBOR

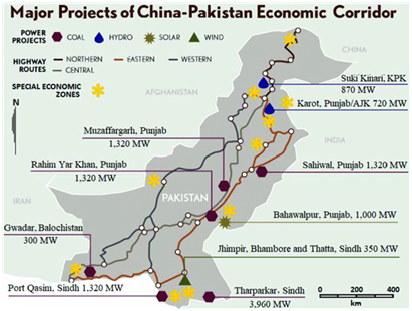

What is the China–Pakistan Economic Corridor (CPEC)?

- China–Pakistan Economic Corridor (CPEC) is a collection of infrastructure projects that are under construction throughout Pakistan since 2013.

- CPEC is intended to rapidly upgrade Pakistan’s required infrastructure and strengthen its economy by the construction of modern transportation networks, numerous energy projects, and special economic zones.

- On 13 November 2016, CPEC became partly operational when Chinese cargo was transported overland to Gwadar Port for onward maritime shipment to Africa and West Asia.

- A vast network of highways and railways are to be built under the aegis of CPEC that will span the length and breadth of Pakistan.

- CPEC passes through the disputed region of Kashmir where Indian and Pakistani border guards have occasionally exchanged fire across the Line of Control. The Government of India, which shares tense relations with Pakistan, objects to the CPEC project as upgrade works to the Karakoram Highway are taking place in Gilgit Baltistan; territory that India claims as its own.

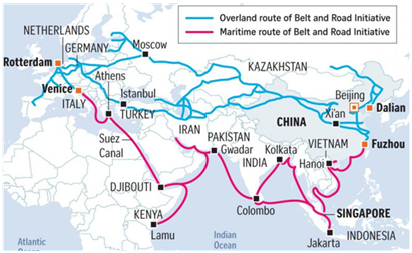

What is Belt and Road Initiative (BRI) One Belt One Road (OBOR)?

- One Belt One Road (OBOR), also called the Belt and Road Initiative (BRI), the brainchild of Chinese President Xi Jinping, is an ambitious economic development and commercial project that focuses on improving connectivity and cooperation among multiple countries spread across the continents of Asia, Africa, and Europe spanning about 78 countries.

- Initially announced in the year 2013 with the purpose of restoring the ancient Silk Route that connected Asia and Europe.

- The project involves building a big network of roadways, railways, maritime ports, power grids, oil and gas pipelines, and associated infrastructure projects.

- The project covers two parts. The first is called the “Silk Road Economic Belt,” which is primarily land-based and is expected to connect China with Central Asia, Eastern Europe, and Western Europe.

- The second is called the “21st Century Maritime Silk Road,” which is sea-based and is expected to will China’s southern coast to the Mediterranean, Africa, South-East Asia, and Central Asia.

- Landlocked Nepal has recently joined OBOR by signing a deal that will help it improve cross-border connectivity with China, and Pakistan is set to benefit from the $46 billion China Pakistan Economic Corridor (CPEC) that will connect southwestern China to and through Pakistan, allowing access to Arabian Sea routes.

India’s perspective of the CPEC

- India has opposed CPEC since inception in view of its opaque nature and uneven balance towards Beijing.

- As the corridor passes through Pakistan occupied Kashmir (PoK), India has flagged its objection about Chinese project “that ignores its core concerns on sovereignty and territorial integrity”. The strategic location of port of Gwadar could be used against Indian SLOCs, threatening hydrocarbon supply through the Strait of Homruz.

- With Chinese control over transport routes in Pakistan and growing Chinese relations with Iran, India’s access to Afghanistan and Central Asia may be restricted.

- As Chinese economic influence increases in South Asian countries, the balance may tilt towards Beijing, with even a futuristic containment policy towards India.

- Further as CPEC integrates Pakistan and China economically, politically and militarily, any future conflict for India could be on two fronts.

India’s Perspective of the BRI/OBOR

- As China launched its OBOR in 2013, India displayed a lukewarm response to the proposal in view of its opacity and one-sided control with Beijing.

- However, Chinese empirical planning has ensured project inroads into the entire IPR with economic and strategic challenges to India in its immediate neighborhood in South Asia.

- India has been among the very few countries which didn’t attend Belt and Road Forum (BRF) in May 2017, attended by heads of 29 states and representatives from 100 countries, including the US and Japan.

- The principle opposition of India to CPEC is about the ‘core concerns on sovereignty and territorial integrity’.

Bangladesh

- Even though the present ruling party has ensured strong relations with New Delhi, Chinese economic influence is evident.

- With Bangladesh formally joining OBOR initiative in 2016, New Delhi is making concerted efforts to maintain its balance.

Nepal

- The political turmoil in Nepal in recent past has occasionally disturbed the strong relations with New Delhi.

- While recent cancellation of a few projects displays Nepal’s sensitivity towards ‘debt–trap’, it’s response to New Delhi led BIMSTEC (Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation) exercise recently gave opposing signals.

- As China offers its ports for trade with land-locked Nepal, New Delhi is required to put up lot of economic and diplomatic efforts to ensure long term bonding with Nepal is closely maintained.

Myanmar

- While BRI has manifested itself as CPEC on India’s western front, the eastern side would be covered by CMEC (China Myanmar Economic Corridor).

- With MoU already signed, it intends to connect Yunnan province in China to Kyaukpyu port in Burma.

- The project would provide China an alternate route from Strait of Malacca for hydrocarbon supply, along with increased Chinese strategic presence in Bay of Bengal.

Sri Lanka

- With the change in government, the ‘debt trap’ has most glaringly been exposed with Hambantota port project in southern Sri Lanka.

- As present government realized its inability to pay off the huge debts and unviability of the project, the port was leased to Chinese for 99 years, a stark similarity to history of Hong Kong leasing to British Imperial powers.

- While Colombo has presently warded off possibilities of PLAN usage of these assets; future is uncertain considering the continuation of Chinese ‘cheque book diplomacy’.

Maldives

- Maldives is the most glaring example of strategic value of BRI for Beijing.

- A small archipelago in Indian Ocean, its strategic location at the prime SLOC makes it a key asset.

- The years of Indian diplomatic, economic, and even military support has been dwarfed by the huge Chinese investment in a short time period.

Steps taken by India to Counter the BRI/OBOR

- India has taken its own steps to provide practical alternatives to BRI which are economically viable and strategically balance Chinese spreading sphere of influence.

- India has rightly transformed its ‘Look East’ policy to ‘Act East’ policy. Strong relations with Vietnam, pursuance of Trilateral Highway project, proposed Mekong-Ganga Economic Corridor, strengthening BIMSTEC and developing maritime relations with Indonesia and Singapore are steps in this ambit.

- Further with ‘Go West’ strategy, India is pursuing to be a partner in International North South Transport Corridor, ensuring access to Central Asia.

- India’s interest in development of strategic Chabahar port in Iran is viewed as a counter to Gwadar. Additionally, India and Japan are also collectively working on ‘Asia Africa Growth Corridor’ (AAGC).

- On the strategic front, India has donned the role of a ‘Net Security Provider’ in the Indian Ocean Region (IOR).

- The Indian Navy, transforming its operational philosophy to ‘mission-based deployment’ is playing a key role in ‘securing the seas’.

- Through the conduct of joint naval exercises such as Malabar, Varuna, MILAN, coordinated patrol with neighbouring regional navies; participation in RIMPAC (Rim of Pacific Exercise), KOMODO multinational exercises; goodwill visits to foreign ports and HADR (Humanitarian Assistance and Disaster Relief) – the Indian Navy has built strong partnerships with strategic partners.

- Further, through strong security relations with the IOR countries such as Seychelles, Mauritius and Oman and leading role in promoting collective security forums like Indian Ocean Naval Symposium (IONS), India has gained a leading and respectful position in the IOR.

-Source: The Hindu

WB GOVT CALLS FOR EOI TO SET UP DEEP SEA PORT IN TAJPUR

Context:

The West Bengal government has called for expressions of interest (EoI) from global agencies to set up a deep-sea port in Public-Private Partnership in East Midnapore at Tajpur.

Relevance:

GS-III: Industry and Infrastructure (Ports)

Dimensions of the Article:

- What is the Tajput deep-water port and why is it needed?

- Significance and Benefits of Tajpur Port

- What are Deep Water Ports?

What is the Tajput deep-water port and why is it needed?

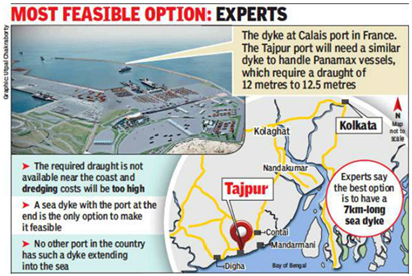

- The Tajpur Port is a proposed seaport in Tajpur, East Midnapore district of West Bengal.

- The government has proposed to build the port on the coast of the Bay of Bengal near Tajpur.

- West Bengal’s main port is Kolkata Port (including Haldia Port), but because of the shallow depth of the Hooghly river, it is impossible to anchor ocean-going vessels there.

- As a result, shipping growth is declining. Commodities in Kolkata and Asansol-Durgapur industrial region are instead taken to Paradip port.

- The future of the state’s port industry and the Haldia industrial region is uncertain and, for this reason, the state government decided to act.

Significance and Benefits of Tajpur Port

- Located, nearly 200 kms from Kolkata, the Tajpur port is expected to boost the economy of the region and generate about 25,000 jobs.

- When built, it would be the only one in the country to connect to the mainland via a dyke. It would also be one of the longest sea dykes in the world.

- The project is expected to draw investments to the tune of ₹15,000 crore.

- There will not be any land acquisition involved as there is adequate land available for the project.

What are Deep Water Ports?

- A deep-water port, from its nomenclature can be suggested that is different from regular ports in respect of the depth of water.

- A port is usually an area or platform entered into from the sea, by vessels, boats, ships, which also allows for protected staging and anchoring or docking for these ships to load and unload consignments and continue up towards its destination.

- However, a deep-water port is usually made up for the usage of very large and heavily loaded ships.

- The depth of water helps get them access to the deep-water ports.

- Deep water ports are also defined to be any port which has the capability to accommodate a fully laden Panamax ship, which is determined principally by the dimensions of the Panama Canal’s lock chambers.

-Source: The Hindu – Business Line

‘MAIN BHI DIGITAL’ DRIVE FOR STREET VENDORS

Context:

The ‘Main Bhi Digital (me too digital)’ drive designed by the Centre targets to make over a million street vendors across India to accept and make payments digitally.

Relevance:

GS-II: Social Justice (Welfare schemes for development)

Dimensions of the Article:

- About the ‘Main Bhi Digital (me too digital)’ Drive

- PM SVANidhi

About the ‘Main Bhi Digital (me too digital)’ Drive

- The ‘Main Bhi Digital (me too digital)’ drive has been prompted by the success of the Prime Minister Street Vendor’s AtmaNirbhar Nidhi (PMSVANidhi) scheme, launched in the wake of the Covid-19 lockdown, to provide vendors microcredit.

- Under the ‘Main Bhi Digital (me too digital)’ drive over 10 lakh street vendors across the country who have availed of the Rs 10,000 loan under PM will be trained in using digital payments.

- The vendors would be able to not just receive payments digitally but also pay for material they procure from sellers using unique QR codes.

- The mobile phones of the vendors will be equipped with the software needed for the transactions, and training provided to them on safe and secure payments.

PM SVANidhi

- PM SVANidhi, short for Pradhan Mantri Street Vendor’s AtmaNirbhar Nidhi, will help street vendors resume their businesses, impacted due to the nationwide lockdown.

- Vendors can avail of a working capital loan of up to ₹10,000, which is repayable in monthly instalments over one year.

- On timely, or early repayment, an interest subsidy of 7% per annum will be credited to the bank accounts of beneficiaries through Direct Benefit Transfer every six months.

- There will be no penalty for early repayment of loans.

Who will be Benefitted by this scheme?

- Five million street vendors who were operating on or before 24 March are expected to benefit from the scheme, which will be available till March 2022.

- The scheme is applicable to vendors, hawkers, thelewalas, rehriwalas, and theliphadwalas supplying goods and services.

- Street vendors in peri-urban or rural areas will also be able to avail the benefits.

Implementation of PM SVANidhi

- Urban local bodies will be playing a pivotal role in the implementation of the scheme as the lending institutions under the scheme include, Regional Rural Banks, Scheduled Commercial Banks, Cooperative Banks, Small Finance Banks, Micro Finance Institutions, NBFCs, and Self-Help Groups.

- It is the first time that NBFCs/MFIs/SHG Banks have been allowed in a scheme for urban poor. The change is because of their ground-level presence and proximity to the urban poor including the street vendors.

- Also, for the fast implementation of the scheme for transparency, a digital platform with a mobile app and web portal has also been developed to administer the scheme with end-to-end solutions. This platform will also help in integrating the vendors in a formal financial system.

- The scheme will also incentivise digital transactions by the street vendors through monthly cashback.

-Source: Indian Express

ICE CALVING AND ICEBERG A68a

Context:

The giant iceberg A68, the biggest block of free-floating ice from Antarctica has been drifting towards the remote sub-Antarctic island of South Georgia, prompting fears about the impact the iceberg could have on the island’s abundant wildlife.

Relevance:

GS-I: Geography (Geophysical phenomena and geographical features – Ice caps), Prelims

Dimensions of the Article:

- Concerns Regarding A68a iceberg

- Ice calving

Concerns Regarding A68a iceberg

- The Giant iceberg A68a has been drifting in the Atlantic Ocean since 2017.

- Icebergs travel with ocean currents and either get caught up in shallow waters or ground themselves.

- In 2020, due to an ocean current, the iceberg was propelled into the South Atlantic Ocean and since then it has been drifting towards the remote sub-Antarctic island of South Georgia

Concerns

- The fear is that if the iceberg grounds itself near the island, it could cause disruption to the local wildlife that forages in the ocean.

- As per ecologists if the iceberg gets stuck near the island, it could mean that penguins and seals will have to travel farther in search of food, and for some this might mean that they don’t get back in time to prevent their offspring from starving to death.

- On the other hand, there are some positives of an iceberg being stuck in the open ocean, since icebergs carry dust which fertilises ocean plankton, which draws up carbon dioxide from the atmosphere.

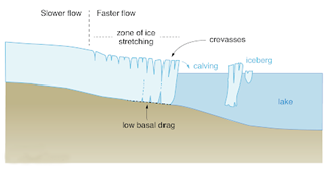

Ice calving

- Ice calving, also known as glacier calving or iceberg calving, is the breaking of ice chunks from the edge of a glacier.

- It is a form of ice ablation or ice disruption.

- It is the sudden release and breaking away of a mass of ice from a glacier, iceberg, ice front, ice shelf, or crevasse.

- The ice that breaks away can be classified as an iceberg, but may also be a growler, bergy bit, or a crevasse wall breakaway.

- Calving of glaciers is often accompanied by a loud cracking or booming sound before blocks of ice break loose and crash into the water.

- The entry of the ice into the water causes large, and often hazardous waves.

- Many glaciers terminate at oceans or freshwater lakes which results naturally with the calving of large numbers of icebergs.

-Source: Indian Express