Contents

- Herd Immunity: India still far from it

- Sandalwood Spike Disease

- JIMEX-2020 & Logistics Sharing Agreement

- Clashes between Armenia and Azerbaijan

- India calls on Sri Lankan PM to implement 13th Amendment

- Full statehood to Gilgit-Baltistan

- The 3 Farm Bills

- Changes in Labour Laws

- Cesses and their Parking

- CAG moots probe into Accounting method

HERD IMMUNITY: India still far from it

Union Health Ministry warned that the Indian Council of Medical Research’s first COVID-19 sero-survey should not create a sense of complacency among the people with regard to the virus. The first sero-survey from May had revealed a nationwide prevalence of novel coronavirus infection of only 0.73%.

What is the ministry indicating?

The 2nd Sero Survey shows that India is far from having achieved any kind of herd immunity”. This becomes all the more reason why people should continue to follow COVID-19 appropriate behaviour.

It has advised against the wide usage of investigational therapies such as Remdesivir and plasma therapies.

What is ‘Herd Immunity”?

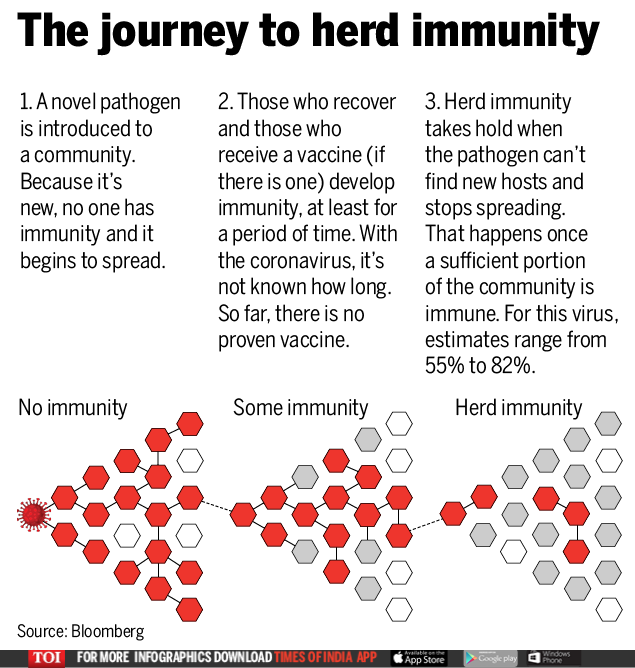

Herd immunity, or community immunity, is when a large part of the population of an area is immune to a specific disease. If enough people are resistant to the cause of a disease, such as a virus or bacteria, it has nowhere to go.

While not every single individual may be immune, the group as a whole has protection. This is because there are fewer high-risk people overall. The infection rates drop, and the disease peters out.

Remdesivir

It is a drug that once offered hope against Ebola, is now in the spotlight as the only current effective medication for COVID-19. But experts caution that it’s no “silver bullet” against the disease caused by the new coronavirus, SARS-CoV-2.

Remdesivir is thought to interfere with the mechanism that certain viruses, including the new coronavirus, use to make copies of themselves

Plasma therapies

Plasma therapy is an old medical procedure that uses the blood of a recovered patient to create antibodies on those infected individuals. Medically known as convalescent plasma therapy, this treatment uses antibodies found in the blood taken from a recovered Covid-19 patient. It is then used to treat those with severe SARS-CoV-2 infection to aid recovery.

Sandalwood Spike Disease

India’s sandalwood trees, the country’s pride — particularly of Karnataka — are facing a serious threat with the return of the destructive Sandalwood Spike Disease (SSD).

About Sandalwood Trees

The woods are heavy, yellow, and fine-grained, and, unlike many other aromatic woods, they retain their fragrance for decades. Sandalwood oil is extracted from the woods for use. Sandalwood is often cited as one of the most expensive woods in the world.

Some species of these slow-growing trees have suffered over-harvesting in the past.

It is a species indigenous to South India, and grows in the Western Ghats and a few other mountain ranges such as the Kalrayan and Shevaroy Hills. Although sandalwood trees in India, Pakistan, and Nepal are government-owned and their harvest is controlled, many trees are illegally cut down.

The disease

The Sandalwood trees in reserve forests in Karnataka and Kerala are heavily infected with SSD for which there is no cure as of now. Presently, there is no option but to cut down and remove the infected tree to prevent the spread of the disease, caused by phytoplasma — bacterial parasites of plant tissues — which are transmitted by insect vectors.

- SSD has been one of the major causes for the decline in sandalwood production in the country for over a century.

- The disease was first reported in Kodagu in 1899.

- The devastating impact in natural habitats resulted in sandalwood being classified as “vulnerable” by the International Union for Conservation of Nature in 1998.

JIMEX-2020

It is the 4th edition of the biennial India and Japan naval exercise

- It was conducted in the north Arabian Sea.

- This is the first exercise following the conclusion of the mutual logistics support agreement signed in Sept 2020.

The maritime cooperation has significantly increased between the two sides with focus on information sharing and Maritime Domain Awareness (MDA) in the Indian Ocean Region (IOR) and Indo-Pacific.

About Mutual Logistics Support Agreements

India and Japan inked this landmark agreement that will allow their militaries to access each other’s bases for logistics support, a key development that comes in the backdrop of growing concerns over China’s military muscle flexing in the region.

- The agreement provides for creation of an enabling framework for closer cooperation and interoperability, besides allowing militaries of the two countries to use each other’s bases and facilities for repair and replenishment of supplies

- In June 2020, India and Australia sealed a similar Mutual Logistics Support Agreement (MLSA) while resolving to scale up their overall defence cooperation.

- India has already signed similar agreements with the US, France and Singapore.

Clashes between Armenia and Azerbaijan

Tensions ran high even as clashes erupted between Armenia and Azerbaijan over the volatile Nagorno-Karabakh region

The clashes prompted a flurry of diplomacy to prevent a new flare-up of a decades-old conflict between majority Christian Armenia and mainly Muslim Azerbaijan

Location & Significance

Nagorno-Karabakh region is in the South Caucasus. Pipelines shipping Caspian oil and natural gas from Azerbaijan to the world pass close to Nagorno-Karabakh.

The Caucasus, or Caucasia, is a region between the Black Sea and the Caspian Sea and mainly occupied by Armenia, Azerbaijan, Georgia, and south western Russia.

A bit of war History

Both sides fought a war in the 1990s. Nagorno-Karabakh broke away from Azerbaijan in a conflict that broke out as the Soviet Union collapsed in 1991. Though a ceasefire was agreed in 1994, after thousands of people were killed and many more displaced, Azerbaijan and Armenia frequently accuse each other of attacks around Nagorno-Karabakh and along the separate Azeri-Armenian frontier.

India calls on Sri Lankan PM to implement 13th Amendment

The PM of India called upon the newly elected Sri Lankan government to fully implement the 13th constitutional amendment, which envisages devolution of powers to provinces. The Northern Province of Sri Lanka is where the Tamil minorities reside

The 13th Amendment is seen by India as a piece of legislation that can address the aspirations of the Tamil people for equality, justice, peace and respect within a united Sri Lanka, including by carrying forward the process of reconciliation

All about 13th Amendment

It is an outcome of the Indo-Lanka Accord of July 1987, signed by the then Prime Minister Rajiv Gandhi and President J.R. Jayawardene, in an attempt to resolve Sri Lanka’s ethnic conflict that had aggravated into a full-fledged civil war, between the armed forces and the Liberation Tigers of Tamil Eelam, which led the struggle for Tamils’ self-determination and sought a separate state.

- The 13th Amendment, which led to the creation of Provincial Councils, assured a power sharing arrangement to enable all nine provinces in the country, including Sinhala majority areas, to self-govern.

- Subjects such as education, health, agriculture, housing, land and police are devolved to the provincial administrations, but because of restrictions on financial powers and overriding powers given to the President, the provincial administrations have not made much headway.

- In particular, the provisions relating to police and land have never been implemented.

- Initially, the north and eastern provinces were merged and had a North-Eastern Provincial Council, but the two were de-merged in 2007 following a Supreme Court verdict.

- The 13th Amendment was opposed vociferously by both Sinhala nationalist parties and the LTTE. The former thought it was too much power to share, while the Tigers deemed it too little.

- Though signed by the powerful President Jayawardene, it was widely perceived as an imposition by a neighbour wielding hegemonic influence.

- The Tamil polity, especially its dominant nationalist strain, does not find the 13th Amendment sufficient in its ambit or substance. However, some including the Tamil National Alliance (TNA) — which chiefly represented the Tamils of the north and east in Parliament in the post-war era — see it as an important starting point, something to build upon.

OKAY. What is the present Sri Lankan Govt’s stand on it?

Many including ministers have openly called for the abolition of provincial councils after the new government took charge. They deem the councils “white elephants”, and argue that in a small country the provinces could be effectively controlled by the Centre.

Neither President Gotabaya Rajapaksa nor Prime Minister Mahinda Rajapaksa has commented on the Amendment so far.

During Mr. Mahinda Rajapaksa’s two terms as President, for a decade from 2005, he gave several assurances to implement the 13th Amendment and go even beyond its provisions, popularly referred to as his promise of “13 plus”.

New Delhi’s scepticism about past assurances and future outcomes is thus understandable

Full statehood to Gilgit-Baltistan

In a move that could flare up tensions between India and Pakistan, Pakistan is moving to grant full statehood to Gilgit-Baltistan, seven decades after it took control of the region. It was part of the erstwhile princely state of Jammu and Kashmir and is claimed by India.

History

Pakistan initially governed Gilgit-Baltistan directly from the central authority after it was separated from ‘Azad Jammu and Kashmir’ in 1949

- In 1963, Pakistan gave away 5,180 sq km of the region to China, despite local protests

- Under Prime Minister Zulfiqar Ali Bhutto, the name of the region was changed to the Federally Administered Northern Areas. Now, the region is set to become Pakistan’s fifth state

- During the first Indo-Pak war of 1947, Pakistan occupied 78,114 sq km of the land of Jammu and Kashmir, including the ‘Northern Areas’. The Northern Areas is the other name of Gilgit-Baltistan that Pakistan has used for administrative reasons because it was a disputed territory.

- The political nature of Gilgit-Baltistan has been directionless from the beginning.

- Pakistan passed the Gilgit-Baltistan Empowerment and Self Governance Order in 2009, which granted “self-rule” to the ‘Northern Areas’. There were protests in the area at that time from people who demanded an executive form of government based on international resolutions.

- The local situation altered considerably with Pakistan signing an agreement with China for mega infrastructure and hydel power projects in September 2009. With the agreements arrived Chinese investments and heavy machinery, which found both support and opposition from the locals.

More recently

In early 2019, a seven-judge bench of the Supreme Court of Pakistan took up the constitutional status of Gilgit-Baltistan. The purpose of the court’s intervention was to determine the extent of political rights that could be enjoyed by the people of the ‘Northern Areas’. The Supreme Court allowed Islamabad to amend a 2018 administrative order to hold general elections in the region. The Gilgit-Baltistan Order of 2018 provided for administrative changes, including empowering the Prime Minister of Pakistan to legislate on an array of subjects.

Sense of alienation

One of the main reasons for the rebellion in the region in 1947 was the sense of alienation that the population felt towards the Dogra rulers of Srinagar, who operated under the protection of the British government.

- Under the post-1947 special administrative arrangement, local councils worked to meet economic, social and educational development of the region. Irrigation channels, protective bunds, roads and pony tracks were built during the early years of Pakistan.

About Gilgit-Baltistan

It is one of the most mountainous regions in the world that is rich with mines of gold, emerald and strategically important minerals, and is known for its extraordinary scenic beauty, diversity and ancient communities and languages, yet it is largely an underdeveloped region.

- It’s home to K-2, the second tallest mountain in the world.

- Tourism remains restricted by many factors, including military hostility, though the region has some of the ancient Buddhist sculptures and rock edicts.

- It is also home to an old Shia community, which often finds itself subjected to persecution in Pakistan’s urban centres.

- At present, a Governor and an elected Chief Minister rule the region, which is divided into Gilgit, Skardu, Diamer, Astore, Ghanche, Ghizer and Hunza-Nagar.

Indian protest

Following Pakistan’s announcement of holding the legislative election in Gilgit-Baltistan, India reiterated its territorial sovereignty over the region. India has maintained that the Pakistani move to change the status of the region will “have no legal basis whatsoever”.

- India has consistently opposed Pakistan’s activities in Gilgit-Baltistan.

- It also opposed the announcement of the commencement of the Diamer-Bhasha dam in July 2020.

- There have been local and international concerns as reports suggest priceless Buddhist heritage will be lost once the dam is built.

- India has objected to the use of Gilgit-Baltistan to build and operate the China Pakistan Economic Corridor (CPEC), which cuts through the region before heading to the Arabian Sea coastline of Balochistan’s Gwadar port.

- Beginning with the August 5, 2019 decision by India to withdraw the special status of Jammu and Kashmir, a number of developments have taken place on both sides of the Line of Control.

- India declared that the decision will pave the way for reclaiming Pakistan-occupied Kashmir (including Gilgit-Baltistan).

- India launched a new political map in November 2019, which showed the Gilgit-Baltistan region as part of the new Union Territory of Ladakh.

- In response, Pakistan laid claim to Ladakh and the whole of Jammu and Kashmir in its map. An election and full statehood for Gilgit-Baltistan will likely infuriate India, which will perceive it as a step to deny reclaiming PoK ever in the future.

Importance of the region

Gilgit-Baltistan is important for Pakistan as it is the gateway for the CPEC. But for India, the region represents the continuity with the past of Jammu and Kashmir, which included Gilgit-Baltistan at the time of Partition of 1947.

Significantly, the ongoing stand-off with China at the Line of Actual Control in Eastern Ladakh has a Gilgit-Baltistan connection as the Darbuk-Shyok-DBO road of India is viewed as a tactical roadway to access the Karakoram Pass, which provides China crucial access to Gilgit-Baltistan and Pakistan.

Full statehood for the region may give Pakistan a political and legal upper hand and strengthen China’s position in the region, but Gilgit-Baltistan will continue to remain one of the hotspots in the tense India-Pakistan relations.

The 3 Farm Bills

Farmers started protesting against three Bills on agriculture market reforms that were passed by Parliament. Opposition parties and farmers groups across the political spectrum have expressed concern that the laws could corporatise agriculture, threaten the current mandi network and State revenues and dilute the system of government procurement at guaranteed prices.

What are the three Bills?

The Bills aim to change the way agricultural produce is marketed, sold and stored across the country

- The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Bill, 2020, allows farmers to sell their harvest outside the notified Agricultural Produce Market Committee (APMC) mandis without paying any State taxes or fees.

- The Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Bill, 2020, facilitates contract farming and direct marketing.

- The Essential Commodities (Amendment) Bill, 2020, deregulates the production, storage, movement and sale of several major foodstuffs, including cereals, pulses, edible oils and onion, except in the case of extraordinary circumstances.

Govt’s take

- The laws will provide farmers with more choice

- More competition will lead to better prices

- They will usher in a surge of private investment in agricultural marketing, processing and infrastructure.

Delineating the concerns voiced

- MSPs

- These are the pre-set rates at which the Central government purchases produce from farmers, regardless of market rates, and are declared for 23 crops at the beginning of each sowing season.

- However, the Centre only purchases paddy, wheat and select pulses in large quantities, and only 6% of farmers actually sell their crops at MSP rates, according to the 2015 Shanta Kumar Committee’s report using National Sample Survey data.

Most at the farmers’ protests say MSPs, or minimum support prices, are threatened by the new laws. Most government procurement centres in Punjab, Haryana and a few other States are located within the notified APMC mandis. Farmers fear that encouraging tax-free private trade outside the APMC mandis will make these notified markets unviable, which could lead to a reduction in government procurement itself. Farmers are also demanding that MSPs be made universal, within mandis and outside, so that all buyers — government or private — will have to use these rates as a floor price below which sales cannot be made.

Counter: None of the laws directly impinges upon the MSP regime

2. State List

Regional political parties and non-BJP State governments say that agriculture falls in the State list, arguing that the Centre should not be making legislation on this subject at all.

- They are concerned about the loss of revenue from mandi taxes and fees.

- Both Punjab and Rajasthan are considering legal measures to expand the bounds of their APMC mandi yards to ensure that they can continue collecting taxes on all agricultural trade within their State’s borders.

- States such as Chhattisgarh and Odisha have only seen procurement increase over the last five years, after the implementation of decentralised procurement. Paddy farming has received a major boost with procurement at MSPs and farmers fear their newly assured incomes are at stake

Why are protests vociferous in some States?

More than half of all government procurement of wheat and paddy in the last five years has taken place in Punjab and Haryana. More than 85% of wheat and paddy grown in Punjab, and 75% in Haryana, is bought by the government at MSP rates.

Farmers in these States fear that without MSPs, market prices will fall. These States are also most invested in the APMC system, with a strong mandi network, a well-oiled system of arthiyas or commission agents facilitating procurement, and link roads connecting most villages to the notified markets and allowing farmers to easily bring their produce for procurement. The Punjab government charges a 6% mandi tax (along with a 2.5% fee for handling central procurement) and earns an annual revenue of about ₹3,500 crore from these charges.

Conclusion

The majority of agricultural marketing already happens outside the mandi network, with only 7,000 APMC markets operating across the country. Bihar, Kerala and Manipur do not follow the APMC system at all. However, most private buyers are currently small traders at local mandis.

The removal of stock limits and facilitation of bulk purchase and storage through the amendment to the Essential Commodities Act could bring large corporate players into the agriculture space. Although they will bring much-needed investment, they could also skew the playing field, with small farmers unlikely to match them in bargaining power.

Changes in labour laws

Three Codes on labour law were passed, amid criticism and protests by many trade unions even as the industry calls them as a much-needed reform

In 2019, a separate Code on Wages was enacted. The Codes enacted now are modified versions of the Industrial Relations Code Bill introduced in 2019. Among these, the Industrial Relations Code is touted as one that would energise industry and spur economic activity, as it aims to free employees from the constraints of earlier labour laws.

Main features of the Industrial Relations Code

- The Industrial Relations Code combines the features of three erstwhile laws —

- the Trade Unions Act, 1926

- the Industrial Employment (Standing Orders) Act, 1946

- the Industrial Disputes Act, 1947.

- The new code defines ‘workers’ to include everyone in the firm drawing up to ₹18,000 a month as salary.

- It introduces ‘fixed term employment’, giving employers the flexibility to hire workers based on requirement through a written contract. Fixed term employees should be treated on a par with permanent workers in terms of hours of work, wages, allowances and other benefits, including statutory benefits such as gratuity.

- The Code says any establishment that employs 300 or more workers must prepare standing orders relating to classification of workers, manner of intimating to them periods and hours of work, holidays, pay days etc, shifts, attendance, conditions for leave, termination of employment, or suspension, besides the means available for redress of grievances. Earlier, the 2019 Bill applied this to units with 100 employees or more.

- It confers on the ‘appropriate Government’, that is the Centre or the State governments, the power to exempt, with or without conditions, any industrial establishment or class of industrial establishments from all or any of the provisions of the Code, if it is satisfied that adequate provisions exist to fulfil its objectives.

What about the trade unions?

Where there is more than one trade union in an establishment, the sole negotiating union status will be given to the one that has 51% of the employees as its members.

- It has been brought down from the 75% requirement in the 2019 version.

- If no union has 51%, then employer constitutes a ‘negotiating council’ consisting of representatives drawn from the various unions, with only those with at least 20% of employees as its members.

Lay-offs and closure

- Establishments have more than 300 employees per day in the last 12 months, require the prior permission of the government for lay-off, retrenchment and closure. This threshold can be raised by the govt using a notification.

- A lay-off would be deemed illegal if it is effected without permission, but it will not be so if the employee had been offered alternative employment that does not require any special skill or cause undue hardship.

- The Code prescribes notice period, or payment in lieu of notice period, and prior government permission before retrenchment of anyone who has been in continuous service for a year or more. Such a prior permission requirement is in place also for closure of a unit, with the application to be filed 90 days prior to the intended closure.

Right to strike

- The Code prohibits strikes and lock-outs in all industrial establishments without notice.

- No unit shall go on strike in breach of contract without giving notice 60 days before the strike, or within 14 days of giving such a notice, or before the expiry of any date given in the notice for the strike.

- Further, there should be no strike during any conciliation proceedings, or within seven days of the conclusion of such proceedings; or during proceedings before an industrial tribunal or 60 days after their conclusion or during arbitration proceedings.

- Similar restrictions have been given on the employer from announcing a lock-out.

- The Industrial Disputes Act, 1947, had placed such restrictions on announcing strikes only in respect of public utility services. However, the present Code extends it to all establishments. Even the Standing Committee on Labour had favoured limiting these provisions to public utilities.

CESSES and their parking

The CAG of India made an observation that the Central Govt has withheld in Consolidated Fund of India (CFI) more than ₹1.1 lakh crore out of the almost ₹2.75 lakh crore collected through various cesses in 2018-19.

The reason why CAG is not happy is that usually cess collections are supposed to be transferred to specified Reserve Funds that Parliament has approved for each of these levies.

Here is what has transpired with respect to cess money:

- ₹1.24 lakh crore collected as Cess on Crude Oil over the last decade had not been transferred to the designated Reserve Fund — the Oil Industry Development Board

- Goods and Services Tax (GST) Compensation Cess was also “short-credited” (credited less money to that designated account – GST compensation fund) to the extent of ₹47,272 crore in two years (₹40,806 crore in 2018-19 and ₹6,466 crore in 2017-18).

- The express purpose of this particular cess is to help recompense States for the loss of revenue on account of their having joined the GST regime by voluntarily giving up almost all the power to levy local indirect taxes on goods and services. However, the Central Govt had not transferred these finances to the states, which were promised so.

What is a cess?

The Union government is empowered to raise revenue through a gamut of levies, including taxes (both direct and indirect), surcharges, fees and cess.

- Direct taxes, including income tax, and indirect taxes such as GST are taxes where the revenue received can be spent by the government for any public purpose in any manner it deems appropriate for the nation’s good

- A cess is a earmarked tax that is collected for a specific purpose and ought to be spent only for that. Every cess is collected after Parliament has authorised its creation through an enabling legislation that specifies the purpose for which the funds are being raised.

- Article 270 of the Constitution allows cess to be excluded from the purview of the divisible pool of taxes that the Union government must share with the States.

Cesses levied by the govt.

- There have been 42 cesses levied at various points in time since 1944.

- The very first cess was levied on matches.

- Post Independence, the cess taxes were linked initially to the development of a particular industry, including a salt cess, a tea cess, the iron ore mines labour welfare cess etc.

- The introduction of the GST in 2017 led to most cesses being done away with and as of August 2018, there were only seven cesses that continued to be levied.

- Cess on Exports

- Cess on Crude Oil

- Health and Education Cess

- Road and Infrastructure Cess

- Building and Other Construction Workers Welfare Cess

- National Calamity Contingent Duty on Tobacco and Tobacco Products

- the GST Compensation Cess.

- And in February 2020 , Finance Minister Nirmala Sitharaman introduced a new cess — a Health Cess of 5% on imported medical devices — in the Finance Bill for 2020-2021.

Probe cess accounting dodge: CAG

The Comptroller and Auditor General (CAG) sought an investigation against the Central government’s accounting officials for incorrectly recording ₹10,250 crore of cess receipts from additional excise duties on petrol and diesel, as non-tax receipts for the exchequer in 2018-19.

What does it mean?

Any cess collected should goto the account precisely created for that purpose. They are not to be put under revenue receipts (Tax or non-tax). However, this was done through a journal entry made after the end of the financial year ‘primarily for the purpose of artificially inflating revenue receipts of the year’.

- Cess collections from petrol and diesel are to be routed to the Central Road Fund (CRF), created by the Parliament as a dedicated non-lapsable Reserve Fund to be used only for designated purposes.

- The CRF was replaced with a Central Road and Infrastructure Fund (CRIF) through amendments introduced in the Union Budget for 2018-19.

- The Finance ministry said that after the replacement of CRF with CRIF, a journal entry was made and the unutilised funds in the CRF were transferred to “Non-tax revenues”. Their actual transfer had to be to CRIF

- This is what the CAG says

Reply and it’s untenableness

FM said: Such write-backs had been done in the past also, based on recommendations of the Standing Committee on Finance (16th Lok Sabha) for transferring unutilised funds / idle funds in the public account to the CFI.

CAG says: Ministry’s reply is ‘untenable’. The reference to precedents is either not relevant or cannot be used to justify wrong practices.

- The Standing Committee recommendation was in the context of closing idle Funds and transferring unutilised balances back to the CFI. The Central Road Fund/ CRIF is not an idle fund.

- Further, the stipulated accounting procedure for transferring idle Fund balances back to the CFI does not require inflating the revenue receipts for the year as the JE has done”