Contents

- Compound conundrum

- GST and the complexity of political negotiations

- India’s outreach to Myanmar

Compound conundrum

Context: While the waiver of the interest on interest is welcome, MSMEs need more help

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Sub topics: Sector of economy (Small Scale Industries)

Mains questions:

- For India, just achieving economic growth is not sufficient. We require job-led growth to provide employment to 400 million plus workforce. Discuss this statement in context of MSMEs sector in India. 15 marks

- India needs a roadmap to make MSMEs resilient, sustainable and a part of the nation’s green development plan. In this context examine the U.K. Sinha committee recommendations. 15 marks

Dimensions of topic:

- What is MSMEs?

- What is new classification of MSMEs?

- Significance of MSMEs.

- Challenges being faced by MSMEs.

- Recent measures by the government to help MSMEs.

- Recommendations of expert committee on MSMEs (U.K. Sinha)

- Way forward

What is MSMEs?

The Government of India has introduced MSME or Micro, Small, and Medium Enterprises in agreement with Micro, Small and Medium Enterprises Development (MSMED) Act of 2006. These enterprises primarily engaged in the production, manufacturing, processing, or preservation of goods and commodities.

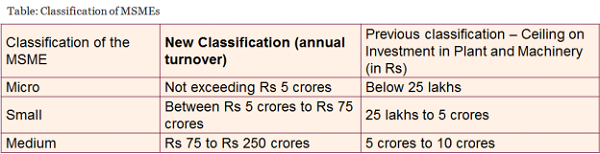

Classification of MSMEs: The government proposed new classification:

Significance of MSMEs: Across the globe, MSMEs are accepted as a means of economic growth and for promoting equitable development. They are known to generate the highest rate of growth in the economy. MSMEs have driven India to new heights through requirements of low investment, flexible operations, and the capacity to develop appropriate native technology.

- MSMEs employ around 120 million persons, becoming the second-largest employment generating sector after agriculture.

- With approximately 45 lac units throughout the country, it contributes about 6.11% of GDP from manufacturing and 24.63% of the GDP from service activities.

- MSME ministry targets to increase its contribution towards GDP by up to 50% by 2025 as India moves ahead to become a $5 trillion economy.

- Contributing around 45% of overall Indian exports.

- MSMEs promote all-inclusive growth by providing employment opportunities, especially to people belonging to weaker sections of the society in rural areas.

- MSMEs in tier-2 and tier-3 cities help in creating opportunities for people to use banking services and products, which can amount to the final inclusion of the contribution of MSMEs for the economy.

Challenges being faced by MSMEs:

- Limited capital: Absence of adequate and timely banking finance, as per Economic Survey 2017-18, the MSME received only 17.4 per cent of the total credit outstanding as of November 2017.

- Problem of delayed payments is faced by MSMEs due to various reasons, which increase the financial crunch for their businesses.

- Due to their lack of scale and in-house capabilities, MSEs find it difficult to access proper market for selling their products.

- Large-scale presence of MSMEs in informal sector, which doesn’t allow them to use different assistance available to MSMEs.

- Non-availability of suitable technology, creating public perception of products with low quality standards.

- Low production due to reasons such as Ineffective marketing strategy, constraints on modernisation & expansions etc.

- Deficiencies in basic infrastructural facilities like water, power supply, road/rail and telephone connectivity, etc.

- There are large numbers of clusters but the resource availability for undertaking cluster development activities is limited.

- A huge divergence persists between research institutions (suppliers of technology) and the business requirements of MSMEs (consumers of technology)

- Presently, MSMEs must do multiple registrations with various entities such as Udyog Aadhaar portal, GSTN, NSIC, etc. This leads to cumbersome registration process and duplication of efforts.

Recent measures by the government to help MSMEs:

1: Credit and Financial Assistances to MSMEs:

- 59-minute loan portal to enable easy access to credit for MSMEs: A link to this portal will be made available through the GST portal.

- Interest Subvention: A 2 percent interest subvention will be provided for all GST registered MSMEs, on fresh or incremental loans. For exporters who receive loans in the pre-shipment and post-shipment period, there will be an increase in interest rebate from 3 percent to 5 percent.

- Cash flow certainty: All companies with a turnover more than Rs. 500 crore, must now compulsorily be brought on the Trade Receivables e-Discounting System (TReDS). Joining this portal will enable entrepreneurs to access credit from banks, based on their upcoming receivables. This will resolve their problems of cash cycle.

- Prime Minister’s Employment Generation Programme (PMEGP) is aimed at generating self-employment opportunities through establishment of micro-enterprises in the non-farm sector by helping traditional artisans and unemployed youth.

- Credit Guarantee Scheme for Micro and Small Enterprises covers collateral free credit facility (term loan and/or working capital) extended by eligible lending institutions including Non-Banking Financial Company (NBFC) to new and existing micro and small enterprises up to 2 crore per borrowing unit.

- Credit Linked Capital Subsidy Scheme (CLCSS) aims at facilitating technology upgradation of the MSME sector.

- The Government has also initiated the Pradhan Mantri Mudra Yojana for development and refinancing activities relating to micro industrial units.

2: Skill Development and Training :

- A Scheme for Promotion of Innovation, Rural Industry & Entrepreneurship (ASPIRE) to create a framework for start-up promotion through Network of Technology Centres and Incubation and commercialisation of Business Idea Programme.

3: Infrastructure:

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI)

- Scheme for Micro & Small Enterprises Cluster Development Programme (MSE-CDP)

4: Marketing Assistance:

- Scheme for providing financial assistance to Khadi institutions under MPDA (Market Promotion Development Assistance).

- MSME Delayed Payment Portal – MSME Samadhaan

- Public Procurement Portal for MSEs – MSME Sambandh

- Mandatory public procurement: Public sector companies have been mandated to compulsorily procure 25 percent, instead of 20 percent of their total purchases, from MSMEs.

- Women entrepreneurs: Out of the 25 percent procurement mandated from MSMEs, 3 percent now be reserved for women entrepreneurs.

- GeM Portal: All public sector undertakings of the Union Government must now compulsorily be a part of GeM. They should also get all their vendors registered on GeM.

5: Technology Upgradation and Competiveness:

- Financial Support to MSMEs in ZED (Zero Defect and Zero Effect) certification to encourage MSMEs to upgrade their quality standards in products and processes with adoption of Zero Defect production processes and without impacting the environment, etc

6: Ease of Doing Business

- Support to pharma companies: Clusters will be formed of pharma MSMEs and 70 percent cost of establishing these clusters will be borne by the Union Government.

- One annual return: The return under 8 labour laws & 10 Union regulations now to be filed only once a year.

- No more inspector raj: Now the establishments to be visited by an Inspector will be decided through a computerised random allotment and inspectors must upload reports on portal within 48 hours.

- Relaxation in environmental clearances: As part of establishing a unit, an entrepreneur needs two clearances namely, environmental clearance and consent to establish. Under air pollution and water pollution laws, now both these have been merged as a single consent. Moreover, the return will be accepted through self-certification.

- Reserve Bank of India (RBI) has asked the banks to link the floating interest rate on retail loans and loans extended to micro and small businesses to external benchmarks like Repo Rate or Treasury Bills.

Committee recommendations: the report of the ‘Expert Committee on Micro, Small and Medium Enterprises’ under the chairmanship of U.K. Sinha was released by the Reserve Bank of India.

- Review of the legislative framework- The Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 may be reimagined as a comprehensive and holistic MSME Code having a provision for sunset on plethora of complex laws scattered all over the legislative framework.

- Change in the definition of MSMEs– from current investment based to turnover-based definition, as it would be more transparent, progressive, easier to implement. It will also remove the bias towards manufacturing enterprises in the existing definition.

- Strengthening the procurement mechanism– by promotion of the Government e-Market (GEM) Portal and improving its payment system.

- Exit Policy for MSMEs- Due to the lack of sophistication on the part of MSMEs, Insolvency code/ delegated legislation should provide for out-of-court assistance to MSMEs such as mediation, financial education, or the appointment of a trustee.

- Market Support for MSMEs- can be enhanced by developing networks of development service providers that can provide customized solutions to MSMEs that are struggling with capability and resources constraints.

- Setup a National Council for MSMEs- under the Chairmanship of the Prime Minister, in order to facilitate coherent policy outlook and unity of monitoring.

Way forward:

The development of MSMEs is crucial on many counts for Indian economy and society. Apart from proper implementation of U.K. Sinha Committee recommendations, a cue could be taken from the global best practices such as the Competition by cooperation concept in Italy, Contract Financing in Mexico and success stories of Shenzhen as a technology hub in China.

GST and the complexity of political negotiations

Context: Over the last couple of months, the Centre and States have not been on the same page over issues connected with the Goods and Services Tax (GST).

Relevance:

GS Paper 2: issues and challenges of federal structure

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein

Mains Questions:

- Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. 15 marks

- Discussion the rationale for introducing Good and services tax in India. Bring out critically the reasons for delay in roll out for its regime. 15 marks

- Economic and fiscal federalism scholarship offers us reasonably sound economic and normative reasons, which include efficiency, equity, stabilisation, economic growth, and balanced development. Examine this statement in context of implementation of GST in India. 15 marks

Dimensions of the editorial:

- What is GST?

- Significance of GST.

- Advantages of GST.

- Challenges regarding GST.

- Steps to address these challenges.

- Way forward

What is GST?

GST is a destination-based indirect tax and is levied at the final consumption point. Under it, the final consumer of the goods and services bear the tax charged in the supply chain. GST is a transparent and fair system that prevents black money and corruption and promotes new governance culture.

Significance of GST:

- GST merged the indirect central government levies like sales tax, service tax, excise duty, surcharges and cesses and indirect state government levies like VAT, Entry tax etc. Earlier, India’s indirect tax regime was fragmented with many taxes at both Centre & State level with varying rates of each in different jurisdictions. This created tariff & nontariff barriers to trade.

- Encouragement to co-operative federalism: GST Council has proved to be an extremely effective and powerful decision making federal institution.

- Reduced Human Interface: GST is largely technology driven leading to speedy decisions.

- Improving revenue buoyancy: GST revenue growth is 11 per cent, would translate into a revenue buoyancy of 1.14 against the historical buoyancy of indirect taxes of about 0.9.

- GST Network: data generated by the GSTN can provide deep insights about the economy. It would also provide data quickly to the policy-makers on various emerging trends in the economy.

- Better Compliance: Total registrations post GST increased from around 65 lakh to a110 lakh (without double counting), representing a net gain of around 70 percent.

- More efficient neutralization of taxes especially for exports thereby making our products more competitive in the international market.

Advantages of GST:

- Unified National Market: It is a step towards “One Country, One Tax, One Market” providing a relatively stable tax regime which will give boost to foreign investment and Make in India.

- Impact on economy – It is estimated to increase the GDP growth by 1.5 to 2%. Inflation in general for goods is going to be reduced due to removal of cascading effect as well as lower rates than present regime for most of them.

- No Cascading effect: GST prevents cascading of taxes as it is a destination based consumption tax & Input Tax Credit is available across goods and services at every stage of supply.

- Ease of doing business: Harmonization of laws, procedures and rates of tax, will improve environment of compliance as all returns to be filed online, input credits to be verified online reducing need to deal with different tax authorities. It would also discourage mere ‘invoice shopping’.

- Reduce Tax Evasion: Uniform SGST and IGST rates will reduce incentive for evasion because of

- Elimination of rate arbitrage between neighbouring States and that between intra and inter-state sales as integrated GST rate would be applicable.

- ‘Self-policing feature’ of tax being levied on the value added to a good or service.

- Reduction in compliance costs due to simplification as no multiple record keeping for a variety of taxes because 17 taxes and cesses is merged into one.

- Impact on consumer – Half the consumer price index basket, including food grains, will be attract zero tax rate, thus enabling them to be part of GST chain but without burdening consumers.

Challenges regarding GST:

- Digital infrastructure – Availability of bandwidth for digital connectivity all-over India to conduct electronic transfers and payments properly.

- Issue of Parliamentary and Legislative autonomy : GST Council (an executive body) will finalize a vote by a majority of not less than three-fourths of weighted votes of members present and voting (Centre to have 33% and states to have 66% weight of the total votes cast).

- Federalism: The states are giving up much of their most important power – ‘to impose taxes’ autonomously. States will no longer be able to change their tax rates individually. As both Centre and State is vested with power to make law on GST under Art. 246(A) unlike existing regime, both centre and state will have to work together which may create workspace challenge.

- Urban local bodies will have to deal with a huge fiscal gap once local body tax, octroi and other entry taxes are scrapped for GST system.

- List of Exclusions & different rates – Many exclusions like petroleum products, diesel, petrol, aviation turbine fuel, alcohol etc. & 4 different rates are undermining the principle of One Country, One Tax.

- Pressure due to increased taxes – Small companies with a turnover of Rs 10 lakh will have to pay GST as opposed to currently Rs 1.5 crore. Even unorganized sector, biggest job creator, may loose its competitive edge. They may have to raise prices to stay profitable.

- For consumers – Benefits from reduced cost due to lower taxes may not be passed on to them. Also, some are seeing GST as a regressive system of taxation as it more or less equalizes taxation across products which mean that rich will pay less tax on luxury goods and services and poor will pay more for basic goods and services.

Steps taken by Government to address these challenges:

- Exemptions to small business – Businesses in the North-eastern and hill states with annual turnover below Rs.10 lakh would be out of the GST net, while the threshold for the exemption in the rest of India would be an annual turnover of Rs 20 lakh.

- Anti – profiteering law: The GST council has approved the creation of National Anti-Profiteering Authority (NAA) to ensure that benefits of input tax credit and tax reductions are passed on to the end consumer.

- Mandatory registration: Tax can’t be evaded now– as every person should be in the GST system if he wants to trade. E-way bill also has been passed where movement of good costing more than 50,000 beyond 10 Km is required to be registered online.

- Change in ownership pattern of Goods and Services Tax Network: Earlier 51% of GSTN was privately held. This gave the control of tax and trade data to a private company and without adequate data protection measures. GSTN council has approved change in the ownership structure and eventually the central government should hold 50 percent and the state governments will hold 50 percent collectively.

- Communication and awareness programs: For this, Suvidha Kendra’s in government offices and various handholding programmes are started.

- GST suvidha providers (GSP): GSTN has selected 34 GSPs to provide innovative and convenient methods to taxpayers and to smoothen the process of tax administration under GST.

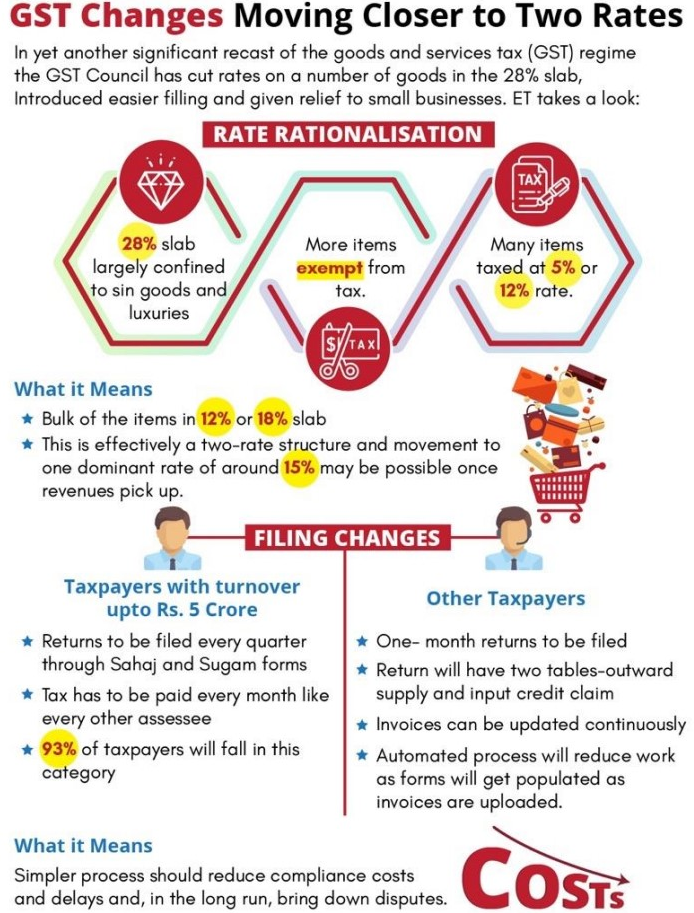

- Rate Rationalization: GST rates has been rationalized to make system more effective which would lead to lower tax burden and better tax compliance.

- Mandatory e-way Application:

Way forward:

The GST has helped us transition from “one nation, many taxes” to “one nation, one tax”. It has been a wonderful lesson in co-operative federalism, one which is in the process of transforming India into a common market by bringing about economic integration in an already integrated polity. GST is still a work in progress and the next important step would be to bring the excluded items, especially electricity, real estate and petroleum products, within its ambit.

India’s outreach to Myanmar

Context: The recent visit of Foreign Secretary Harsh Vardhan Shringla and Chief of the Army Staff Gen. Manoj Naravane to Myanmar reflected India’s multidimensional interests in the country and the deepening of ties between Delhi and Naypyidaw.

Relevance:

GS Paper 2: India and its Neighbourhood (relations)

Mains Questions:

- Myanmar is key in linking South Asia to Southeast Asia and the eastern periphery becomes the focal point for New Delhi’s regional outreach. Elaborate. 15 marks

Dimensions:

- Historical perspective of India Myanmar relations.

- Importance of Myanmar to India.

- Convergence between India and Myanmar.

- Divergence between India and Myanmar

- Way forward

Historical perspective of India Myanmar relations:

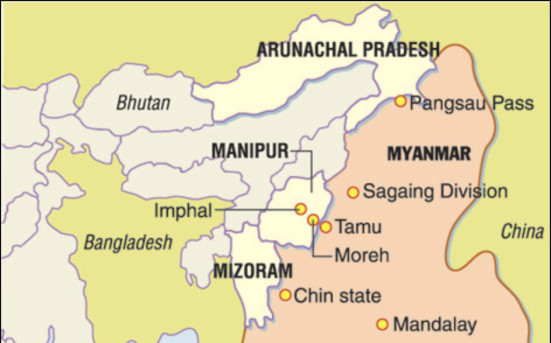

India-Myanmar relations are rooted in shared historical, ethnic, cultural and religious ties. As the land of Lord Buddha, India is a country of pilgrimage for the people of Myanmar. India and Myanmar relations have stood the test of time. The geographical proximity of the two countries has helped develop and sustain cordial relations and facilitated people-to-people contact. India and Myanmar share a long land border of over 1600 km and a maritime boundary in the Bay of Bengal.

Importance of Myanmar to India:

- Myanmar is at the heart of Indian government’s Act East policy with the India-Myanmar-Thailand Asian Trilateral Highway, the Kaladan multimodal project, a road-river-port cargo transport project, and BIMSTEC.

- India is also working closely with the security forces of Myanmar to target the insurgents operating in the country’s northeast.

- Myanmar is expected to act as the bridge between India and ASEAN, has risen in much significance in the context of India’s Act East Policy, and good neighbourhood policy.

- Better relations with Myanmar have become crucial for India with China gradually gaining confidence of countries in the region. Further India’s completion of the projects with Myanmar would also prove India to be a responsible regional player, thus improving its reliability.

- In terms of security and strategic partnership, several deep sea ports of Myanmar, including Yangon and Dawei, can be crucial for India like Chabahar port in the west.

- Myanmar is on India’s energy security radar on account of its “abundant oil and natural gas” reserves. Oil and gas companies ONGC Videsh and GAIL are aggressively scouting for more exploratory blocks in Myanmar.

- Myanmar like the other CLMV countries (Cambodia, Laos, Myanmar and Vietnam) — represents a rapidly growing economy with rising consumption, strategic location and access, rich natural resources (oil, gas, teak, copper and gemstones), biodiversity and an industrious workforce with low wages. And it offers significant opportunities for trade in goods and services, investment and project exports.

Convergence between India and Myanmar:

1: Developmental cooperation: India has committed highest grant-in-aid to Myanmar and is developing four major connectivity projects in Myanmar namely:

- Kaladan multi-modal corridor,

- Repair of 69 bridges on the Tamu-Kalewa road.

- The construction of the 120-km KalewaYargyi corridor (both of which are part of the India-Myanmar-Thailand trilateral highway).

- The Rhi-Tiddim road in the Chin state bordering Mizoram.

- The Archaeological Survey of India has also recently restored the Ananda temple, a jewel among all Bagan pagodas.

2: Capacity building in Myanmar:

- India has been actively involved in capacity building in Myanmar. Six centres imparting training in diverse subjects, from English language to industrial skills, are running successfully in Myanmar.

- The Myanmar Institute of Information Technology set up in Mandalay with the collaboration of IIIT Bangalore has been a success with all its graduates finding ready employment.

- The Advanced Centre for Agriculture Research and Education set up in collaboration with India’s ICAR is a fine example of pooling research efforts on pulses and oilseeds.

- With Myanmar’s government emphasizing higher education and vocational training, more Indian assisted institutions can come up in the country.

3: Greater cooperation between Northeast India and Western Myanmar: Four states in the Northeast (viz. Arunachal Pradesh, Nagaland, Manipur and Mizoram) share common borders with Myanmar’s Sagaing and Chin provinces. The Kaladan corridor also passes through the Rakhine state till it arrives at the Sittwe port developed by India.

4: Regional/ Sub-regional cooperation: Myanmar’s membership of ASEAN, BIMSTEC and Mekong Ganga Cooperation has introduced a regional/sub-regional dimension to bilateral relations and imparted an additional significance in the context of our “Act East” policy.

5: Commercial Cooperation- India is the fifth largest trading partner of Myanmar and is presently the tenth largest investor with major investments in oil & gas sector.

6: Defence & Security Cooperation– Various MoUs on Border Cooperation, training, Army, Air Force and Naval Staff Talks have been signed between the two countries.

7: Disaster Relief: India has responded promptly and effectively to assist Myanmar in humanitarian relief operations following natural calamities along with financial assistance for relief and reconstruction work.

8: Land Crossing Agreement: Recently agreement between India and Myanmar on Land Border Crossing has also been agreed which will

- Facilitate regulation and harmonization of already existing free movement rights for people ordinarily residing in the border areas of both countries increasing connectivity and social and economic interaction among the people.

- It would allow India to leverage its geographical connections with Myanmar to boost trade and economy of the North-East.

- The Agreement will safeguard the traditional rights of the largely tribal communities residing along the border which are accustomed to free movement across the land border.

Divergence between India and Myanmar:

- The Rohingya crisis: India does not directly engage with the issue of Myanmar’s treatment of its Rohingya Muslim minority. But India condemned the recent terrorist attacks in northern Rakhine State in a measure of support to Myanmar. Further both sides agreed that there will be no glorification of terrorists as martyrs.

- China factor: As China’s profile continues to rise in India’s vicinity, New Delhi would like to enhance India’s presence by developing infrastructure and connectivity projects in the country. India has found it difficult to counter Chinese influence in Myanmar.

- Project Delays: India is losing friends because of widespread discontent over continuing delay in completion of flagship projects — Kaladan and the India-Myanmar-Thailand trilateral highway. Conceived over a decade back, they are scheduled to be completed by 2019.

- Inadequate public awareness about the recent projects on IT and agriculture that our government completed on time. Officials need to develop an effective communication strategy, and a new management mechanism that fast-tracks the flagship projects.

- Despite mutual consensus on the value of people-to-people exchanges, actual progress is negligible due to the absence of an enabling instrument.

Way forward:

- The various projects undertaken by India have not been completed in time. As a result, India has not got due credit. It is crucial for India to focus on timely delivery of projects to improve its legitimacy.

- It is essential that the two countries immediately start negotiating transit and other agreements for the smooth movement of goods and vehicles for optimal use of the infrastructure — even though such traffic may not flow before 2020.