Contents

- RBI opens Rs. 50,000-cr liquidity tap for mutual funds

- India among top 3 military spenders: report

- 56% more water in reservoirs than last year

- UN warns of a ‘human rights disaster’

- Cost of doing business to see significant rise

RBI OPENS RS. 50,000-CR LIQUIDITY TAP FOR MUTUAL FUNDS

Focus: GS-III Indian Economy, Prelims

Why in news?

- In a bid to address concerns arising out of Franklin Templeton’s decision to wind up six debt funds, the Reserve Bank of India on 27th April 2020, decided to open a special liquidity facility for mutual funds (SLF-MFs) of ₹50,000 crore. The move is aimed at easing the liquidity pressure that mutual funds face.

- The liquidity facility provided by the RBI is a good confidence-building measure for mutual fund investors and will help in the normal functioning of the market.

Why was this necessary?

- Heightened volatility in capital markets in reaction to COVID-19 has imposed liquidity strains on mutual funds.

- The stress is, however, confined to the high-risk debt MF segment at this stage; the larger industry remains liquid.

- The decision by Franklin Templeton to voluntarily wind up six of their debt funds has shaken up the debt mutual fund industry.

Read More about the Franklin Templeton move at: https://www.legacyias.com/centre-should-act-now-on-franklin-templeton-issue/

Details of RBI’s Move

- The RBI has opened the SLF-MFs in the backdrop of Franklin Templeton Mutual Fund deciding to close six debt schemes, citing lack of liquidity in the debt market and unprecedented redemptions in these yield-oriented schemes.

- Under the SLF-MF, the RBI will conduct repo operations of 90-day tenor at the fixed repo rate. The SLF-MF is on tap and open-ended, and banks can submit their bids to avail themselves of funding on any day.

- The special repo window will be available to all LAF (liquidity adjustment facility) eligible banks against eligible collateral and can be availed of only for on-lending to mutual funds (MFs).

- The central bank has stated that it remains vigilant and will take whatever steps are necessary to mitigate the economic impact of Covid-19 and preserve financial stability.

What are Mutual Funds?

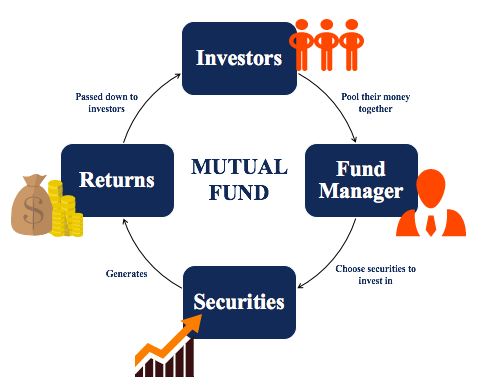

- A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets.

- Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors.

- A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

- Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds, and other securities.

Types of Mutual Funds

The Securities and Exchange Board of India (SEBI) has categorised mutual fund in India under four broad categories:

- Equity Mutual fund scheme: These schemes invest directly in stocks. These schemes can give superior returns but can be risky in the short-term as their fortunes depend on how the stock market performs. Investors should look for a longer investment horizon of at least five to 10 years to invest in these schemes. There are 10 different types of equity schemes.

- Debt Mutual fund schemes: These schemes invest in debt securities. Investors should opt for debt schemes to achieve their short-term goals that are below five years. These schemes are safer than equity schemes and provide modest returns. There are 16 sub-categories under the debt mutual fund category.

- Hybrid Mutual fund Schemes: These schemes invest in a mix of equity and debt, and an investor must pick a scheme based on his risk appetite. Based on their allocation and investing style, hybrid schemes are categorised into six types.

- Solution-Oriented Schemes: These schemes are devised for particular solutions or goals like retirement and child’s education. These schemes have a mandatory lock-in period of five years.

INDIA AMONG TOP 3 MILITARY SPENDERS: REPORT

Focus: GS-III Internal Security, Indian Economy

Why in news?

The global military expenditure rose to $1917 billion in 2019 with India and China emerging among the top three spenders, according to a report ‘Trends in World Military Expenditure, 2019’ by Stockholm International Peace Research Institute (SIPRI).

Details

- India’s tensions and rivalry with both Pakistan and China are among the major drivers for its increased military spending.

- The $71.1 billion spent by India on defence in 2019 was 2.4% of its Gross Domestic Product (GDP).

- India’s expenditure in 2019 was 6.8% more than that in 2018.

- Pensions constitute a significant part.

- In comparison, Pakistan’s military expenditure rose by 70% over the decade 2010–19, to reach $10.3 billion while the military burden increased from 3.4% of GDP in 2010 to 4% in 2019

- In Asia and Oceania, other than India and China, Japan ($47.6 bn) and South Korea ($43.9 bn) were the largest military spenders.

56% MORE WATER IN RESERVOIRS THAN LAST YEAR

Focus: GS-III Environment and Ecology

Do we have enough water?

- Under a lockdown with summer approaching and with the injunction of constant hand washing as a preventative for the spread of COVID-19 the water availability in India was a concern.

- The plentiful rains last year and heavy snowfall in the Himalayan States have ensured that in terms of just volumes, we have 56% more water than we had last year in the reservoirs.

- 132 reservoirs under the Central government out of the 5,000 total reservoirs provide two thirds of the total supply of water across the country – These Reservoirs have 56% more water than last year and 47% higher than the average for the last 10 years.

What has been the feedback from the States?

- Water is a State subject, and Ministers of all States were asked to ensure that there is enough drinking water during the lockdown and the weeks ahead.

- There is enough water to get us through this period, both for drinking and irrigation.

What about Jal Jeevan Mission?

- The Jal Jeevan Mission was launched as a time-bound Mission by hon’ble Prime Minister in September 2019.

- Its urgency is underlined by the fact that COVID-19 is accompanied by lockdowns and the emphasis on hand-washing as a preventative.

- The works have now been divided into those where only retrofitting is required, those where existing water bodies need to be harnessed and green field works.

- The importance of the Mission cannot be emphasised enough under the present circumstances and we are determined that our promise of piped drinking water to every home be fulfilled in the time-frame suggested earlier.

More about Jal Jeevan Mission

- Jal Jeevan Mission, a central government initiative under the Ministry of Jal Shakti, aims to ensure access of piped water for every household in India.

- National Rural Drinking Water Programme (NRDWP) was restructured and subsumed into Jal Jeevan Mission (JJM) – to provide Functional Household Tap Water (FHTC) to every rural household with service level at the rate of 55 lpcd i.e., Har Ghar Nal Se Jal (HGNSJ) by 2024.

Implications

- Supply of water to all households is a basic necessity

- Reduction in water borne diseases which was due to due to consumption of substandard water

Challenges

- Critical situation of Decrease in ground water table.

- Water demand and supply is a miss match

- Contamination of local ground level sources of water like, ponds lakes and wells.

- Sustaining the provision of water to all households is a challenge, not just starting it.

Way forward:

- Integrated water management Programme from school level.

- Jan andolan for Conservation of water,

- Curb ground water and surface water pollution

- Stopping the over exploitation of ground water

- Ground water mapping, using GIS enabled systems, use of ICT to track the availability of water should be done by government.

UN WARNS OF A ‘HUMAN RIGHTS DISASTER’

Focus: GS-II Governance

Why in news?

The UN rights chief warned on 27th April, that countries flouting the rule of law in the name of fighting the novel coronavirus pandemic risk sparking a “human rights disaster”.

UN High Commissioner for Human Rights called upon countries to refrain from violating fundamental rights “under the guise of exceptional or emergency measures”.

How are Human Rights violated according to the UN Statements?

- Emergency powers should not be a weapon that governments can wield to quash dissent, control the population, and even perpetuate their time in power.

- They should be used to cope effectively with the pandemic — nothing more, nothing less.

- There have been numerous reports from different regions that police and other security forces have been using excessive, and at times lethal, force to make people abide by lockdowns and curfews and such violations have often been committed against people belonging to the poorest and most vulnerable segments of the population. This is clearly an unacceptable and unlawful response.

- The UN rights chief also warned that efforts to rein in dangerous misinformation around the pandemic was in some cases being used as an excuse to crack down on legitimate free speech.

- Undermining rights such as freedom of expression may do incalculable damage to the effort to contain COVID-19 and its pernicious socioeconomic side-effects.

Way forward suggested:

Any exceptional measures or state of emergencies introduced in the name of fighting COVID-19 should be subject to proper parliamentary, judicial and public oversight to avoid abuses.

COST OF DOING BUSINESS TO SEE SIGNIFICANT RISE

Focus: GS-III Indian Economy

Why in news?

As COVID-19 takes its toll on the economy and on human lives, the cost of doing business is set to go up as companies gear up to adhere to new safety and hygiene standards in their daily operations despite likely scaled down business activity and lower earnings.

Why would the Cost of Daily Operations increase?

- Extra expenditure on PPE for employees and maybe even customers.

- Lesser number of people workers/customers with the same shop area/workspace will reduce efficacy and income.

- Companies will be forced to operate at sub-optimal levels due to lack of demand and fewer employees.

- Businesses may have to redesign services to deliver non-contact service and maintain social distancing norms etc.

- May have to deploy more manpower to enforce safety and hygiene norms.

- Airlines and airport operators, other transportation firms will also have to bear extra costs to take on board fewer passengers.