Contents

- Think smarter: Smart Cities Mission

- GST cut can put auto sales on fast track to revival

- Why cash can save the Rural Jobs Scheme?

THINK SMARTER: SMART CITIES MISSION

Focus: GS-III Science and Technology

Introduction

One of the lessons that the pandemic has taught a civilisation is that even the most technologically capable nations cannot easily protect the lives and health of their citizens from a medieval plague.

Details of Inadequacy in Smart Cities Mission

- Only 1.18% of the 5,861 projects okayed since 2015 in the Smart Cities Mission are for augmenting infrastructure and capability in health, accounting only to 1.03 per cent of the volume invested by the Mission. (For comparison, the total health expenditure in the US in 2017 was 17.9 per cent of GDP)

- Of the 30 municipal jurisdictions which account for 79 per cent of cases, 17 are smart cities — and, of them, only 7 have invested Mission funds directly in health.

Reading into the issue with India’s Smart Cities Mission

- As the Mission clarifies on its website, a smart city has no absolute definition. The term originated among Western planners to describe a city which uses Internet of Things data to optimise its services.

- The Indian ministry of housing and urban affairs mentions this aspect in only one of the eight features it lists for a smart city.

- The rest focus on urban planning strategies for quality of life, such as reducing pollution and improving land use.

- Health is mentioned only in one point, which discusses urban identity conferred through local economic activities like making sports goods and hosiery, and providing medical facilities.

What are Smart Cities?

- The answer is, there is no universally accepted definition of a smart city. It means different things to different people.

- The conceptualisation of Smart City, therefore, varies from city to city and country to country, depending on the level of development, willingness to change and reform, resources and aspirations of the city residents.

- A smart city would have a different connotation in India than, say, Europe. Even in India, there is no one way of defining a smart city.

Definition of “Smart Cities” according to Smart Cities Mission

- Some definitional boundaries are required to guide cities in the Mission.

- In the imagination of any city dweller in India, the picture of a smart city contains a wish list of infrastructure and services that describes his or her level of aspiration.

- To provide for the aspirations and needs of the citizens, urban planners ideally aim at developing the entire urban eco-system, which is represented by the four pillars of comprehensive development-institutional, physical, social and economic infrastructure.

- This can be a long-term goal and cities can work towards developing such comprehensive infrastructure incrementally, adding on layers of ‘smartness’.

Smart City Features

Some typical features of comprehensive development in Smart Cities are described below:

- Promoting mixed land use in area-based developments–planning for ‘unplanned areas’ containing a range of compatible activities and land uses close to one another in order to make land use more efficient.

- Housing and inclusiveness – expand housing opportunities for all;

- Creating walkable localities –reduce congestion, air pollution and resource depletion, boost local economy, promote interactions and ensure security.

- Preserving and developing open spaces – parks, playgrounds, and recreational spaces in order to enhance the quality of life of citizens, reduce the urban heat effects in Areas and generally promote eco-balance;

- Promoting a variety of transport options – Transit Oriented Development (TOD), public transport and last mile para-transport connectivity;

- Making governance citizen-friendly and cost effective – increasingly rely on online services to bring about accountability and transparency, especially using mobiles to reduce cost of services and providing services without having to go to municipal offices.

- Forming e-groups- e-Groups to easy governance and to listen to people and obtain feedback and use online monitoring of programs and activities with the aid of cyber tour of worksites;

- Giving an identity to the city – based on its main economic activity, such as local cuisine, health, education, arts and craft, culture, sports goods, furniture, hosiery, textile, dairy, etc;

- Applying Smart Solutions to infrastructure and services in area-based development in order to make them better.

Smart Cities Mission

- National Smart Cities Mission is an urban renewal and retrofitting program by the Government of India with the mission to develop smart cities across the country, making them citizen friendly and sustainable.

- The Union Ministry of Urban Development is responsible for implementing the mission in collaboration with the state governments of the respective cities.

- While the mission initially included only 100 cities, the government later announced to expand the mission to all 4,000 cities in India.

-Source: Indian Express

GST CUT CAN PUT AUTO SALES ON FAST TRACK TO REVIVAL

Focus: GS-III Indian Economy

Introduction

- The Automobile manufacturing industry is gradually restarting as curbs put in place to check the spread of coronavirus are eased.

- Automobiles comprise passenger cars and vans; two-wheelers, including motorcycles, scooters, and mopeds; commercial vehicles; three-wheelers and quadricycles.

Auto Sales in the last Fiscal Year

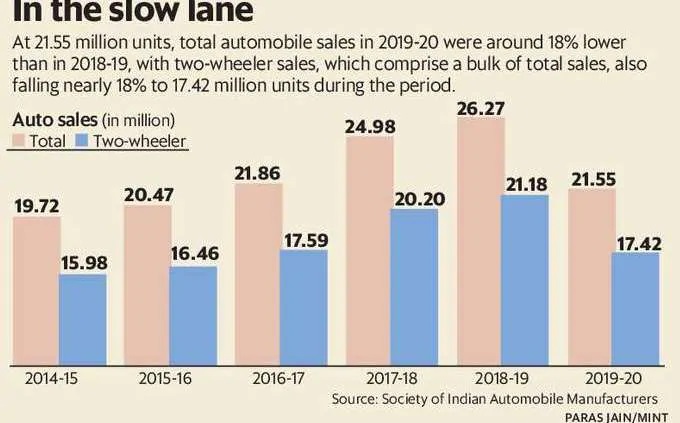

- The total sales in 2019-20 were around 18% lower at 21.55 million units than in 2018-19.

- Part of the drop in the sales was due to the lockdown introduced in late March, but sales had been falling right through 2019-20.

- This was a reflection of a slowdown in the Indian economy and a lack of confidence among people in their economic future to be able to pay equated monthly instalments.

What can the govt do to revive auto sales?

- The Centre can reduce the goods and services tax (GST) on automobiles.

- This reduction will be especially important for two-wheelers, as two-wheeler prices have of late gone up by 30% because of a series of new mandates such as: Bharat Stage-VI norms, rise in insurance costs and the introduction of new safety features.

Wouldn’t this mean the Centre earning lower taxes?

- Yes, it would mean the Centre earning lower taxes for every vehicle sold.

- However, what it would lose per vehicle sold, it is more than likely to make up through an increase in sales because of lower prices.

How else will GST rate cuts benefit the govt?

- Increased auto sales will mean better GST collections than if the rates are not reduced.

- Also, higher sales will mean more production and higher excise duty collections.

- Higher sales will mean more work for contract workers, and more work will mean income and once they spend this money buying goods and services, the government will earn GST through these means too.

- With higher sales, the auto and auto-ancillary sector will end up paying higher income taxes as well

Any other factors to be taken into account?

- State governments have to be convinced about the move given that the GST Council, which also comprises finance ministers of states, decides the GST rates.

- Further, the supply chains of automakers should work.

- So, it is important for the Centre to speak to them and know how they are placed on ramping up production to meet the likely higher demand due to a cut in GST rates. Cutting GST rates is likely to provide a real stimulus to the economy.

What is Goods & Services Tax (GST) in India?

- In simple words, Goods and Service Tax (GST) is an indirect tax levied on the supply of goods and services.

- GST is one indirect tax for the entire country.

- The Goods and Service Tax Act was passed in the Parliament on 29th March 2017.

- The Act came into effect on 1st July 2017; Goods & Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

- GST has replaced many Indirect Taxes in India, and Goods and Service Tax Law has replaced many indirect tax laws that previously existed in India.

What are the components of GST?

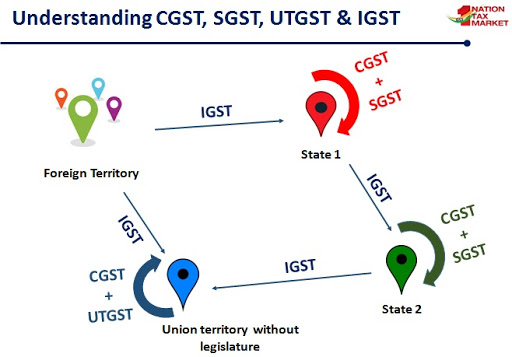

- There are 3 taxes applicable under this system: CGST, SGST & IGST.

- Central Goods and Service Tax CGST: Collected by the Central Government on an intra-state sale (Eg: transaction happening within Maharashtra)

- State Goods and Service Tax SGST: Collected by the State Government on an intra-state sale (Eg: transaction happening within Maharashtra)

- Integrated Goods and Services Tax IGST: Collected by the Central Government for inter-state sale (Eg: Maharashtra to Tamil Nadu)

CGST

Revenue under CGST is collected by the Central Government.

CGST subsumes the below given central taxations and levies:

- Central Excise Duty

- Services Tax

- Central Sales Tax

- Excise Duty

- Additional Excise Duties Countervailing Duty (CVD)

SGST

Revenue under SGST is collected by the State Government.

SGST subsumed the following state taxations:

- Luxury Tax

- State Sales Tax

- Entry tax

- Entertainment Tax

- Levies on Lottery

IGST

- IGST is charged when there is movement of goods from one state to another state.

- The revenue will be collected by the central government and accordingly will be shared between the Union and states in the manner prescribed by Parliament or GST Council.

GST Council

- GOODS & SERVICES TAX COUNCIL IS A CONSTITUTIONAL BODY for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

- As per Article 279A (1) of the amended Constitution, the GST Council has to be constituted by the President within 60 days of the commencement of Article 279A.

- The Constitution (One Hundred and Twenty-Second Amendment) Bill, 2016, for introduction of Goods and Services tax in the country was introduced in the Parliament and passed by Rajya Sabha on 3rd August, 2016 and by Lok Sabha on 8th August, 2016.

- GST Council is an apex member committee to modify, reconcile or to procure any law or regulation based on the context of goods and services tax in India.

- The GST council is responsible for any revision or enactment of rule or any rate changes of the goods and services in India.

The council contains the following members:

- Union Finance Minister (as chairperson)

- Union Minister of States in charge of revenue or finance (as member)

- The ministers of states in charge of finance or taxation or other ministers as nominated by each states government (as member).

GST Council makes recommendations on:

- Taxes, cesses, and surcharges levied by the Centre, States and local bodies which may be subsumed in the GST;

- Goods and services which may be subjected to or exempted from GST;

- Model GST laws, principles of levy, apportionment of IGST and principles that govern the place of supply;

- Threshold limit of turnover below which goods and services may be exempted from GST;

- Rates including floor rates with bands of GST;

- Special rates to raise additional resources during any natural calamity;

- Special provision with respect to Arunachal Pradesh, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand; and

- Any other matter relating to the goods and services tax, as the Council may decide.

GST Act

- Goods and Services Tax (GST) Act came into effect in 2017.

- Goods and Services Tax (GST) was introduced by the Government of India to boost the economic growth of India. GST is considered to be the biggest taxation reform in the history of Indian economy.

- The power to make any changes in the GST law is in the hands of GST Council. GST Council is headed by the Finance Minister. One hundred and first amendment act, 2016 introduced the GST in India from July 2017.

-Source: Livemint

WHY CASH CAN SAVE THE RURAL JOBS SCHEME?

Focus: GS-II Social Justice

Why in news?

With millions of workers returning to rural India, the government has naturally (and belatedly) committed to a major boost in the outlay for the National Rural Employment Guarantee Act (NREGA) this year

Evolution of NREGA: What has changed with time?

NREGA 0.0: When the demand for a state employment guarantee Act (based on a state Act in Maharasthra) was raised, Centre was to play a role. Rajasthan’s success in implementing drought relief works provided the springboard for reviving the demand for a national NREGA.

NREGA 1.0 (2005-2009): The NREGA, enacted in 2005, was adapted from a similar model which was in place in Maharashtra.Important lessons learnt from grassroots organizations in Rajasthan were incorporated into the NREGA: muster rolls at the worksite and payment of wages publicly at the worksite.

They enhanced transparency and kept corruption under control.

NREGA 2.0: In 2008, the central government ordered a transition to bank and post office payments to reduce corruption. The main highlight of NREGA 2.0 was implementation of technology like e-muster rolls (eMRs) and e-fund management system (e-FMS) and GPS-enabled biometric attendance to geo-tagged NREGA assets. NREGA 2.0 was also soon burdened with Aadhaar. Payments were held up if Aadhaar numbers were not linked to the job card and/or bank account.

NREGA 2014 onwards: When the transition to bank payments for NREGA wages was made, we had observed that while they provide a protection against corruption, three channels of corruption remain open: extortion, collusion and fraud.

There is anecdotal evidence that collusion (between NREGA functionaries and “ghost” workers) is on the rise. Ghost workers are non-workers whose names are entered on eMRs by NREGA functionaries for a cut without them actually working.

NREGA in times of COVID: The first COVID relief package announced on 26 March provided double rations for three months for public distribution system (PDS) ration cardholders, a one-off payment of ₹1,000 for social security pensioners and ₹1,500 in three instalments for female Jan Dhan Yojana account holders. Many NREGA households would have lost remittance income that came from migrant family members. The crash in employment in April 2020 due to the lockdown hurt them further. The decision to keep NREGA works remain open during the monsoon is also a good move.

Reviving Old Features that might help:

- Large worksites should be opened proactively in each gram panchayat without waiting for anyone to apply for work. Such worksites should remain open for the coming months.

- Anyone who shows up to work should be allowed to work. The requirement of demanding work formally must be relaxed. For this, uniquely numbered muster rolls issued to sarpanches and panchayat secretaries, without pre-printed names, can also be considered.

- States could be allowed to pay wages as cash-in-hand, bypassing the banking system. Many are horrified at the suggestion that we revert to cash payments (it has been projected as the main cause of corruption), but there are important reasons to consider it now.

- Withdrawing cash right now in rural areas is an ordeal for poor people, and the payment system for many welfare schemes, including NREGA, is beginning to resemble a popular visual trope from India. Considering that when Cash payment was the norm during the NREGA 1.0 days, some states were able to control corruption, Cash Payments can be revived.

Click Here to read more about the MGNREGA Scheme

Click Here to read more about the JAM Trinity

-Source: Livemint