Contents

- The challenge of catching elusive taxpayers

- Reversing health sector neglect with a reform agenda

- India does need a Fiscal Council

- India’s inflation targeting raises tough questions

THE CHALLENGE OF CATCHING ELUSIVE TAXPAYERS

Focus: GS-III Indian Economy

Introduction

- India’s tax collection is set to decline sharply in 2020 because of the decline in national income and fall in employment due to COVID-19.

- Thus, the fiscal deficit in the budget is set to rise unless other expenditures are cut.

- However, there are committed expenditures which cannot be curtailed and the deficit in the budget is set to climb to a new high for 2020-21. So, there is no option but to try and collect more taxes.

Recently in news:

The Prime Minister unveiled income tax reforms to make the system faceless, painless and seamless.

He stated that 15 million people pay income tax out of a population of more than 1.35 billion.

Drop in number of taxpayers

- The number of tax filers has increased but the number of taxpayers has dropped. This is a result of the tax concession offered in the Budget — those filing a return up to ₹5 lakh do not have to pay a tax.

- Despite an increase in population and the laws introduced in the last six years to bring the rich into the tax net, there has been little change in the number of taxpayers.

- The fact that the direct tax to GDP ratio in percentage terms is stagnating at about 5.5% is another indication of this.

- A 2016 report says the top 10% of Indians earned 55% of the nation’s incomes.

- If these people could be brought under the income tax net and they paid their taxes honestly, at current tax rates, income tax to GDP ratio alone would have been about 18%. Add to that the collection from other direct taxes, like corporate tax, and the figure would be more than 20%.

- More than 23,000 high net worth individuals left the country in five years up to 2019.

Steps in the right direction

- A considerable part of the tax filing process was computerised when e-filing and, earlier, PAN were introduced. These measures tried to cajole people into filing honest returns.

- The Government has decided to hand over the process of taxation to computers – The computer will decide who will assess the tax return of an individual and during the different stages of a case, different officers will be involved. (So that no nexus can be formed between the taxpayer and the officer involved in passing the return.)

Concerns

The department is grossly understaffed and officers have inadequate time to scrutinise cases. A few thousand officers have to deal with lakhs of cases.

-Source: The Hindu

REVERSING HEALTH SECTOR NEGLECT WITH A REFORM AGENDA

Focus: GS-II Social Justice

Introduction

- Two countries which lead in the COVID-19 cases tally in the world today, namely the United States (first) and India (third), are also the ones where the need for health-care reform post COVID-19 has been most keenly felt.

- This is due to the lack of effective universal health coverage (UHC) in these countries, which has broadened concerns beyond the frontiers of an epidemic response into the larger domain of access, equity, and quality in health care.

Legacy implications and UHC

- Certain entrenched characteristics of these health systems that have accrued over decades tend to dictate the terms of further evolution and lead to a number of compromises.

- The long legacy itself comprises a path-dependent trajectory that precludes far-reaching health-care reform.

For example: The US Affordable Care Act (ACA) envisaged a number of overarching measures to expand health insurance and improve access; however, the foundational aspects of U.S. health care, such as a fragmented private insurance landscape and a love for expensive specialised care, could hardly be altered due to their entrenched nature.

India’s attempts

- The government has looked poised to employ Ayushman Bharat–Pradhan Mantri Jan Arogya Yojana (AB-PM-JAY) health insurance as the tool for achieving UHC, and such calls have only grown stronger in the context of the COVID-19 pandemic.

- Plans are reportedly under way to extend coverage to the non-poor population under AB-PM-JAY, which currently covers the bottom 40% of the population.

- Taking the health insurance route to UHC driven by private players, rather than strengthening the public provisioning of health care, is reflective of the non-negotiability of private health care in India.

- This could have several unwanted consequences, which merits attention.

- Stark maldistribution of health-care facilities (almost two-thirds of corporate hospitals concentrated in major cities) and low budgetary appropriations for insurance could mean that universal insurance does not translate to universal access to services.

Regarding National Digital Health Mission (NDHM)

- Integration and improved management of patient and health facility information are very welcome.

- However, in the absence of robust ground-level documentation practices and its prerequisites, it would do little more than helping some private players and adding to administrative complexity and costs like the electronic health records did under the US ACA.

Other Concerns

- Covering the remaining population under the AB-PM-JAY presents massive fiscal and design challenges.

- Turning it into a contributory scheme based on premium collections would be a costly and daunting undertaking, given the huge informal sector and possible adverse selection problems.

- Meeting requirements through general revenue financing would greatly strain the exchequer and looks very unlikely especially in the immediate aftermath of the pandemic.

Click Here to read more about National Digital Health Mission (NDHM)

-Source: The Hindu

INDIA DOES NEED A FISCAL COUNCIL

Focus: GS-III Indian Economy

Introduction

- The fiscal situation in India has been under severe stress even before COVID-19 and the novel coronavirus pandemic has only worsened it.

- While the prevailing exceptional circumstance warrants loosening of purse strings, it is necessary that the government must return to a credible fiscal consolidation path once the crisis gets over.

Details

- The fiscal deficit of the Centre in 2019-20 as estimated by the Controller General of Accounts (CGA) was 4.6%, 0.8 percentage point higher than the revised estimate.

- For the current year, even without any additional fiscal stimulus, the deficit is estimated at about 7% of GDP as against 3.5% estimated in the Budget due to a sharp decline in revenues.

- The consolidated deficit of the Union and States could be as high as 12% of GDP and the overall debt could go up to 85%.

Need for transparency

- The report of the Comptroller and Auditor General (CAG) of India in 2018 on the compliance of the Fiscal Responsibility and Budget Management (FRBM) Act for 2016-17, highlights various obfuscations done to keep the liabilities hidden.

- In order to make the Budgets comprehensive, transparent and accountable, the 13th Finance Commission recommended that a committee be appointed by the Ministry of Finance which should eventually transform itself into a Fiscal Council to conduct an annual independent public review of FRBM compliance, including a review of the fiscal impact of policy decisions on the FRBM roadmap.

- The FRBM Review Committee too made a similar recommendation underlining the need for an independent review by the Finance Ministry appointing the Council.

- The 14th Finance Commission recommended the establishment of an independent Fiscal Council which should be appointed by and reporting to Parliament by inserting a new section in the FRBM Act – as a Council created by the Finance Ministry and reporting to it can hardly be expected to be independent.

The mandate

A Fiscal Council is an independent fiscal institution (IFI) with a mandate to promote stable and sustainable public finances.

- An unbiased report to Parliament helps to raise the level of debate and brings in greater transparency and accountability.

- Costing of various policies and programmes can help to promote transparency over the political cycle to discourage populist shifts in fiscal policy and improve accountability.

- Scientific estimates of the cost of programmes and assessment of forecasts could help in raising public awareness about their fiscal implications and make people understand the nature of budgetary constraint.

- The Council will work as a conscience keeper in monitoring rule-based policies, and in raising awareness and the level of debate within and outside Parliament.

Diverse role, more acceptance

- According to the International Monetary Fund (IMF), there were 36 countries with IFIs in 2014 and more have been established since.

- While most of the IFIs are in advanced countries, emerging economies too have also shown growing interest in them.

Although their common agenda has been to function as watchdogs, there is considerable diversity in their structure and functions.

important tasks of these IFIs include:

- Independent analysis, review and monitoring and evaluating of government’s fiscal policies and programmes;

- Developing or reviewing macroeconomic and/or budgetary projections;

- Costing of budget and policy proposals and programmes;

- Presenting policy makers with alternative policy options.

Conclusion

- When the markets fail, governments have to intervene. What do we do when the governments fail? It is here that we need systems and institutions to ensure checks and balances. In that respect, a Fiscal Council is an important institution needed to complement the rule-based fiscal policy.

- While we cannot state that the FRBM Act has been an unqualified success, it has also not been an abject failure either. The counterfactual will show that things would have been much worse without it, and it has helped to raise the awareness of government, legislators and the public at large.

- Similarly, the Fiscal Council will help in improving comprehensiveness, transparency and accountability.

-Source: The Hindu

INDIA’S INFLATION TARGETING RAISES TOUGH QUESTIONS

Focus: GS-III Indian Economy

What is the new monetary framework?

- The new monetary framework was an outcome of the agreement between the Reserve Bank of India (RBI) and the central government signed in 2015.

- The agreement explicitly made inflation targeting the objective of the MPC while using the repo rate as the instrument for it.

- The Reserve Bank’s MPC was given the target of keeping inflation at 4% with a tolerance limit of 2%.

- This meant that inflation should be between 2% and 6%.

- The target was in contrast with the multiple indicator approach that predated this framework where the central bank focused on both growth and price stability.

How does the MPC target inflation?

- Every two months, the Reserve Bank’s MPC has a review meeting where they discuss the likely inflation and growth estimates over the coming months.

- Based on this review, the MPC targets inflation using the policy rate, or the repo rate. When inflation is higher than the inflation target set by the central bank, then the MPC must increase the repo rate. On the other hand, when the actual inflation is lower than the target, the MPC could decrease the repo rate. The

- MPC looks at consumer price inflation (CPI) as the inflation target that it must keep between 2% and 6%.

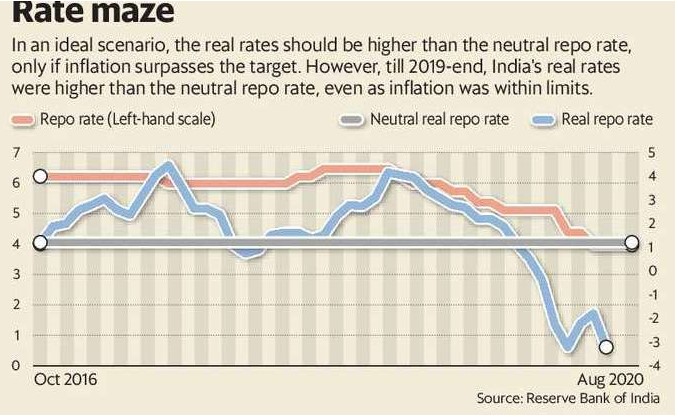

How is the neutral real rate defined?

- The Real Rate = Repo rate minus inflation.

- A neutral real rate is the rate of interest at which the monetary policy is neither accommodative nor too tight.

- The neutral real rate concept is important and significant for inflation targeting.

- If inflation is higher than the target, we should have a higher real rate than the neutral real rate and vice versa.

Has inflation targeting failed in India?

- There has been a shift in the approach towards the conduct of monetary policy as many nations gradually shift from inflation targeting.

- Indeed, inflation in India has been subdued since the new monetary policy framework was brought in.

- Many view this as a sign of its success in India while others point at the tight policy and its adverse impact on India’s growth rate as a sign of problems with the framework, which has come at the cost of growth.

-Source: Livemint