Contents

- Standing External Advisory Committee (SEAC)

- EPF cap raised by FM, Discussing GST on fuel

- Indus water panel holds meeting

- China, Russia: New regional security dialogue platform

- India abstains in UNHRC vote on Sri Lanka

STANDING EXTERNAL ADVISORY COMMITTEE (SEAC)

Context:

The Reserve Bank of India (RBI) has set up a five-member committee – called the Standing External Advisory Committee (SEAC) – for evaluating applications for universal banks and small finance banks.

Relevance:

GS-III: Indian Economy (Economic Development of India, Macroeconomics, Banking and NBFCs)

Dimensions of the Article:

- About the Standing External Advisory Committee (SEAC)

- Background on Setting up of SEAC

- What are Universal Banks?

- What are Small Finance Banks (SFBs)?

About the Standing External Advisory Committee (SEAC)

- The Standing External Advisory Committee (SEAC) comprising eminent persons with experience in banking, financial sector and other relevant areas, will evaluate the applications thereafter.

- The SEAC has a three-year tenure.

- The SEAC will evaluate the applications for universal banks and SFBs after the RBI evaluates them first to ensure prima facie eligibility of the applicants.

- The secretarial support to the committee would be provided by RBI’s Department of Regulation.

Background on Setting up of SEAC

- An internal working group of the RBI, proposed an overhaul of the licensing policy for private banks in 2020 and suggested allowing large corporate and industrial houses to float banks in India after suitable amendments to the Banking Regulation Act.

- Although several large corporate houses had applied for a banking license in the past, the regulator had rejected these proposals.

- Eminent economists have criticised the proposal to allow corporate houses to float banking entities, saying it will lead to “connected lending” which, according to them, is “invariably disastrous”.

What are Universal Banks?

- Universal Banks are those banks which undertake multiple financial activities under one roof, thereby creating a financial supermarket (like: commercial banks, Financial Institutions, Non-Banking Financial Companies (NBFCs)).

- Universal Banks focus on leveraging their large branch network and offer a wide range of services under a single brand name/Bank’s name.

- According to the guidelines on on-tap licensing of universal banks issued in August 2016, resident individuals and professionals having 10 years of experience in banking and finance at a senior level are eligible to promote universal banks.

- However, large industrial houses are excluded as eligible entities but are permitted to invest in the banks up to 10%.

- A non-operative financial holding company (NOFHC) has been made non-mandatory in case of promoters being individuals or standalone promoting/converting entities who/which do not have other group entities. NOFHC means a non-deposit taking NBFC.

What are Small Finance Banks (SFBs)?

- Small Finance Banks (SFBs) are the financial institutions which provide financial services to the unserved and unbanked region of the country.

- SFBs primarily undertake basic banking activities of acceptance of deposits and lending to small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

- It can also undertake other non-risk sharing simple financial services activities, not requiring any commitment of own funds, such as the distribution of mutual fund units, insurance products, pension products, etc.

- The small finance bank can also become an Authorised Dealer in foreign exchange business for its clients’ requirements.

-Source: Indian Express

EPF CAP RAISED BY FM, DISCUSSING GST ON FUEL

Context:

- Finance Minister of India said that the Centre is ready to consider bringing fuel under the Goods and Services Tax regime if the States bring up the issue at the GST Council.

- The Minister also introduced 127 amendments to the Finance Bill, 2021, which was passed by the Lok Sabha which included an income tax break for the proposed development finance institution to fund infrastructure and a tweak in the proposed tax provisions for employees’ provident fund (EPF) contributions.

Relevance:

GS-III: Indian Economy (Economic Development of India, Macroeconomics- Taxation)

Dimensions of the Article:

- About the Changes in EPF Tax

- Bringing Fuel under GST

- Impact of bringing Fuel under GST

- Current Pricing of Petrol and Diesel

About the Changes in EPF Tax

- The government has also introduced an amendment in the Budget proposal to tax income on employee contributions of more than Rs. 2.5 lakh a year into Provident Fund accounts.

- The FM said that they intend to raise this limit to Rs. 5 lakhs in those cases, and only in those cases where there is no contribution by the employer in the EPF account.

Bringing Fuel under GST

- Economists have said that bringing petrol and diesel under the goods and services tax is an unfinished agenda of the GST framework and getting the prices under the new indirect taxes framework can help.

- Centre and states are loathing to bring crude oil products under the GST regime as sales tax/VAT (value added tax) on petroleum products is a major source of own tax revenue for them.

- Thus, there is lack of political will to bring crude under the ambit of GST.

- At present, states choose to levy a combination of ad valorem tax, cess, extra VAT/surcharge based on their needs and these taxes are imposed after taking into account the crude price, the transportation charge, the dealer commission and the flat excise duty imposed by the Centre.

Impact of bringing Fuel under GST

- A growth in the consumption – diesel going up 15 per cent and petrol by 10 per cent – has been used to assess the Rs 1 lakh crore fiscal impact of getting petroleum prices under GST.

- States, which have the highest share of tax revenues at present, will be the biggest losers if the system shifts to GST.

- However, such a move will help consumers pay up to Rs 30 less per liter of fuel. This is because he highest slab under the existing GST rates is 28%. Even if petrol and diesel were to be taxed at the highest rate, the post-tax price will be much lower than what it is currently.

Loss of autonomy

- Once petrol and diesel are subsumed within the GST, both the Centre and states will have to give away the current autonomy they enjoy with these taxes which serve twin purposes of counter-cyclical interventions in the realm of both politics and economy.

- For example, both the Centre and the states increased taxes on petrol and diesel to compensate for revenue loss during the lockdown.

- The central taxes on petrol and diesel are a fixed amount per litre rather than a fraction of the base price, which is how GST is levied currently.

- Also, the current regime allows individual state governments to change their taxes – poll bound Assam has reduced taxes on petrol-diesel – a leeway which will not exist once they are subsumed within GST, as taxes will have to be uniform across the country.

Current Pricing of Petrol and Diesel

- As per the latest (as of March 2021) price-build of petrol and diesel: State taxes had a smaller contribution to the retail price than central taxes.

- While the state Value Added Tax (VAT) was just over 10 and 20 rupees, on diesel and petrol respectively, the union excise duties for both petrol and diesel exceeded 30 Rs.

- These headline numbers suggest that the centre is a bigger beneficiary of tax incomes from the sale of petrol and diesel.

- This is because FFC’s earmarked share of states in centre’s revenues applies to what is called the divisible pool of taxes, which excludes cess and other forms of special taxes. Overtime, the weight of cess and other such non-sharable taxes has been increasing in the centre’s gross tax revenue. This, in practice, has meant that the share of states in gross total revenue of the centre has never reached 41% and in fact gone down overtime.

-Source: The Hindu, Hindustan Times

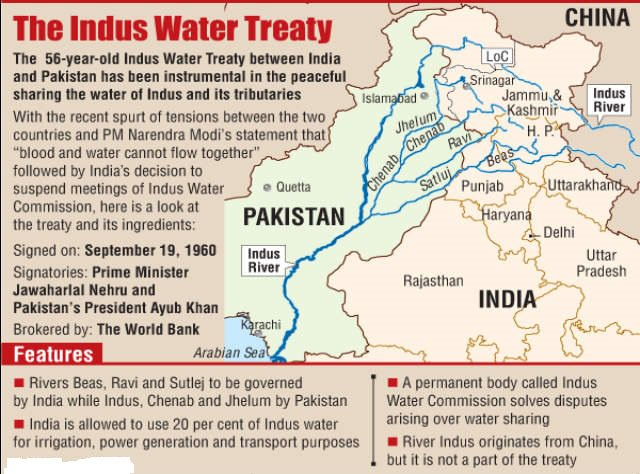

INDUS WATER PANEL HOLDS MEETING

Context:

After a gap of more than two and half years Indian and Pakistani delegations began the 116th Meeting of the Permanent Indus Commission.

The positive backdrop of the talks between the two delegation has indicated that the interaction is likely supported by the reported back channel talks that are taking place between India and Pakistan.

Relevance:

GS-II: International Relations (India and its Neighborhood, International Treaties, Policies and Agreements affecting India’s Interests)

Dimensions of the Article:

- What is the Permanent Indus Commission?

- About the Indus Waters Treaty (IWT)

- Indus River Basin

What is the Permanent Indus Commission?

- The Permanent Indus Commission (PIC) is a bilateral commission consisting of officials from India and Pakistan, created to implement and manage the goals and objectives and outlines of the Indus Waters Treaty (IWT).

- The PIC has experts who look into issues and disputes on the ground over the utilisation of the waters of six rivers of the Indus system.

About the Indus Waters Treaty (IWT)

- The Indus Waters Treaty is a water-distribution treaty between India and Pakistan, brokered by the World Bank, to use the water available in the Indus River and its tributaries.

- The Indus Waters Treaty (IWT) was signed in Karachi in 1960.

- The Treaty gives control over the waters of the three “eastern rivers” — the Beas, Ravi and Sutlej to India, while control over the waters of the three “western rivers” — the Indus, Chenab and Jhelum to Pakistan.

- India was allocated about 16% of the total water carried by the Indus system while Pakistan was allocated the remainder.

- The treaty allows India to use the Western River waters (the ones in Pakistan’s control) for limited irrigation use and unlimited non-consumptive use for such applications as power generation, navigation, floating of property, fish culture, etc.

- It lays down detailed regulations for India in building projects over the western rivers.

- The preamble of the treaty recognises the rights and obligations of each country in the optimum use of water from the Indus system in a spirit of goodwill, friendship and cooperation.

Indus River Basin

- The Indus River (also called the Sindhū) is one of the longest rivers in Asia and the longest river of Pakistan.

- It flows through China (western Tibet), India (Ladakh) and Pakistan.

- Its estimated annual flow is estimated to be twice that of the Nile River making it one of the largest rivers in the world in terms of annual flow.

- The Zanskar river is its left bank tributary in Ladakh.

- In the plains, its left bank tributary is the Panjnad which itself has five major tributaries, namely, the Chenab, Jhelum, the Ravi, the Beas, and the Sutlej.

- Its principal right bank tributaries are the Shyok, the Gilgit, the Kabul, the Gomal, and the Kurram.

-Source: The Hindu

CHINA, RUSSIA: NEW REGIONAL SECURITY DIALOGUE PLATFORM

Context:

China and Russia have proposed setting up a new “regional security dialogue platform” to address security concerns of countries in the region, as their foreign ministers hit out at the United States for “forming small circles to seek bloc confrontation”.

Relevance:

GS-II: International Relations (India and its Neighborhood, International Treaties, Policies and Agreements affecting India’s Interests)

Dimensions of the Article:

- What transpired in the Russia China foreign ministers meet?

- Significance of Russia-China ties and RIC to India

- Russia-India-China Grouping (RIC)

What transpired in the Russia China foreign ministers meet?

- Russia and China proposed the establishment of a regional security dialogue platform to converge a new consensus on resolving the security concerns of countries in the region.

- China and Russia are already part of the Shanghai Cooperation Organisation (SCO) security grouping, which includes India.

- China and Russia have rejected U.S. calls for “a rules-based order” – a call endorsed by the Quad summit – and instead said “all countries should follow the purposes and principles of the Charter of the United Nations” and “uphold true multilateralism, make international relations more democratic, and accept and promote peaceful coexistence and common development of countries with different social systems and development paths.”

Significance of Russia-China ties and RIC to India

- India is in the Shanghai Cooperation Organization (SCO), which is driven by Russia and China and includes four Central Asian countries.

- Pakistan’s membership of SCO and the potential admission of Iran and Afghanistan (as member states) heighten the significance of the SCO for India.

- Growing Chinese influence is testing the informal Russia-China understanding that Russia handles the politico-security issues in the region and China extends economic support.

- The ongoing India-Iran-Russia project for a sea/road/rail link from western India through Iran to Afghanistan and Central Asia, is an important initiative for achieving an effective Indian presence in Central Asia, alongside Russia and China.

- Access to Russia’s abundant natural resources can enhance our materials security — the importance of which has been highlighted by COVID-19.

Russia-India-China Grouping (RIC)

- Russia, India and China (RIC) is a strategic grouping that first took shape in the late 1990s under the leadership of Russia as “a counterbalance to the Western alliance.”

- The group was founded on the basis of ending its subservient foreign policy guided by the USA and renewing old ties with India and fostering the newly discovered friendship with China.

- Together, the RIC countries occupy over 19% of the global landmass and contribute to over 33% of global GDP.

- Even though India, China and Russia may disagree on a number of security issues in Eurasia, there are areas where their interests converge, like, for instance, on Afghanistan. RIC can ensure stable peace in Afghanistan and by extension, in Central Asia.

Trends during formation of RIC

- When the RIC dialogue commenced in the early 2000s, the three countries were positioning themselves for a transition from a unipolar to a multipolar world order.

- The RIC shared some non-West (as distinct from anti-West) perspectives on the global order, such as an emphasis on sovereignty and territorial integrity, impatience with homilies on social policies and opposition to regime change from abroad.

- The initial years of the RIC dialogue coincided with an upswing in India’s relations with Russia and China.

-Source: The Hindu

INDIA ABSTAINS IN UNHRC VOTE ON SRI LANKA

Context:

India abstained from a crucial vote on Sri Lanka’s rights record at the United Nations Human Rights Council in Geneva.

Relevance:

GS-II: International Relations (India and its Neighborhood, International Organizations, International Treaties, Policies and Agreements affecting India’s Interests)

Dimensions of the Article:

- Background to the Resolution

- About the UNHRC Resolution against Sri Lanka

- Results of the UNHRC Voting

Background to the Resolution against Sri Lanka

- Sri Lanka is facing a new resolution calling on it to hold human rights abusers to account and deliver justice to victims of its 26-year civil war (1983-2009).

- The war was mainly a clash between the Sinhalese-dominated Sri Lankan government and the Liberation Tigers of Tamil Eelam (LTTE) insurgent group, the latter of which had hoped to establish a separate state for the Tamil minority.

- Sri Lankan forces and Tamil rebels were accused of atrocities during the war, which killed at least 1,00,000 people.

About the UNHRC Resolution against Sri Lanka

- The draft resolution is based on a report by the Office of the High Commissioner for Human Rights (UN Human Rights) – according to which the government of Sri Lanka had created parallel military task forces and commissions that encroach on civilian functions, and reversed important institutional checks and balances, threatening democratic gains, the independence of the judiciary and other key institutions.

- Sri Lanka abruptly withdrew in 2020 from an earlier UNHRC resolution (Resolution 30/1) on war crimes – under which it had committed, 5 years previously, to a time-bound investigation of war crimes that took place during the military campaign against the Liberation Tigers of Tamil Eelam (LTTE).

Results of the UNHRC Voting against Sri Lanka

- The resolution on ‘Promoting reconciliation, accountability and human rights in Sri Lanka’ was, however, adopted after 22 states of the 47-member Council voted in its favour.

- Sri Lanka was quick to reject the UN move to collect and preserve evidence of war crimes in the country, committed by the armed forces and the LTTE.

- The statement made clear Sri Lanka’s resistance to the process envisaged in the resolution to prosecute war criminals through an international evidence gathering and investigation mechanism.

- Sri Lanka also extended a “warm thank you” for the “solid support” shown by the 11 countries, including China, Pakistan, Russia and Bangladesh, that voted against the resolution, and in support of the Sri Lankan government.

-Source: The Hindu