Contents

- India ranks among lowest in terms of Internet quality

- IIP numbers and Industrial activity in lockdown

- ‘No-Go’ forests cleared for coal mining

- PM-CARES contribution need not be credited to NDRF: SC

- RBI unveils framework for retail payments entity

- Centre targets PSBs’ stake sale

INDIA RANKS AMONG LOWEST IN TERMS OF INTERNET QUALITY

Focus: GS-III Science and Technology, Industry and Infrastructure

Why in news?

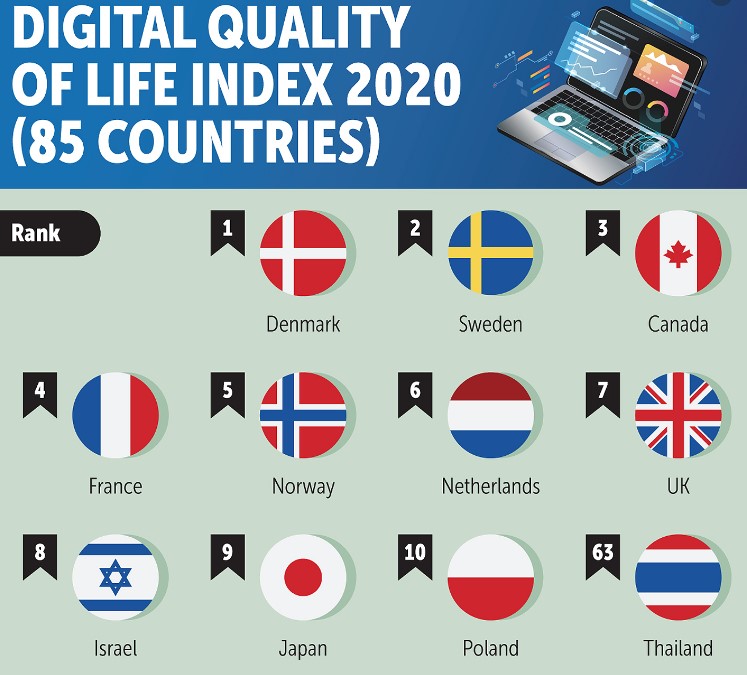

India ranks among the lowest in the world in terms of Internet quality, according to the “Digital Quality of Life Index 2020” global research released by SurfShark.

Details

- “Digital Quality of Life Index 2020”, researches on the quality of a digital wellbeing in 85 countries (81% of the global population), in terms of e-infrastructure.

- India ranks 79th out of 85, ranking below countries including Guatemala and Sri Lanka.

- India makes it into the top 10 in terms of Internet affordability.

- When it comes to e-government, India occupies the 15th place globally, just below countries like New Zealand and Italy.

- Even though India ranks higher is Affordability, it figures in the bottom of the rankings for Internet Quality because of: unstable and slow mobile Internet, hence, dragging it down in the overall Internet quality index

- This year’s Digital Quality of Life Index found that seven of the 10 countries with the highest digital quality of life are in Europe, with Denmark leading among 85 countries.

-Source: The Hindu

IIP NUMBERS AND INDUSTRIAL ACTIVITY IN LOCKDOWN

Focus: GS-III Indian Economy

Why in news?

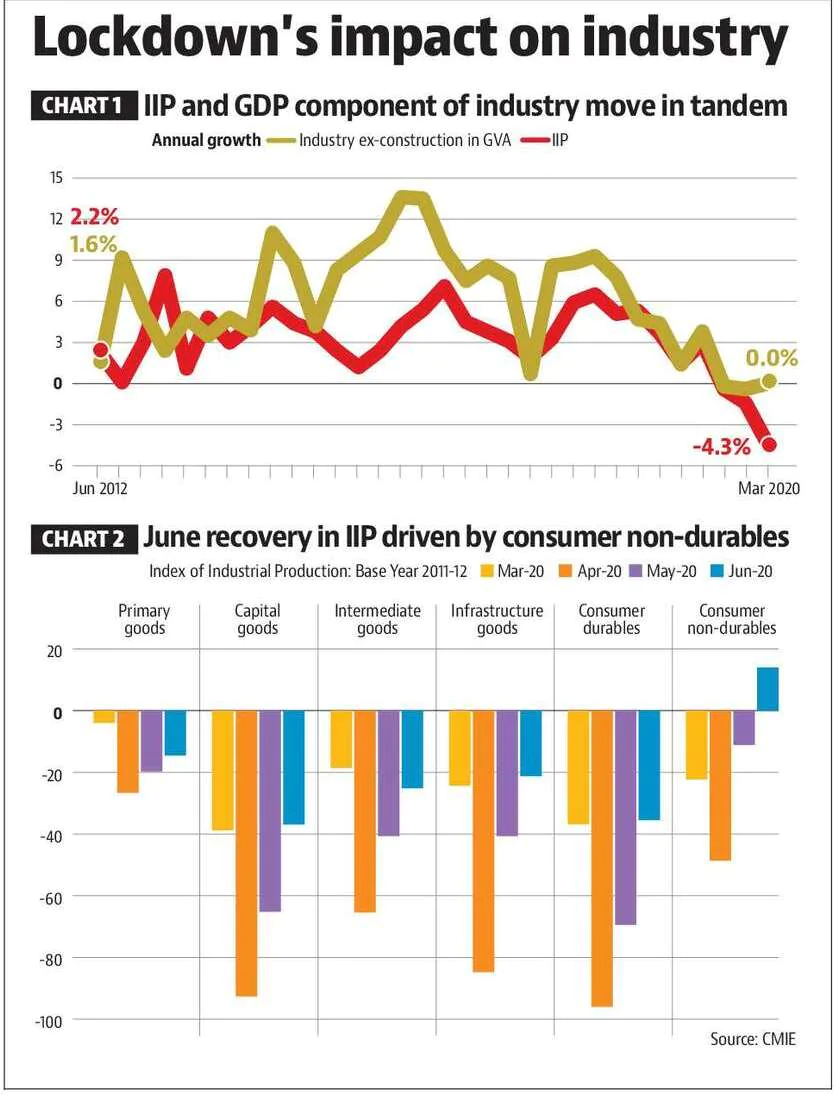

The Index of Industrial Production (IIP) numbers for June completes the data for first quarterly estimates of a major sector’s activity during the lockdown phase.

Details

- The IIP has three components by economic activity: mining and quarrying, manufacturing and electricity.

- These three sub-sectors had a share of around one-fifth of the total Gross Value Added (GVA) in 2019-20.

- Experts suggests India’s June quarter gross domestic product (GDP) could witness a significant annual contraction due to the headwinds in the sub-sectors covered under the IIP alone.

- The overall extent of the fall in GDP will be much greater once the losses in the services sector, which account for more than half of the GVA, are factored in.

- The IIP numbers also suggest that the sequential recovery in June was led by pent-up demand due to the coronavirus disease lockdown, and businesses remain circumspect about a sustainable increase in demand.

The trend

- As is expected, manufacturing has the highest share among these three sub-sectors.

- Growth rate of IIP and these three sectors in GVA move in tandem.

- A Purchasing Managers’ Index (PMI) value less than 50 signifies a contraction in economic activity – (for the month of July was industry 46 and services 34.2).

- Even if one excludes public administration, defence and other services; assuming the government has not cut back on spending, it is more than 40%.

- While the rate of contraction in IIP has been declining – it does not mean that economic activity has returned to last year’s levels.

-Source: Hindustan Times

‘NO-GO’ FORESTS CLEARED FOR COAL MINING

Focus: GS-III Industry and Infrastructure, Environment and Ecology

Why in news?

- Since 2015, of the 49 blocks cleared for coal mining, 9 were in ‘No-Go’ areas, according to a Centre for Science and Environment (CSE) report.

- In 2020, of the 41 blocks put up for auction, 21 feature in the original No-Go list.

- The CSE investigation pointed out that currently India was not utilizing its existing capacity fully and according to the Union Coal Ministry 67% of the mines auctioned since 2015 are not operational yet.

What is ‘No-Go’ Area?

- In 2009, the Environment and Coal Ministries had jointly placed the country’s forested areas under two categories – Go and No-Go zones.

- ‘No-Go’ areas are regions that were classified by the Ministry of Environment and Forests and Climate Change as containing very dense forests and hence closed to coal mining.

- The exercise is aimed at prioritising forest areas under the Forest Conservation Act, 1980.

- ‘No Go’ areas are those having either more than 10 per cent weighted forest cover (WFC) or more than 30 per cent gross forest cover (GFC).

Why no mining in those areas?

- Diversion of forest land, which are rich in flora and fauna, for coal mining in these areas is the main cause of concern as they will have “avoidable serious adverse impact on forests and wildlife”.

- If mining were to continue, even with afforestation and reclamation, it would not be possible to restore the regions biodiversity.

How were No-Go Areas given clearance?

- The government determines which of the dense forests are too ecologically important to leave untouched and which of them are amenable to be opened up using a ‘decision support system software’ that rated forest lands on environmental parameters.

- In some cases, the CSE investigation found that results of the software evaluation were “tweaked” to make ‘No-Go’ land into ‘Go-forests’.

- It also found that officials from the Coal Ministry, the beneficiary organisation, were “deputed” to work with the Forest Survey of India to “rework” conditions and clear forests for mining.

Recently in news: Privatization of coal sector

- Recently, the Prime Minister launched the auction of 41 coal blocks for commercial mining – following the center’s announcement under the Aatmanirbhar Bharat Abhiyan, of opening the coal sector for commercial mining, ending the government monopoly on the sector.

- Foreign Direct Investment (FDI) Policy, 2017 was amended in 2019 to permit 100% FDI under automatic route in coal mining activities.

Click Here to read more about FDI in coal Mining

-Source: Down to Earth, The Hindu

PM-CARES CONTRIBUTION NEED NOT BE CREDITED TO NDRF: SC

Focus: GS-II Governance

Why in news?

The Supreme Court held that funds received into the PM-CARES Fund need not be credited to the National Disaster Response Fund (NDRF) for the fight against the COVID-19 pandemic.

Details

- The court held that there is “no statutory prohibition on individuals to make voluntary contributions to NDRF” under the Disaster Management Act of 2005.

- The government was of the stand that PM-CARES was a “public charitable trust” to which “anyone can contribute”.

The provision of the act (that the Supreme Court left untouched) holds that the National Authority shall recommend guidelines for the minimum standards of relief to be provided to persons affected by disaster, which shall include the minimum requirements to be provided in the relief camps in relation to shelter, food, drinking water, medical cover and sanitation; special provisions to be made for widows and orphans; ex gratia assistance on account of loss of life as also assistance on account of damage to houses and for restoration of means of livelihood, among other things.

Recently in news: Click Here to read more about PMO’s denial RTI plea seeking info on PM-CARES

-Source: The Hindu

RBI UNVEILS FRAMEWORK FOR RETAIL PAYMENTS ENTITY

Focus: GS-III Indian Economy

Why in news?

The Finance Ministry is working to expedite the sale of stakes in four state-owned banks — IDBI Bank, Bank of Maharashtra, Punjab & Sind Bank and UCO Bank — with the aim of completing the disinvestment process in the current fiscal.

Details

- The government is looking to divest its stakes in multiple public sector companies at a time when its finances have taken a hit from significant shortfalls in tax revenue amid the economic fallout of the COVID-19 pandemic.

- The four banks: IDBI Bank, Bank of Maharashtra, Punjab & Sind Bank and UCO Bank, were the only prospects currently being considered for divestment in the banking sector.

‘Strategic sectors’

- The Centre’s Aatmanirbhar Bharat Abhiyan announced as a stimulus package in the wake of the pandemic, had promised a new Public Sector Enterprise Policy that would notify specific strategic sectors in which no more than four PSU players would be allowed, with the rest being privatized, merged or brought under holding companies.

- The Chief Economic Advisor asserted that banking would be categorised as a strategic sector, meaning that apart from four public sector banks, all others would have to be privatised or merged.

The Economic Survey 2020 on Govt. Divestment in PSUs

- The Economic Survey 2020 has aggressively pitched for divestment in PSUs by proposing a separate corporate entity wherein the government’s stake can be transferred and divested over a period of time.

- The performance of privatized firms, after controlling for other confounding factors using the difference in the performance of peer firms over the same period, improves significantly the following privatization.

- Further, the survey has said privatized entities have performed better than their peers in terms of net worth, profit, return on equity and sales, among others.

-Source: The Hindu, Economic Times

CENTRE TARGETS PSBS’ STAKE SALE

Focus: GS-III Indian Economy

Why in news?

The Reserve Bank of India (RBI) released a framework for setting up of a pan-India umbrella entity for retail payments systems.

Details: The Entity for Retail Payments

- The pan-India umbrella entity for retail payments systems is to be incorporated under the Companies Act, 2013, would need to focus on retail payments systems, the RBI said.

- The umbrella entity will set up, manage and operate new payments systems in the retail space comprising ATMs, white label PoS, Aadhaar-based payments and remittance services.

- The entity will operate clearing and settlement systems for participating banks and non-banks, identify and manage relevant risks, monitor retail payments system developments and related issues in the country and internationally.

- The RBI said it will be the responsibility of the entity to frame necessary rules and the related processes to ensure that the system is safe and sound, and that payments are exchanged efficiently.

- The entity will be permitted to participate in Reserve Bank’s payment and settlement systems, including having a current account with Reserve Bank, if required.

- The formation of the umbrella entity has been authorised under the Payment and Settlement Systems Act, 2007.

Payment and Settlement Systems Act, 2007

- The Payment and Settlement Systems Act 2007, set up by the RBI, provides for the regulation and supervision of payment systems in India and designates the apex institution (RBI) as the authority for that purpose and all related matters.

- To exercise its powers and perform its functions and discharge its duties, the RBI is authorized under the Act to constitute a committee of its central board, which is known as the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS).

- The Act also provides the legal basis for ‘netting’ and ‘settlement finality’.

- The Act defines that a payment system enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them, but does not include a stock exchange.

- It is further stated a ‘payment system’ includes the systems enabling credit card operations, debit card operations, smart card operations, money transfer operations or similar operations.

Except stock exchanges and clearing corporations set up under stock exchanges, all other systems carrying out either clearing or settlement or payment operations or all of them are regarded as payment systems.

-Source: The Hindu