Contents

- The Great Indian Growth Miracle

- What is plea bargaining?

- India China and the Indian Ocean

- High Real Interest Rates and Investments in India

- Itolizumab

THE GREAT INDIAN GROWTH MIRACLE

Focus: GS-III Indian Economy

Introduction

India saw an unprecedented growth surge for more than three decades since the historic contraction of 1979, when India’s gross domestic product (GDP) contracted by more than 5% for the first time since independence.

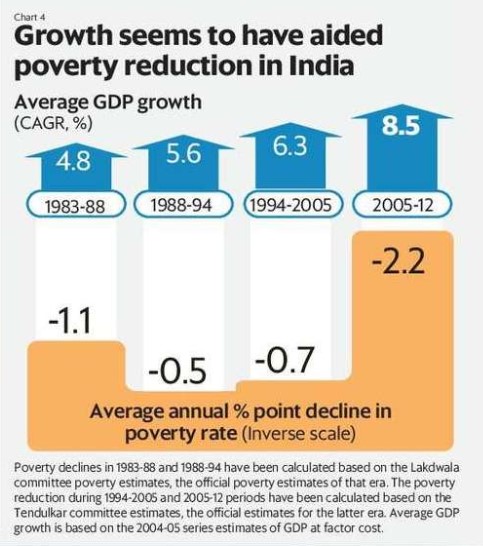

The growth surge survived a balance-of-payments crisis, stock market scams, and multiple phases of political instability, pulling millions out of poverty.

Why Growth Matters?

Growth matters primarily because it directly impacts the average income levels.

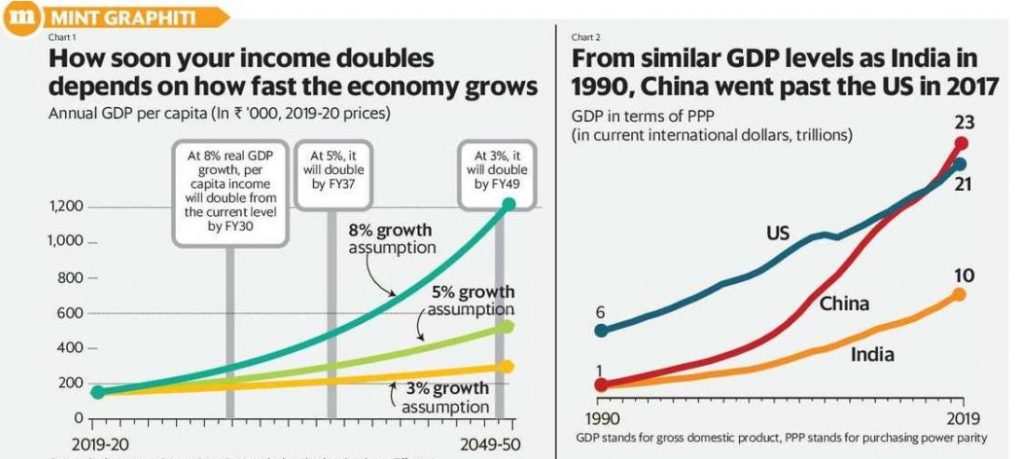

Explaining with example in simple words: If GDP grows at an average inflation-adjusted (real) rate of 8% per annum, an average Indian would roughly double her income in 10 years. A more modest 5% GDP growth would mean that the same journey would take 17 years.

- The trajectory of growth will also influence how far can India stand up to external aggression and threats.

- Without fast, evenly-balanced growth, it won’t be possible to create enough decent jobs for the millions of youth who are joining India’s workforce every year.

- Growth not only boosts average income levels, but also generates extra funds for welfare programmes.

India and China GDP Growth Comparison

- China’s growth took off around the same time as India’s and till about 1990, the GDP of the two countries were roughly equal in terms of purchasing power parity (PPP).

- Since then, China zoomed ahead to eclipse the US, leaving India far behind.

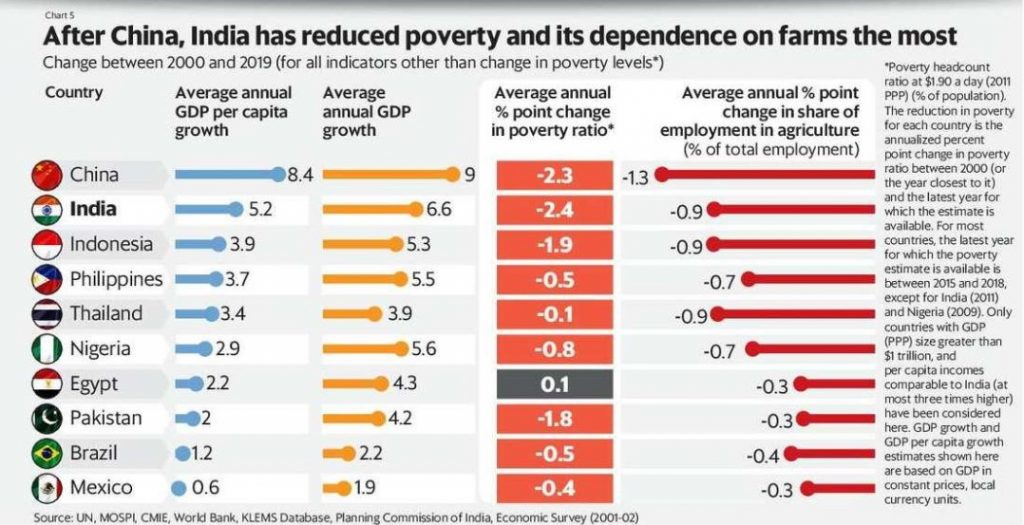

- India’s growth performance has been superior to that of most other large developing economies in the world over the past few decades even if it has not been able to better China’s record so far

Shifting to non-farm jobs

- Nobel-winning economist Arthur Lewis showed that by moving surplus labour from the farm to the non-farm sector, developing economies could raise productivity in both sectors and raise overall savings and growth.

- Since then, several economies, including the fast-growing economies of East Asia, have followed the Lewisian transformation to shift workers from farms to factories, driving growth and reducing poverty at the same time.

India and the Sectors

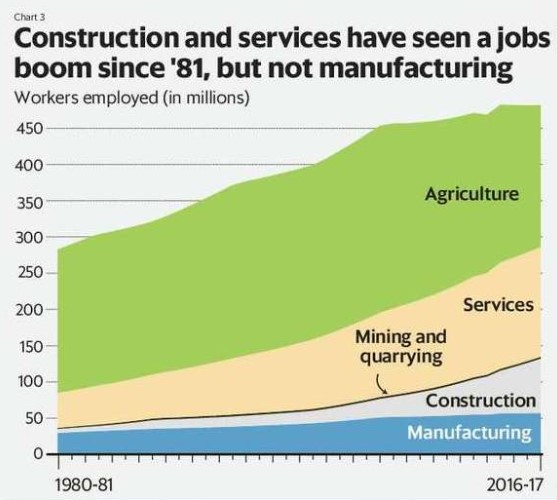

- India’s growth process over the past four decades has also witnessed a shift away from farm to non-farm jobs, but the process has been lopsided and the transformation remains incomplete.

- The farm sector remains the biggest employer in the country, though the share of farm jobs has shrunk over time.

- Unlike in other fast-growing Asian economies, the new non-farm jobs have mostly been in construction and services, rather than in factories.

- The construction sector pays better than the farm sector, but offers only slightly more productive jobs.

- The services sector does offer some high-productivity jobs (such as in software services), but the bulk of the new service sector jobs in India have been low-end, such as in trade, transport, and storage with relatively lower productivity levels.

- If India is to create more high-productivity jobs, it will need fast growth spread across more sectors.

- India needs several more decades of rapid growth as its huge poverty challenge is being aggravated now by the pandemic.

-Source: Livemint

WHAT IS PLEA BARGAINING?

Focus: GS-II Governance

Introduction

- Many members of the Tablighi Jamaat belonging to different countries have obtained release from court cases in recent days by means of plea bargaining.

- Accused of violating visa conditions by attending a religious congregation in Delhi, these foreign nationals have pleaded guilty to minor offences and paid the fines imposed by the court, escaping tedious trials.

- These cases have brought the focus on plea bargaining as a practice by which time consuming trials can be avoided.

Plea Bargaining: What is it and how it came to be?

- Plea bargaining refers to a person charged with a criminal offence negotiating with the prosecution for a lesser punishment than what is provided in law by pleading guilty to a less serious offence.

- There has always been a provision in the Code of Criminal Procedure for an accused to plead ‘guilty’ instead of claiming the right to a full trial, but it is not the same as plea bargaining.

- In India, the concept was not part of law until it was introduced in 2006 as part of a set of amendments to the CrPC.

- Unlike in the U.S. and other countries, where the prosecutor plays a key role in bargaining with the suspected offender, the Indian code makes plea bargaining a process that can be initiated only by the accused.

What are the cases for which Plea Bargaining may be applied for?

- Cases for which the practice is allowed are limited. Only someone who has been charge sheeted for an offence that does not attract the death sentence, life sentence or a prison term above seven years can make use of the scheme.

- It is also applicable to private complaints of which a criminal court has taken cognisance.

- Other categories of cases that CANNOT be disposed of through plea bargaining are those that involve offences affecting the “socio-economic conditions” of the country, or committed against a woman or a child below the age of 14.

What is the rationale for the scheme? What are its benefits?

- The Justice Malimath Committee on reforms of the criminal justice system endorsed the various recommendations of the Law Commission with regard to plea bargaining.

- Some of the advantages it culled out from earlier reports are that the practice would ensure speedy trial, end uncertainty over the outcome of criminal cases, save litigation costs and relieve the parties of anxiety.

- Prolonged incarceration of undertrials without any progress in the case for years and overcrowding of prisons were also other factors that may be cited in support of reducing pendency of cases and decongesting prisons through plea bargaining.

Do courts have reservations?

- Case law after the introduction of plea bargaining has not developed much as the provision is possibly not used adequately.

- Courts are also very particular about the voluntary nature of the exercise, as poverty, ignorance and prosecution pressure should not lead to someone pleading guilty of offences that may not have been committed.

-Source: The Hindu

INDIA CHINA AND THE INDIAN OCEAN

Focus: GS-II International Relations

Introduction

- There is speculation in the media that New Delhi could soon invite Australia to join the Malabar naval exercises to be held later in 2020.

- While no decision was reached, it appears a green signal to Australia could soon be given, making it the first time since 2007 that all members of Quad will participate in a joint military drill, aimed ostensibly at China.

Possible conflict point

- Beijing has long opposed a coalition of democracies in the Indo-Pacific region.

- The Chinese leadership sees the maritime Quadrilateral as an Asian-NATO that seeks only to contain China’s rise.

- At a time of strained bilateral ties with China, India’s intention to involve Australia in the Malabar drill could only be construed as a move directed against Beijing.

The prospect of modest gains

- Indian decision-makers should also reflect on the strategic rationale of the military-Quad, as unlike the U.S. and its Pacific partners, India’s priority is to acquire strategic capabilities to counter a Chinese naval presence in the Indian Ocean.

- While India has acquired airborne surveillance assets from the U.S., the Indian Navy is yet to develop the undersea capability to deter Chinese submarines in the eastern Indian Ocean.

Recent Developments with Other Countries

- China has stepped up its naval presence in the South China Sea, even as Washington directed three aircraft carrier groups — USS Theodore Roosevelt, USS Nimitz and USS Ronald Reagan — to the region, in a seeming bid to counter the People’s Liberation Army Navy (PLAN).

- The U.S. would expect its Indo-Pacific partners, including India, to assist the U.S. Navy in its South China Sea endeavour.

- While they may engage in the occasional naval exercise in the Bay of Bengal, the U.S. and Japanese navies have little spare capacity for sustained surveillance and deterrence operations in the IOR.

- Australia, ironically, is the only one ready and able to partner India in securing the Eastern Indian Ocean.

Need for careful thought

- Upgrading the trilateral Malabar to a quadrilateral, without acquiring the requisite combat and deterrence capability, could yield gains for India in the short term, but it is not guaranteed to be effective in the long-term.

- Although, inviting Australia to join the Malabar is a good idea, India should not sign up to quadrilateral engagement without a cost-benefit exercise and commensurate gains in the strategic-operational realm.

-Source: The Hindu

HIGH REAL INTEREST RATES AND INVESTMENTS IN INDIA

Focus: GS-III Indian Economy

Introduction: What was done so far?

- Boosting manufacturing is seen as India’s best chance to create jobs for the thousands that enter the job market each year.

- To enable Indian businesses to boost productive capacity — either by augmenting existing factories or laying down new factories — the government sharply cut the corporate tax rate in 2019.

- At the same time, RBI has cut the benchmark interest rate in the economy by as much as 250 basis points (bps) between February 2019 and May 2020.

- Over this period, the RBI has also worked with the banks to improve the transmission of these cuts to the banking system.

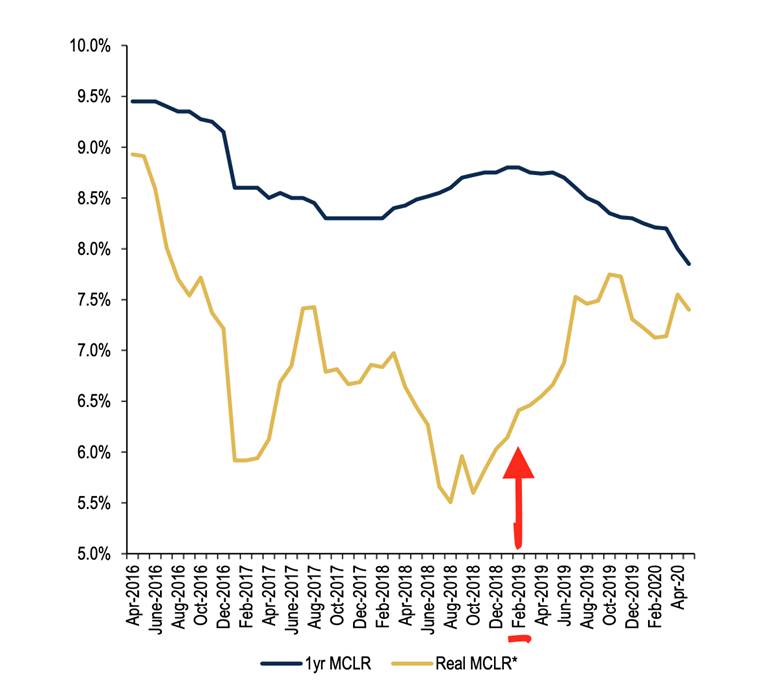

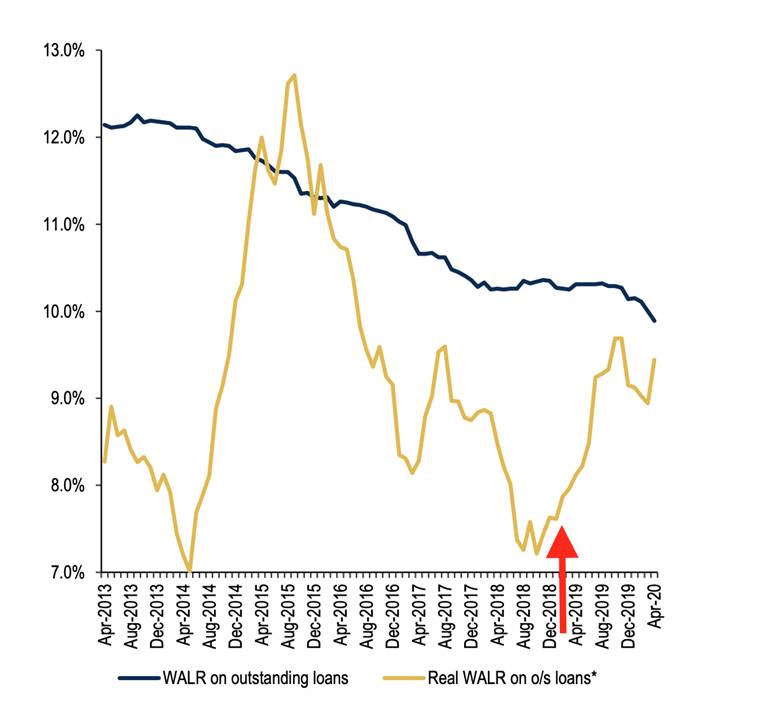

- Over the last 12 months, for instance, RBI has cut 150 bps and the MCLR (marginal cost lending rate or the rate that a bank charges the last customer seeking loan) has come down.

- On the face of it, it is not just the nominal interest rates that have come down; even the real interest rates have come down.

Real Interest

- Real interest rate is essentially derived after subtracting the inflation rate from the nominal interest rate.

- So, if the nominal interest rate is 10% and inflation is 8% then the real interest will be 2%.

- Since RBI targets retail inflation, which is calculated by the Consumer Price Index (CPI), it is easy to believe that the real interest rates are coming down.

Real Interest (R) = Nominal Interest Rate (N) — Inflation Rate (I)

- If N is falling sharply and I is increasing — the latest retail inflation was over 6% — then, R or the real interest rate must be falling.

- A low real interest rate should encourage businesses to borrow more and make new investments in the economy.

However, Businesses are not Borrowing more and making New Investments

- In common perception “inflation rate” refers to the “retail” (CPI) inflation in the economy, faced by Consumers. However, it is not the same for businesses.

- While calculating that “R” or the real interest rate for a firm in the manufacturing sector — say a steel manufacturer or a TV or car manufacturer — it would be odd to use “retail” inflation.

- Since these products are sold wholesale, one should use Wholesale Price Index-based inflation.

What happens to the real interest rate for the manufacturing sector when we calculate the real interest rate by using core-WPI as the inflation rate (I)?

- Contrary to common perception, real interest rates have actually gone up.

- When you look at the chart with real MCLR (Marginal Cost of Funds based Lending Rate) and real WALR (Weighted Average Lending Rate) – unlike, the MCLR, which is lower because it is for the newest borrower, the WALR is the interest rate charged on all the outstanding loans of a bank, and as such, is much higher than MCLR.

- This is because the core-WPI has decelerated even faster than the rate at which nominal interest rates have come down.

- This odd situation has arisen because retail and wholesale inflation rates are diverging.

- The RBI targets the retail inflation but, as shown above, the relevant inflation rate to monitor for boosting investments right now could be the core-WPI.

-Source: Indian Express

ITOLIZUMAB

Focus: Prelims, GS-III Science and technology

Introduction

A repurposed drug, Itolizumab, is one of the newest treatments for Covid-19 approved in India.

What is Itolizumab?

Itolizumab is an existing drug used for psoriasis, a chronic skin disease involving unregulated growth of some skin cells that develop into red patches mostly on knees and elbows, but also on some other parts of the body.

Why was it approved for emergency use in Covid treatment?

- The SARS-CoV-2 virus has been observed to induce an overreaction of the immune system, generating a large number of cytokines that can cause severe damage to the lungs and other organs, and, in the worst scenario, multi-organ failure and even death.

- A study confirmed the safety and efficacy of Itolizumab in preventing cardio-renal complications in Covid-19 patients who also have acute respiratory distress.

- Basically, the drug controls the hyper-activation of the immune system in response to SARS-CoV-2 virus and prevents morbidity and mortality related to the cytokine storm.

-Source: The Hindu, Indian Express