Contents

- Cabinet approves Development Finance Institution

- Lok Sabha passes Appropriation Bill

- Solicitor General appeal to SC on amicus curiae

- New method for removing heavy metals from water

CABINET APPROVES DEVELOPMENT FINANCE INSTITUTION

Context:

The Union Cabinet approved the bill for setting up of Development Finance Institution (DFI) which was announced during the Union Budget 2021-22.

Relevance:

GS-III: Indian Economy (Government Budgeting, Fiscal Policy), GS-II: Polity and Governance (Government Policies and Interventions)

Dimensions of the Article:

- What is a Development Finance Institution?

- Objectives of DFIs

- About the recent bill for creation of DFI

- Some Important Development Finance Institutions in India

What is a Development Finance Institution?

A Development Finance Institution (DFI) is an organization which is either owned by the government or by charitable institutions to finance infrastructure projects that are of national importance but may or may not meet commercial return standards.

- DFIs do not accept deposits from people, they raise funds by borrowing funds from governments and by selling their bonds to the general public.

DFIs have evolved in India in three below-mentioned phases:

- The first phase began with Indian Independence to the year 1964.

- The second phase began from 1964 to the mid-1990s.

- In the third phase after 1993-94, the prominence of development banking declined, as liberalization resulted in the exit of some firms from development banking and in a waning in the resources mobilized by other firms.

Categories of DFIs:

- National Development Banks such as IDBI, SIDBI, ICICI, IFCI, IRBI, and IDFC.

- Sector-specific financial institutions such as TFCI, EXIM Bank, NABARD, HDFC, and NHB.

- Investment Institutions such as LIC, GIC and UTI.

- State-level Institutions such as State Finance Corporations and SIDCs.

Objectives of DFIs

- The prime objective of DFI is the economic development of the country.

- These banks provide financial as well as the technical support to various sectors.

- It also provides a guarantee to banks on behalf of companies and subscriptions to shares, debentures, etc.

- Underwriting enables firms to raise funds from the public. Underwriting a financial institution guarantees to purchase a certain percentage of shares of a company that is issuing IPO if it is not subscribed by the Public.

- They also provide technical assistance like Project Report, Viability study, and consultancy services.

About the recent bill for creation of DFI

- A bill for the creation of the Development Finance Institution (DFI) is listed for the ongoing session of the Indian Parliament that describes DFI as a provider, enabler and catalyst for infrastructure financing and as the principal financial institution and development bank for building and sustaining a supportive ecosystem across the life-cycle of infrastructure projects.

- Finance Minister Nirmala Sithraman while presenting the Union Budget 2021-22 stated that India will set up a new DFI called the National Bank for Financing Infrastructure and Development.

- The DFI will be set up on a capital base of Rs. 20,000 crores and will have a lending target of Rs. 5 lakh crores in three years. Debt financing through the infrastructure investment trust (InvIT) and real estate investment trust (REIT) routes will be enabled through necessary amendments in the rules.

Some Important Development Finance Institutions in India

- IFCI: Industrial Finance Corporation of India was established in 1948. It is India’s first Development Finance Institution.

- ICICI: Industrial Credit and Investment Corporation of India Limited was established in the year 1955 by an initiative of the World Bank and was the first DFI in the private sector. ICICI Limited established its subsidiary company ICICI Bank Limited in 1944 and in 2002, ICICI Limited was merged into ICICI Bank Limited, making it the first universal bank of India.

- IDBI: Industrial Development Bank of India was set up in 1964 under RBI and was granted autonomy in 1976. The bank is responsible for ensuring adequate flow of credit to various sectors and was converted into a universal bank in 2003.

- IRCI: Industrial Reconstruction Corporation of India was set up in 1971 to revive weak units and provide financial & technical assistance.

- SIDBI: Small Industries Development Bank of India was established in 1989 as a subsidiary of IDBI and was granted autonomy in 1998.

- EXIM Bank: Export-Import Bank was established in January 1982 to provide technical assistance and loan to exports.

- NABARD: National Bank for Agriculture and Rural Development was established in July 1982 on the recommendation of the Shivraman Committee and functions as a refinancing institution.

- NHB: National Housing Bank was established in 1988 to finance housing projects.

-Source: The Hindu

LOK SABHA PASSES APPROPRIATION BILL

Context:

The Lok Sabha cleared the Appropriation Bill, allowing the Central government to draw funds from the Consolidated Fund of India for its operational requirements and implementation of various programmes.

Relevance:

GS-II: Polity and Governance (Constitutional Provisions, Parliamentary Procedures)

Dimensions of the Article:

- Money Bills and Financial Bills:

- All about Appropriation Bills

- Procedure followed to Pass an Appropriation Bill

Money Bills and Financial Bills:

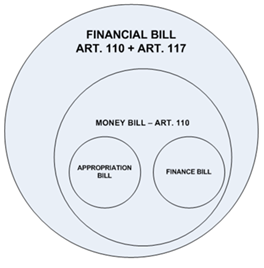

Every bill which has provisions related to financial matters is a Financial Bill.

There are three kinds of Financial Bills in the Indian Parliament:

- Money Bills

- Financial Bills category-I

- Financial Bill category-II.

All Money Bills are Financial Bills, but all Financial Bills are not Money Bills.

Only those Financial Bills which contain provisions exclusively on matters listed in Article 110 of the Constitution are called Money Bills.

All about Appropriation Bills

- An Appropriation Bill is a Money Bill that allows the Government to withdraw funds from the Consolidated Fund of India (CFI) to meet its expenses during the course of a financial year.

- According to Article 114 of the Constitution, the government can withdraw money from the Consolidated Fund only after receiving approval from Parliament.

- To put it simply, the Finance Bill contains provisions on financing the expenditure of the government, and Appropriation Bill specifies the quantum and purpose for withdrawing money.

Important Points regarding Appropriation Bills and Money Bills:

- The motion for the introduction of a Finance Bill or an Appropriation Bill is not opposed.

- During the Budget the Government needs to get Appropriation bills and Finance bills passed and the failure to get them passed in the Parliament would lead to the collapse of the Government.

- No amendment can be proposed to an Appropriation Bill which will have the effect of varying the amount or altering the destination of any grant so made or of varying the amount of any expenditure charged on the Consolidated Fund of India, and the decision of the Speaker as to whether such an amendment is admissible is final. An amendment to an Appropriation Bill for omission of a demand voted by the House is out of order.

- In other respects, the procedure in respect of an Appropriation Bill is the same as in respect of other Money Bills.

Procedure followed to Pass an Appropriation Bill

- The government introduces the Appropriation Bill in the Lok Sabha (only) after discussions on Budget proposals and Voting on Demand for Grants.

- The Appropriation Bill is first passed by the Lok Sabha and then sent to the Rajya Sabha.

- The Rajya Sabha has the power to recommend any amendments in this Bill. However, it is the prerogative of the Lok Sabha to either accept or reject the recommendations made by the upper house of Parliament.

- The unique feature of the Appropriation Bill is its automatic repeal clause, whereby the Act gets repealed by itself after it meets its statutory purpose.

-Source: The Hindu

SOLICITOR GENERAL APPEAL TO SC ON AMICUS CURIAE

Context:

The Solicitor General of India made a strong appeal to the Supreme Court to frame guidelines to rein in lawyers appointed as the court’s amici curiae in various cases, especially sensitive ones.

Relevance:

GS-II: Polity and Governance (Constitutional Provisions, Constitutional and Non-Constitutional Bodies)

Dimensions of the Article:

- About the Solicitor General of India

- Amicus Curiae

About the Solicitor General of India

- The Solicitor General of India is subordinate to the Attorney General for India.

- He/She is the second law officer of the country, assists the Attorney General, and is himself/herself assisted by Additional Solicitors General for India.

- Like the Attorney General for India, the Solicitor General and the Additional Solicitors General advise the Government and appear on behalf of the Union of India in terms of the Law Officers (Terms and Conditions) Rules, 1972.

- However, unlike the post of Attorney General for India, which is a Constitutional post under Article 76 of the Constitution of India, the posts of the Solicitor General and the Additional Solicitors General are merely statutory.

- While the Attorney General for India is appointed by the President under Article 76(1) of the Constitution, the Solicitor General of India is appointed to assist the attorney general along with four additional solicitors general by the Appointments Committee of the Cabinet (ACC).

Amicus Curiae

- An amicus curiae is someone who is not a party to a case who assists a court by offering information, expertise, or insight that has a bearing on the issues in the case.

- Lawyers are appointed by the court as amicus curiae or ‘friend of the court’ in specific cases to assist the court.

- Many cases would have multiple parties, States or departments with diverse views.

- An amicus curiae is appointed to help the court compile facts, research the law in question and even offer a non-partisan opinion.

- An oral statement from a top government law officer in the highest court to tether amici curiae hand-picked by the latter is significant.

The recent tussle regarding Amicus Curiae

- The Solicitor General said that the appointed amici curiae tended to even interfere in the “running” of organisations such as the CBI.

- However, the Supreme Court Bench said an amicus curiae has no further interest except to help the court.

-Source: The Hindu

NEW METHOD FOR REMOVING HEAVY METALS FROM WATER

Context:

A new method for efficient removal of heavy metals from water has been developed by an Indian Institute of Technology (IIT) Mandi research team.

Relevance:

GS-III: Science and Technology (Developments in Science and Technology, Applications to of S&T in daily life)

Dimensions of the Article:

- What are Heavy Metals?

- How do heavy metals affect humans?

- About the recently development method to remove Heavy Metals from water

What are Heavy Metals?

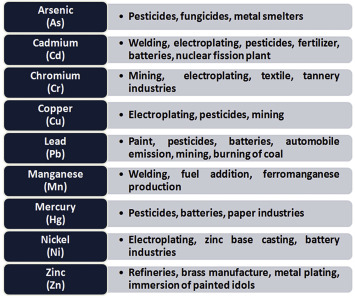

- The term heavy metal refers to any metallic chemical element that has a relatively high density (> 5 g/cm 3) and is toxic or poisonous at low concentrations.

- Examples of heavy metals include mercury (Hg), cadmium (Cd), arsenic (As), chromium (Cr), thallium (Tl), and lead (Pb)

How do heavy metals affect humans?

- There are some essential heavy metals which the human body requires in trace amounts such as Cobalt, copper, zinc, and manganese but in the excessive amount, it can be detrimental to health.

- The heavy metals found in drinking water such as lead, mercury, arsenic, and cadmium have no beneficial effects on our body.

- Heavy metal toxicity can either be acute or chronic effects. Long-term exposure of the body to heavy metal can progressively lead to muscular, physical and neurological degenerative processes that are similar to diseases such as Parkinson’s disease, multiple sclerosis, muscular dystrophy and Alzheimer’s disease.

About the recently development method to remove Heavy Metals from water

- A research team has developed a fibrous membrane filter using a biopolymer-based material that helps to separate out the heavy metals from water samples.

- These membranes contain adsorbents materials that attract and hold the metals.

- These adsorbents contain a large amount of a biopolymer, Chitosan, derived from crab shells that is mixed with a well-known polymer, Nylon.

Advantages of the new research:

- The normal absorbent fibres bind to the target metal only at their surface, in their nanofiber membranes.

- The membranes could be reused at least eight times before there was considerable reduction in the efficiency of metal adsorption.

- The adsorbed metal in a metal-hydroxyl nitrate form can be easily recovered. It is a value-addition to the membrane filter.

- The researchers have provided a method to produce fibre-based adsorbents at large scale for handling larger volumes of metal-contaminated water.

- Using the solution blowing technique could replace the synthetic polymers with natural polymers.

-Source: Down to Earth Magazine