Contents

- India on US’s Currency Manipulator Watchlist

- India slips two spots: Human Development Index

- Vijay Diwas: 50 Years of Indo-Pak War

- 12th GRIHA Summit

- Himalayan Serow

- India’s 42nd communications satellite: CMS-01

INDIA ON US’S CURRENCY MANIPULATOR WATCHLIST

Focus: GS-III Indian Economy

Why in news?

The United States has once again included India in its monitoring list of countries with potentially “questionable foreign exchange policies” and “currency manipulation”.

Details regarding the news:

- According to the U.S. Treasury Department – Over the four quarters through June 2020, four major US trading partners -Vietnam, Switzerland, India, and Singapore-INTERVENED in the foreign exchange market in a sustained, asymmetric manner.

- The U.S. Treasury Department designated Switzerland and Vietnam as Currency Manipulators for the first time while keeping China in the Watchlist along with India, Taiwan, Thailand, Japan, South Korea, Germany, Italy, Singapore and Malaysia etc. (Many Countries are maintained in the monitoring list).

Back to basics: How does Currency Manipulation work?

- Let’s take China as an example for a country that manipulates its currency to gain an unfair advantage.

- We can first consider the fact that – the value of China’s exports in goods annually surpasses the amount it imports from the rest of the world – (China’s global trade surplus for the first 11 months of 2020 is $460 billion, up by more than 20% in comparison to 2019.)

- In the normal Scenario – when China exports a particular good (say “X”) to the U.S., it receives payment for the goods in Dollars which the U.S. firms importing “X” use, and upon conversion at the current exchange rate, the Chinese exporters receive the amount in Yuan.

- Now, if China intervenes by releasing more Yuan into the exchange market by buying Dollars, the value of Yuan drops (its exchange rate weakens, so now one receives more Yuan for a Dollar on exchange).

- In such a scenario, the Chinese Exporters can now price their product “X” lower in terms of Dollars in comparison to domestic sellers and sell “X” in the U.S. while receiving the same or higher amount in Yuan upon conversion.

- This gives the Chinese exporters an unfair advantage against the domestic competitors in the U.S. and hence capturing the market driven by demand for Chinese goods which are now priced competitively.

- The reduced value of Yuan will affect the value of goods Imported to China from other countries as well (i.e., now that the value of Yuan is lower, Chinese importers have to pay more for the goods that they import from U.S. or other exporters).

- However, the negative impact (losses) on imports are much lesser considering the fact established earlier that China exports more than it imports, and the protectionist action of manufacturing essential goods within China help in reducing the import bill.

Currency Manipulator Designation by the U.S.

- Currency manipulator is a designation applied by United States government authorities, such as the United States Department of the Treasury, to countries that engage in what is called “unfair currency practices” that give them a trade advantage.

- Such practices may be currency intervention or monetary policy in which a central bank buys or sells foreign currency in exchange for domestic currency, generally with the intention of influencing the exchange rate and commercial policy.

- Policymakers may have different reasons for currency intervention, such as controlling inflation, maintaining international competitiveness, or financial stability.

- In many cases, the central bank weakens its own currency to subsidize exports and raise the price of imports, sometimes by as much as 30-40%, and it is thereby a method of protectionism.

- The Treasury’s goal is to focus attention on those nations whose bilateral trade is most significant to the US economy and whose policies are the most material for the global economy.

How are countries identified for the currency manipulation list?

The US Treasury has established three criteria which act as thresholds:

- The Country has a significant bilateral trade surplus with the U.S. (that is if the trade surplus with U.S. is at least $20 billion in a year).

- The Country has material current account surplus (that is at least 3% of GDP in a year).

- The country is involved in persistent, one-sided intervention reflected in repeated net purchases of foreign currency and total at least 2% of an economy’s GDP over a year.

What is the impact of being designated as “Currency Manipulator”?

- The Currency Manipulator designation has no specific or immediate consequence, beyond short-term market impacts.

- But the law requires the U.S. administration to engage with the countries to address the perceived exchange-rate imbalance, and the Penalties include Exclusion from U.S. Government Contracts.

- The objective of designating some countries as manipulators seem to be to gain leverage in trade negotiations.

- Bigger consequences would emerge if the Commerce Department used Currency undervaluation findings to initiate countervailing duties against industries benefitting from the undervaluation.

U.S. Treasury Department’s Arguments against India

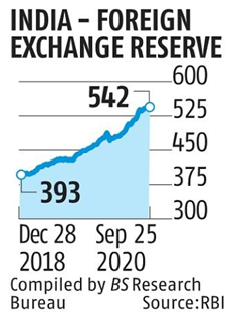

- The U.S. Treasury Department said that based on Reserve Bank of India’s regularly published intervention data, India’s net purchases of foreign exchange accelerated notably in the second half of 2019, and following sales during the initial onset of the pandemic, India sustained net purchases for much of the first half of 2020.

- The accelerated purchases by India has pushed the purchases of Foreign Exchange to 2.4 per cent of GDP over the four quarters through June 2020.

- However, it can be noted that the U.S. Treasury continues to welcome India’s long-standing transparency in publishing foreign exchange purchases and sales.

How things worked out in India According to the U.S. Treasury?

- According to the Treasury, India’s economy contracted sharply in the first half of 2020 due to the collapse in domestic demand brought on by the COVID-19 pandemic.

- The authorities responded with modest direct fiscal support of around Two-per cent of GDP and substantial monetary easing.

- India’s deep domestic demand contraction and slower recovery relative to its key trading partners contributed to the economy’s first four-quarter current account surplus since 2004 (0.4 per cent of GDP over the year to June 2020).

- It said that India for several years has maintained a significant bilateral goods trade surplus with the United States, which totaled $22 billion in the four quarters through June 2020.

- The RBI states that the value of the rupee is broadly market-determined, with intervention used only to curb undue volatility in the exchange rate.

- Rupee volatility did not appear to have been particularly elevated in the four quarters through June 2020, however.

- These purchases have led to a rapid rise in total reserves that are now well in excess of standard reserve adequacy benchmarks.

Suggestions by the U.S. Treasury

- The Treasury said that Indian authorities should allow the exchange rate to move to reflect economic fundamentals and limit foreign exchange intervention to circumstances of disorderly market conditions.

- It said India can also leverage the recovery period to pursue structural reforms that will open its market further to foreign investment and trade, including foreign portfolio investment in Indian sovereign and sub-sovereign bonds, thereby fostering stronger long-term growth.

Criticisms of the U.S.’s Authority to designate as Manipulator

- It has been argued that the concept of “currency manipulation” is hypocritical, given that the US already has the privilege of having the main reserve currency of the world, which is needed for international trade.

- Besides, massive interventions of the Federal Reserve since the financial crisis of 2008, such as Quantitative Easing and interventions in the REPO market, could very easily be interpreted as currency cheating.

Recently-in-news: Regarding U.S. China trade war

- In 2019, under personal pressure from President Donald Trump, as part of the China–United States trade war, the United States Treasury again designated China a currency manipulator

- This designation was not supported by the International Monetary Fund and it had to be withdrawn after China agreed to refrain from devaluing its currency to make its own goods cheaper for foreign buyers.

- U.S. and China are soon to sign a “Phase 1 U.S.-China trade agreement” that includes a provision that prevents China from manipulating its currency to gain trade advantages.

-Source: Indian Express

VIJAY DIWAS: 50 YEARS OF INDO-PAK WAR

Focus: GS-I History

Why in news?

Vijay Diwas is celebrated on December 16 every year to commemorate India’s victory over Pakistan in 1971 and in 2020 – India will celebrate 50 Years of Indo-Pak War, also called Swarnim Vijay Varsh on 16th December 2020.

About the 1971 Indo-Pak war

- Prior to 1971, Bangladesh was a part of Pakistan, which was called ‘East Pakistan’.

- It is believed that people of ‘East Pakistan’ were beaten, exploited, raped and murdered by the Pakistani Army.

- India supported Bangladesh against Pakistan’s oppression in ‘East Pakistan’.

- The Government of India decided on December 03, 1971, that India would go for war with Pakistan to save Bengali Muslims and Hindus.

- This war was fought between India and Pakistan for 13 days –

- On 16 December 1971, about 93,000 Pakistani soldiers surrendered before the Indian Army Commander Lt Gen Jagjit Singh Arora in Dhaka

- Bangladesh emerged on the world map with India’s victory in this war – Bangladesh celebrates its Independence Day (Bijoy Dibos) on 16th December every year.

-Source: India Today

INDIA SLIPS TWO SPOTS: HUMAN DEVELOPMENT INDEX

Focus: GS-II Governance

Why in news?

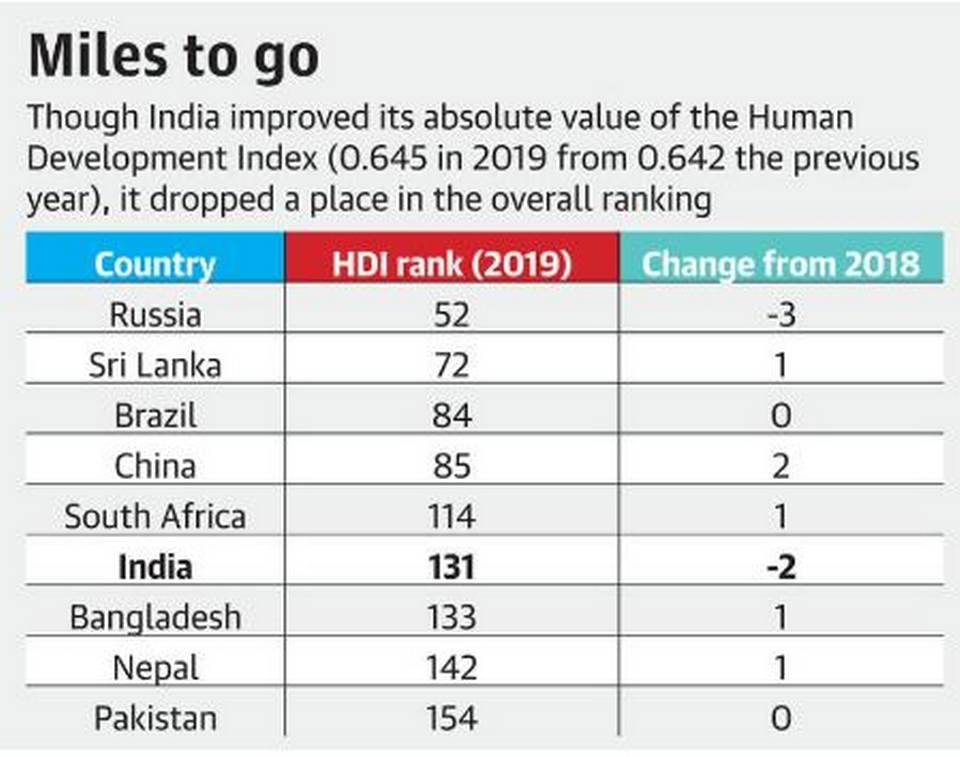

- India dropped two ranks in the United Nations’ Human Development Index 2020, ranked at 131 out of 189 countries.

- However, if the Index were adjusted to assess the planetary pressures caused by each nation’s development, India would move up eight places in the ranking, according to the report.

Highlights of the HDI report 2020

- For the first time, the United Nations Development Programme introduced a new metric to reflect the impact caused by each country’s per-capita carbon emissions and its material footprint, which measures the amount of fossil fuels, metals and other resources used to make the goods and services it consumes.

- Norway, which tops the HDI, falls 15 places if this metric is used, leaving Ireland at the top of the table.

- In fact, 50 countries would drop entirely out of the “very high human development group” category, using this new metric, called the Planetary Pressures-adjusted HDI, or PHDI.

- China’s net emissions (8 gigatonnes) are 34% below its territorial emissions (12.5 gigatonnes) compared with 19% in India and 15% in Sub-Saharan Africa.

- No country has yet been able to achieve a very high level of development without putting a huge strain on natural resources.

Human Development Index (HDI)

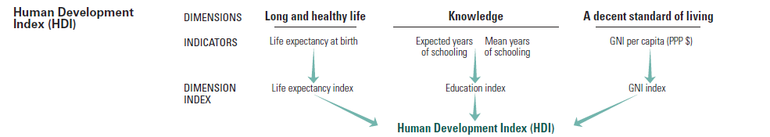

- Human Development Index (HDI) is a statistic composite index of life expectancy, education (Literacy Rate, Gross Enrollment Ratio at different levels and Net Attendance Ratio), and per capita income indicators, which are used to rank countries into four tiers of human development.

- HDI is published by the United Nations Development Programme (UNDP).

- HDI is a statistical tool used to measure a country’s overall achievement in its social and economic dimensions.

- A country scores a higher HDI when the lifespan is higher, the education level is higher, and the gross national income GNI (PPP) per capita is higher.

- It was developed by Pakistani economist Mahbub ul Haq (his approach is often framed in terms of whether people are able to “be” and “do” desirable things in life) and was further used to measure a country’s development by the United Nations Development Programme (UNDP)’s Human Development Report Office.

HDI measures average achievement of a country in three basic dimensions of human development:

- A long and healthy life.

- Access to knowledge.

- A decent standard of living.

-Source: The Hindu, Indian Express

12TH GRIHA SUMMIT

Focus: GS-III Environment and Ecology

Why in news?

Recently, the inaugural session of the 12th Green Rating for Integrated Habitat Assessment (GRIHA) Summit was organized.

Highlights regarding the 12th GRIHA Summit

- Theme of the GRIHA Summit for 2020 was “Rejuvenating Resilient Habitats.”

- The purpose of the summit was to serve as a platform to deliberate on innovative technologies and solutions which shall help in creating robust mechanisms for developing sustainable and resilient solutions for the benefit of the entire community.

Green Rating for Integrated Habitat Assessment (GRIHA)

- Green Rating for Integrated Habitat Assessment (GRIHA) is the national rating system of India for any completed building construction.

- GRIHA is recognised as India’s own green building rating system in India’s Intended Nationally Determined Contributions (INDC) submitted to the United Nations Framework Convention on Climate Change (UNFCCC).

- It was conceived by The Energy and Resources Institute (TERI) and developed jointly with the Ministry of New and Renewable Energy.

- The objective of the rating system is to help design green buildings and, in turn, help evaluate the ‘greenness’ of the buildings.

- The system has been developed to help ‘design and evaluate’ new buildings (buildings that are still at the inception stages). A building is assessed based on its predicted performance over its entire life cycle.

- This system, along with the activities and processes that lead up to it, benefits the community with the improvement in the environment by reducing GHG (greenhouse gas) emissions, reducing energy consumption and the stress on natural resources.

The Parameters used for GRIHA rating are:

- Site selection and planning

- Conservation and efficient utilization of resources

- Building operation and maintenance

- Innovation points

-Source: Indian Express

HIMALAYAN SEROW

Focus: GS-III Environment and Ecology

Why in news?

A Himalayan serow has been sighted for the first time in the Himalayan cold desert region.

Himalayan serow

- The Himalayan serow (Capricornis sumatraensis thar) is a subspecies of the mainland serow native to the Himalayas.

- The Himalayan serow is listed as Vulnerable under the IUCN Red List.

- It is also listed in Appendix 1 of CITES and Schedule 1 of the Wildlife Protection Act, 1972.

- Himalayan serow resembles a cross between a goat, a donkey, a cow, and a pig.

- It’s a medium-sized mammal with a large head, thick neck, short limbs, long, mule-like ears, and a coat of dark hair.

- There are several species of serows, and all of them are found in Asia.

- They are typically found at altitudes between 2,000 metres and 4,000 metres.

- They are known to be found in eastern, central, and western Himalayas, but not in the Trans Himalayan region.

-Source: Indian Express

INDIA’S 42ND COMMUNICATIONS SATELLITE: CMS-01

Focus: GS-III Science and Technology

Why in news?

Indian Space Research Organisation (ISRO) is all set to launch India’s 42nd communications satellite after the completion of the fueling process of the launch vehicle was achieved.

Details

- This will be ISRO’s only the second launch during the Covid-19 pandemic India’s workhorse Polar Satellite Launch Vehicle (PSLV) in its 52nd flight will put in orbit the 42nd communications satellite that will provide coverage over the entire country for disaster management and satellite internet connection.

- The satellite, named CMS-01, will be the first in a new series of communication satellites by India after the INSAT and the GSAT series.

- Communication satellite CMS-01 onboard the Polar Satellite Launch Vehicle (PSLV-C50) is scheduled from the Satish Dhawan Space Centre (SDSC) SHAR in Sriharikota.

- The new satellite will replace the current GSAT-12 in orbit, which was launched in 2011.

- The previous satellite launched by Isro also had an altered nomenclature- EOS (Earth Observation Satellite) 01.

- Previous earth observation satellites were thematically named by the space agency depending on their task or the kind of instrumentation carried. EOS-01 had previously been named RISAT-2BR2, short for Radar Imaging Satellite (RISAT).

-Source: The Hindu, Hindustan Times