Contents

- Fine Tuning GST

- Need of a Vigilant Watchdog

- Battling the Bug: Corona Virus

- The Tariff Game of Countries

- NASA’s Future Ventures — Venus, moons of Jupiter, Neptune

- Antarctica: Study by Indian Studies

FINE TUNING GST

Context

Many have argued that GST is losing its sheen and needs a complete overhaul while others contend that the new tax system is on course and the trials and tribulations were not unexpected.

The faltering collection in September and October, 2019, has added fuel to the fire.

Details:

- Average monthly GST collection for the period August 2017 to January 2020 stands at Rs 97,188 crore which is an impressive 39 per cent increase over the average monthly collection of subsumed taxes in the base year 2015-16, at around Rs 70,000 crore

- This is an average growth rate of 9.7 per cent over the almost 4-year period post 2015-16 and a compounded growth rate of 8.55 per cent.

- The revenue performance of GST during the current fiscal year is not out of sync with the overall economic situation in the country.

- There are other reasons for tepid growth in GST collections

- Complacency in the states on account of assured 14 per cent growth cannot be ruled out. States were jolted with the delay in compensation for August-September 2019 and resorted to vigorous monitoring of compliance and action against toxic and unverified credits, circular trading and tax evasion which had resulted in unmatched credit claims of around Rs 50,000 crore.

- A host of steps are being

taken or have been contemplated.

- The GSTN has developed red flag reports based on GSTR-1, auto-generated GSTR-2A, GSTR-3B and the national e-way bill system.

- These reports identify non-filers so that action can be taken against active taxpayers who defaulted in filing returns

- An SOP has been developed for proceeding against such return defaulters and this has helped increase the percentage of filing which has contributed to revenue.

- differences between turnovers and the credits are being investigated.

- It has now been decided to mandate Aadhaar authentication for taking new registration and thereafter the existing registered taxpayer population would have to undergo Aadhaar authentication in a phased manner.

- Advanced analytic tools are being used to unravel complex networks of firms created just for generating credit and these analyses are being strengthened through machine learning and AI

- In order to identify dealers posing a “hazard” to revenue and do a 360-degree profile of risky taxpayers, a system of regular data exchange with banks, CBDT, ED, RoC and other agencies is being put in place;

- In order to validate and improve the quality and fidelity of invoice reporting and return filing, a system of e-invoicing is proposed to be implemented in a phased manner beginning April 1

NEED OF A VIGILANT WATCHDOG

- The auditor is a watchdog, not a blood hound.

- Responsibility is to find the true and fair value of the business and provide details of errors and fraud

- The remedial action has to come from the owner of the entity in question.

- Recent scams in various large entities have displayed the inability of auditors to report fraud to the owner/shareholders

Examples:

- In most of the cases, the magnitude of the fraud is in the thousands of crores.

- In the NSEL scam, a default to the tune of Rs 5,600 crore exists.

- Around 13,000 trading clients were affected and their money was stuck for more than six years. The failure of the auditor to detect the fraud and report it is the main cause for these losses.

- IL&FS case, lenders and shareholders lost about Rs 3 lakh crore. In the PMC bank scam more than Rs 4,300 crore worth of loans were extended to HDIL through bogus accounts

- Then there are frauds committed in the nationalised banks and not reported in time by the auditor.

- SEBI recently issued a circular to discourage the auditor from resigning midway through an audit, instead of reporting the lapses.

- There is a government plan to revise the company auditor regulation order 2016 (CARO 2016).

- There are various steps being taken to improve the reporting, especially about the use of borrowed funds and to report on critical financial ratios.

- The Institute of Chartered Accountants (ICAI) has its own disciplinary committee and the power of a civil court to try professional misconduct.

- The National Financial Reporting Authority (NERA) has largely taken over the powers of ICAI to regulate auditors.

- The time has come to review the entire reporting system and introduce stringent provisions before it is too late

- The law should be more stringent

- Auditors should not only be arrested but their assets confiscated and they should be treated as party to the fraud along with the management.

- There should be an entirely new regulatory body to protect against frauds of the sort we have been discussing. It is well said that prevention is better than cure.

BATTLING THE BUG: THE CORONAVIRUS

- An animal virus that gets into humans, causes human-to-human transmission, has high infectivity and a range of clinical severity, with no human immunity, no diagnostic tests, drugs or vaccines.

- COVID 19- With the World Health Organisation declaring it a Public Health Emergency of International Concern (PHEIC), this outbreak is now a pandemic

- It has spread to all provinces of China and is quickly moving across the globe

- It has spread to 27 countries with a total of 64,436 cases and 1,383 deaths

- Coronaviruses are a group of animal viruses identified by their crown-like (corona) appearance under a microscope.

- The 2019-nCoV belongs to this group of viruses, six of which, including the 2003 Severe Acute Respiratory Syndrome (SARS) and the 2012 Middle East Respiratory Syndrome (MERS) viruses, were earlier known to cause disease in humans

- Since the SARS outbreak in 2003, scientists have discovered a large number of SARS-related coronaviruses from their natural hosts — bats

- Genetic sequencing of the virus from five patients showed it to be 79.5 per cent identical to the SARS virus and over 96 per cent identical to a bat coronavirus.

- Viruses sequenced from nine patients were identical and had 88 per cent identity to two bat-derived SARS-like coronaviruses, bat-SL-CoVZC45 and bat-SL-CoVZXC21

- Thus, 2019-nCoV clearly originated from bats, jumped into humans either directly or through an intermediate host, and adapted itself to human-to-human transmission

- Bats are a particularly rich reservoir for viruses with the potential to infect humans

- Examples of these include viruses such as Hanta, Rabies, Nipah, Ebola and Marburg viruses, and others that have caused high levels of mortality and morbidity in humans

- India has 117 species and 100 sub-species of bats

- China’s anti-corruption watchdog — the Central Commission for Discipline Inspection — will punish those who are derelict in their duty or misappropriate funds and materials

- Also, unlike SARS, the 2019-nCoV outbreak has moved rapidly crossing the cumulative number of SARS cases (8,098) within six weeks of first case detection, but with a reduced case fatality rate (CFR) of about 2 per cent versus 9.5 per cent for SARS.

India has put together a good emergency response, there are two areas of concern

- First, there is mixed messaging promoting AYUSH products that are untested and of questionable efficacy.

- Second, India has been a “hot zone” for the emergence of new zoonotic (animal-derived) pathogens for over a decade.

- But we continue to lack the capacity to quickly identify, isolate and characterise a novel pathogen.

- The most recent steps of the Indian Council of Medical Research (ICMR) to shut down surveillance research at the Manipal Centre for Virus Research, and to question the first-ever surveillance study of Indian bats, are steps in the wrong direction.

- Surveillance and sensible public health measures will be needed over the next few months.

- In India, we escaped the 2003 SARS and 2012 MERS outbreaks largely unscathed. This may still be the case with 2019-nCoV, but the laws of probability are likely to catch up soon.

- It would help to invest, build capacity and be ready.

THE TARRIFF GAME OF COUNTRIES

- Tariff is a tax levied on an imported good at the border.

- Countries use tariffs to either provide easy market access or restrict them to protect domestic industry.

- Also serves the purpose of revenue collection and in some cases to achieve some strategic objectives by giving/denying tariff concessions to countries.

- The classification of these codes to classify goods is streamlined under an international coding system called ‘Harmonized System’ (HS) under World Customs Organization (WCO) to which 138 countries are contracting parties and about 200 customs authorities are signatories

- Adam Smith in 18th Century challenged this idea of regimented trade with his advocacy of free trade that was convincingly brought out in his seminal work ‘Wealth of Nations’.

- In the 19th Century, David Ricardo, building on this concept, propagated the ‘theory of comparative advantage’, according to which nations should remain focused in their specific areas of competence and allowed to trade freely with other countries.

- This theory is against import substitution and considers raising tariffs as a drag on the economic growth

Calibrating tariffs and low tariff

- Each country calibrates its tariffs taking into account its domestic production, demand and sensitivities.

- Availability of cheaper raw materials and intermediate products support making of competitively priced finished goods for export markets

- For MSMEs (micro, small and medium enterprises), this dependency linkage is even more critical, without which they might close down their operations under threat of persistent losses or low returns.

- The Trade Policy of a country should not lose sight of these dynamics in the clamor for narrowing trade deficit.

Flipside of high tariffs

- High tariffs could breed inefficiency and corruption at the entry points as it leaves much scope for discretion at the hands of officials, circumvention through under/over invoicing and violation of rules of origin

- Overtime, it runs the risks of impairing demand and paralyzing domestic manufacturing

- The assumption that tariff concessions under bilateral free trade agreements (FTAs) would help get access markets is misplaced.

- This gradual tariff liberalization is a natural progression and failing to do so could result in a situation of inverted duties where finished products end up being cheaper than raw materials and intermediate goods, thus, calling for tariff correction in course of time

NASA’s FUTURE VENTURES — VENUS, MOONS OF JUPITER, NEPTUNE

- NASA has selected four Discovery Program investigations to develop concept studies for possible new missions.

- Two proposals are for trips to Venus, and one each is for Jupiter’s moon Io and Neptune’s moon Triton.

DAVINCI+:

- Deep Atmosphere Venus Investigation of Noble gases, Chemistry, and Imaging Plus.

- This will analyse Venus’s atmosphere to understand how it was formed and evolved, and if it ever had an ocean.

- This will advance understanding of the formation of terrestrial planets.

IVO:

- Io Volcano Observer is a proposal to explore Jupiter’s moon Io, which is extremely volcanically active. This will try to find out how tidal forces shape planetary bodies.

- The findings could further knowledge about the formation and evolution of rocky, terrestrial bodies and icy ocean worlds in the Solar System.

ANTARCTICA: STUDY BY INDIAN SCIENTISTS

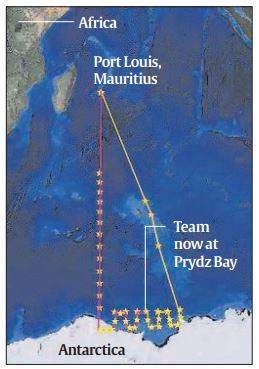

- Indian scientists on a South African vessel are in Antarctica, midway through an expedition across the Southern Ocean

- The South African oceanographic research vessel SA Agulhas set off from Port Louise in Mauritius, on a two-month Indian Scientific Expedition to the Southern Ocean 2020.

- The vessel has reached Prydz Bay, in the coastal waters of “Bharati”, India’s third station in Antarctica.

- The 18-institution team is collecting air and water samples from around 60 stations along the cruise track

- This will give valuable information on the state of the ocean and atmosphere in this remote environment and will help to understand its impacts on the climate, according to a statement from the National Centre for Polar and Ocean Research (NCOPR) in GoaA key objective of the mission is to quantify changes that are occurring and the impact of these changes on large-scale weather phenomenon, like the Indian monsoon

- carbon dioxide is getting emitted into the atmosphere, and through atmospheric circulation goes to the Antarctic and polar regions. Since the temperature is very low there, these gases are getting absorbed and converted into dissolved inorganic carbon or organic carbon, and through water masses and circulation it is coming back to tropical regions

- All oceans around the world are connected through the Southern Ocean, which acts as a transport agent for things like heat across all these oceans.

- The conveyor belt that circulates heat around the world is connected through the Southern Ocean and can have a large impact on how climate is going to change due to anthropogenic forces

There are six core projects:

- Study hydrodynamics and biogeochemistry of the Indian Ocean sector of the Southern Ocean; involves sampling sea water at different depths. This will help understand the formation of Antarctic bottom water.

- Observations of trace gases in the atmosphere, such as halogens and dimethyl sulphur from the ocean to the atmosphere. Will help improve parameterisations that are used in global models.

- Study of organisms called coccolithophores that have existed in the oceans for several million years; their concentrations in sediments will create a picture of past climate.

- Investigate atmospheric aerosols and their optical and radiative properties. Continuous measurements will quantify impact on Earth’s climate.

- Study the Southern Ocean’s impact on Indian monsoons. Look for signs in sediment core taken from the bottom of the ocean.

- Dynamics of the food web in the Southern Ocean; important for safeguarding catch and planning sustainable fishing.