Contents

- Can the right to work be made real in India?

- What is a technical recession?

- Analysis of the Aatma Nirbhar Bharat Abhiyaan

Can the right to work be made real in India?

Context:

As economies around the world struggle to recover from the double whammy of a pandemic and a lockdown, unemployment is soaring. In India, the land of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), the promise of jobs and the politics of unemployment have a long history.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilization of resources, growth, development, employment); Inclusive growth and issues therein.

Mains questions

- The nature of economic growth in India in described as jobless growth. Do you agree with this view? Give arguments in favor of your answer. 15 marks

- In the capital-labour bargaining process, labour is structurally weak in India, which means it is incumbent on the state to provide that support to labour. In this context, discuss the role of MGNERGA. 15 marks

Dimensions of the Article

- About MGNERGA

- Status of Unemployment in India

- Significance of MGNERGA to address the Unemployment

- Drawbacks in MGNERGA

- Way Forward

About MGNERGA

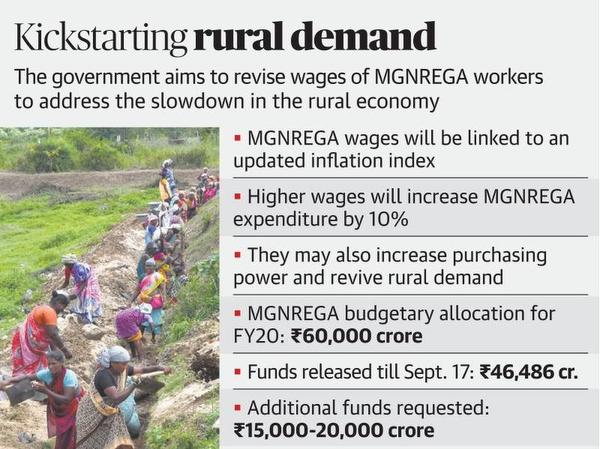

The Government of India formulated the MGNREGA in 2005 with the objective of producing a well-designed wage employment program to address poverty more effectively.

It was aimed at enhancing the livelihood security of the poor by providing at least 100 days of guaranteed employment in a financial year to every household whose adult members were willing to do unskilled manual work.

- MGNREGA is unique in not only ensuring at least 100 days of employment to the willing unskilled workers, but also in ensuring an enforceable commitment on the implementing machinery i.e., the State Governments, and providing a bargaining power to the laborer.

- The failure of provision for employment within 15 days of the receipt of job application from a prospective household will result in the payment of unemployment allowance to the job seekers.

- Employment is to be provided within 5 km of an applicant’s residence, and minimum wages are to be paid.

- Thus, employment under MGNREGA is a legal entitlement.

Status of Unemployment in India

Findings of Periodic Labour Force Survey (PLFS):

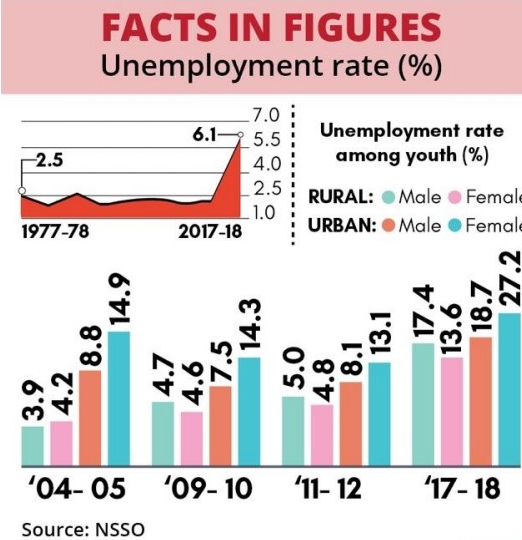

- The Labour Force Participation Rate (LFPR) in India has declined to 36.9% in 2017-18 from 39.5% in 2011- 12 (NSSO) as per usual status.

- Rural areas: LFPR declined by 3.6 %

- Urban areas: LFPR declined by 0.1%

- The Worker Population Ratio (WPR) in India has declined to 34.7% in 2017- 18 from 38.6% in 2011-12 (NSSO).

- Rural areas: WPR declined by 4.9%.

- Urban areas: WPR declined by 1.6%.

- Gender Gap- 71% of men above 15 years and above are a part of the workforce as compared to just 22 per cent woman. Meghalaya is the only state where 50% of the female population is at work while states like Bihar have just 4 % employed women.

- Rise in formal employment- The share of workers employed in informal enterprises in industry and services, and non-crop producing agriculture, has dropped to 68.4% in 2017-18 from 72.5% in 2011-12.

Significance of MGNERGA to address the Unemployment

- In poorer states, more people preferred MGNREGS over traditional labour: The shift to MGNREGS from traditional employment is more in case of casual labour households and is more evident in Odisha (75 per cent), Uttar Pradesh and West Bengal. The major reasons include Payment parity among gender and rise in wages over traditional employment.

- MGNREGA wage rates per person-day have been showing a rising trend over the years: Agricultural wages have increased across the country and MGNREGA has been an important driving force behind this.

- Offered better bargaining power to agricultural laborers: The tightening of labor markets has offered better bargaining power to agricultural laborers, better treatment at the place of work, and ability to negotiate the duration of agricultural working days. It also caused a growing shift towards piece rate or contract work in agriculture, facilitating a change in the number of working days.

- Gender Parity: The rate of increase in the agricultural wage for females has been much higher than that for males, and the historically high male-female differentials in agricultural wages have declined substantially. According to Economic Survey 2018, approximately 4.6 crore households were given employment under MGNREGA, of which 54 percent were taken up by women.

- Drastic reduction in distress migration: One of the salutary effects of MGNREGA on poor rural households is the drastic reduction in distress migration.

- Age distribution among labour: Majority (75%) of the MGNREGS workers belonged to the age group of 30- 50 years. The aged population (50-70 years) constituted 17 per cent and the young population (20-30 years) formed mere 8 per cent of the sample population.

Drawbacks in MGNERGA

- Employment provided under the scheme has been showing a tendency towards deceleration in recent years: There is no state which could provide 100 days of employment even to 50% of the participating households in 2011- 12.

- Differences in implementation of the scheme across states: Two states i.e., Tamil Nadu and West Bengal, accounted for nearly one-fourth of employment provided through MGNREGS, which was more than their share in total rural households. Maharashtra and Bihar, which have a higher share in total rural households, generated comparatively lower employment through MGNREGS.

- Decline in agricultural labour: Between 1993-94 and 2011-12 the share of agriculture in rural employment declined from 78% to 64% and the pace of decline in the last five years was much faster. The absolute decline in labour force has tightened the rural labor market leading to a shortage of labor for farm operations.

Way forward

- Negotiated MGNREGA calendar that avoids implementing works during the agricultural peak season: For instance, in West Bengal, work schedule was adjusted to the seasonality of traditional employment to some extent.

- Making the scheme more farmer-friendly by extending its coverage to some of the agricultural operations which may address the problems of excluded small and marginal farmers.

- Technology driven options need to be adopted to mitigate the problem of labor scarcity.

- Other measures like easy access to cheaper institutional credit for farm mechanization, promotion of farmer producer companies, policy support, an inclusive farm mechanization program especially for women and youth, institutional changes to ensure security, safety and social protection to migrant labor are required.

What is a technical recession?

Context:

Latest RBI bulletin projects contraction for a second consecutive quarter, which means the economy is in a ‘technical recession’. What does it mean, and how is it different from a ‘recession’ and a ‘recessionary phase’?

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Mains questions

- Among several factors for India’s potential growth, savings rate is the most effective one. Do you agree? What are the other factors available for growth potential? 15 marks

- RBI bulletin projects contraction for a second consecutive quarter, which means the economy is in a ‘technical recession’. What are the causes of technical recession and to what extent Atmanirbhar Bharat Abhiyan can address it. 15 marks

Dimensions of the article

- What is economic cycle and its stages?

- Features of the Economic cycle

- Causes of the economic cycle

- Economic cycle and India’s growth

- What is technical recession?

- Way forward

What is economic cycle and its stages?

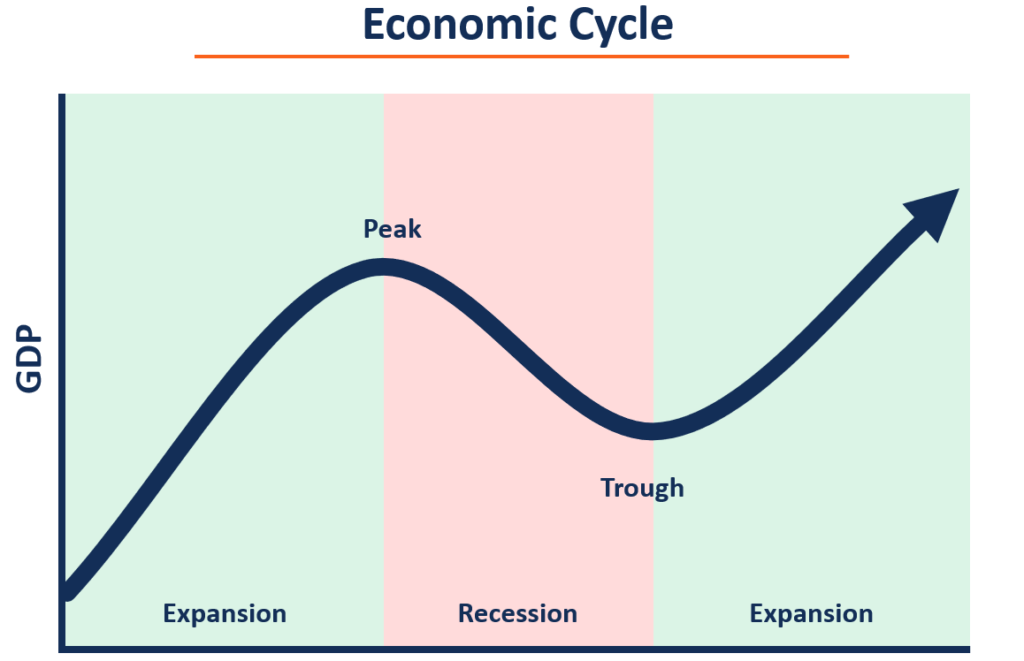

The economic cycle is the fluctuating state of an economy from periods of economic expansion and contraction. It is usually measured with the Gross Domestic Product (GDP) of a country or region. Other economic factors, such as employment rates, consumer spending, and interest rates, can also be used to determine the stage of the economic cycle.

The economic cycle is also known as the business cycle, and it is the fluctuating state of a market-based economy. An economy is a term that describes a set of production and consumption activities that determine how resources ought to be allocated. Supply and demand pressures influence the economy through different variables, such as global economic conditions, trade balances, productivity, inflation rates, interest rates, and exchange rates. The variables, in aggregate, shape the economy and the state of the economic cycle.

Stages of Economic cycle

- Expansion: During the expansion phase, an economy will experience strong growth, and interest rates will generally be lower but will begin to increase as the expansion matures. The overall production level increases, and inflation rates begin to rise as the expansion matures.

- The Peak: The peak is reached when the growth of an economy reaches a plateau or maximum rate. It is usually characterized by higher inflation that needs to be corrected.

- Recession: According to National Bureau of Economic Research (NBER) in the United States “During a recession, a significant decline in economic activity spreads across the economy and can last from a few months to more than a year”.

- The Trough: The trough is characterized as a low point in the economy from which it can re-enter an expansionary phase.

Features Of The Economic Cycle

Following a few of the common features which are found in the economic cycle:

- The economic cycle is one of the crucial affecting factors for the turnover of consumer goods like washing machines, television sets, houses, etc. These goods are the ones who are affected the most by the fluctuations in the economic cycle.

- The economic cycle is one of the important factors which affects many variables, including consumption, employment rate, price rise, rate of interest, and investment in many sectors.

- All of the phases of the economic cycle are considered to be synchronized with each other. That is depression or expansion occurs at the same time in almost all of the industries and their sectors in the economy.

- It is often observed that this recession or expansion forms a chain and is passed from one industry to other until it affects the entire economy. The reason this happens is that most of the industries are dependent on other industries for procurement of raw material for the processing of the final product. This is observed in both receptions for depression and expansion phase.

- An important characteristic of the economic cycle is that there is a huge fluctuation of profitability during every cycle of the economic. This leads to a lot of uncertainty, and it also makes it very cumbersome for businessmen to invest.

Causes of the Economic cycle

One may often wonder why do economic cycle takes place. There are multiple reasons associated with the economic cycle. Following are a few of them:

- Population: Population affects the economic cycle directly because an increase or decrease in population affects the demand and supply ratio, which is a direct responsible and primary affecter of the economic cycle.

- Demand: Sometimes there may be a rising demand without the rise of population because of other factors. For example, there would be seen a rise in sales of an umbrella as if the natural calamities like excessive rain occurs.

- The monetary and government’s policies: This can be considered perhaps as the primary cause of the economic cycle. Change in the policy of the government on monetary policy impacts directory to the economic cycle. If the government policy introduces a new policy that a certain product cannot be sold in India, then it affects the sales of that product, and in turn, this affects inventory of the product.

- Interest rate: One of the important factors which affect the economic cycle is government interest rates. If there is a rise in increase rate that discourages investors from investing and then there is hardly any growth seen in the economic cycle. On the other hand, if the interest rates are low more and more investments will come forward, which will increase the opportunities and grow the economy.

Economic cycle and India’s growth

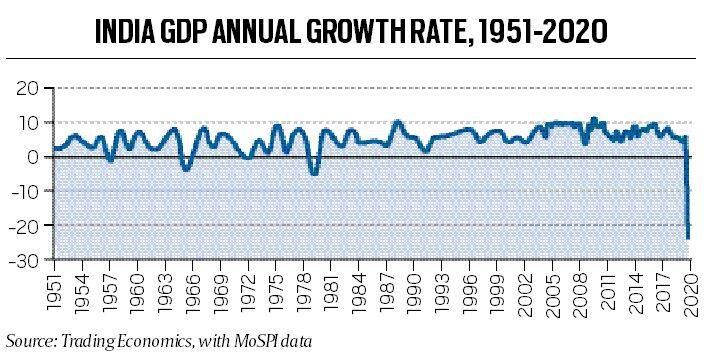

The line graph accompanying maps India’s quarterly real GDP growth since 1951. As one can see, this line goes up and down. The peaks and troughs show the different expansionary and recessionary phases of the economy. As the graph shows, there have been several expansionary and recessionary phases in India’s history.

What is technical recession?

A technical recession means that a country has experienced two consecutive quarters of decline in the GDP, but these are not year-on-year comparisons. As per RBI bulletin, Indian economy has entered into phase of Technical recession.

Way forward

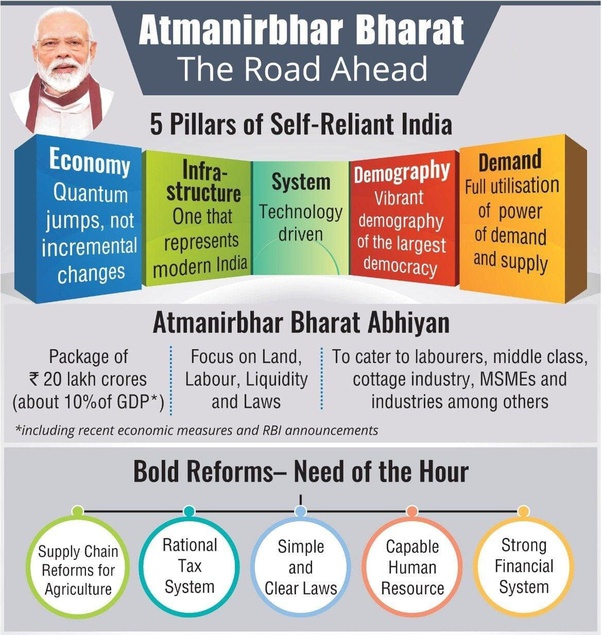

The government announced an economic package totalling Rs 20 lakh crore to tide over the Covid-19 crisis under ‘Atmanirbhar Bharat Abhiyan’. The Rs 20 lakh crore package includes the government’s recent announcements on supporting key sectors and measures by Reserve Bank of India. The special economic package would focus on land, labour, liquidity and laws, and it would benefit labourers, farmers, honest tax payers, MSMEs and cottage industry. If this program will implemented properly then India can come out from technical recession.

Analysis of the Aatma Nirbhar Bharat Abhiyaan

Context:

Emphasising that the special economic package would focus on land, labour, liquidity and laws, PM Modi said it would benefit labourers, farmers, honest tax payers, MSMEs and cottage industry.

Relevance:

GS Paper 3: Indian Economy (issues re: planning, mobilisation of resources, growth, development, employment); Inclusive growth and issues therein.

Dimensions of the topic:

- Five Pillars of Aatma Nirbhar Bharat Scheme

- Sector 1: Banking (RBI Measures)

- Impact of RBI measures.

- Way forward

Sector 1: Banking (RBI Measures)

Monetary policy, the demand side of economic policy, refers to the actions undertaken by a nation’s central bank to control money supply and achieve macroeconomic goals that promote sustainable economic growth. In India, The RBI through monetary policy regulates the supply of money in economy to control inflation and increase the growth. Indian economic is facing demand side constraints therefore RBI took various measures to improve the growth under Atmanirbhar Bharat Abhiyan.

Increase liquidity available to banks:

RBI noted that the COVID-19 pandemic has triggered pressures on cash flows and markets. It has introduced measures to introduce more liquidity.

- Repo Rate: In May 2020, the Monetary Policy Committee (MPC) decreased the repo rate from 4.4% to 4%.48 The repo rate is the rate of short term lending by the RBI to banks.

- Reverse Repo Rate: The MPC also decreased the reverse repo rate from 3.75% to 3.35%.48 The reverse repo rate is the rate at which RBI borrows money from banks. A decrease in it can prompt banks to lend more, instead of keeping their funds with the RBI.

- Cash Reserve Ratio (CRR): CRR was decreased from 4% to 3% in March 2020, for a period of one year.[49] CRR is the amount of liquid cash that banks have to maintain with the RBI, as a percentage of their total deposits. This is expected to provide a liquidity support of Rs 1.3 lakh crore.

- Marginal Standing Facility (MSF): MSF limit was increased from 2% to 3%.[50] MSF is the window in which banks can borrow additional money from the RBI. Raising the limit increases the total amount of funds that a bank can borrow. This is expected to provide a liquidity support of Rs 1.37 lakh crore to banks.

Provide liquidity to mid-sized companies and NBFCs:

- RBI announced Targeted Long-Term Repo Operations (TLTRO) to provide Rs one lakh crore of liquidity to Non-Banking Financial Companies (NBFCs), Micro-Finance Institutes (MFIs), mutual funds and other eligible business holdings. TLTRO provides banks with funds for one to three years at the repo rate to be invested in investment-grade debt of NBFCs and small to mid-sized companies.

Increase refinance capacities:

- Special refinance facilities worth Rs 50,000 crore were announced for National Bank for Agriculture and Rural Development (NABARD), Small Industries Development Bank of India (SIDBI) and National Housing Bank (NHB) in April, 2020. Refinance is the process by which a loan is replaced by another loan, generally offering more favourable terms.

Impacts of RBI’s measure:

- Liquidity enhancing measures will ease financial stress and help increase credit flows particularly to NBFC sector

- The NBFCs have experienced liquidity shortage since banks had not offered them any moratorium for repayment

- Housing sector: The soft loan to NHB should help bring down the cost of home loans

- Small businesses can hope for some cheap credit from SIDBI, and the rural-agrarian community from NABARD.

- Provides comfort to States to plan market borrowing programmes better and undertake better containment and mitigation efforts.

- Avoids Lazy Banking: Reduction in repo rate will discourage banks from parking their excess liquidity with RBI

- Relief to borrowers who were worried that opting for the moratorium may turn them into NPAs.

Way forward

Banks will have to be liberal in extending help for working capital loans and overdrafts to their borrowers, including MSMEs. The government could help by extending a scheme of credit assurance cover that will encourage banks to be more liberal in their lending activity.