Contents

- NIRF’s India Rankings 2020

- GST Council Provides Some Relief to India Inc

- Economic impact to vary in sectors

- Trump Mulls Suspending H-1B Visas

- Supreme Court allows firms to negotiate with staff

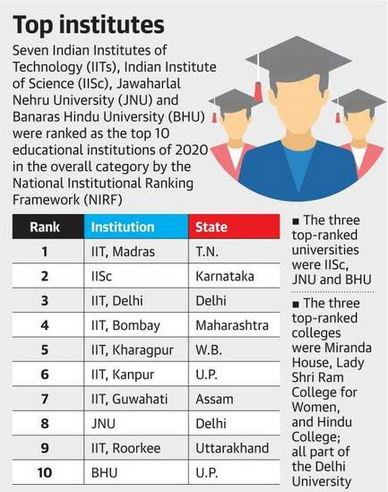

NIRF’S INDIA RANKINGS 2020

Focus: GS-III Social Justice

Why in news?

National Institutional Ranking Framework (NIRF) India Rankings 2020 was announced by the Minister of Human Resource Development.

Details

- IIT Madras retains 1st Position in Overall Ranking as well as in Engineering,

- Indian Institute of Science, Bengaluru tops the University list.

- IIM Ahmedabad tops in Management Category and AIIMS occupies the top slot in Medical category for a third consecutive year.

- Miranda College retains 1st position amongst colleges for a third consecutive year.

More information about NIRF

- The National Institutional Ranking Framework (NIRF) is a methodology adopted by the Ministry of Human Resource Development (MHRD), Government of India, to rank institutions of higher education in India.

- There are separate rankings for different types of institutions depending on their areas of operation like universities and colleges, engineering institutions, management institutions, pharmacy institutions and architecture institutions.

- The ranking framework evaluates institutions on five broad generic groups of parameters, i.e. Teaching, Learning and Resources (TLR), Research and Professional Practice (RP), Graduation Outcomes (GO), Outreach and Inclusivity (OI) and Perception (PR).

- Rankings help universities to improve their performance on various ranking parameters and identify gaps in research and areas of improvement.

-Source: The Hindu

GST COUNCIL PROVIDES SOME RELIEF TO INDIA INC

Focus: GS-III Indian Economy

Why in news?

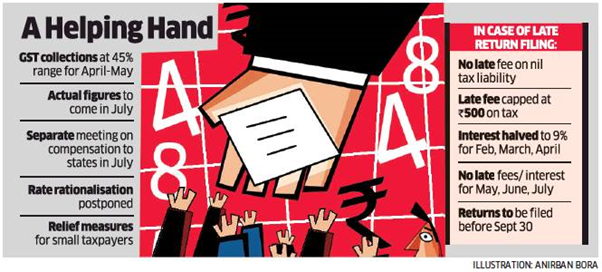

Looking to ease compliance burden on businesses, the Goods and Services Tax Council decided provide relief to taxpayers on late fee and interest payable on delayed tax payments.

Details

The Council reduced late fee and interest for those businesses with tax liabilities and waived off late fee completely for those with no tax liabilities.

GST collections had fallen to about 45%, aggravating the problem of compensation to states, even as states have demanded they be funded through market borrowing.

GST Council

- GOODS & SERVICES TAX COUNCIL IS A CONSTITUTIONAL BODY for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

- As per Article 279A (1) of the amended Constitution, the GST Council has to be constituted by the President within 60 days of the commencement of Article 279A.

- The Constitution (One Hundred and Twenty-Second Amendment) Bill, 2016, for introduction of Goods and Services tax in the country was introduced in the Parliament and passed by Rajya Sabha on 3rd August, 2016 and by Lok Sabha on 8th August, 2016.

- GST Council is an apex member committee to modify, reconcile or to procure any law or regulation based on the context of goods and services tax in India.

- The GST council is responsible for any revision or enactment of rule or any rate changes of the goods and services in India.

The council contains the following members:

- Union Finance Minister (as chairperson)

- Union Minister of States in charge of revenue or finance (as member)

- The ministers of states in charge of finance or taxation or other ministers as nominated by each states government (as member).

GST Council makes recommendations on:

- Taxes, cesses, and surcharges levied by the Centre, States and local bodies which may be subsumed in the GST;

- Goods and services which may be subjected to or exempted from GST;

- Model GST laws, principles of levy, apportionment of IGST and principles that govern the place of supply;

- Threshold limit of turnover below which goods and services may be exempted from GST;

- Rates including floor rates with bands of GST;

- Special rates to raise additional resources during any natural calamity;

- Special provision with respect to Arunachal Pradesh, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand; and

- Any other matter relating to the goods and services tax, as the Council may decide.

-Source: Economic Times

ECONOMIC IMPACT TO VARY IN SECTORS

Focus: GS-III Indian Economy

Why in news?

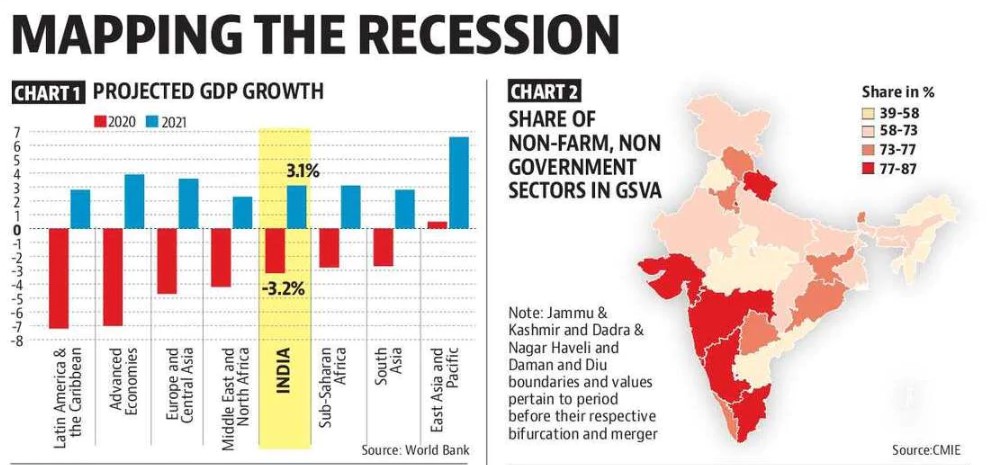

- World Bank expects India’s gross domestic product (GDP) to contract by 3.2% in 2020-21.

- There will be a moderate recovery to 3.1% growth in 2021-22.

- This means that 2021-22 GDP will be less than what it was in 2019-20.

Contraction in Growth is not Uniform

- It can be expected that at least two sectors; agriculture and government, will not see a contraction.

- In 2019-20, these two sectors had a share of almost 30% in total Gross Value Added (GVA), which implies that the economic downfall will be far more severe in the rest of the economy.

- The non-farm, non-government economy contains many sub-sectors. A contraction in each sub-sector will have different impact across states and jobs.

How to Use this knowledge that growth is not uniform?

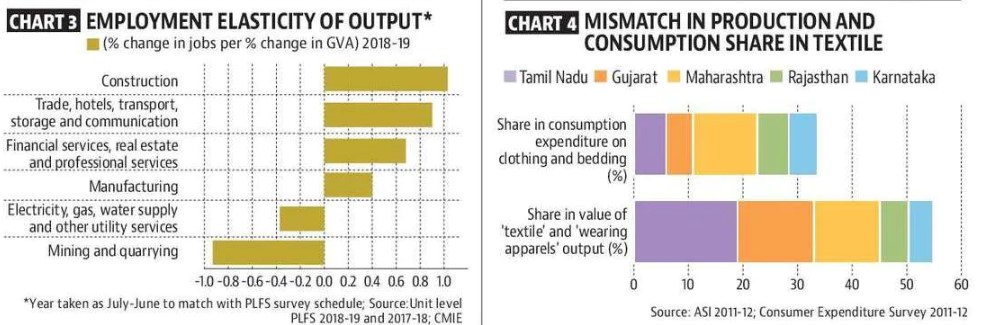

- -Construction sector has less than 10% share in GVA in 2018-19, however, The Employment share according to Periodic Labour Force Survey (PLFS), was 12%.

- So, for an equal value of loss in output, job losses in construction would be far higher than in the financial sector.

- Bailing out the construction sector can save a lot of jobs, and mostly of the poor.

Elasticity of Output

- A useful way to measure job losses during a contraction is by using what is referred to as employment elasticity of output in economics.

- It is equal to the change in number of jobs per unit change in economic output.

- The concept captures the idea that for the same amount of growth, job creation varies across sectors.

- This also means that job losses during a contraction phase will vary across sectors.

Issues with tracking consumption trends

- There is a major blind spot for policymakers in tracking consumption trends.

- India does not have a consumption expenditure survey (CES) after 2011-12. This will be a decade-old in 2021-22.

- After the 2008 financial crisis, there was a lot of uncertainty about job losses. India did not have high-frequency employment data.

- Although, no the PLFS does collect employment data in each quarter of the year. However, the government has not been releasing the quarterly data regularly.

-Source: Hindustan Times

TRUMP MULLS SUSPENDING H-1B VISAS

Focus: GS-II International Relations

Why in news?

Indians students and white-collar professionals are ditching the “American dream” to pursue a Canadian one because of the increasingly restrictive visa and immigration policies of the Trump administration.

Details

- There are growing rumors and expectations that the U.S. President is going to scrap or freeze the H-1B visa programme and the optional practical training programme that allows graduate foreign students to intern in the US, because of the high unemployment rate due to coronavirus.

- New analysis of US government data shows Indian STEM students and skilled professionals were already veering away to Canada.

- In the 2016-17 academic year, almost 70% of international graduate students in computer science at US universities were from India.

Canadian Dream

- It is acknowledged that Canada is benefiting from a diversion of young Indian tech workers and students from US destinations, largely because of the challenges of obtaining and renewing H-1B visas and finding a reliable route to US permanent residence.

- The number of Indians who became permanent residents in Canada rose by more than 115%.

H-1B Visa

- The H-1B is a United States visa under the Immigration and Nationality Act, and it is one of the most popular visas for foreigners visiting the US for business or trade purpose.

- It is a non-immigrant visa that allows U.S. companies to employ foreign workers in speciality occupations that require theoretical or technical expertise.

- Speciality occupations include specialized fields like IT, finance, accounting, architecture, engineering, mathematics, science, medicine, etc. which usually require a bachelor’s degree or higher.

- US employers wishing to bring in staff for long-term assignment prefer H1B visa because its application is quicker than applying for a US Green Card.

-Source: Times of India

SUPREME COURT ALLOWS FIRMS TO NEGOTIATE WITH STAFF

Focus: GS-II Indian Economy

Why in news?

The Supreme Court asked factory owners and other private industrial establishments to negotiate terms and enter into settlements with their workers on the payment of wages during the lockdown period.

Details

- The court urged employers and employees to sort out their differences and resume work in a congenial atmosphere.

- The court asked employers to allow their workers to resume their jobs, this is without prejudice to the rights of the employees regarding unpaid wages for these 54 days. It said that employers whose factories had continued to work during the lockdown may also enter into talks.

- With this, the court continued its existing order that no coercive action should be taken against private factory/industry owners who were unable to pay wages to workers during the lockdown.

-Source: The Hindu