Contents:

- Worst single day Fall for Sensex

- Madras High Court Dismisses GI tag for Basmati Rice plea

- Convict’s Death Sentence commuted over Mental State

- Raise Pay of Subordinate Judiciary

- 67% of Donations to National Parties by Unknown Sources

- COVID-19 outbreak could help Agri exports

- Government to Launch Mahua-Based Alcoholic Drink

WORST SINGLE DAY FALL FOR SENSEX

Focus: GS-III Indian Economy

Why in news?

The Sensex on 9th March 2020 witnessed its worst fall since demonetisation in 2016 as the sell-off in stocks continues unabated.

The Nifty hit a one-year low.

5 factors causing this crash

Oil price crash

- Crude oil prices tanked over 30 per cent following Saudi Arabia’s decision to cut prices and raise production after the talks with OPEC+ countries fell out, marking the biggest price crash since the first Gulf War.

- This led to a crash in the shares of major energy firms in India.

Covid-19 panic deepens

- Investors panicked over the economic damage from the coronavirus outbreak. The number of people infected by the virus topped 1,07,000 across the world as the outbreak reached more countries.

Questions over financial stability

- The YES Bank crisis has raised concerns over the stability of the country’s banking system, adding to the woes of domestic investors, traders said.

- Many financial entities have exposure to YES Bank bonds that have been downgraded by rating agencies.

FII outflow

- Non-stop selling by the foreign institutional investors added to the woes of Dalal Street. In last 15 sessions, FPIs have withdrawn a net Rs 21,937 crore from Indian equities, NSE data compiled by Accord Fintech showed.

- February 24 onwards, FIIs have been net sellers of equities in India every day.

Global markets tumble

- Major equity markets across the globe traded in the red, discouraging the traders on the Dalal Street. Japan’s Nikkei fell 5.2 per cent and Australia’s commodity-heavy market tanked 6.4 per cent.

MADRAS HIGH COURT DISMISSES GI TAG FOR BASMATI RICE PLEA

Focus: GS-III Environment and Ecology

Why in news?

A 2016 case challenging the exclusion of 13 districts in the State from a map submitted by the Agricultural and Processed Food Products Export Development Authority (APEDA) seeking Geographical Indication tag for basmati rice grown in the Indo Gangetic Plain was dismissed by Madras High Court.

Details

- Both the writ petitions were dismissed, on the primary ground of maintainability.

- The High Court stated that The Geographical Indications Registry (GIR) had already issued GI tag certificates to APEDA by accepting its claim that basmatic rice was grown only in the States of Punjab, Haryana, Himachal Pradesh, Delhi and Uttarakhand apart from 26 districts in Uttar Pradesh besides Jammu as well as Kathua.

- The present petitions were challenging an order passed by the Intellectual Property Appellate Board (IPAB) in Chennai.

GI Tag

- A geographical indication (GI) is a name or sign used on certain products which corresponds to a specific geographical location or origin (e.g., a town, region, or country).

- India, as a member of the World Trade Organization (WTO), enacted the Geographical Indications of Goods (Registration and Protection) Act, 1999 has come into force with effect from 15 September 2003.

- GIs have been defined under Article 22 (1) of the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement as: “Indications which identify a good as originating in the territory of a member, or a region or a locality in that territory, where a given quality, reputation or characteristic of the good is essentially attributable to its geographic origin.“

- The GI tag ensures that none other than those registered as authorised users (or at least those residing inside the geographic territory) are allowed to use the popular product name.

- Darjeeling tea became the first GI tagged product in India, in 2004–2005.

- GI protection systems restrict the use of the GIs for the purpose of identifying a particular type of product, unless the product and/or its constituent materials and/or its fabrication method originate from a particular area and/or meet certain standards.

- Sometimes these laws also stipulate that the product must meet certain quality tests that are administered by an association that owns the exclusive right to license or allow the use of the indication.

Geographical Indications Registry (GIR)

- As per the Geographical Indication of Goods (Registration and Protection) Act, 1999 , association of persons or producers can apply for GIs for specific products supported by required documents.

- The Controller General of Patents, Designs & Trade Marks (CGPDT), (under the Dept. of Industrial Policy and Promotion of Ministry of Commerce and Industry) is the ‘Registrar of Geographical indications’.

- The CGPDT directs and supervises the functioning of the Geographical Indications Registry (GIR).

Intellectual Property Appellate Board (IPAB)

- The Intellectual Property Appellate Board (IPAB) was constituted on September 15, 2003 by the Indian Government to hear and resolve the appeals against the decisions of the registrar under the Indian Trademarks Act, 1999 and the Geographical Indications of Goods (Registration and Protection) Act, 1999.

- Since April 2, 2007, IPAB has been authorized to hear and adjudicate upon the appeals from most of the decisions, orders or directions made by the Patent Controller under the Patents Act.

- Therefore all pending appeals of Indian High Courts under the Patents Act were transferred to IPAB.

Agricultural and Processed Food Products Export Development Authority (APEDA)

- Agricultural and Processed Food Products Export Development Authority (APEDA) is an apex body under the Ministry of Commerce and Industry, Government of India, responsible for the export promotion of agricultural products.

- APEDA is mandated with the responsibility of export promotion and development of the scheduled products viz. fruits, vegetables and their products; meat and meat products; poultry and poultry products; dairy products; confectionery, biscuits and bakery products; honey, jaggery and sugar products; cocoa and its products, chocolates of all kinds; alcoholic and non-alcoholic beverages; cereal and cereal products; groundnuts, peanuts and walnuts, pickles, papads and chutneys; guar gum; floriculture and floriculture products; herbal and medicinal plants.

- APEDA was created under APEDA Act, 1985, to promote exports of agricultural and processed food products.

CONVICT’S DEATH SENTENCE COMMUTED OVER MENTAL STATE

Focus: GS-II Governance

Why in news?

The Supreme Court has commuted the death sentence of a man who murdered three children aged between eight and four, concluding that he was suffering from “extreme mental disturbance” at the time of the “abominable crime”.

Views of the Supreme Court in this Case

- It is true that a larger number of criminals go unpunished, thereby increasing criminals in society and law losing its deterrent effect.

- It is true that the court must respond to the cry of society and settle what would be the deterrent punishment for an abominable crime.

- Sometimes it is stated that only rights of criminals are kept in mind and the victims are forgotten.

- However, death penalty was a rarest of rare punishment. Hence, while awarding death, the courts must strike a balance between the mitigating and aggravating factors, which depend on the facts and circumstances of each particular case.

Tools to suspend, remit or commute death sentence

Pardon: It removes both the sentence and the conviction and completely absolves the convict from all sentences, punishments, and disqualifications.

Commutation: It denotes the substitution of one form of punishment with a lighter form of punishment. For example, a death sentence may be commuted to rigorous imprisonment.

Remission: It implies reducing the period of the sentence without changing its character. For example, a sentence of rigorous imprisonment for five years may be remitted to rigorous imprisonment for one year.

Respite: It denotes awarding a lesser sentence in place of one originally awarded due to some special fact, such as the physical disability of a convict or the pregnancy of a woman offender.

Reprieve: It implies a stay of the execution of a sentence (especially that of death) for a temporary period. Its purpose is to enable the convict to have time to seek pardon or commutation from the President.

Pardoning Powers under the Constitution of India

In India, the power to grant pardon is conferred upon the President of India and the Governors of States under Articles 72 and 161 of the Constitution of India.

Article 72:

(1) The President shall have the power to grant pardons, reprieves, respites or remissions of punishment or to suspend, remit or commute the sentence of any person convicted of any offence—

(a) in all cases where the punishment or sentence is by a Court Martial;

(b) in all cases where the punishment or sentence is for an offence against any law relating to a matter to which the executive power of the Union extends;

(c) in all cases where the sentence is a sentence of death.

Article 161:

The Governor of a State shall have the power to grant pardons, reprieves, respites or remissions of punishment or to suspend, remit or commute the sentence of any person convicted of any offence against any law relating to a matter to which the executive power of the State extends

Pardoning power under Judicial Review: Curative Petition

- The concept of Curative petition was evolved by the Supreme Court of India in the matter of Rupa Ashok Hurra vs. Ashok Hurra and Anr. (2002) where the question was whether an aggrieved person is entitled to any relief against the final judgement/order of the Supreme Court, after dismissal of a review petition.

- The Supreme Court in the said case held that in order to prevent abuse of its process and to cure gross miscarriage of justice, it may reconsider its judgements in exercise of its inherent powers.

- For this purpose, the court has devised what has been termed as a “curative” petition. In the Curative petition, the petitioner is required to aver specifically that the grounds mentioned therein had been taken in the review petition filed earlier and that it was dismissed by circulation.

- This has to be certified by a senior advocate.

- The Curative petition is then circulated to the three senior most judges and the judges who delivered the impugned judgement, if available.

- No time limit is given for filing Curative petition.

- It is guaranteed under Article 137 of Constitution of India i.e. powers of the Supreme Court to review of its own judgements and orders.

Purpose of Granting Pardon

- Pardon may substantially help in saving an innocent person from being punished due to miscarriage of justice or in cases of doubtful conviction.

- The object of conferring this

power on the President is two-fold:

- To keep the door open for correcting any judicial errors in the operation of law;

- To afford relief from a sentence, which the President regards as unduly harsh.

RAISE PAY OF SUBORDINATE JUDICIARY

Focus: GS-II Governance

Why in news?

- A supreme court bench made it clear to the States and Union Territories that the Second National Judicial Pay Commission recommendation to nearly triple that pay and allowances for subordinate Judiciary should be implemented ‘proactively’.

- The court said that financially self-sufficient subordinate judiciary was pivotal for its independence.

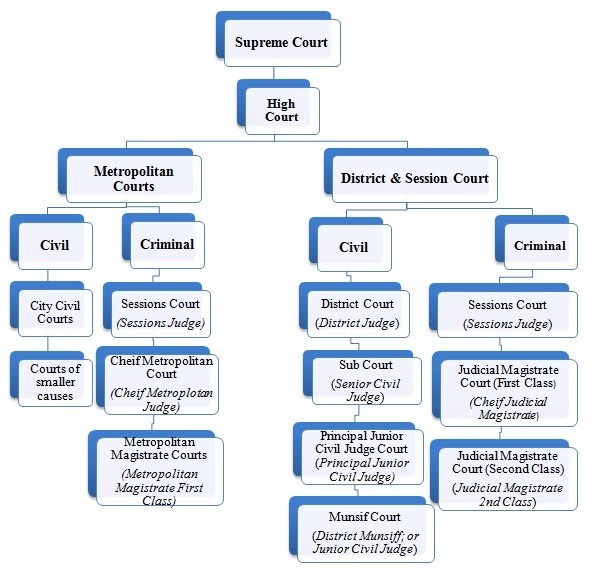

Hierarchy if Indian Judiciary

The provisions related to subordinate courts are provided in the 6th part of the Indian Constitution. Articles 233-237 deal with the subordinate courts.

District Courts

- The District Courts of India are established by the State governments of India for every district or for one or more districts together taking into account the number of cases, population distribution in the district.

- They administer justice in India at a district level.

- These courts are under administrative control of the High Court of the State to which the district concerned belongs.

- The decisions of District court are subject to the appellate jurisdiction of the concerned High court.

Subordinate Courts

- Subordinate courts are also known as village courts, Lok Adalat (people’s court) or Nyaya panchayat (justice of the villages), compose a system of alternative dispute resolution.

- They were recognised through the 1888 Madras Village Court Act, then developed (after 1935) in various provinces and (after 1947) Indian states.

- The model from the Gujarat State (with a judge and two assessors) was used from the 1970s onwards.

- In 1984 the Law Commission recommended to create Panchayats in rural areas with laymen (“having educational attainments”).

- The 2008 Gram Nyayalayas Act had foreseen 5,000 mobile courts in the country for judging petty civil (property cases) and criminal (up to 2 years of prison) cases.

- However, the Act has not been enforced properly, with only 151 functional Gram Nyayalayas in the country (as of May 2012) against a target of 5000 such courts.

- The major reasons behind the non-enforcement includes financial constraints, reluctance of lawyers, police and other government officials.

Control over Subordinate Courts

- This is an extension of the above supervisory and appellate jurisdiction. It states that the High Court can with draw a case pending before any subordinate court, if it involves the substantial question of law. The case can be disposed of itself or solve the question of law and return back to the same court.

- In the second case the opinion tendered by High court would be binding on the subordinate court. It also deals with matters pertaining to posting promotion, grant of leave, transfer and discipline of the members there in.

- High court has complete authority and control over its officers and employees. In this regard it appoints officers and servants to be made by Chief Justice or such other judge of High Court as the Chief Justice may direct. However the Governor of the state may by rule require that in such cases as may be specified in the rule no person not already attached to the court shall be appointed to any office connected with the court except after the consultation with the state public service commission.

67% OF DONATIONS TO NATIONAL PARTIES BY UNKNOWN SOURCES

Focus: GS-II Governance

Why in news?

- As much as 67% of donations to national parties in 2018-19 came from “unknown sources,” an increase from 53% in the 2018-19 financial year, said a report released by the Association for Democratic Reforms.

- Electoral bonds accounted for 78% of the ₹2,512.98 crore, or 67%, income from unknown sources.

Electoral Bonds Explained

- On January 2, 2018, the government had notified the Electoral Bond Scheme 2018. It was touted as an alternative to cash donations and to ensure transparency in political funding.

- As per the provisions of the scheme, electoral bonds may be purchased by an Indian citizen or a company incorporated or established in India.

- Only political parties registered under Section 29A of the Representation of the Peoples Act, 1951 and has secured no less than one per cent votes in the last Lok Sabha elections are eligible to receive electoral bonds.

- The electoral accounts are issued by the State Bank of India (SBI). The electoral bonds can be purchased in the months of January, April, July and October.

- Political parties are allotted a verified account by the Election Commission and all the electoral bond transactions are done through this account only.

- The donors can buy these electoral bonds and transfer them into the accounts of the political parties as a donation. The electoral bonds are available in denominations from Rs 1,000 to Rs 1 crore.

- The bonds remain valid for 15 days and can be encashed by an eligible political party only through a bank account with the authorised bank within that period only.

- Every donor has to provide his/her KYC detail to the banks to purchase the electoral bonds. The names of the donors are kept confidential.

- Before 2017, the electoral bonds scheme was for donation of over Rs 20,000. In 2017, the government capped the donation limit at Rs 2,000.

What is Political Funding?

- Political Funding implies the methods that political parties use to raise funds to finance their campaign and routine activities.

- A political party needs money to pitch itself, its objectives, its intended actions to get votes for itself.

Statutory Provisions

- Section 29B of the Representation of the People Act (RPA) entitles parties to accept voluntary contributions by any person or company, except a Government Company.

- Section 29C of the RPA mandates political parties to declare donations that exceed 20,000 rupees. Such a declaration is made by making a report and submitting the same to the EC. Failure to do so on time disentitles a party from tax relief under the Income Tax Act, 1961.

COVID-19 OUTBREAK COULD HELP AGRI EXPORTS

Focus: GS-III Indian Economy, Agriculture

Why in news?

In the wake of the COVID-19 outbreak, the Centre has identified 21 agricultural products, including honey, potatoes, grapes, soya beans and groundnuts, in which Indian exports could benefit from trade restrictions against Chinese goods.

Analysis of the impact of COVID-19 outbreak on India’s agricultural trade report prepared by the Ministry of Agriculture and Farmers Welfare.

- There may be opportunities for Indian exporters of agri-items, in case some countries impose restrictions on Chinese goods in response to outbreak of COVID-19.

- Opportunities may arise in case of other countries imposing import restriction on these tariff lines.

- There are 21 agri-tariff lines where China’s global exports and India’s global exports are more than $25 million and where India is price and volume-wise competitive and capable to provide an alternative.

- With regard to Indian exports to China, two items — cotton linter and mango pulp — may get impacted, as they are used as raw material by China for further processing and then export.

- Apart from these two, most major items are used for domestic consumption in China and may not be too badly hit.

GOVERNMENT TO LAUNCH MAHUA-BASED ALCOHOLIC DRINK

Focus: GS-III Agriculture, Economic Development

Why in news?

- The government is set to launch a mahua-based alcoholic beverage in the market for the first time. Called Mahua Nutribeverage.

- The beverage has a high nutritional value and relatively low alcohol content, at 5 per cent.

- It has been developed by IIT-Delhi after two years of research in collaboration with TRIFED (Tribal Cooperative Marketing Development Federation of India).

Mahuwa / Mahua

Mahua longifolia is an Indian tropical tree found largely in the central and north Indian plains and forests.

It is adaptable to arid environments, being a prominent tree in tropical mixed deciduous forests in India in the states of Odisha, Chhattisgarh, Jharkhand, Uttar Pradesh, Bihar, Maharashtra, Telangana, Madhya Pradesh, Kerala, Gujarat, West Bengal and Tamil Nadu.

Uses of Mahua

- It is cultivated in warm and humid regions for its oleaginous seeds (producing between 20 and 200 kg of seeds annually per tree, depending on maturity), flowers and wood.

- The fat (solid at ambient temperature) is used for the care of the skin, to manufacture soap or detergents, and as a vegetable butter.

- It can also be used as a fuel oil.

- The seed cakes obtained after extraction of oil constitute very good fertilizer.

- The flowers are used to produce an alcoholic drink in tropical India. This drink is also known to affect the animals.

- Several parts of the tree, including the bark, are used for their medicinal properties.

- It is considered holy by many tribal communities because of its usefulness.

TRIFED (Tribal Cooperative Marketing Development Federation of India)

- The Tribal Cooperative Marketing Development Federation of India (TRIFED) came into existence in 1987.

- It is a national-level apex organization functioning under the administrative control of Ministry of Tribal Affairs, Govt. of India.

- TRIFED has its registered and Head Office located in New Delhi and has a network of 13 Regional Offices located at various places in the country.

- The basic objective of the TRIFED is to provide good price to the products made or collected from the forest by the tribal peoples.

Aims of TRIFED

- The ultimate objective of TRIFED is socio-economic development of tribal people in the country by way of marketing development of the tribal products such as metal craft, tribal textiles, pottery, tribal paintings and pottery on which the tribals depends heavily for major portion of their income.

- TRIFED acts as a facilitator and service provider for tribes to sell their product.

- The approach by TRIFED aims to empower tribal people with knowledge, tools and pool of information so that they can undertake their operations in a more systematic and scientific manner.

- It also involves capacity building of the tribal people through sensitization, formation of Self Help Groups (SHGs) and imparting training to them for undertaking a particular activity.

Functions of TRIFED

- If the price of the products fluctuates then TRIFED arranges compensation for the tribes from the Ministry of Agriculture.

- It also assures the tribes for purchasing their products at a particular price, primary processing of products, storage of products and transportation etc.

- It provides information related to fair price markets for the ‘Minor Forest Produce (MFP). Like tribes of all over country sell their products in the trade fair organised at the Pragati Maidan, New Delhi every year.

- It helps in increasing the bargaining power of the tribes to fetch good price of the MFP.

- It provides adequate training to the tribes to make value addition to their products.